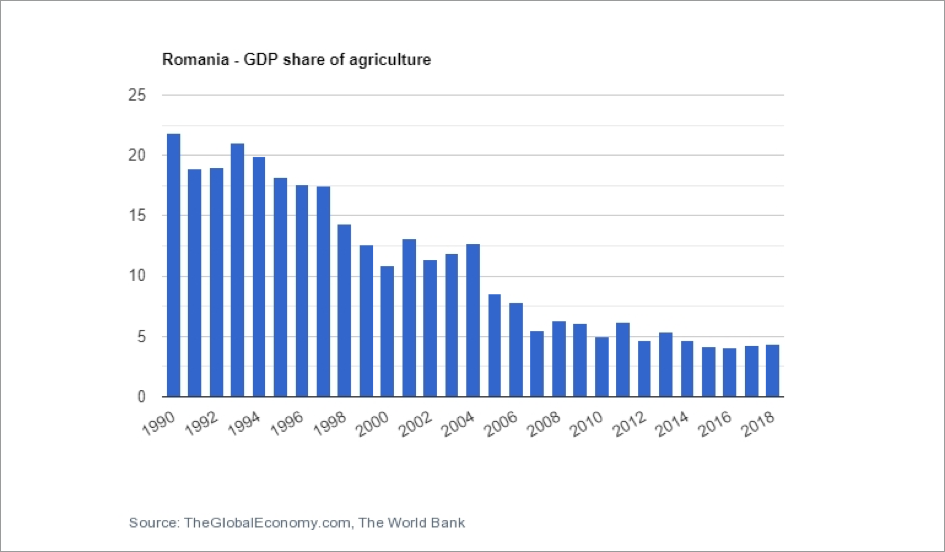

With a total land area of almost 240,000 square km, Romania is the biggest country in the Balkan. It is very much an industrial country since overtaking agriculture as the main economic driver since 2007 when the country joined the European Union. With an agricultural land capacity of close to 15 million hectares, currently only 10 million hectares are used as arable land. Agriculture which used to contribute to 20% to Romania’s GDP in the 1990’s has now declined to less than 5% as in 2019 statistics showed that agriculture contributed to only about 4.3% of GDP in 2019, down from 12.6% recorded in 2004. According to the Romania Country Economic Memorandum (2020), Romania’s income per capita increased from 26% of the European Union (EU)-28 average in 2000 to 63% in 2017. (Refer to Chart below).

Oilseed planted areas

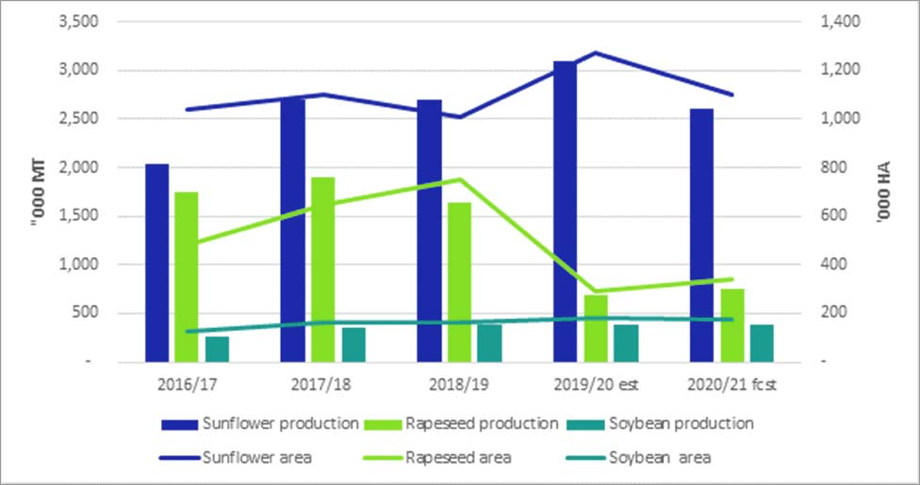

Romania’s oilseed area accounts for approximately 25% of its total grain and oilseed area with sunflower seed planted area accounting for the largest share, followed by rapeseed, and soybeans. Based on USDA data, the total oilseed area is projected to fall by 7% due to a decline in the sunflower area. As a result, it is expected that year-on-year the total oilseed production is expected to fall by 10.7%. Rapeseed production was most affected as it declined significantly mainly due to dry planting conditions.

Despite being the EU’s largest producer of sunflower seed, Romania’s production is forecast to decline by 13% in 2020/21 due to lower profit margins and crop rotation, compared to an expansion of 26% in 2019/20. As a consequence, exports are expected to fall by 20%, with the largest share of sunflower exports bound for other EU markets, with only about 15% destined for non-EU markets.

Source : USDA

It is estimated that 400,000 ha rapeseed were planted under rapeseed in the fall 2019 during exceedingly dry planting conditions. Of the initial 400,000 ha, only about 340,000 ha is likely to remain under rapeseed, with the other 60,000 ha diverted into spring crops. Romania’s 340,000 ha of rapeseed in 2020/21 marked a 50,000 ha increase over 2019/20, however both years fall considerably short of MY 2018/19’s record rapeseed area. Dry conditions during fall planting is the biggest factor. Drought conditions over the winter and spring, as well as a damaging mid-March frost, are likely to lead to a seven percent decline in yields compared to last year. Despite the lower reduced area, total rapeseed production is forecast at 750,000 MT, a 9.3% increase compared to last year. (Refer to Chart above).

Oils & fats situation

Romania is self-sufficient in terms of oils and fats production and they are a net exporting country of oils and fats. Annually they produce more than 700,000 MT oils and fats with sunflower oil comprising 65% or 500,000 MT of their total production. Consumption is at 650,000 MT with sunflower and rapeseed oils the main oils consumed at a combined 400,000 MT or 62% of total consumption. Most of their exports (90%) are to countries within the EU region.

Despite being a net exporter, Romania still import more than 110,000 MT oils and fats and palm oil is the most imported oil with almost 60,000 MT annually which comprise slightly more than 50% or of total imports. In terms of consumption, palm oil is in third most consumed vegetable oil behind sunflower oil and rapeseed oils.

Romania is a market pressed by low margins, and several large players such as Prutul, Bunge, Ulerom, Ultex and Expur have already invested in or announced plans to invest in biodiesel production as they expect this market to increase in the future. The most significant oils and fats players are Bunge, Argus, Cargill and Agricover. Bunge has a share of about36% in the edible oil market and operates two factories, Interoil Oradea and Unirea Iasi. Argus is the second biggest player in Romanian the market, with about 20% share of the market volume. The third player is Cargill, and they have acquired the oil business of Topway (including the “Bunica” brand) and they are aiming to be the number one player in the industry.

| (‘MT) | 2015 | 2016 | 2017 | 2018 | 2019 | 2020F |

| Opening Stock | 58,600 | 88,000 | 67,000 | 61,000 | 79,600 | 97,500 |

| Production | 674,100 | 615,000 | 673,700 | 774,600 | 797,800 | 750,000 |

| Import | 135,300 | 123,700 | 112,200 | 109,300 | 121,300 | 128,000 |

| Export | 248,100 | 203,300 | 228,600 | 269,000 | 264,100 | 265,000 |

| Consumption | 531,900 | 556,400 | 563,300 | 596,300 | 637,100 | 642,000 |

| Ending Stock | 88,000 | 67,000 | 61,000 | 79,600 | 97,500 | 68,500 |

Source : MPOC Intelligence & Oil world

Storage capacity

Romania has somewhat limited storage capacity and the storage prices are quite high. The prices are not only due to the good services provided, but includes other factors such as regional monopoly which the storage company has over other competitors and the loading/unloading from silo costs 10 euro/ton of the product. One company providing such a service is Cargill and with the financial clout they have they are able to pay for the stored product the next day after receiving from farmers but it has to be noted that the prices are slightly higher than the average prices. Practically every farmer in Romania sell their oilseeds produced at the harvesting as they lack adequate storage facilities and even when they do, they cannot control very well the self-heating phenomenon which is very prevalent in the case of oilseeds.

The oil factories have low storage facilities, which ensures that their operation is for one month only and they mandate the silos or send representatives to silos to purchase sunflower seeds from farmers at harvest time. The factory pays for the seeds in the shortest time possible and furthermore the oil factories have established long-term contractual relations with the silos and it apparently both parts are happy with this partnership.

Romania palm oil situation

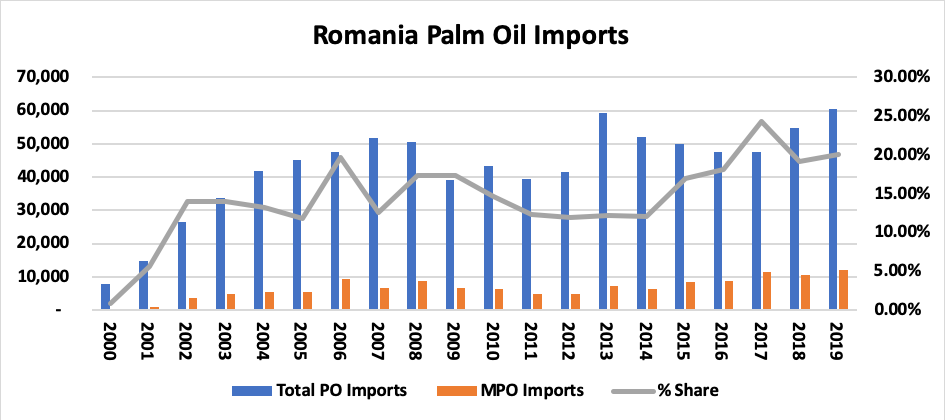

Romania’s palm oil import comprise between 20% – 25% of the total oils and fats imported into the country annually and 80% of the palm oil imported is via Netherlands. As for Malaysian import share, it is about 20% and there are opportunities for Malaysian palm oil exports to Romania if Malaysian exporters could take advantage by exporting direct as it would save cost and be much cheaper than through third countries. We have been informed by sources that most of the palm oil imported is in flexibags which is used mainly as ingredients for food processing and manufacturing. There is also a lack of storage facilities in Romania

Industrial users are the largest users of palm oil. Industries like food manufacturing, chemicals, cosmetics and pharmaceuticals are significant potential customers for palm oil, and they are all important industries in Romania. Some large manufacturers already use palm oil in their production processes and by various restaurants, bread producers, etc. By targeting these industries and encouraging them to use palm oil instead of the vegetable oils or fats they are currently using, palm oil can build significant market share.

| (‘000 T) | 2015 | 2016 | 2017 | 2018 | 2019 | 2020F |

| Sunflower oil | 235,900 | 256,600 | 253,400 | 264,300 | 283,000 | 279,000 |

| Rapeseed oil | 105,800 | 105,700 | 122,500 | 121,000 | 123,000 | 125,000 |

| Palm Oil | 50,000 | 47,500 | 48,100 | 54,700 | 60,000 | 64,000 |

| Other oils | 140,200 | 146,600 | 139,300 | 156,300 | 171,100 | 174,000 |

| Total | 531,900 | 556,400 | 563,300 | 596,300 | 637,100 | 642,000 |

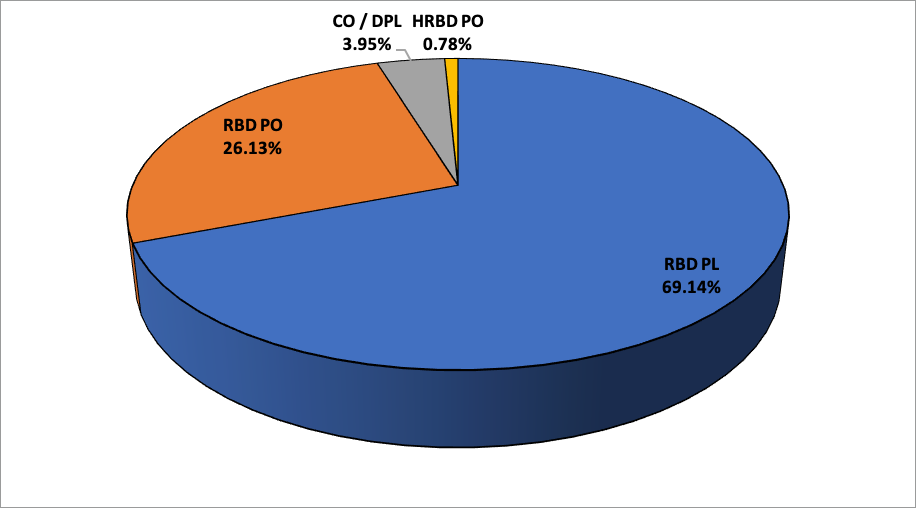

Almost all the annual imports of palm oil in Romania is consumed and there are no carryover stocks. This would indicate that they have limited storage facilities and they would purchase only what is needed. In 2019, Malaysia exported 12,104 MT palm oil valued at RM37.14 million. RBD palm olein is the main category of palm oil imported and this is used in prepared food industries.

Malaysian palm oil exports to Romania by type

Import Procedures

Being a member state of the EU, Romania follows the same procedure in the process of importing food based products as all countries in the EU. Romania’s food laws and regulations are harmonized with EU legislation but this depends on the type of imported agricultural or food product where specific authorities have responsibilities for clearing the shipments, namely MARD, ANSVSA, and the MOF’s Customs Directorate. Each border inspection point (BIP) is authorized to conduct checks depending on the type of commodity. As such, exporters should verify if the border point they intend to use for commodities prior to shipping into Romania is authorized by the competent authority to perform checks on the respective category of products.

Among the important Government of Romania (GOR) entities with regulatory responsibilities in respect of food and agricultural products, produced locally or imported are:

- Ministry of Agriculture and Rural Development (MARD) – responsible for drafting and implementing the national agricultural policy. MARD ensures implementation of the EU regulations in agriculture, food processing, land reclamation, and agricultural research.

- Ministry of Environment (MOE) – in charge of national environmental-protection policies, the green economy, biodiversity, protected natural areas, and climate change. MOE is the main regulatory body environmental risk assessment oversight, including for genetically engineered (GE) products, and for monitoring activities that may affect human health, and the environment.

- National Sanitary Veterinary and Food Safety Authority (ANSVSA) is the main body charged with sanitary, veterinary, and food-safety activities in Romania. It regulates animal health, and food and feed safety, either produced locally or imported. ANSVSA publishes annual information on the surveillance, prevention, and control of animal diseases and for the surveillance, and control of food safety.

- Ministry of Health (MOH) is responsible for overseeing the production and registration of drugs, food additives, and medical equipment. It is also responsible for public health as it relates to contaminants and food supplements.

- National Authority for Consumers Protection (ANPC) protects consumer rights and interests by enforcing consumer-protection legislation, including food products. It also regulates food labeling.

Duties, taxes and excises

Romania adopts the EU level customs regime through EU Regulation 2013/952 of the EU Parliament. Import duties are determined by the tariff classification of goods and by the customs value. Other taxes applicable to agricultural and food products are the value added tax (VAT) and excises. Romania applies a reduced VAT rate at 9 percent for food products and agricultural inputs (such as fertilizers and pesticides) and a standard VAT rate of 19 percent for other items.

Port facilities and logistics in Romania

Based on reports by the EU Commission, the main port for Romania is the Port of Constanta which is located on the Western Coast of the Black Sea. The total quay length is 29.83 km and the depths range between 8 and 19 meters. It covers an area of more than 3,900 hectares and contains 156 berths, out of which 140 berths are operational with a handling capacity of 100 million tons per year.

These facilities and landscape characteristics are comparable to those offered by the most European and international ports, which allows the accommodation of tankers with capacity of up to 165,000 dwt and bulk carriers of up to 220,000 dwt. Currently there are several projects in progress to build new facilities for cargo handling and to improve the transport connections between Constanta Port and its hinterland. These projects are mainly located in the South part of the port.

Conclusion

In view of the possibly lower crushing of edible seed this year, it is very likely that Romania would import more vegetable oils in 2020. Their annual import averaged at 270,000 MT and in 2020 it could reach 300,000 MT. This presents a superb opportunity for Malaysian oil to extend its presence within the country through marketing.

Palm oil incorporates a good reputation among consumers in Romania, although it is not widely known. Industrial consumption is already quite heavy, especially within the food manufacturing sector. There are opportunities in industries like chemicals, cosmetics and pharmaceuticals furthermore. Since the common EU foreign policy now applies for Romania, direct imports (i.e. not via other countries) from Malaysia could increase

The most important players are Bunge, Argus, Cargill and Agricover. Bunge features a share of about 36% within the edible oil market and operates two factories, i.e. Interoil Oradea and Unirea Iasi. Argus is that the second biggest player in the market with about 20% share of the market volume. The third player is Cargill, which has acquired the refining industry of Topway (including the “Bunica” brand) and aims to be the top producer within the industry.

One key importer in Romania is Render Com who began to import oil to the country from Malaysia since 1995. They continue to import Malaysian oil thanks to the regeneration of orders received from customers and a market uptrend has been seen since early 2000’s. Render Com is one among the earliest and largest Romanian importers of vegetable oil.

The market has been steadily increasing and a serious a part of the oil products are for industrial use. On the patron side, the market is dominated by one particular brand, OLINA, which distributed by Render Com. it’s mainly distributed through key accounts, especially through bulk retailers like Metro Cash & Carry. the merchandise comes in matte 3 litre plastic containers.

Since the market is dominated by one distributor, it can be that they need a big power over their marketing. However, key accounts still have the strongest negotiating power, irrespective of the importance of the distributor or manufacturer. Distributors are key within the industrial use for oil so any incentive strategy during this regard should be targeted at them. Industrial use is simpler to manage as sellers would should handle fewer customers, most of whom already know of the advantages and will experience healthy growth because the local food processing industry develops.

As direct imports are expected to extend, it’s important to facilitate the contact of Romanian distributors and importers with their potential Indonesian partners. Even perhaps better would be to determine a trade route through a Romanian sea port (most likely Constanta), so as to undertake to interchange the imports which are possibly coming through other ports from Netherlands, Turkey or Greece

Prepared by Mohd. Izham Hassan

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.