Australia

With a population of 25.2 million, Australia consumed 844,100 MT of oils and fats in 2019. Rapeseed oil and palm oil are the main consumed edible oils with a share of 29% and 14% respectively. Rapeseed oil is the second largest produced oil in Australia after tallow and grease. In 2019, Australia exported 412,400 MT of tallow and grease which the main importer is Singapore with the share of 69% or 286,100 MT.

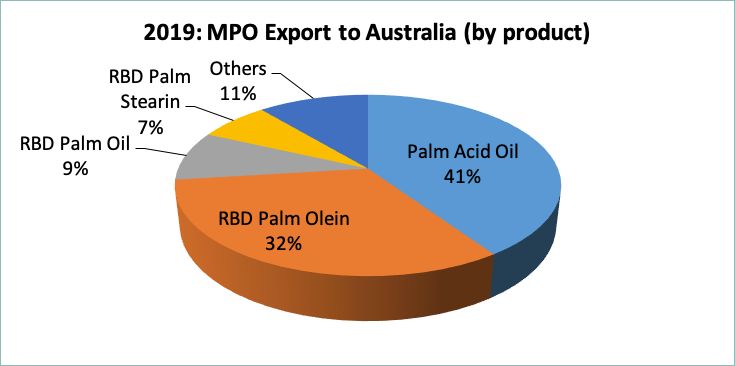

Palm oil is the leading imported edible oil in Australia which Malaysia is the major supplier with a share of 98% from total palm oil import. The main palm products imported are palm acid oil and RBD palm olein with a share of 41% and 32% respectively. Palm acid oil is being used for making laundry soaps and calcium soaps for animal feed formulations for the cattle.

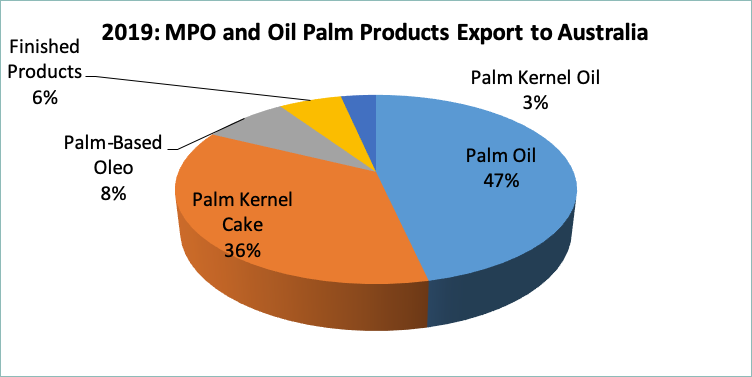

Besides palm oil, Australia also imports oil palm products such as palm kernel cake (PKC), palm-based oleo, finished products and palm kernel oil.

Palm kernel cake is being used as high protein feed for dairy cattle or burner in boilers to generate electricity for palm oil mills. Australia used PKC to feed dairy cattle in the dairy industry. Australia dairy industry is one of the most important agricultural industries which generates $13 billion across the whole supply chain. The dairy industry in Australia is the fourth-largest rural industry with an average of 1.44 million cows in a year. This industry exported 35% of milk production to the major markets such as China, Japan, Singapore, Malaysia and Indonesia.

New Zealand

In 2019, New Zealand’s population was about 4.8 million people which consumed 186,000 MT of oils and fats. Rapeseed oil and butter are the main consumed oils and fats with a share of 31% and 14% respectively. Butter is the main produced fat about at 445,200 MT or 71% of total oils and fats produced in 2019. 95% of butter production is being exported to the rest of the world. The major markets for New Zealand’s butter are China, Philippines, Australia and the United States.

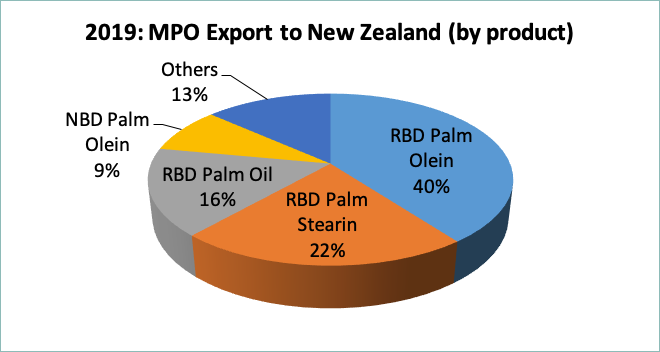

Palm oil is the second largest imported edible oil in New Zealand with a share of 16% while rapeseed oil is the main imported oil with a share of 41% from total oils and fats import. 97% of palm oil import in New Zealand is from Malaysia. In 2019, New Zealand imported 21,046 MT of palm oil from Malaysia. The main palm oil products are RBD palm olein and RBD palm stearin.

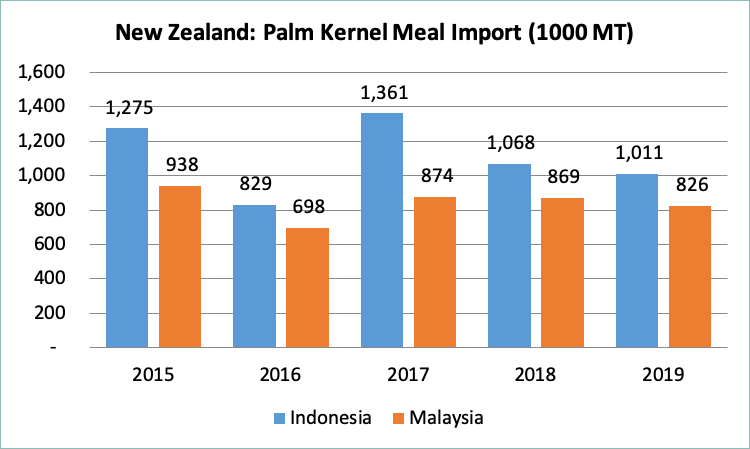

New Zealand also imported palm kernel cake for cattle feed in the dairy industry. New Zealand’s dairy industry contributes $7.8 billion (3.5%) to the country’s total GDP. Dairy is New Zealand’s largest goods export sector, at $17 billion in the year 2019. Based on the USDA official data, New Zealand has 5 billion cattle which produced 21.9 million MT of milk. This year, New Zealand’s milk production is estimated at 21.7 million MT, 0.7% less than 2019 production due to the drought conditions.

In 2019, New Zealand imported 1.8 million MT of palm kernel meal which Indonesia held a 55% share while Malaysia was at 45%. Palm kernel cake is a good source of protein and fats for energy. The high fibre levels can be an advantage when fed as part of a balanced diet for cattle.

Free Trade Agreement between Malaysia with Australia and New Zealand

Background

Quoting from MATRADE Free Trade Agreement (FTA) is an international agreement between two or more countries to reduce or remove trade barriers and bring closer economic integration. FTA offers lower or zeroes tariff (tariff concession) on exports and imports of goods and components assigned under FTA. This would make products more competitive, as compared to exports and imports from non-FTA partner countries. Additional perks such as hassle-free custom procedures, relaxed or quarantine import restrictions will be enjoyed by the exporters as well.

Malaysia has signed numbers of FTAs such as with Australia, New Zealand, Japan and Korea among others to ensure Malaysian products stay competitive against other countries. Palm oil products are on for the goods which have enjoyed zero import duties under FTA. Malaysian palm oil has enjoyed a significant increase in export to some of these countries.

Malaysia’s FTAs with Australia (MAFTA) and New Zealand (MNZFTA) were concluded on 30 March 2012 and 30 May 2009 respectively. And they were commenced on 1 January 2013 and 1 August 2010. Since then goods from Malaysia are eligible for tariff-free treatment in both Australia and New Zealand. Likewise, Australian and New Zealand goods enjoy the same privileges when exporting to Malaysia. Palm oil is one of the goods listed in the FTA’s preference list. The table as below:-

Australia

| Reference Number | Statistical Code | Unit | Goods | Rate# |

|---|---|---|---|---|

| 1511 | Palm oil and its fractions, whether or not refined, but not chemically modified | |||

| 1511.10.00 | 19 | t | – Crude oil | Free |

| 1511.90.00 | – Other | Free | ||

| 20 | t | – Palm stearin | ||

| 32 | t | – Palm Olien | ||

| 33 | t | – Other |

Source: Australian Border Force

| Reference Number | Statistical Code | Unit | Goods | Rate# |

|---|---|---|---|---|

| 2308.00.00 | 49 | kg | Vegetables materials and vegetable waste, vegetable residues and by-products, whether or not in the form of pallets, of a kind used in animal feeding, not elsewhere specified or included | Free |

Source: Australian Border Force

New Zealand

1511.10.000 (HS2012) |

|

Palm oil and its fractions, whether or not refined, but not chemically modified |

|

MNZFTA |

|

IN FORCE |

|

FTA Rate |

Free |

Source: New Zealand Foreign Affairs & Trade

2306.60.00 (HS2012) |

|

Residue and waste from the food industries; Prepared animal fodder- of Palm nuts and kernel |

|

MNZFTA (2013) |

|

IN FORCE |

|

FTA Rate |

Free |

Source: New Zealand Foreign Affairs & Trade

These FTAs have given the advantage to Malaysia in both countries. Malaysia palm oil export to these countries has shown decent growth and strong market shares. Malaysian exporters should explore further on how to increase the palm oil uptake in the countries. They need to do it as soon as possible because other palm oil exporters are also aiming the same goal.

ASEAN-Australia-New Zealand Free Trade Area (AANZFTA)

Before Malaysian – Australia and Malaysia-New Zealand FTAs commencement, ASEAN agreed with Australia and New Zealand to form ASEAN-Australia-New Zealand Free Trade Area (AANZFTA). It was signed on 27 February 2009. Under the FTA duty imposed on the majority of palm products imported into Australia and New Zealand, ranging from 5%-7% would be brought down to 0% by 2020. The agreement is indicated that in 2020 the majority of palm products will have 0% import tariff which means all palm oil products originated from ASEAN will not be subject to an import tariff. Hence, beginning from 2020 Malaysia palm oil does not have any tariff advantage against other palm oil originated from ASEAN. Malaysian palm oil exporters should continue to pursue and dominate the market. Malaysia still has the upper hand in term of good relationship which has established before.

Articles’ Sources:

- Dairy Australia

- USDA Gain Report

- Statista

- Riverina.com

- Malaysian Palm Oil Board (MPOB)

- MATRADE

Prepared by : Rina Mariati and Muhammad Kharibi

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.