Iran oils and fats market

Iran is an important export market that is ranked as the second biggest oils and fats consuming country, after Turkiye, in the Middle East region. In 2021, Iran consumed 2.17 million MT of oils and fats, and is estimated to surpass 2.2 million in 2022. The consumption per capita was recorded as relatively high at 25.6 kg. Due to its high population of 84 million residents, Iran has a good potential as an export market in the region.

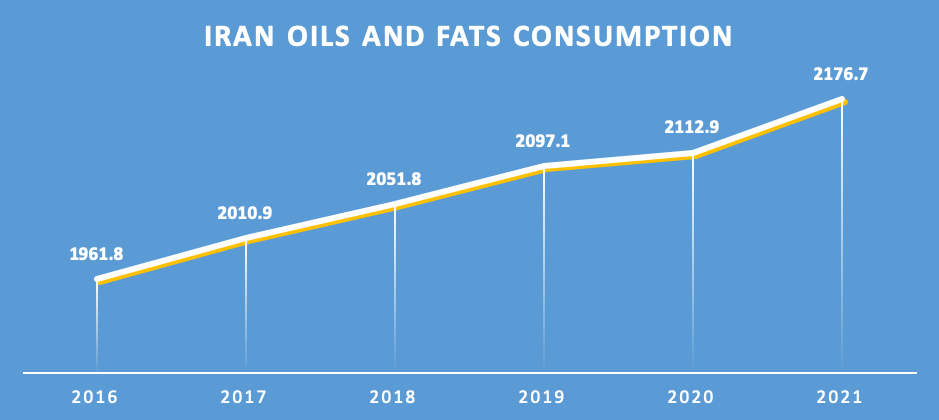

Chart 1: Iran Oils & Fats Consumption (‘000 MT)

As shown in Chart 1 above, Iran’s consumption of oils and fats has increased by 214,900 MT or 11 per cent since 2016. Even during the global economic downturn in 2019/2020, its consumption of oils and fats maintained its upward trend. However, the total import of oils and fats in 2020 decreased, including that of palm oil. This was mainly due to the higher importation of seeds and local production of oils, particularly the higher crushing of soybean seeds to support a higher requirement of local soybean meal. The imports increased again in 2021 by 104 per cent as compared to the previous year, mainly to cover the shortage and recover the economic activities in the local market (Chart 2).

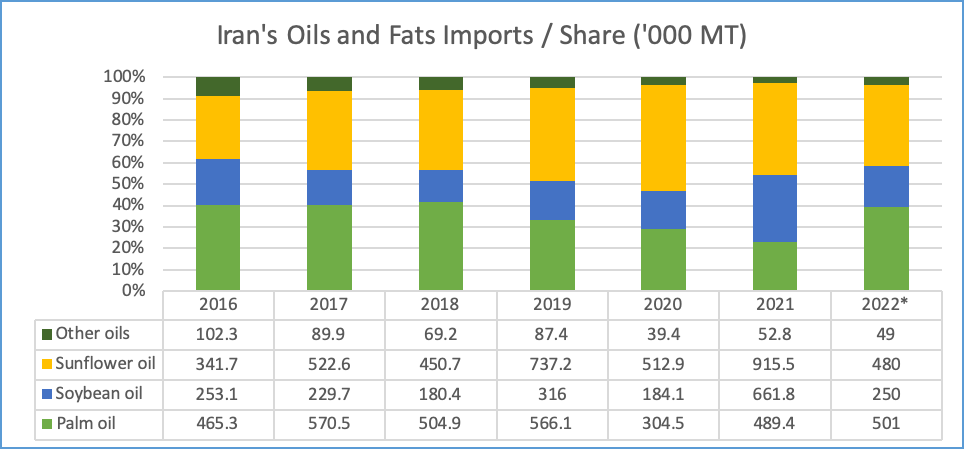

Chart 2: Iran’s Oils and Fats Imports / Share (‘000 MT)

Sunflower, soybean and palm oils are the top three vegetable oils imported by Iran, covering more than 90 per cent of the total oils and fats imported every year. Improving economic activities after the Covid-19 pandemic in the country pushed the demand for oils and fats which then increased imports, especially palm oil.

Last year, there was nearly 460,000 MT of Malaysian palm oil (MPO) imported by Iran, which increased to more than 50,000 as recorded in 2021. Whereas, palm oil imports from other countries accounted for around 50,000 MT or 11 per cent of the palm oil imported. The lowering of import tariff from 40 per cent to 1 per cent at the beginning of 2022 for all vegetable oils, including palm oil, has given another advantage to palm oil as compared to other vegetable oils.

As a result, palm oil recaptured the market last year at 40 per cent of the total oils and fats imported by the country, the same level recorded in 2016-2018. And this was at the expense of other main vegetable oils in the country such as soybean and sunflower oils. Soybean and sunflower oil imports in 2022 dropped by 412,000 and 435,000 MT, respectively.

MPO export performance in 2022

Iran imported 458,770 MT of MPO in 2022, showing a favourable trend for this year, an increase by 54,450 MT as compared to the same period last year. The MPO products value was also positively recorded at RM2.53 billion, a hike of 45.6 per cent during the period. RBD Palm Olein was the highest, representing 68 per cent of the total MPO exported to Iran. Higher demand for RBD Palm Olein came from industrial usages such as the production of fat products, frying and the HORECA sector. Apart from that, Palm Olein is also used as a blended cooking oil in households.

Table 1: MPO Exports to Iran

| PRODUCTS | Jan-Dec 2021 (MT) | Jan-Dec 2021 (RM Mil.) | Jan-Dec 2022 (MT) | Jan-Dec 2022 (RM Mil.) |

|---|---|---|---|---|

| COOKING OIL | 6,258 | 31 | 6,339 | 45 |

| PALM MID-FRACTION | 519 | 3 | 249 | 2 |

| RBD PALM OLEIN | 318,561 | 1,331 | 314,317 | 1,702 |

| RBD PALM OIL | 78,298 | 370 | 137,799 | 781 |

| RBD PALM STEARIN | 684 | 3 | 66 | 0 |

| TOTAL | 404,320 | 1,738 | 458,770 | 2,530 |

Source: MPOB

MPO export expectations and opportunities in 2023

The importation of commodities including oils and fats is highly controlled by the Iranian government. This is done to manage the pricing of the commodity supplies in the local market, as well as the inflation rate of the finished products intended for local consumption. The depreciation of the Iranian currency also puts pressure on the local government to control inflation, especially in the importation of products for local consumption and production. To address the issue, some parts of the importation policy has been changed, including the importation of oils and fats.

Since 2018, oils and fats including palm oil have been put under the Iranian subsidies scheme, whereby the importers could apply for a lower exchange rate to get USD from the Central Bank of Iran to import the commodities. This again has been changed in early 2022 with the introduction of lower import tariffs from 40 to 1 per cent for the products under the subsidies scheme, to encourage the importation of commodities and supply the products to the local market at a more affordable price.

The current policy has provided a better advantage to palm oil as the import tariff is on par with other vegetable oils, as compared to the higher tariff on palm oil in the previous importation policy. With palm oil being more price competitive, it is expected that the volume of Malaysian palm oil imports this year will be higher.

The consistency of Malaysian government policy on the export tariff and the supply of Malaysian palm oil has attracted Iranian palm oil importers. It is important for them to stabilise the supply of palm oil in their local market and price fluctuation risks. Hence, Malaysian players should take this opportunity to regularly enhance their communication and network with Iranian players to explore other palm oil niche markets in Iran, especially for a better channel for financial transaction matters and a more competitive logistics arrangement.

Prepared by: Mohd. Suhaili Hambali

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.