Japan ranks among the top five countries worldwide in the booming retail cosmetics and toiletries industry. In 2021, its market size for cosmetics and toiletries reached an impressive USD38 billion. The Japanese beauty and personal care market continued to flourish in 2022, generating a substantial revenue of approximately USD41.98 billion. Looking ahead, experts predict a promising future with a projected Compound Annual Growth Rate (CAGR) of 5.4% for the period between 2022 and 2026.

What sets Japan apart is not just its market size, but also the discerning nature of its consumers. Japanese individuals are renowned for their sophistication and well-informed approach when it comes to the chemical formulations present in beauty products. They possess a keen awareness of ingredients, demonstrating a strong interest in the efficacy and safety of the products they use.

Furthermore, Japan has solidified its position as one of the largest global markets for cosmetics and personal care products. This vibrant market showcases the dynamic and diverse range of offerings available, catering to a wide array of beauty needs and preferences. The remarkable growth and sustained success of the Japanese beauty and personal care market can be attributed to the country’s commitment to innovation, quality, and a relentless pursuit of excellence.

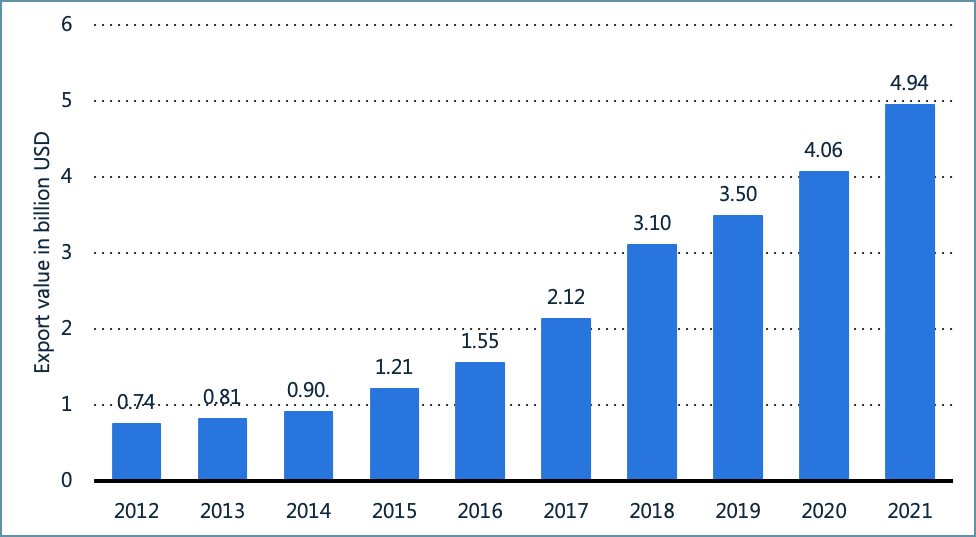

Export Value of Cosmetics in Japan 2012-2021

Source: Statista

In 2021, Japan recorded an export value of approximately USD4.94 billion for its cosmetics. Over the past decade, cosmetics exports has been experiencing consistent growth, with neighbouring countries such as Taiwan, South Korea, and China serving as significant importers.

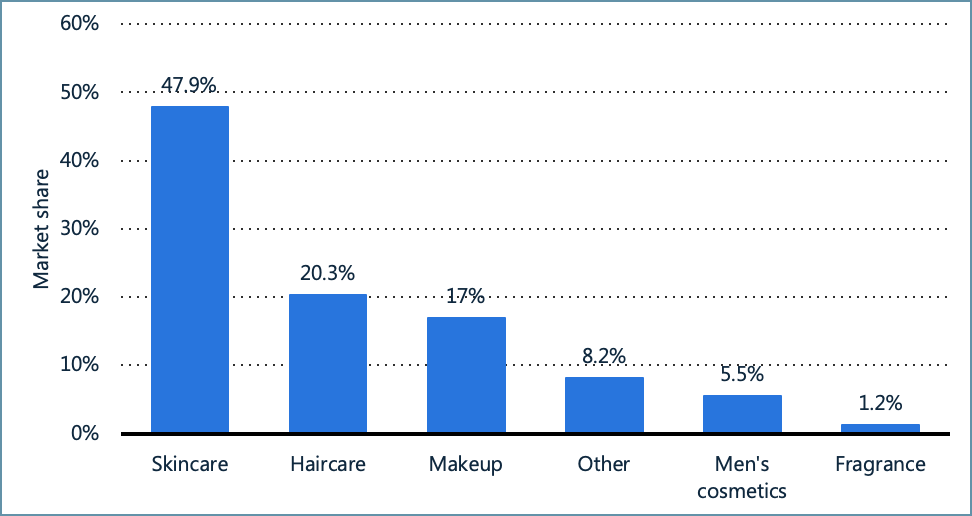

Distribution of the Cosmetics Market Size in Japan in Fiscal Year 2021, by Category

Japan’s cosmetics market boasts renowned beauty brands that have made a significant impact on the world, elevating the success of J-beauty internationally. Within the domestic market, skincare is the primary segment, making up about 48% of cosmetics shipments in Japan. Following closely behind is hair care, which has emerged as the second-largest segment, with hair colouring and treatment preparations playing a substantial role in shaping the market’s size.

The beauty market in Japan is closely connected to the personal care market, where innovative products blend the research advancements of both industries, creating a seamless combination. When it comes to cosmetics, Shiseido Company, Limited stands out as the clear leader, known for its high-end and reasonably priced products that enjoy a strong reputation both in Japan and internationally. Until 2021, Kao Corporation held the top position in the toiletries market, offering a portfolio of brands suited for both mass-market and premium price segments.

Export Value of Cosmetics from Japan in 2021, by Region

(Export value in million USD)

Sources: Statista; Japan Customs; West-Japan Cosmetic Industry Association

In 2021, the Chinese market emerged as the top destination for Japanese beauty products, with cosmetics exports valued at approximately USD2.85 billion. The total export value of cosmetics from Japan surpassed USD5.6 billion USD that year, with neighbouring regions playing the crucial role of primary importers.

Sustainable Palm Oil Potentials

Sustainable palm oil has the potential to play a significant role in the J-Beauty industry as it aligns with the values of sustainability and responsible sourcing, which can be a valuable ingredient in various beauty and skincare products.

Palm oil is highly versatile and finds its way into a wide range of beauty and skincare products as it serves as a fantastic natural and eco-friendly alternative to other oils and emollients. One of the standout features of palm oil is its smooth texture and emollient properties, which greatly enhance the sensory experience of beauty products. It helps improve the spreadability, absorption, and moisturising capabilities of skincare formulations. Sustainable palm oil delivers these benefits while maintaining ethical and environmental standards.

Apart from that, palm oil naturally contains antioxidants, including vitamin E, which contribute to the stability and prolong the shelf life of beauty products. This is particularly important for products that incorporate natural and organic ingredients, as they typically have shorter shelf lives as compared to their synthetic alternatives.

Malaysian Palm-based Oleochemicals Export to Japan

| Product | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Purified / Refined / Distilled Glycerin / Graded Glycerin | 37,924 | 33,573 | 31,261 | 35,439 | 39,056 |

| Lauryl Alcohol | 23,799 | 18,888 | 20,466 | 21,120 | 25,980 |

| Stearic Acid / Stearic Acid Flakes | 24,634 | 29,465 | 17,312 | 24,218 | 24,229 |

| Distilled / Topped / Stripped PKOFA | 261 | 303 | 7,475 | 6,653 | 11,566 |

| Oleic Acid | 10,725 | 11,085 | 9,456 | 12,298 | 11,477 |

| Palmitic Acid | 11,677 | 11,301 | 9,367 | 10,956 | 9,251 |

| Lauric Acid | 15,280 | 14,057 | 11,894 | 13,268 | 8,110 |

| Myristic Acid | 9,834 | 10,504 | 7,397 | 8,856 | 7,244 |

| Stearyl Alcohol | 6,860 | 8,924 | 6,901 | 7,983 | 7,236 |

| Others | 103,706 | 87,502 | 67,701 | 74,648 | 66,814 |

| TOTAL | 244,700 | 225,602 | 189,230 | 215,439 | 210,963 |

Source: MPOB

Over the past five years, there has been a notable rise in the export of Malaysian palm-based oleochemicals to Japan, particularly for products such as lauryl alcohol and stearic acid, which are commonly used in skincare formulations. Glycerin exports to Japan have also increased significantly as most skincare products incorporate glycerin because it improves hydration for all skin types. The demand for palm oil and its derivatives in the oleochemical sector experienced a decline in 2020 due to the outbreak of the Covid-19 pandemic. However, in 2021, a positive turnaround was witnessed as the cosmetics industry showed strong demand, leading to a resurgence in the demand for palm oil and its derivatives.

Ways to Enhance Malaysian Palm Oil’s Visibility as a Sustainable Source in the J-Beauty Industry

1. Focusing on maintaining high-quality production standards by implementing strict quality control measures and adopting sustainable and ethical practices.

2. Investing in research and development by studying the specific needs, preferences, and trends in Japanese skincare and cosmetic products, and tailoring the palm oil products to meet these demands.

3. Building collaborations and partnerships with Japanese beauty companies, skincare brands, and cosmetic manufacturers by actively participating in trade fairs and industry events, and establishing direct communication channels.

4. Creating a strong marketing and branding strategy targeting the J-beauty market by highlighting the sustainable and ethical aspects of Malaysian palm oil production, as well as the unique benefits it offers to skincare and cosmetics.

5. Conducting awareness campaigns and educational initiatives to inform Japanese consumers, retailers, and beauty professionals about the benefits and responsible sourcing of Malaysian palm oil. Seminars, workshops, or online resources can be organised to emphasise the positive attributes of palm oil and address any concerns or misconceptions.

6. Exploring opportunities for product innovation by developing new palm oil derivatives or value-added products specifically for the J-beauty industry.

7. Highlighting the sustainability credentials of Malaysian palm oil by showcasing efforts to minimise deforestation, protect biodiversity, and promote social responsibility within the supply chain.

In conclusion, with its unique properties and numerous benefits, Malaysian palm oil has significant potential of tapping into the thriving J-beauty industry. When it comes to the cosmetics and personal care industry, palm oil and its derivatives are already widely utilised in skincare products, soaps, hair care items, and more. The emollient properties and stability of Malaysian palm oil make it an attractive ingredient for these formulations. With a strong emphasis on sustainable and ethical practices, Malaysian palm oil can meet the demands of Japanese consumers who are increasingly conscious of the ingredients in their skincare and cosmetic products.

Furthermore, by venturing into the J-beauty industry, Malaysian palm oil can seize the opportunity to explore a highly profitable market. It is a chance for our industry to showcase our dedication to sustainability, leverage the versatility of our palm oil, form collaborative partnerships, and enhance brands’ reputation. These advantages make venturing into the J-beauty industry a smart and strategic move, with great potential for growth and success.

Prepared by Nursabrina Mohd Hayat

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.