Domestic Oils and Fats Industry and Cultivation

The key segments in Brazilian cooking oils market are soybean oil, olive oil, corn oil, and sunflower oil. The whole cooking oils market in Brazil was valued at BRL14,332 million in 2022 (GlobalData). According to GlobalData, the market is projected to grow at a CAGR of more than 6% during the period 2020-2025. The vegetable oil segment accounted for a major share where the overall market volume of the oils is estimated to achieve volume sales of 2,358.3 kg million by 2025.

Brazil is the largest soybean producer in the world, accounting for more than one third of the country’s agricultural production value. Production is the highest in the Central-West region, in particular the state of Mato Grosso. In addition to its leading position in production, Brazil also ranks as the largest exporter of soybean worldwide. Exports are closely related to the demand in China, by far the most important country of destination for Brazilian soybean exports.

Along with the global market, increased domestic consumption has also contributed to the growth in soybean cultivation in Brazil. The industrial sector consumption of soybean oil has consistently increased in the past decade, mainly a result of its use as the main feedstock for biodiesel production. With the mandated biodiesel blend rate for commercialised diesel fuel in Brazil set to be raised to 15% from 10% beginning in April 2023, the increasing demand for soybean oil in the Brazilian fuel sector can be expected to continue. Consumers rely on soybean oil as a key component in the majority of Brazilian native meals. From empanadas to moqueca, soybean oil is a common cooking oil used in food preparation in Brazilian kitchens. The product is easily accessible on grocery store shelves, with several brands to pick from.

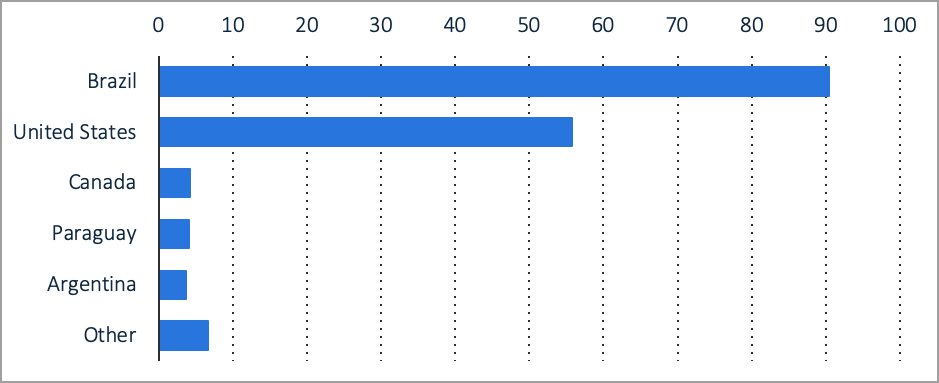

Top Global Soybean Exporters 2021/22 (MT)

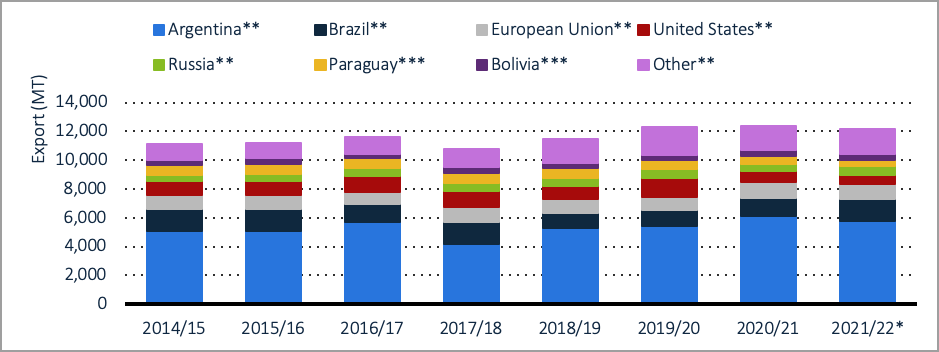

Top Global Soybean Oil Exporters (MT)

Palm Oil Competitive Landscape in Brazil

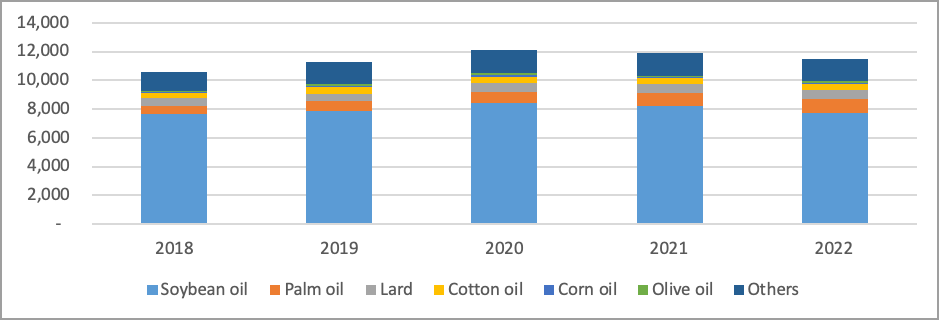

After soybean oil, palm oil, lard, and cotton oil are the most consumed oils in Brazil. Total oils and fats consumption in Brazil in 2022 is at 11,458,000 MT, decreasing by 3.8%. Even though total consumption recorded a decline, palm oil consumption was on a rising trend. In 2022, consumption of palm oil stood at 1,010 MT, increasing by 60 MT or 6.3% compared to the amount in 2021.

Brazil: Total Oils and Fats Consumption (‘000 MT)

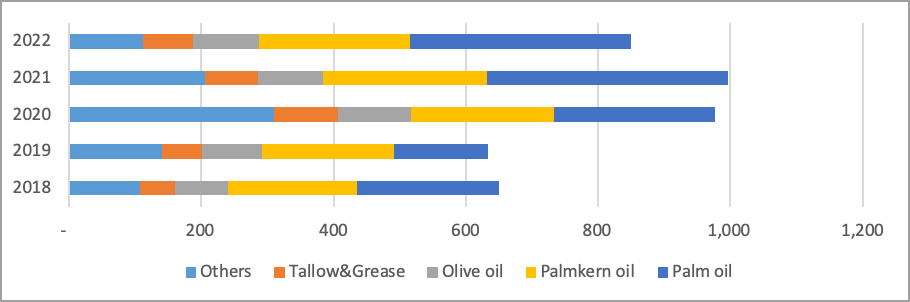

Brazil recorded a total palm oil import of 335,000 MT in 2022. This makes it the most imported oil, followed by palm kernel oil and olive oil. Palm oil is sourced mainly from Indonesia and Colombia. In 2021, 64% of palm oil import by Brazil comes from Indonesia, 31% from Colombia, and 1.7% from Malaysia.

Brazil: Palm Oil Import (‘000 MT)

Even though the import of Malaysian palm oil is small at only 9,383 MT in 2022 (MPOB), Brazil also imported other oil palm products from Malaysia. The largest chunk of oil palm product being imported is palm kernel oil (38%), followed by palm-based oleo (30%), and finished products (17%).

Brazil: Malaysian Oil Palm Product Import (MT)

| Product Group | 2022 (MT) | 2021 (MT) | Diff. (MT) | Diff. (%) |

|---|---|---|---|---|

| Palm Kernel Oil | 25,660 | 4,999 | 20,661 | 413.28 |

| Palm-based Oleo | 20,461 | 30,228 | (9,767) | (32.31) |

| Finished Products | 11,722 | 12,268 | (546) | (4.45) |

| Palm Oil | 9,383 | 8,546 | 837 | 9.80 |

| Grand Total | 67,226 | 56,041 | 11,185 | 19.96 |

Source: MPOB

The most imported OPP from Malaysia is palm kernel oil. Under this category, RBD palm kernel oil recorded the largest volume and the highest increment, increasing by over 9,000 MT from 101 MT when compared to the same period in 2021. Another product that recorded a high increment is RBD kernel olein, increasing by over 3,000 MT from 0 MT in 2021. Although palm-based oleo category declined by 32%, this category remained as the second highest most imported. Top five components under this category are stearic acid at 3,086 MT, palmitic acid at 2,747 MT, lauric acid at 2,528 MT, triple pressed stearic acid at 2,432 MT, and oleic acid at 1,170 MT. Under finished products, the top components imported are vegetable fats, increasing by 16.44% at 9,206 MT. This is followed by cocoa butter equivalent at 2,177 MT.

Outlook for Palm Oil

Research report by Statista stated that the edible oil market in Brazil is set to advance at a CAGR of 3.61% in revenue and 2.99% in volume during the 2023-2028 forecasted period. Soybean oil is anticipated to remain a key staple in the nation’s culinary habits, despite the rising demand for premium edible oils. However, Brazil as the fifth largest country in the world and the 9th largest economy by GDP with a population of about 210 million people, has plenty of opportunities for oil palm product utilisation growth.

Brazil’s revenue of the food market was among the ten highest-grossing in the world, amounting to almost USD250 billion in 2021 (Statista). One of the sectors that can capitalise on oil palm products is in bakery. Sao Paulo has emerged as the largest bakery market in Brazil followed by Rio de Janeiro and Belo Horizonte, led by the bread and rolls category in both value and volume terms in 2021 (GlobalData). The country is also one of the leading global players for biscuit, pasta, industrial bread, and cake categories. Average bakery product consumption per capita in the country is calculated at 21.6 kilograms for 2020.

Biscuits retain a distinctive place in Brazil’s basic food basket because of their high quality and low price, while the sector is continually releasing new goods to increase demand and finding new chances to expand portfolios and package presentations. This biscuit industry offers rooms for oil palm-based ingredient to rise further. Brazil is the world’s third-largest maker of pasta following Italy and the US, with a production exceeding one million tons. Many producers in the sector produce pasta as well as bakery products such as flour, cake, and cookies. Brazil’s oleochemicals market is expected to grow at a considerable rate in the near future, owing to increase in investments in irrigation, genetic improvements to increase crop productivity, and mechanisation of production. Brazilians are popularly known for paying special attention to their physical appearance. The country ranks among the largest cosmetic markets worldwide with over USD600 million worth of export for beauty and hygiene products. Revenue in confectionery segment amounts to USD10.70 billion in 2022, with an average volume per person amounting to 10.7 kg in 2023 (Statista).

Opportunities for oil palm based product in the Brazilian market is abound, especially since the country has an enormous internal growth potential, a broad industrial base and infrastructure and a diversified economy. Brazil is a traditional leader among emerging markets where the country represents the gateway to the Mercosur trade bloc, including Argentina, Paraguay, Uruguay, and Venezuela. And thanks to Brazil’s special relationships with Bolivia, Chile, Colombia, Ecuador, Peru, Guiana and Suriname, the country provides access to a shared market of more than 310 million customers, representing potential growth for oil palm-based product growth.

Prepared by Nur Adibah Mohd Razali

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.