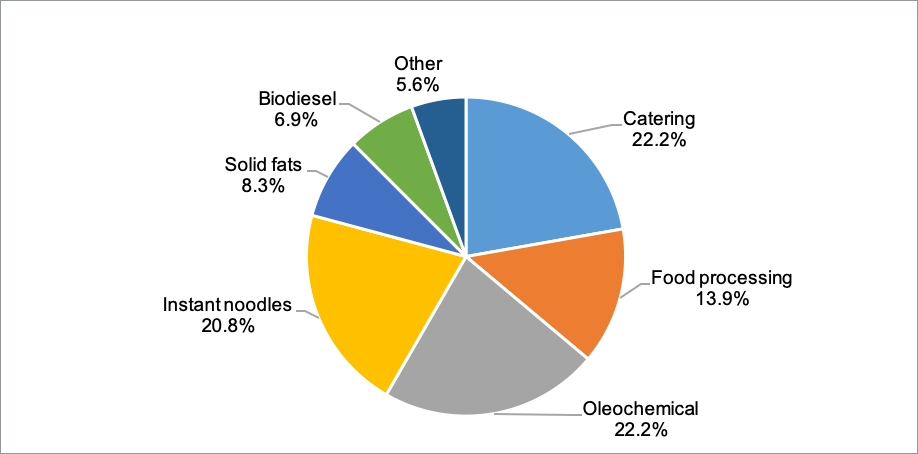

China’s domestic consumption of palm oil has reached 7.2 million MT in 2019, which is approximately 9.5% of the total global production of palm oil. The imports and consumption of palm oil recorded a significant growth of 33% in 2019 (increasing from 5.4 million MT in 2018 to 7.2 million MT in 2019) which was primarily due to the decline in soybean crushing as a result of ASF and the competitiveness in palm oil price against its competing oils last year. Palm oil consumption in China is primarily concentrated in the food and edible oil sector. In 2019, around 43% of the total palm oil imported by China was used in the food manufacturing process, whereas in edible oil sector, the share was close to a quarter of the total imported palm oil. The other 22% of the imported palm oil is used in oleochemical production and close to 13% is used in other sectors including biodiesel & animal feed.

Key Sectors and Industry for China’s Palm Oil Imports

China’s hospitality sector and retail food segments prefers to use palm oil as compared to other edible oils. With the steep growth of China’s fast-food industry, and other takeaway segments such as Yum China and McDonald’s, the significant undertakings of palm oil as cooking oil is big due to its price advantage, especially for frying purposes such as chicken and potato items in fast-food restaurants.

Besides the food retail industry, rapid development in processed food and confectioneries also has been creating more room for higher palm oil usage and import. Among the processed food, instant noodles are the main product that uses the majority of imported palm oil. The companies responsible for the substantial palm oil usage hikes are, Chinese organizations like Dali Food, Need, Toly Bread, and worldwide brands, including Mars, Danone, PepsiCo, Kraft, and Nestlé, which are widely popular in the Chinese market.

The oleochemical industry in China uses 22% of its imported palm oil in manufacturing home care detergents, cosmetic and personal care products. International brands like Unilever and L’Oréal along with domestic companies such as Nice Group and Guangzhou Liby are the key players in this segment.

Growing Sustainability in China

China is leading the world, in renewables energy expansion in the current decade. It committed $758 billion between 2010 and the first half of 2019, almost 30% of the total world’s spending according to United Nation’s 2019 report. China is also giving out financial aid to sustainability-linked initiatives to business with lower interest rate. The Chinese government is also has been supportive of promoting sustainable food consumption and advocating sustainable palm oil import in line with their green belt and road, the “2030 Agenda”. This government initiative will drive the Chinese companies and other international brands to import more CSPO.

Consumer Demand for Sustainability

Together with the growing usage of palm oil by various sectors in the oils and fats industry, awareness of the environmental and social issues associated with palm oil is slowly increasing. The demand for sustainable products among end-consumers are at historical high, given that China alone makes up more than 10% of global consumption. 85% of the Chinese population advocate for sustainable products compared to only 36% from the USA according to Ipsos’ survey conducted on behalf of the World Economic Forum in January 2020.

Sustainability Challenges

Despite a huge leap in China’s take on sustainability in green energy and economy, there is still a loophole in implementing the initiatives, especially in the food sector mainly due to price factor. As per RSPO impact report 2019, there was only 2% CSPO import in the market and by the end of 2020, the amount is expected to reach by 10%. The low uptake of sustainable palm oil in the global market is largely due to the complexity of supply chains as well as the high cost of production. The estimates of the premium charged for Roundtable Sustainable Palm Oil (RSPO) certified palm oil range from 3% to 10%.

Malaysian government have their certification scheme called Malaysian Sustainable Palm Oil (MSPO). As of July 2020, 85% of the total palm oil produced is MSPO certified. If China could recognize this certification scheme as “green” and sustainable, similar to RSPO, and run trials of best practices with the Malaysian government to satisfy to meet their regulations, the high-cost challenge can be mitigated effectively.

Malaysia’s Commitment to Sustainability

Malaysia has taken the lead in penetrating the Chinese market in term on getting recognition on MSPO’s standard. In 2019, MPOCC has started working with China’s Green Food Development Center (GFDC) to get reciprocal accreditation between China’s Green Food labelled products and MSPO certified palm products. Under the MoU signed between the 2 parties, any Malaysian product certified MSPO will be granted with “Green Food” label by GFDC on that product. Although the operational aspect of this cooperation has yet to be finalized, this is undoubtedly is a milestone for Malaysia. This initiative will make Malaysian palm oil the preferred choice and will enhance the position of the Malaysian government and the palm oil industry’s sustainability commitment in the eyes of Chinese consumers.

Prepared By: Theventharan Batumalai and Desmond Ng

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.