When overdependence on Russia bites the collective back of European nations

The leaders of the European Union (EU) nations have been busy addressing an impending disaster, one that they are scrambling to avoid, with winter just several weeks away. The ongoing energy crisis in Europe is a grave one, as there is uncertainty whether the current supply will be sufficient in its peak demand in the winter.

How did the European nations (including the United Kingdom, a former EU state member) get embroiled in this situation?

The situation began spiralling out of control when Gazprom, the Russian energy provider, announced an indefinite closure of Nord Stream Gas Pipe 1 on 5 September 2022. The Nord Stream gas pipeline is the single biggest pipeline to channel gas from Russia to Europe. It has an annual capacity of 55 billion cubic metre (bcm) of gas. This is the result of a price cap on Russian oil that was imposed by the G7 countries in an attempt to restrict the flow of funds towards the Russian regime.

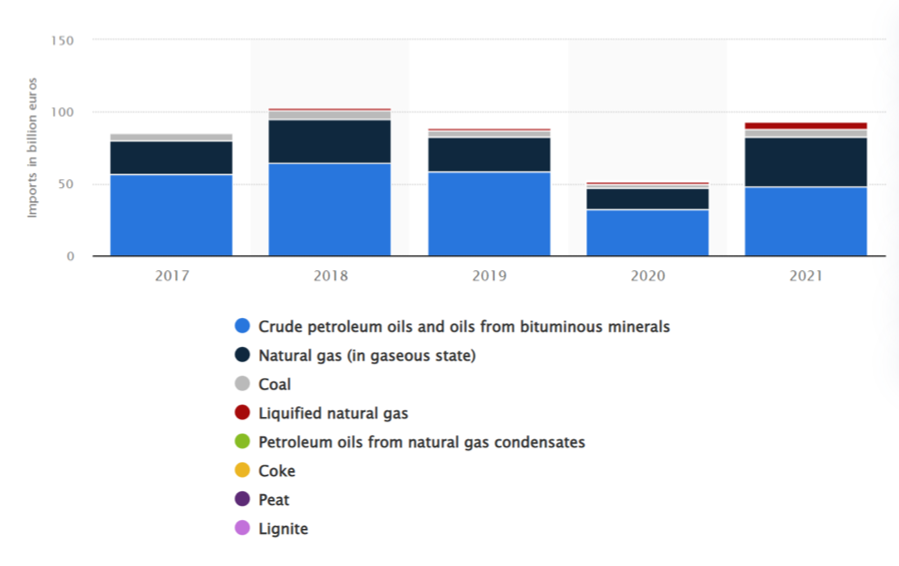

Russian gas supply represents approximately 40% of European imports. The volume of gas imported from the Russian pipeline in 2022 was 155 bcm.[1] EU nations have learnt the hard way that it stands to lose more by punishing Russia for the latter’s invasion of Ukraine.

The immediate impact of the current energy crisis in Europe

The prices of European natural gas have increased tenfold in Europe as compared to their average in the last decade.[3] Germany has increased its power prices by 17% for 2023, to 750 euros a megawatt-hour (MWh). Meanwhile, France too has increased its 2023 prices by 12% to reach €883/MWh.

With the extremely short supply of gas from Russia to Europe, scores of European nations have secured alternative suppliers. Qatar, Norway, and Azerbaijan have been selected as the alternative providers of gas. Meanwhile Algeria has supplied gas to Italy. Liquefied natural gas (LNG) can be sourced from Canada and the United States, however, this also means that the European nations will also be competing with Asia, the behemoth of the LNG market. Should Europe be successful in sourcing LNG, its prices will be significantly higher than that of Russian gas.[4]

The three mitigation steps from the European Commission in managing the ongoing energy crisis[5]

- Reduced consumption:

Its member states are to cut consumption by 10% overall, and 5% during peak hours.

- Revenue cap and profit-sharing:

An EU-wide revenue cap of 180 €/MWh from renewables, nuclear energy, and lignite. The fossil fuel sector in Europe that gains above a 20% increase on the average profits will be subjected to 33% of the taxable surplus profit. These measures are aimed at getting the energy sectors involved in addressing the crisis.

- Supporting more liquidity in the energy futures market:

Simplifying the procedures and state guarantees to solve liquidity issues on the energy futures market.

Will the strategies by the EU be sufficient in the long term?

The EU member states can up their ante in reducing their dependency on Russia. Biofuels could just be the source that can add value to the EU.

Biofuels are defined as liquid fuels and blending components produced from biomass materials called feedstocks.[6] Biofuels are mostly utilised by the transportation sector. However, biofuels may also be used for heating and electricity generation. Biodiesel is a liquid fuel that is produced from renewable sources, such as new and used vegetable oils, as well as animal fats. Biodiesel is produced by combining alcohol with vegetable oil, animal fat, or recycled cooking grease[7].

Although the EU is no stranger to using palm-based biodiesel, this will cease by 2030 with its Renewable Energy Directive (RED II). It serves as a policy to support its transition away from fossil fuels. The RED II added a target of a minimum of 32% of renewable energy, including energy, heating, and transportation.[8]

However, with the looming energy crisis, the EU may be compelled to reconsider its policies. The operations of energy-intensive industries have been disrupted so severely that thousands of industrial employees have been furloughed as a measure to manage the ballooning operating costs. France’s biggest aluminium producer, Aluminium Dunkerque will cut its production by a minimum of 20% and furlough its workforce should there be a potential fourfold jump in its energy costs. Another sector that is associated with high energy consumption is fertiliser production. Factories that have been relying on natural gas to operate, are starting to switch to diesel.[9]

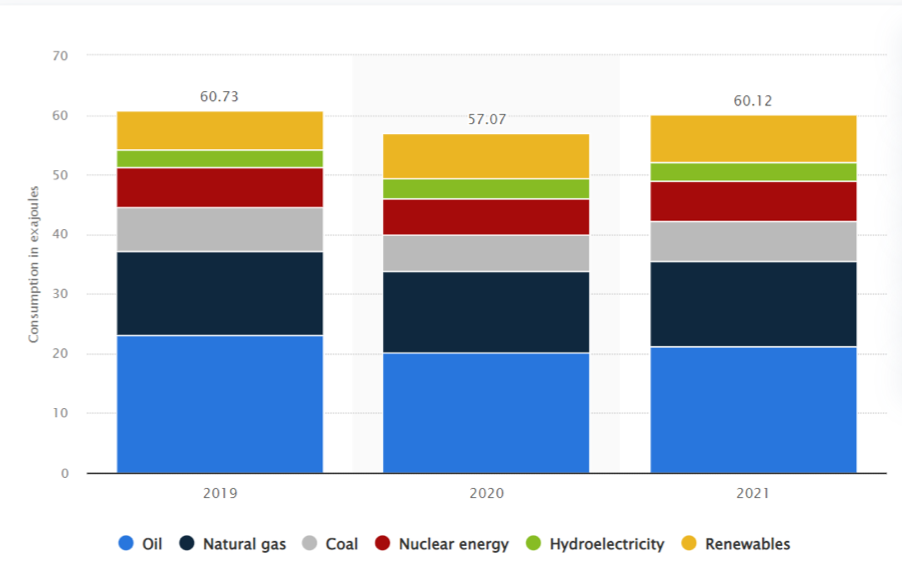

As of the year 2021, the consumption of renewables in the energy mix was at 8%, a mere fraction of the EU’s target of 32%. Oil and natural gas still command a lion’s share in the energy mix of the European nation at 21% and 14%, respectively. The preceding years too did not differ significantly, signalling a high barrier in transitioning into higher consumption of renewables.

With the RED II target that is aimed at a higher mix of renewables, the member states of the European Commission have the opportunity to embrace biofuels, especially palm-based biofuels including biodiesel.

Palm-based biodiesel and biofuels may be just what is needed for Europe. On 7 September, Ursula von der Leyen, the President of the European Commission, announced the three-pronged strategies to mitigate their situation in the coming months. Liz Truss, the newly-minted Prime Minister of Britain, too has laid out Britain’s plans for managing the energy crunch.

Though credit should be given to the EU Commission and Britain for swiftly deciding its next course of action, the absence of their long-term solution is glaring.

As of August 2022, the Netherlands and Spain have imported palm-based biodiesel from Malaysia. Between January and August 2022, the Netherlands imported 89,000 MT of palm-based biodiesel from Malaysia, with an export value of €138 million. Spain trailed behind with an import of 67,000 MT palm-based biodiesel from Malaysia worth €99 million.

It is indeed unfortunate that the EU Commission earmarks palm-based feedstock as high risk ILUC (indirect land use change) biofuels. EU importers will not be incentivised to import palm-based biodiesels. As of now, the EU nations are still able to import biodiesel and CPO as feedstock for biodiesel. This situation has been expected to change by 2030.

With the ongoing energy that is expected to impact 450 million people in the EU this year, and industries worth billions of Euros, the EU may want to reconsider the sustainability and direction of the energy policies. For the EU bloc to dig its heels in to wean off the energy from Russia is admirable. Perhaps it is wise for the EU to revisit its pledges in RED II that restrict the source of biofuels. Palm -based biofuels and biodiesels may just be the missing component that could take the EU away from its dependency on Russia.

Prepared by Hajar Shamsudin

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.

[1] https://www.iea.org/reports/a-10-point-plan-to-reduce-the-european-unions-reliance-on-russian-natural-gas

[2] EU, Eurostat 2017-2021 , https://www.statista.com/statistics/1302408/eu-energy-import-value-from-russia-by-product/

[3] Alex Munton – Rapidan Energy Group (2002)

[4] Christina Lu, Foreign Policy. https://foreignpolicy.com/2022/08/26/europe-energy-crisis-natural-gas-economy-winter/

[5] https://ec.europa.eu/commission/presscorner/detail/en/SPEECH_22_5521

[6] U.S Energy Information Administration

[7] U.S Department of Energy

[8] https://euagenda.eu/upload/publications/eprs-bri2021662619-en.pdf

[9] https://www.nytimes.com/2022/09/19/business/europe-energy-crisis-factories.html

[10] Statista (2022) https://www.statista.com/statistics/236316/primary-energy-consumption-in-the-eu-by-fuel-in-oil-equivalent/