Introduction

Sub-Saharan Africa has always been a palm oil friendly region with 69% or approximately 7.1 million MT of oils and fats consumption being palm oil. Last year, this region imported a total of 2 million MT of Malaysian palm oil. Though palm oil is locally produced in this region, palm oil imports are also needed to fill the gap to meet local consumption of palm oil. Sub-Saharan Africa imports palm oil mainly from Malaysia and Indonesia. As the population grows, demand for oils and fats also has been on the rise. There is a great opportunity for Malaysian palm industry to grow in this region.

Bilateral Trade Agreements

Bilateral trade agreements are an excellent way to strengthen economic ties between two countries which give each other market access to various products. Such agreements would help Malaysia in increasing palm oil share in importing countries with advantages like low or zero tariff. High tariff in importing countries is a common challenge that the palm industry faces in African nations.

Tariff rate in Kenya, Nigeria and South Africa

| No | Country | Crude Palm Oil | Refined Palm Oil |

|---|---|---|---|

| 1 | Kenya | 10.0 | 25.0 |

| 2 | Nigeria | 35.0 | 35.0 |

| 3 | South Africa | 10.0 | 10.0 |

Several countries in Sub-Saharan Africa region have large oils and fats consumption due to growing population and demand. Malaysian palm industry can see opportunity in countries like Nigeria, Kenya, and South Africa.

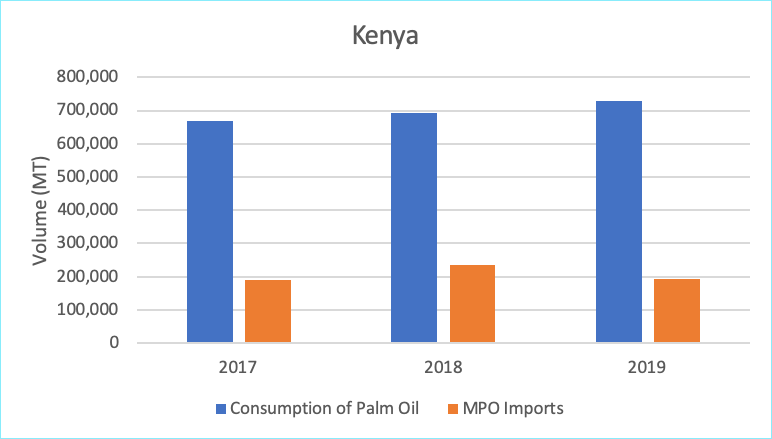

Kenya meets almost all of the oils and fats consumption through imports. Over 96% of their oils and fats imports in 2019 were palm oil. While consumption of oils and fats reached 760,600 MT in 2019, imports of Malaysian palm oil only reached 193,340 MT. The rest of the palm oil came from Indonesia and the neighboring countries.

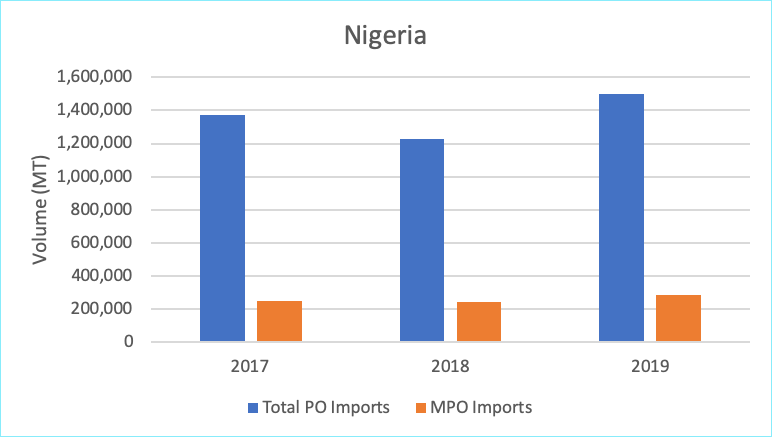

Nigeria on the other hand, is a palm oil producing country. Last year they produced 1.08 million MT of palm oil. This covered about 44% of their local palm oil consumption. Out of the total palm oil imports of 1.5 million MT last year, Malaysian palm oil only covered 286,964 MT. Though Nigeria is a palm oil producing country, there is a large opportunity to grow in this region.

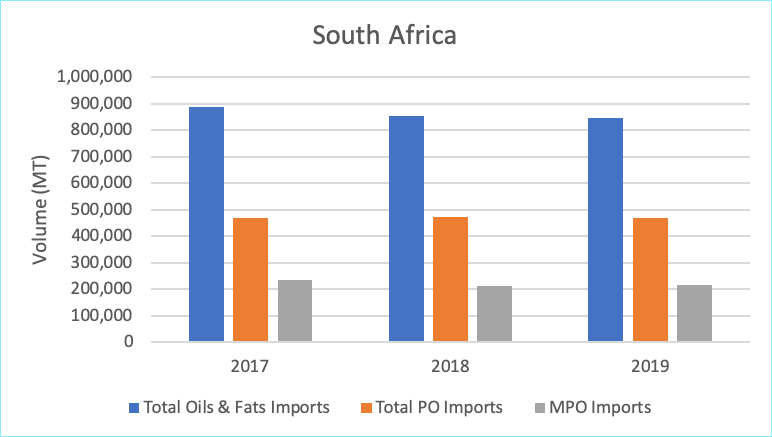

South Africa produces sunflower and soybean oil. Their total production of oils and fats was 726,200 MT last year. They also imported 846,900 MT of oils and fats to cover their growing local consumption which reached 1.45 million MT last year. Out of the total imports, 59% or 500,000 MT was palm oil. While Malaysian palm oil industry holds about 43% of market share, Indonesia holds the rest.

All these countries show potential in market growth. Malaysian palm industry should take the opportunity to expand in these nations. Trade agreements between two countries would help to facilitate the increase of Malaysian palm oil market share.

Conclusion

MPOC has always functioned with an objective to increase Malaysian palm oil market share in this region. MPOC regional office constantly works with industry members on both ends to meet their needs. One important tool MPOC uses is business match. MPOC regional office in Sub-Saharan Africa has been doing biz-match on a regular basis. During this pandemic, preference for online biz-match has increased. Online biz-match has been quite effective and has become a popular and cost-effective choice. There is a potential for Malaysian palm oil market share to increase in this region. While population and demand for oils and fats are always on the rise, imports of palm oil are always needed in this region as local production cannot fill the demand. With the support of governments (G2G), as well as MPOC regional office and the industry itself, we can surely achieve higher exports of palm oil to Sub-Saharan Africa.

Prepared by Karthigayen Selva Kumar

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.