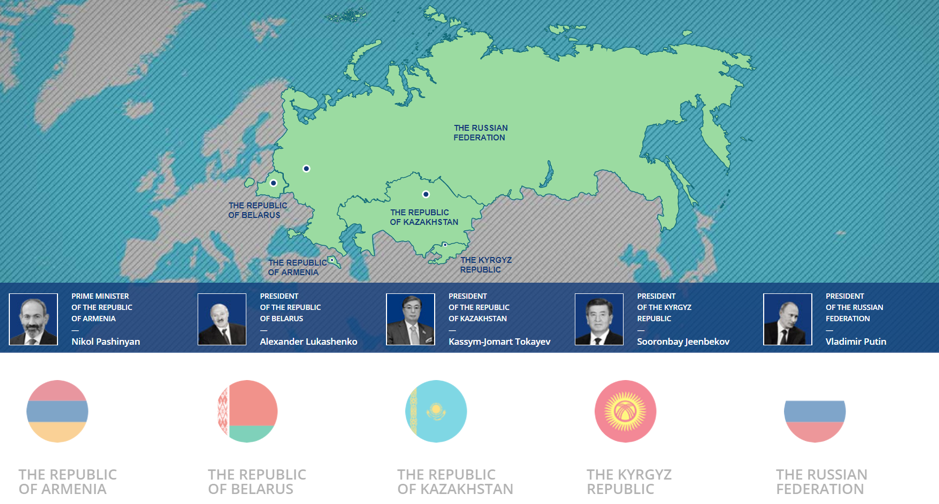

With the combined population of 190 million people and having GDP (PPP) of 5.0 trillion, the Eurasian Economic Union’s (EAEU) an economic union is a powerful trade partner on a global level located in central and northern Asia and Eastern Europe. Palm oil get on the markets in two ways: as raw material supplied in bulk for the needs of food industries or as a part of margarines and specialty fats.

The union allows Russia to project its power among former soviet republics. The economic benefits provided by the EAEU come primarily from removing non-tariff barriers.

For Belarus, participation in the union provides access to the Russian market and guarantees favorable conditions for oil and gas imports from Russia.

Armenia gained security and economic benefits that determined its membership in the EAEU. Russia has provided Armenia with economic benefits, such as lower energy prices, and security guarantees in its conflict with Azerbaijan.

By participating in the Eurasian Economic Community, Kyrgyzstan has strengthened trade relations with Russia and Kazakhstan. A high share of the country’s GDP is due to remittances from labor migrants from Russia.

A landlocked Kazakhstan, sees the Eurasian Union as a way to increase the competitiveness of its economy. In the framework of the EAEU, Kazakhstan gains access to a market with a population of 190 million people and to transport routes connecting European and Asian trade flows.

Ukraine is not a member, but its participation in the EAEU was necessary for the formation of a full-fledged regional alliance. Nevertheless, Ukraine decided to abandon its plans to join the EAEU by choosing the path of European integration, which led to a severe deterioration in political and economic relations with Russia.

Palm oil import to EAEU

According to the UN Statistics Division in 2019 overall import of palm oil to Russia, Belarus, Armenia, Kazakhstan and Kyrgyzstan exceeded 1,1 million tons by HS code 1511 Palm oil and its fractions, whether or not refined. Palm oil import is mixed. Countries with developed food industries such as Russia and Kazakhstan import majority of palm oil in bulk (by HS code 1511), whilst Armenia and Kyrgyzstan are relatively small in bulk import buying finished products (by HS code 1517) instead. Having its own developed food industry Belarus is relatively small in terms of bulk import of palm oil which is rather unusual, but this could be referred to the increased attention to the dairy farming and milk processing.

Table 1 Annual import of margarines by selected countries actual at 2019

| Country | Import by HS 1517 Margarines, tons | Market supplier, market share, % | Average unit value, USD/t |

|---|---|---|---|

| Russia | 51,740 | 37.4 (Sweden) | 1,913 |

| Belarus | 25,242 | 93.0 (Russia) | 1,002 |

| Kazakhstan | 68,191 | 60.9 (Russia) | 910 |

| Kyrgyzstan | 10,398 | 48.9 (Kazakhstan) | 743 |

| Armenia | 21,143 | 65.9 (Russia) | 1,016 |

Table 2 Annual import of palm oil by selected countries actual at 2019

| Country | Import by 1511 Palm oil, tons | Market supplier, market share, % | Average unit value, USD/t |

|---|---|---|---|

| Russia | 1,060,929 | 85 (Indonesia) | 599 |

| Belarus | 4,770 | 90.2 (Russia) | 759 |

| Kazakhstan | 39,415 | 40.0 (Malaysia) | 817 |

| Kyrgyzstan | 3,598 | 70.4 (Malaysia) | 979 |

| Armenia | 953 | 36.3 (Italy) | 1,226 |

First of all we shall say that the trade between the member states is regulated under the TREATY ON THE EURASIAN ECONOMIC UNION. Under the Treaty preferential taxation is applied to many items including specialty fats. Other states such as Ukraine benefit from Preferential tariff for CIS countries. This is seen as a serious barrier for any exporter on the way to the markets of the EAEU.

In order to give some idea of the EAEU market, the member countries of the union will be considered below. As it was stated above two countries of the union – Armenia, Kyrgyzstan – are finished products (margarine and specialty fats) buyers.

Over the five years to date import of margarines by HS code 1517 to Armenia went up from 13,140 tons in 2015 to 21,143 tons in 2019. Russia is the biggest supplier of margarines to Armenia – 65% of total import by this group (HS1517). It is partially explained by the price. In 2019 Russia offered margarines delivered to Armenia at average 1,016 USD per ton while total average price paid by Armenia for a ton of margarines in 2019 was 1,177 USD. At the same time we must acknowledge that in 2019 Malaysia offered margarines delivered to Armenia at average 792 USD per ton. But the quantities exported to Armenia were negligible for mentioning. In 2019 the import of specialty fats by HS 1517 consisted of:

- Edible mixtures or preparations of animal or vegetable fats or oils and fractions by HS code 151790 (Containing, by weight, more than 10% but not more than 15% of milkfats) – 13,939 tons. Average value 1,330 USD/t;

- Margarine (excluding liquid) by HS code 151710 – 6,335 tons. Average value 879 USD/t

Armenia provide preferences to selected trade partners from former Soviet Union (Preferential tariff for CIS countries). While average tariff applied on margarines by Armenia is 15%, Russia, Belarus, Kazakhstan, Ukraine and Georgia benefit from 0% tariff.

Import of margarines by HS code 1517 to Kyrgyzstan is stable. When exporting to Kyrgyzstan both Russia and Kazakhstan – leading suppliers of specialty fats by HS 1517 – use preferential tariff rate applied by Kyrgyzstan in accordance with the Eurasian obligations of the country. Average value paid for a ton of margarines by Kyrgyzstan in 2019 was 863 USD. The cheapest price offered by Kazakhstan – 743 USD.

Kazakhstan is a big buyer of palm oil whether as a raw material for food industries by HS code 1511 or as an ingredient of margarines imported by HS code 1517. In 2019 Kazakhstan imported 39,415 tons of Palm oil by HS 1511 and 68,191 tons of margarines by 1517. Having preferential taxation provided by Kazakhstan on the intragovernmental basis Russian and Ukraine topped the list of suppliers of margarines.

It must be noted that Ukraine managed to supply 11,393 tons of margarines at average of 2,542 USD per ton which is wide above the average price of 1,899 USD offered by Malaysia, which only supplied 302 tons of margarines to Kazakhstan.

And finally, I would like to draw your attention to Belarus. The country is a promising market for trade in palm oil and specialty fats. Belarus has demand for import of 50 thousand tons of specialty fats and margarines by HS code 1517 which is over 80 million USD in value.

Oil and fat industry of Belarus consist of 51 companies, including 16 mills and 35 processing plants. Minsk Margarine Plant is among the largest producers of fat and oil products in Belarus. Gomel Fat Factory is Belarus’ largest producer of vegetable oil and specialty fats. Both factories are certified under ISO 9001:2000 quality management.

Confectionery industry of Belarus demand specialty fats

There are eight big confectionery producers. They are Spartak, Kommunarka, Krasny Pischevik, Krasny Mozyryanin, Slodych, Konfa, Ivkon and First Chocolate Factory. The aggregate estimated production capacity is 113,800 tonnes. These producers need specialty fats for confectionery products, such as chocolate, marshmallow, cookies, waffles, gingerbreads, and crackers. Belarus export confectionery to many countries including EU, the CIS, and USA.

But, the fact is that import of confectionary to the country heavily outpace exports. In other words the confectionary industry of Belarus demand palm oil both as a raw material for oil and fat industry and as a part of specialty fats which are very needed by the confectionary industry of Belarus.

Prepared by Aleksey Udovenko

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.