Nigeria is Africa’s largest economy but its economy is highly dependent on petroleum and fluctuation

in crude oil prices and production cause a major effect on its economy. Petroleum and natural gas sectors account for about 9 percent of the national gross domestic product (GDP), approximately 85 percent of its total export earnings, and about 65 percent of federal government revenue. In 2020, Nigeria had been hit hard by the pandemic and the decline in crude oil prices. The World Bank estimated that the economy of Nigeria has shrunk by 4.1 percent in 2020 due to the effects of the COVID-19 pandemic. The IMF projected that GDP growth projections for Nigeria to 1.5% in 2021 and output recovering to its pre-pandemic level only in 2022.

Oils and Fats Balance

Table 1: Oils and Fats Balance (000 MT)

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020E | |

|---|---|---|---|---|---|---|

| Production | 1485 | 1506 | 1600 | 1735 | 1847 | 1907 |

| Imports | 1633 | 1350 | 1572 | 1468 | 1468 | 1401 |

| Exports | 26.3 | 17 | 18.6 | 17 | 19.7 | 20 |

| Consumption | 3100 | 3072 | 3110 | 3191 | 3220 | 3265 |

| Ending Stocks | 338 | 104 | 148 | 142 | 216 | 236 |

Source: Oil World, MPOC Estimates

With a population estimate of 206 million in 2020, Nigeria would require annually 3.27 million MT of vegetable oils and fats to meet the domestic requirement for food and non-food uses. Nigeria’s production of oils and fats in 2020 was approximately 1.91 million MT. Palm oil is the most produced edible oil in Nigeria. In 2020, the total volume of palm oil produced in Nigeria was 1.28 million MT, which is 67% of the total oils and fats production. Last year Nigeria also produced 362,000 MT of groundnut oils and 104,000 MT of soybean oil. Nigeria is the largest importer and consumer of oils and fats in Sub-Saharan Africa. The nation imported 1.40 million MT of oils and fats and consumed approximately 3.27 million MT of oils and fats in 2020, with palm oil consumption accounting for 79.0 % of total oils and fats consumption or 2.59 million MT.

Table 2: Palm Oil Balance (000 MT)

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020E | |

|---|---|---|---|---|---|---|

| Production | 940 | 960 | 1040 | 1130 | 1220 | 1280 |

| Imports | 1577 | 1302 | 1499 | 1399 | 1431 | 1340 |

| Exports | 20 | 8 | 6.6 | 4 | 4 | 4 |

| Consumption | 2517 | 2480 | 2490 | 2523 | 2573 | 2591 |

| Ending Stocks | 310 | 84 | 126 | 127 | 100 | 125 |

Source: Oil World

Besides Malaysian palm oil, as shown in Table 3 below, Nigeria also imported a substantial amount of Indonesia palm oil and from neighbouring West African countries such as Benin, Togo, and Ivory Coast. In the past six years, the average annual Nigerian palm oil import was 1.39 million MT. The average Malaysian palm oil import during that period was about 260,000 MT per year giving the Malaysian market share of about 19%. However, considering that most palm oil that is imported into Nigeria from Benin and Togo are originated from Malaysia, MPO share in the Nigerian market could be higher.

The major factors that drive palm oil usage in Nigeria are the level of customer demand provided by the growing Nigerian population and the international price of crude palm oil. A decline in the international price of CPO always leads to increased imports of palm oil, as well as smuggling from neighbouring West African countries. Despite paying an import duty of 35%, Nigeria importers are not discouraged to import more palm oil from Malaysia and Indonesia as the demand is always there and imported palm oil is normally cheaper than locally produced palm oil. However, smuggling oil palm oil through neighbouring Western African countries was contained last year when the border between Nigeria and Benin was closed.

Table 3: Palm Oil Imports into Nigeria by Exporting Countries

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020E | |

|---|---|---|---|---|---|---|

| Malaysia | 229,560 | 186,840 | 246,909 | 242,388 | 286,964 | 367,819 |

| Indonesia | 402,500 | 286,300 | 308,600 | 146,200 | 156,300 | 130,000 |

| Others | 972,800 | 796,100 | 961,000 | 975,400 | 848,400 | 800,000 |

| Total | 1,604,860 | 1,269,240 | 1,516,509 | 1,363,988 | 1,291,664 | 1,297,000 |

| MPO Share | 14.30 | 14.72 | 16.28 | 17.77 | 22.22 | 28.36 |

Source: Oil World, MPOB, MPOC Estimate

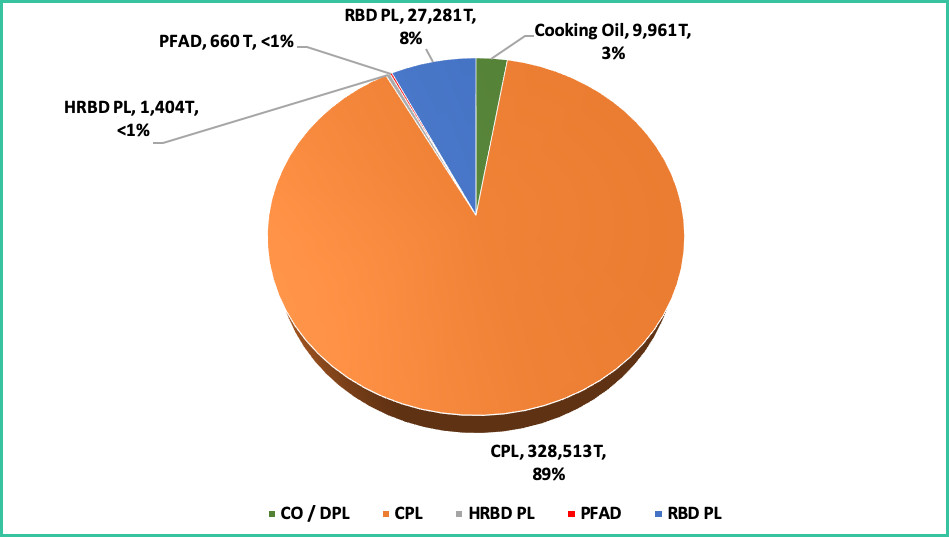

Figure 1: Breakdown of MPO Exports (Tonnes & %) to Nigeria, Jan-Dec 2020

Crude palm olein is the major MPO palm oil product exported into Nigeria with CPL constituted about 89% of total MPO intakes by Nigeria despite having to pay 35% import duties imposed by the Nigerian government. Packed palm oil products still officially banned from entering Nigeria. The surge in demand for CPO/CPL from Malaysia in the second half of last year can be attributed to 100% exemption on crude palm oil export duty given by the Malaysian government.

Strategies to retain or increase market share

a) Free Trade Agreement

Tariff barriers are still considered hindering trade relations between Malaysia and many African countries. It is quite understandably so since countries in the West African region such as Nigeria are also palm oil producers and for all intent and purposes, they want to protect their local production. However, at the current production rate, local palm oil production will not be enough the feed the population in the years to come and Nigerians still have to import palm oil from South East Asian nations and neighbouring countries to satisfy that need. According to the World Bank, with the implementation of AfCFTA that comes into effect on 1st January 2021, trade facilitation measure that cut many red tapes simplify custom procedures would drive $292 billion of the $450 billion in the potential income gains. Throughout the years, free trade agreements have grown in importance and scope. Free trade agreements don’t just reduce and eliminate tariffs, they also help address barriers that would otherwise impede the flow of goods and services; encourage investment; and help market access. Currently, Malaysia does not have any free trade agreement with any African countries. Malaysia would not have to negotiate for lower tariffs with each country individually. It could negotiate with a trade bloc like AfCFTA, and streamline the process, unlocking business opportunities much quicker than it would be by negotiating with each nation one-by-one

b) Investment in Oils and Fats Sectors

Malaysian palm oil traders need to consider setting up joint ventures and partner players from the Sub-Saharan Africa region if they are serious to capture more market share in the country’s oils and fats business. Furthermore, Malaysian palm oil players should also consider investing in storage, bulking, and manufacturing facilities in the region to facilitate the production and distribution of Malaysian palm oil. The hotel, restaurant, and café (HORECA) sectors are other segments that is fast growing and could yield a very high return. By helping hand accelerating the local economy through the opening of new jobs, it will ultimately increase awareness, demand, and purchasing power of the African people for Malaysian palm oil.

c) Roles of Government Agencies

Despite Malaysia’s business presence in Africa, many other Malaysian investors in the oils and fats business are still relatively unaware of the investment opportunities in Nigeria due to lack of information. This is the area where government agencies such as Matrade and MPOC can play a role by providing guidance and assistance to the industry players who want to venture into this market.

Malaysian trade promotion agencies such as Matrade and MPOC have relied on overcoming the physical distance between Malaysia and African countries by co-organizing and often financing in-person attendance of trade shows such POTS, trade missions, conferences, and other programs such as networking events in destination markets. Presently, in the times of the COVID-19 pandemic, these programs have to be put on hold, as most large-scale events are being cancelled or moved online, and travel restrictions make conferences, market visits, and trade missions impossible.

The COVID-19 pandemic, and the resulting digitalization of marketing efforts, are having an important impact on how palm oil export promotion services are carried out. Since 2020, MPOC has started organizing an on-line biz-match between African palm oil buyers Malaysian palm oil exporters. MPOC has set up a new online directory of companies called Palm Oil Link (https://palmoillink.com) specifically to connect the Malaysian palm oil industry players with buyers from the rest of the world directly without intermediaries.

The webinar is another platform has been used quite extensively since the start of the pandemic where the palm oil experts from a specific region are invited to share his/her expertise with on various palm oil subject matters include trade opportunities. The online conference is also an avenue that can be applied to target a wider audience and not region-specific. Until such time when physical programs can be implemented, MPOC can only limit itself to these virtual programs in our marketing efforts to maintain and increase MPO market share in Nigeria.

Nigeria’s palm oil market is growing, driven by the booming population and extensive application it can offer for both food applications and industrial uses. Furthermore, rising processed food and fast-food consumption due to changing consumer preference and taste is expected to have a positive impact on the Nigerian market. As evident from the MPO export volume demonstrated by Table 3 above, Malaysian palm oil has managed to retain its market share in Nigeria despite competition from other exporting countries and locally produced edible oil. Malaysian palm oil players should take this opportunity to make further inroads in Africa’s fastest-growing market.

Prepared by Iskahar Nordin

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.