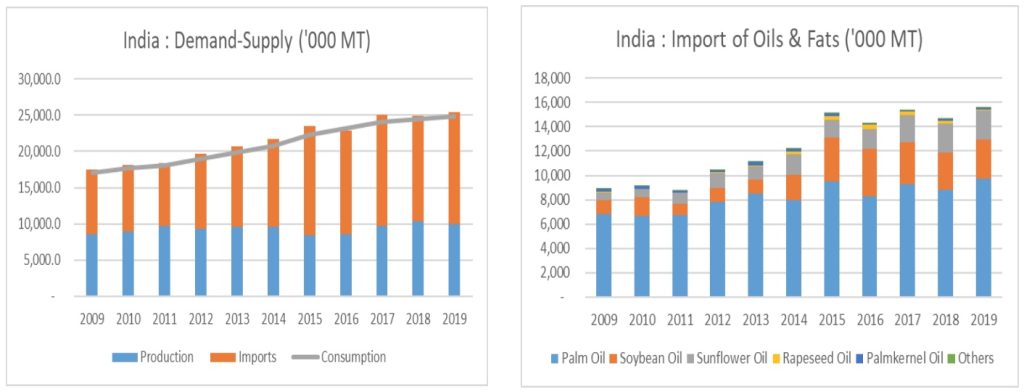

The latest data by The Solvent Extractors’ Association of India (SEA) has indicated that India’s edible oil imports for March 2020 recorded a decrease of 32.44% from a year before. Imports for March 2020 were registered at 941,219 tonnes, a stark comparison to 1,393,255 tonnes registered in March 2019. The decline is mainly attributed to the government restrictions on purchase of refined palm oil from the overseas market. Market share of palm oil is more than 60% of the total vegetable oils imported into India. Heavily relying on importation of oils and fats, domestic production of the edible oils is insufficient and could only fulfil around 40% of local consumption. The HoReCa (Hotel, Restaurants and Cafeterias) sector accounts for 40% of the 23 million tonnes edible oil demand required annually.

According to the provisional data released by the SEA, RBD palm olein was the biggest casualty with a 90% import decline, recorded at 30,850 tonnes in March this year, a steep decline from 312,673 tonnes imported during the same period a year ago. Import of RBD palm olein (refined, bleached and deodorized) has reduced drastically as the commodity has been put on “restricted list” of trade since early this year. Under this restriction, importers would require a licence or permission for the inbound shipment should they wish to import the product.

Imports of crude palm oil (CPO) and crude palm kernel oil (CPKO) have declined 38% to 304,458 tonnes in March this year from 489,770 tonnes a year ago. However, imports of soybean oil as well as sunflower oil declined only marginally to 292,410 and 296,501 tonnes in March this year from 292,925 and 297,887 tonnes respectively during the same period a year ago. Total edible oils imports shows a decline of 10% to 5,391,807 tonnes during November-March period of the 2019-20 oil year compared to 6,005,067 tonnes registered during the same period a year earlier as reported by the SEA. India’s oil year runs from November to October.

The restriction on purchase of

refined palm oil might not be the single contributing factor leading up to

declining demand of India’s vegetable oils in 2020 although it could be singled

out as the main reason. Initial estimates suggest that edible oil demand will

fall by about 475,000 tonnes as a result of the nationwide lockdown which is

being implemented currently for 21 straight days. The SEA projected that

imports would go down by at least half a million tonnes this year due to the

lower demand. India imported 10 million tonnes of palm oil in 2019.

Local refineries are reportedly struggling to sell their finished goods due to the disruptions in the distribution networks. Processing activities have also been reportedly slowed down. This may seem alarming but according to the SEA Executive Director, B V Mehta, there is sufficient stock in the country to meet the domestic requirements and there is no concern about availability. Monthly consumption of edible oil is around 1.8 – 1.9 million tonnes per month and a decline in demand will be seen from the HoReCa sectors as most eateries have closed down during the lockdown period.

However, it is believed that the declining demand from the HoReca sector will be partially offset by the slight increase of household consumption during the lockdown period. Already it is being reported that demand for essential household items such as baby care items, dairy and ready-to-eat food items has seen a spike mostly due to the panic buying. Personal hygiene and home care products seem to be moving out equally fast.

In addition to the marginally decline of imported soft oils, stocks of imported oils are reportedly sufficient. Harvesting of mustard crop is going on in the states of Rajasthan and Madhya Pradesh where production of mustard oil and all local processing mills are taking place as usual. Although there have been some labour shortage and logistics issues being reported, the problems are being sorted out.

As stated earlier, the reduction in edible oils imports to India is mainly due to the restriction of imports on refined palm oil that has demonstrated a major impact on Malaysian palm oil as the main supplier of RBD palm olein into India. It is widely known that the restriction in place is due to the pre and post duty reversal adaptation by the Government of India (GOI) in response towards Malaysia’s stand on certain policies adopted by the GOI. However, the present situation will not last long and India will need to start importing when the current stocks become depleted. Furthermore, it has been reported that the country has no plans to extend the current lockdown as it struggled to keep essential supplies flowing and prevent tens of thousands of out-of-work people fleeing to the countryside. Prime Minister Narendra Modi ordered the country’s 1.3 billion people to remain indoors until April 15 saying that was the only hope to stop the epidemic. But the order has left millions of impoverished Indians jobless and hungry.

Additionally, should India opt for other soft oils to replace palm oil, it should be noted that the price differential will be higher. The purchasing is viable but it’s the local buyers that will feel the pinch the most as other vegetable oils could fetch higher prices.

Prepared by Azriyah Azian

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.