Oleochemicals are chemical compounds derived from natural oils and fats such as palm oil, coconut oil, rapeseed oil, and tallow. These compounds are used in a wide range of applications, from the manufacturing of beauty products to the production of soaps and detergents, to the formulation of animal feed, to name a few. Oleochemical products have a wide range of applications, which have increased the demand for exports.

Mexico’s oleochemical industry is expected to witness significant growth in the near future, owing to the surge in demand for eco-friendly, biodegradable, and sustainable products. The market for oleochemicals in Brazil and Mexico, estimated at USD521.2 million in 2017, is expected to reach USD782.3 million by 2025, growing at a CAGR of 5.2% from 2018 to 2025, according to Allied Market Research.

Some of the basic oleochemicals that are categorised are fatty acids, fatty methyl esters, fatty alcohols, fatty amines, and glycerin. Fatty acids can be used directly in the production of candles and cosmetics. Fatty methyl esters on the other hand are used in the pharmaceutical and cosmetic industries, in the plastic and textile industries, and in other sectors. Derivatives of fatty alcohols are widely utilised in the manufacturing of laundry and cleaning agents. Finally, the mining sector primarily uses fatty amines as an anti-caking agent and in road construction. In addition to its use as an insulating material for carpeting, freezers, refrigerators, and seat cushions, polyurethane is also one of the distinctive oleochemical products.

Soaps and detergents

One of the major applications of fatty acids is in the making of soaps and detergents. Soap market in Mexico registered a positive compound annual growth rate (CAGR) of 5.97% during the 2015-2020 period with a sales value of MXN11,098.12 million in 2020, an increase of 6.61% over 2019. In 2020, the bar soap segment accounted for a major share of 94.74% in the Mexican soap market, while liquid soap ranked second and accounted for 5.26% of the market share in 2020. United States was the main export destination for soaps and detergents from Mexico, accounting for 41% of total exports (Indexbox).

Owing to the development of the textile industry, and the penetration of washing machines into the country, demand for soaps and detergents in Mexico is expected to increase. Furthermore, the rise in healthcare awareness has boosted the demand for soaps and detergents as essential sanitising products. As a result, the demand for oleochemicals in Mexico is predicted to increase, thereby supplementing the growth of the market.

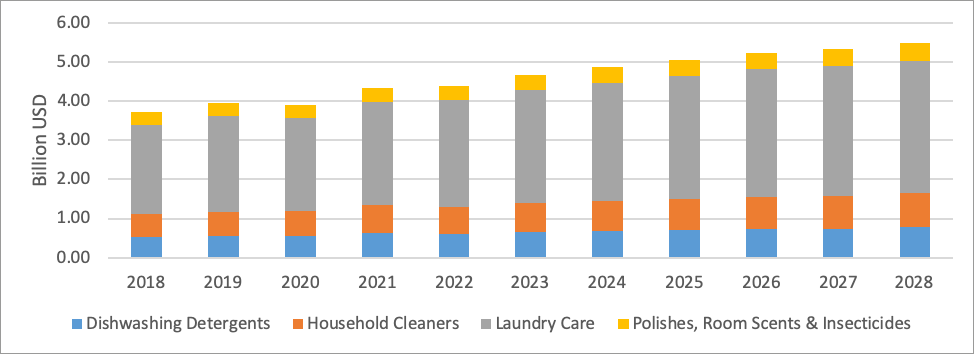

Mexico: Home Care Revenue in billion USD

Cosmetics

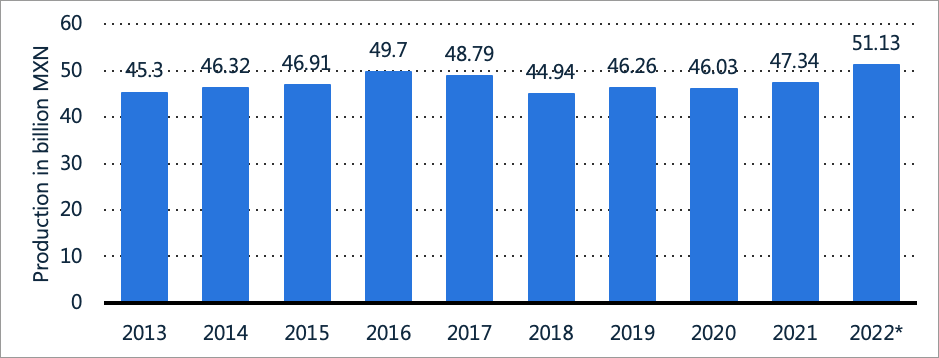

Personal care items are Mexico’s most productive segment in the beauty market, generating a market revenue of USD3.62 billion in 2022. That year, Mexico produced MXN51.13 billion’s worth of beauty products. As per the Flanders Investment & Trade Market Study 2022, Mexican customers annually spend approximately USD215 in beauty and personal grooming items. The significant increase in spending on appearance is contributed by the growing beauty consciousness among male consumers, and an increase in the number of brands foraying into internet retailing. Mexico’s consumption of beauty and personal care products is anticipated to be significantly impacted by an improved consumer lifestyle and an increase in the number of working women. In recent years, anti-aging products have become increasingly popular among older and younger people, while Mexican men are using more hair care products, driving the growth of cosmetics products in Mexico.

Leading cosmetics brands in Mexico include Mary Kay, Gillete, Nivea, Pantene, and Rexona. Natura was the company with the best reputation in the Mexican beauty industry in 2022. After the company’s home country of Brazil, Mexico is its second-most significant market. At the same time, Mexico exported its beauty products mainly to the US, with an export value of approximately USD1.3 billion in 2021. Chile and Colombia followed in the list, with Mexican cosmetic exports amounting to approximately USD104 and 84 million, respectively.

In 2022, Mexico manufactured cosmetics, fragrances, and personal care products valued at MXN51.13 billion, indicating a marginal growth from the preceding year. Mexican production in the cosmetics and personal care sector has experienced slight fluctuations over the past couple of years, with 2016 previously being the strongest year in terms of production value, at nearly MXN50 billion.

Mexico: Production value of cosmetic products 2013-2022

Industrial Goods

Furthermore, oleochemicals are utilised in a variety of applications, and some emerging oleochemical applications have been replacing petroleum-based products, which are expected to generate significant development opportunities for Mexican players. As the price of crude oil rises, manufacturers prefer to switch from petrochemicals to oleochemicals, which are plant-based and serve as an inexpensive source due to their biodegradability, environmental friendliness, and low toxicity. Furthermore, several new oleochemicals including biopolymers, biosurfactants, and biolubricants, which have emerged as alternatives to petroleum-based products, are likely to provide attractive growth prospects for the Mexican oleochemical market.

Palm Oil Opportunities

Over the past decade, many manufacturers and traders shifted towards the use of palm-derived oleochemicals, as opposed to petrochemicals, due to the versatility in application and high yield rates of palm, as well as the increase in the number of plants in Southeast Asia with access to palm feedstocks.

The key factor driving the demand is from end-use industries and easy availability of raw materials. Palm-based oleochemicals are produced from refined palm oil, palm stearin that has been produced from fractionated palm oil, refined palm kernel oil, crude palm kernel oil, and palm fatty acid distillate.

In 2022, Mexico imported 29,225 MT of palm-based oleo from Malaysia, comprising 43.5% of the total oil palm product export. This makes Mexico the largest importer of Malaysian palm-based oleo from the South America region. Export volume in 2022 is higher by 5,6117 MT or by 23.8% as compared to the volume in 2021. The second most imported palm product group from Malaysia is palm kernel oil at 18,456 MT, increasing by 13.6% as compared to the previous year. Palm oil import from Malaysia totalled at 10,450.5 MT in 2022, rising by 55.7%. This is followed by finished products.

Malaysian Oil Palm Product Export to Mexico

| 2022 (MT) | 2021 (MT) | Diff. (MT) | Diff. (%) | |

|---|---|---|---|---|

| Palm-based Oleo | 29,225 | 23,614 | 5,612 | 23.8% |

| Palm Kernel Oil | 18,456 | 16,243 | 2,214 | 13.6% |

| Palm Oil | 10,451 | 6,711 | 3,740 | 55.7% |

| Finished Products | 5,343 | 6,102 | -760 | -12.4% |

| Total | 63,475 | 52,670 | 10,806 | 20.5% |

Source: MPOB

Under the palm-based oleo category, the top three products breakdown include RBD kernel stearin, lauric acid, and palmitic acid.

Product Breakdown of Palm-Based Oleo Export to Mexico

| 2022 (MT) | 2021 (MT) | Diff. (MT) | Diff. (%) | |

|---|---|---|---|---|

| RBD Kernel Stearin | 13,099 | 6,712 | 6,387 | 95.2% |

| Lauric Acid | 7,207 | 3,516 | 3,691 | 105.0% |

| Palmitic Acid | 6,365 | 8,111 | -1,746 | -21.5% |

| Stearic Acid | 4,768 | 3,533 | 1,235 | 35.0% |

| Cocoa Butter Equivalent | 4,523 | 3,544 | 979 | 27.6% |

| NBD Palm Olein | 4,505 | 5,499 | -994 | -18.1% |

| RBD Palm Kernel Oil | 4,038 | 6,520 | -2,482 | -38.1% |

| Others | 18,971 | 15,234 | 3,737 | 24.5% |

| Total | 63,475 | 52,670 | 10,806 | 20.5% |

Source: MPOB

Conclusion

Palm-based oleochemicals are in high demand because of the wide range of applications that are possible with palm and palm kernel oils, due to their versatile and durable chemical profiles. The availability and competitive pricing of palm oil has also driven the demand for palm oil, as the global population grows.

The Mexican palm oil market has been experiencing strong growth in recent years. The driving force behind this growth is the increasing demand for palm oil in various industries, including food, oleochemicals, and biofuels. Additionally, the versatility and cost-effectiveness of palm oil make it an appealing choice for many sectors. Fatty acids, alcohol, and many oleaginous raw materials of plant and animal origin, such as glycerin, soy, and beef tallow, have high growth potential in the Mexican oleochemical industry. Furthermore, environmental restrictions are becoming stringent, and non-renewable resources are depleting, allowing oleochemicals to enter the market and replace the currently used petroleum-based goods. In addition, manufacturers are substituting chemical products with bio-based, eco-friendly products in order to minimise pollution while reducing time and cost. Lastly, increasing focus on personal appearance among the youth is also driving the demand for oleochemicals in personal care and cosmetics.

Prepared by Nur Adibah Mohd Razali

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.