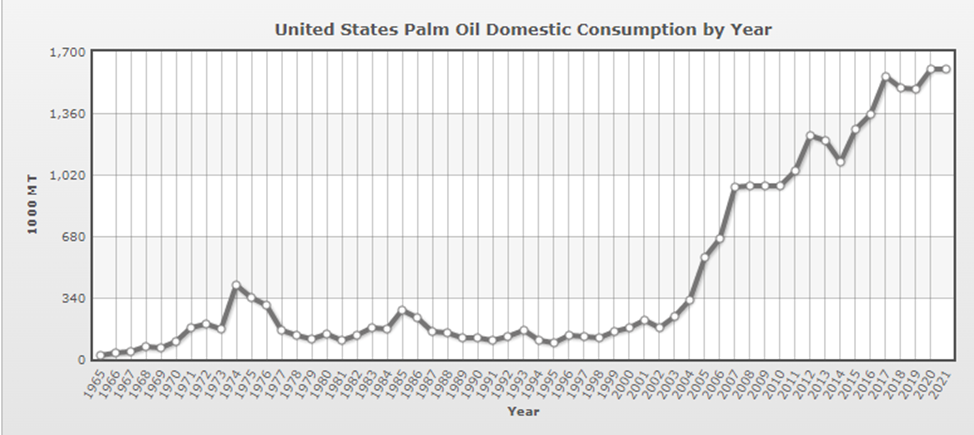

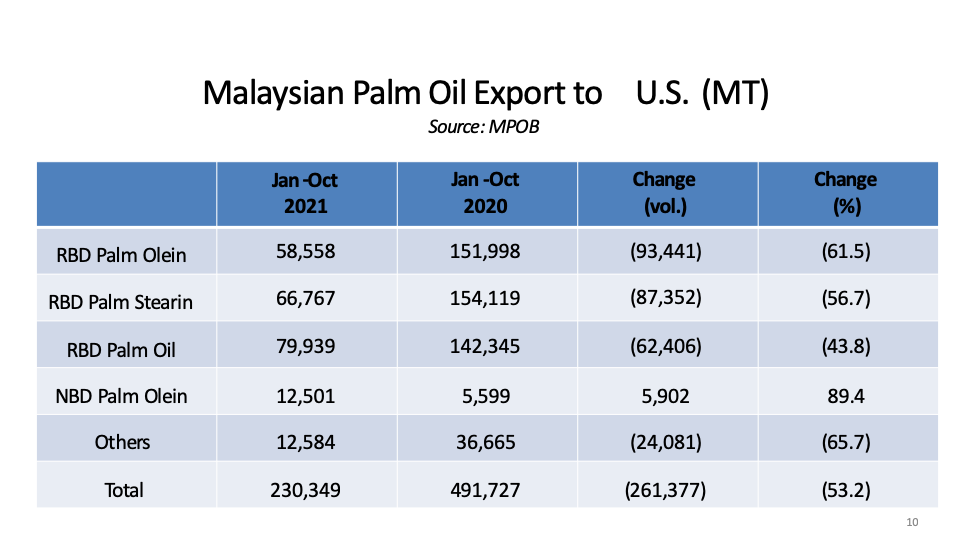

United States palm oil imports is showing a tapering down of volumes over the past three years. Data published by the research group Index Mundi below shows that palm oil consumption is gradually decreasing, after a robust growth period between 2014 to 2017. Malaysia’s palm oil exports to the United States also took a dip in 2021.

The U.S. maintains its position as one of the largest markets for vegetable oils in the world. According to the data published by the research group Statista, in 2021, U.S. oils & fats revenue will reach US$16,066 m. Between 2021-2026, the market is expected to grow annually by 1.20%. In 2020, U.S. oils & fats consumption amounted to about 23.9 million tonnes.

Domestic production of soybean oils shows a steady growth between 2018 to 2020. However, despite a large domestic production, the U.S. is a net importer of oils and fats. In 2020, U.S. total oils and fats imports amounted to 5.23 Mn T. Palm oil imports constitute 27 percent of the total imports.

According to the industry’s estimates, in 2021, the United States palm oil market is estimated at US$11.9 Billion, which constitutes around 26.98% share of the global market. The consumption trend in the domestic market is expected to be driven by the growing demand for certified sustainable palm oil due to an increasing public concern over environmental and deforestation issues.

United States: Palm Oil Import and Consumption (1000T)

| Jan-Dec 2020 | Jan-Dec 2019 | Jan-Dec 2018 | |

|---|---|---|---|

| Import | 1432 | 1577 | 1549 |

| Consumption | 1375 | 1490 | 1504 |

Source: Oil World

The US is by far, the biggest export destination for Malaysian palm oil in the Americas region. Malaysia’s palm oil exports to the US constitute around 88% of the total exports to the Americas region, which amounted to 540,349 tonnes in 2020. However, exports to the U.S. took a major dip in 2021.

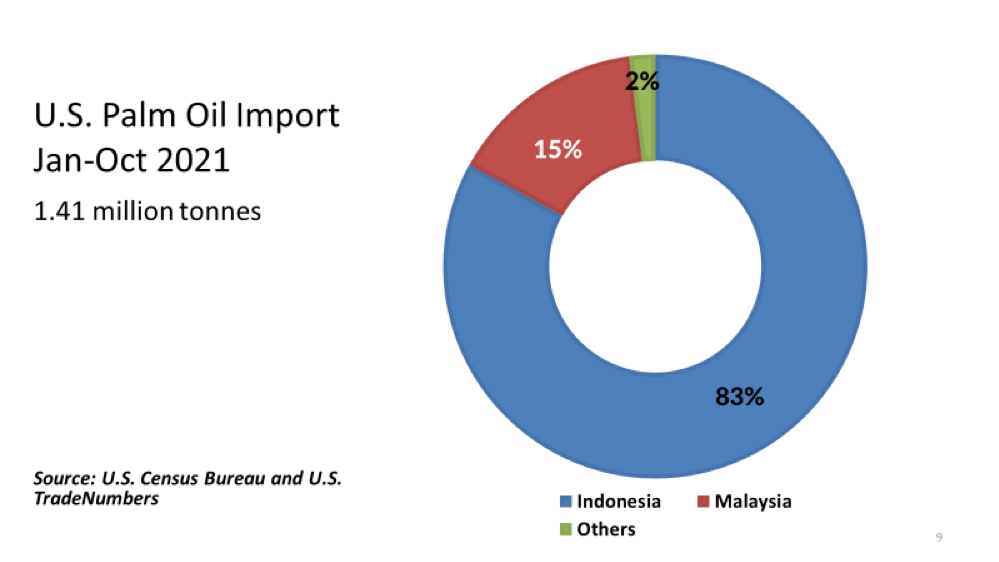

The latest U.S. Census Bureau import data for January-October 2021 shows that total U.S. palm oil imports amounted to 1.41 million tonnes. U.S. imports of palm oil increased 61.40 percent from $823.52 million to $1.33 billion through the first 10 months of 2021 when compared to the same period the previous year. The gap in palm oil imports from Indonesia and Malaysia has widened. Palm oil imports from Indonesia constitute 83% of the total imports into the U.S. or about 1.17 million tonnes. Whereas Malaysia’s market share totaled 15% or 212,000 tonnes. The top four suppliers in October were (1) Indonesia, (2) Malaysia, (3) Colombia, and (4) Mexico.

The U.S. oils and fats market, including palm oil, was affected by several factors. The ongoing pandemic is creating massive chaos across the globe, disrupting daily lives, damaging global supply chains, and wrecking the economy of many nations. The United States is also affected by the onslaught. This grim scenario is also tilting the oils and fats balance and the norms in the U.S. The preventive measures put in place by the U.S. government, and the local and state governments, during the early part of 2020 which include travel restrictions, social distancing, and stay-at-home orders have affected the food industry, among other sectors of the economy due to lower demand. The pandemic restrictions in 2020 have also affected the oils and fats supply chain in the US due to the closure of logistic facilities, disruption in the domestic transportation network, delays in shipments from exporting countries, and the shortage of manpower.

The decision by the US Customs and Border Protection (CBP) to issue the Withhold Release Order (WRO) against two major palm oil producers and exporters, over the alleged use of forced labor, has disrupted Malaysia’s palm oil exports to the U.S. in 2021. It is perceived as the major contributing factor to the decline of the export of specialty fats/shortening to the U.S. According to industry feedback, the U.S. industry players and importers decided not to get entangled with the WRO rulings and have taken measures to source palm oil from other countries for now, until the WRO issue is fully resolved. Importers are also concerned that the supply chain of palm oil imports and shipments from Malaysia may contain some palm oil supply from either one of the WRO affected companies. The U.S. influence is far-reaching, and the WRO rulings could have an impact on Malaysia’s palm oil trade with some major export destinations around the globe.

The supply gap created by the WRO rulings is viewed as a market expansion opportunity to other oils and fats suppliers. The U.S. soybean industry is expanding the production of high oleic soybean oil. The industry is undertaking measures to recapture lost market share in the food sector.

The U.S. soybean oil demand for food was devastated following the decision by the U.S. Food and Drug Administration (FDA) to impose the trans-fats labelling requirement in 2006. In June of 2015, the FDA measure to remove trans-fats from food ingredients was enacted, and the industry was given three years to rid itself of trans fats.

Subsequently, the domestic demand for partially hydrogenated soybean oil declined sharply. According to industry estimates, soybean oil lost an estimated 5.5 billion pounds of demand from U.S. food companies. An article published by the United Soybean Board (USB) in December 2019 pointed out that the food manufacturers in the U.S. gradually shifted to using high oleic canola oil and palm oil to replace partially hydrogenated soybean oil in baking and frying fats. Between 2005 and 2012, U.S. imports of palm oil more than doubled.

The shift in demand encourages the U.S. soy industry to invest in the development of new soybean varieties that provide new functional benefits. This resulted in the launching of the high oleic soybeans initiative in 2012, with a target of reaching 18 million planted acres of high-oleic soybeans by 2023. According to the estimates by the USB, the targeted planted areas will be able to capture an additional 9 billion pounds of soybean oil from new and existing markets, providing the food industry and industrial sectors’ customers with a trans-fat-free replacement for partially hydrogenated oil.

In the long run, the expansion of high oleic soybean oil production may have some effect on the share of palm oil in certain market segments, including the food manufacturing sector. According to the analysis by the USB, while high oleic canola oil and palm oil have temporarily filled the supply gap left by soybean oil’s removal from baking and frying applications, high oleic soybean oil is poised to recapture the markets.

The pandemic situation is the U.S. is improving. New cases have gone down drastically since the starts of the pandemic. Many COVID restrictions have been lifted in many states. Food businesses and factories have started full business opening and consumer spending and consumption are expected to improve. Hopefully, with this new development, the oils and fats market, including palm oil, will also see the recovery of demand and consumption in the U.S.

Prepared by Zainuddin Hassan

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.