Introduction

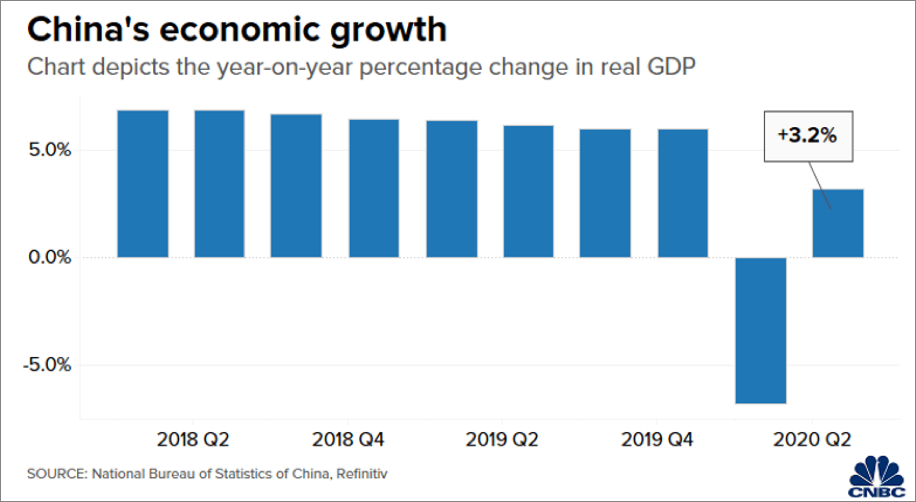

COVID-19 pandemic has severely impacted China’s GDP growth. China has reported that the country’s GDP contracted by 6.8% in the first quarter of 2020 before recovering marginally to 3.2% growth in the second quarter of 2020 after the country underwent practically a shutdown of the economy since Wuhan became the epicenter of the virus outbreak (Xinhua, August 9, 2020). It was the first-ever contraction in China’s history since it started declaring the quarterly GDP data since 1992. (Asia Wall Street Journal, April 17, 2020)

China’s Palm Oil Import Performance for 1st Half 2020

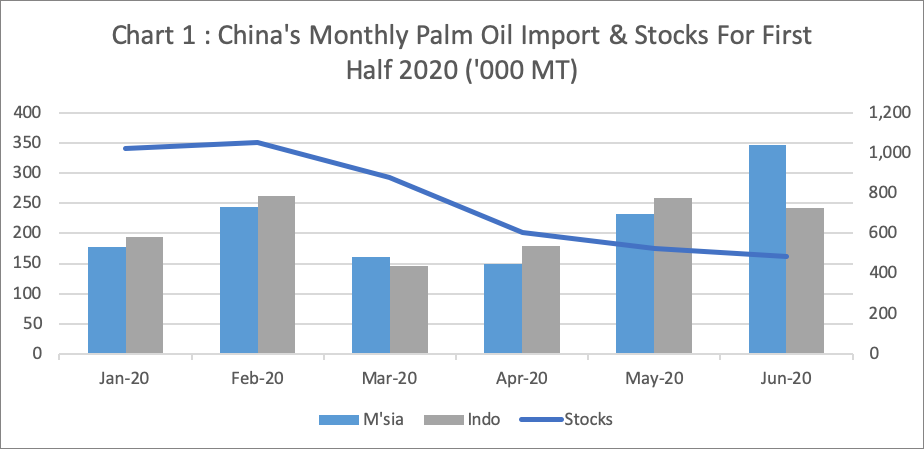

In the first 2 months of 2020, China’s palm oil imports rose from 371,100 MT in January 2020 to 505,500 MT in February 2020. The rising inventories from 848,700 MT in January to 1.05 million MT by end February 2020 has affected importer’s sentiment negatively. China’s edible oil players are reportedly being cautious to import palm oil for fear of higher supply to their demand. Furthermore, the movement control order has impacted China’s palm oil demand, especially in the HORECA sector. These factors cause China’s palm oil imports to drop from 505,500 MT in February 2020 to 328,400 MT in April 2020 (refer to graph 1).

After the Chinese government gradually lifted the country’s movement control order and finally on Wuhan on the 8th April 2020, palm oil imports have started seeing improvement with imports rising from 328,400 MT in April 2020 to 587,600 MT in June 2020. This increase is attributed to the improving demand and also the fast declining PO stock level since April which also supported the price and encouraged importers to bring in more PO to capitalize on good import margin.

Malaysian has Become the Top Palm Oil Supplier to China

Malaysia’s palm oil exports to China increased by 31.9% or 316,400 MT over last year to 1.31 million MT from January to June 2020, while Indonesia shipped 1.28 million MT of PO to China, decreased by 42.7% or 956,400 MT. As a result, PO market share commanded by Malaysia in China up to June this year rose from 30.7% held last year to 50.3%, and Indonesia’s share slid to 49.2% from 69.2% for the same period in comparison. Malaysia has become the top PO supplier once again since 2015.

Table 1: Palm Oil Import by Country of Origin in Jan-Jun 2020 (MT)

| Jan-Jun 2020 | Jan-Jun 2019 | Changes (Vol.) | Changes (%) | |

|---|---|---|---|---|

| Malaysia | 1,308,600 | 992,200 | 316,400 | 31.9 |

| Indonesia | 1,281,500 | 2,237,900 | (956,400) | (42.7) |

| Other | 13,000 | 1,700 | 11,300 | 664.7 |

| Total | 2,603,100 | 3,231,800 | (628,700) | (19.5) |

Source: Chinese General Administration of Customs

The primary reason for the Malaysian market share gain is the increase in domestic usage and the reduction in the availability of Indonesian palm oil for exports. Based on the Indonesian government’s projection, implementation of the B30 mandate from B20 on 1st January 2020 will absorb an additional 2.4 million MT of palm oil for the country’s domestic usage of biodiesel. This far exceeded the increase in Indonesia’s palm oil production projected by Oil World for 2020 of 790,000 MT to 44.5 million MT. The increase in Indonesia’s palm oil exports to India reduced further the availability of the country’s palm oil for exports. For January to June 2020, Indonesia’s palm oil exports to India rose by 36.7% or 620,000 MT to 2.6 million MT.

Palm Oil Import Outlook for 2020

Oil World anticipates that soybean oil production in China will increase by an estimated 1 million MT to 16.6 million MT in 2020 as the ASF hit swine sector is recovering. Reflecting on the recovery, the breeding sow inventory recorded M-o-M increase in Jun 2020 for 9 consecutive months since Oct 2019 to reach 36.29 mil heads. This is 28.6% higher as compared to September 2019 figure. (Source: MPOC China Office).

However, the impact on PO import due to the increase in soybean oil output is mitigated by the reduction in the imports of rapeseed from Canada. The import volume of rapeseed from Canada from January to June decreased by 23.4% y-o-y. It is anticipated that rapeseed imports for the next two quarters will remain low. The ongoing diplomatic tension between China and Canada is believed to be the major contributing factor to this outcome. For the 2019/20F season, mainly due to the drop in Canada’s rapeseed imports, Oil World projected that China’s rapeseed oil production will fall by 0.4 million MT to 2.9 million MT compared to 2018/19 season.

By taking into account the anticipated rising of soybean oil production, the expected drop rapeseed oil production and the overall impact of COVID 19 pandemic on China’s oils and fats demand, MPOC China projected that China’s palm oil import for the year 2020 will decline between 800,000 MT to 1.1 million MT compared to 2019, to 6.5 million MT to 6.8 million MT. Nevertheless, the pursuant of Indonesia’s B30 biodiesel mandate is expected to reduce the Indonesian palm oil supply for the export market in 2020, which will aid Malaysian palm oil exports in 2020 to gain notable market share between 500,000 MT to 800,000 MT.

Prepared by: Lim Teck Chaii, Desmond Ng & Theventharan Batumalai

Prepared By: Lim Teck Chaii , Desmond Ng & Theventharan Batumalai

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.