With a population of almost 130 million, Mexico is among the world’s 15 largest economies in the world and the second-largest economy in Latin America. However, its economy remains fragile despite maintaining a strong trade relationship with the United States and Canada. According to the Heritage Foundation, approximately 40% of Mexico’s total incoming foreign direct investment comes from the United States. The ongoing pandemic has affected cross-border trade between Mexico and the United States. The COVID-19 pandemic has also disrupted the demand and supply of goods in Mexico.

As an effort to alleviate poverty among smallholder farmers at a time when the cattle market had collapsed, the Mexican government initiated the push for the development of palm oil cultivation in the late 1990s by providing seedlings and technical assistance. It was estimated that in 2012, oil palm plantations covered approximately 60,000 hectares. Today, the total number of areas planted with oil palm has doubled to 100,000 hectares today. An article published by Nestlé indicated that as demand for palm oil grew, processing plants began to sprout up across the country. Mexico has 18 processing plants.

The Mexican Federation of Oil Palm (FEMEXPALMA) reported that about 90 percent of Mexico’s 8,000 growers are smallholder farmers and 95% of these, have an area of fewer than 5 hectares, mostly in southeastern Mexico. Most oil plantations are smaller than 123 acres. Smallholders produce 80 percent of the country’s palm oil.

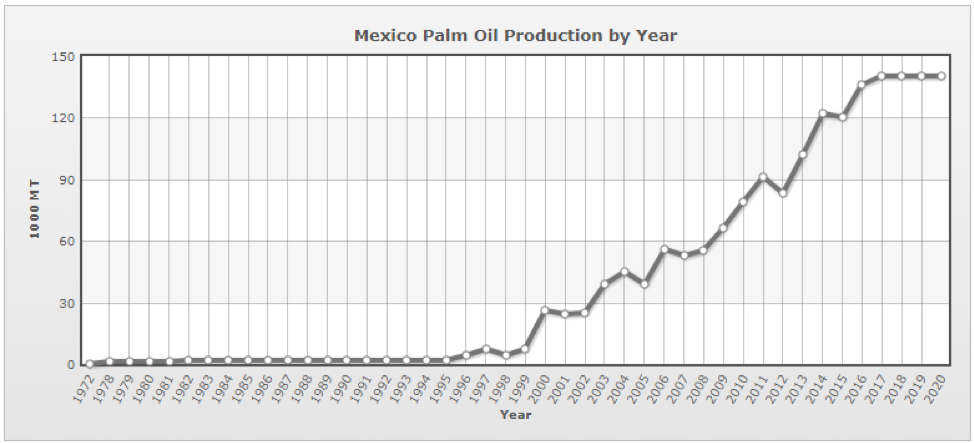

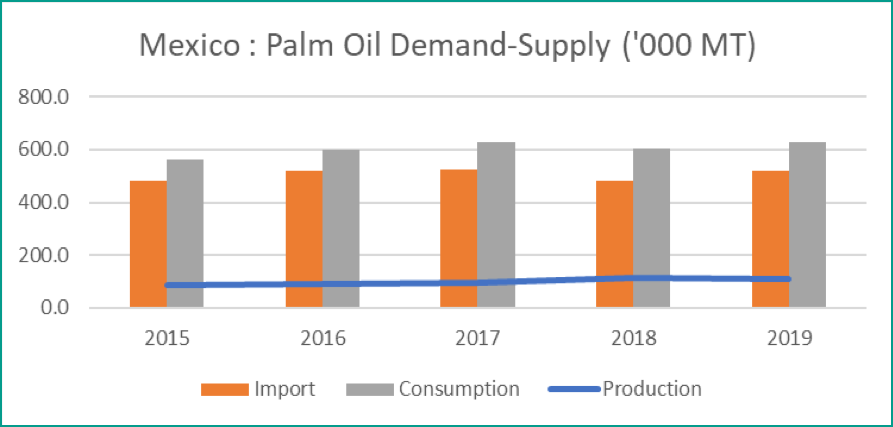

Data published by IndexMundi indicated that in 2019 palm oil production in Mexico amounted to 140,000 MT. However, production remained constant since 2017.

The United States Department of Agriculture (USDA) reported that soybean oil remains the major oil produced domestically, accounting for 62 percent of total production. About 95 percent of domestically produced soybean oil was extracted from imported U.S. soybeans.

Between 1998 to 2016, the palm oil industry in Mexico has grown rapidly to make palm oil the third-largest oil being produced in the country by volume. In large part, this growth has been driven by government programs encouraging the planting of oil palm in several states. Data published by the USDA indicated that soybean oil continues to dominate the Mexican market. Soybean oil is also expected to control approximately 60 percent market share in MY 2019/20, which is slightly higher than in MY 2018/19. The food processing and oil blending industries accounted for most of the consumption of soybean oil in Mexico.

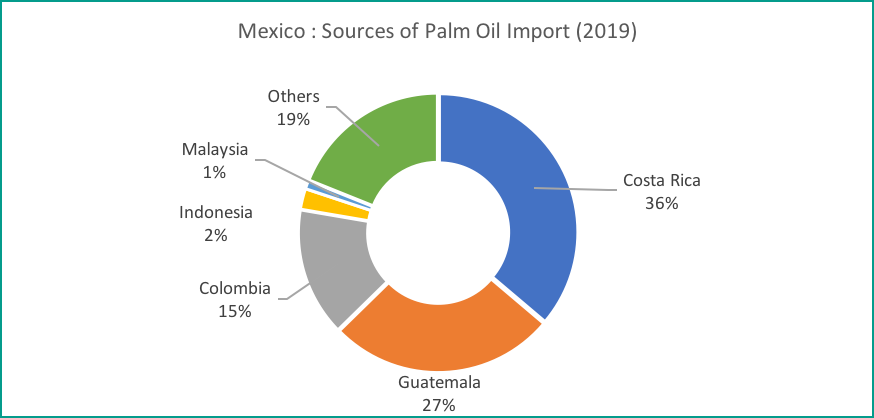

For now, Mexico is expected to remain a net importer of oils and fats. Current domestic productions of oils and fats are insufficient to meet the demand of the large population. In 2019, Mexico imported about 1.29 Mn T of oils and fats. Palm oil import amounted to 543,000 MT which constitutes roughly 42% of the total imports of oils and fats. The two major suppliers of palm oil to Mexico are Guatemala and Costa Rica. This is mainly due to its proximity to the country. Palm oil imports from Indonesia and Malaysia are relatively small. In 2019, Malaysia’s palm oil export to Mexico amounted to 29,673 MT, which placed Mexico as the second-largest Malaysian palm oil export destination in the Americas region.

The consumption of palm oil in Mexico has been on a rising trend over the past three years. Last year, palm oil consumption amounted to 645,000 MT which constitutes 18 percent of the oils and fats consumption. The price competitiveness of palm oil is one of the reasons for the growing demand among price-sensitive Mexican consumers. Based on industry estimates, Mexico’s current per capita consumption of vegetable oils is approximately 18 kg, of which 12 kg is cooking oil for home use and the remaining 6 kg is HRI and industrial consumption.

The development of the palm oil sector in Mexico was hampered by several factors. Even though oil palm cultivation has been around for the past 30 years in Mexico, oil palm cultivation is primarily a smallholder crop and this limitation in the cultivation land area has somehow contributed to the slow pace in the expansion of palm oil production volume in Mexico.

According to industry sources, the oil palm production incentive programs promoted by the previous government have now ended, and the new government has not included commercial oil palm cultivation in any of its current support programs. Moreover, concerns regarding the sustainability and environmental impact of palm oil production are also casting doubt on whether it will be supported in the future. According to a recent USDA report, the Mexican government appears to be encouraging the planning of other types of cultivation such as fruit trees and hardwoods in the key palm oil production areas.

Like many countries in Latin America and around the world, Mexico is also affected by COVID pandemic. The spreading of the COVID-19 pandemics since early this year has affected the demand and supply of oils and fats, including palm oil in Mexico. The preventive measures put in place by the government which includes travel restrictions, social distancing and stay-at-home orders have affected the production and supply chain of palm oil.

Mexico’s economy is seen contracting massively in 2020. The Economist reported that following a deep recession led by the coronavirus crisis this year, Mexico’s economy will only partly recover in 2021 given the absence of financial support measures. In another report published by the FocusEconomics, a leading provider of economic analysis and forecasts, heavy losses in employment and incomes, coupled with elevated uncertainty, will pummel domestic demand. This economic scenario will also affect the demand for oils and fats, including palm oil.

According to industry estimates, palm oil production in Mexico is expected to grow by only 6 percent in 2020. One recent interesting development is the consumer transition into more health-conscious food choices and preference for edible oils that can provide a healthier alternative. With cases of high cholesterol on the rise in the country, these changes in consumer preference are expected to create a new opportunity for companies that produce edible oils. Palm oil has become increasingly important for the food processing industry in recent years since companies began to remove trans-fats from their recipes. Several snack foods companies have also switched to palm oil in the production of their products due to its attractive pricing. This new development in consumer preference may expand the palm oil market in Mexico.

Prepared by Zainuddin Hassan

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.