South Korea is one of the most vibrant and highly developed countries in the Asia Pacific region. It also the fourth largest economy in Asia, and the twelfth largest in the world. The South Korean economy is characterised by a robust industrial base, technological advancements, and an export-oriented nature.

South Korea has grown exponentially over the last few decades. Its transformation from a poor, agricultural nation into one of the most industrialised nations in the world is due to its strong government policies, export-oriented industry developments, and a large skilled and educated workforce. Electronics, automobile, shipbuilding, petrochemicals, steel, and information technology are the key sectors driving the South Korean economy.

Convenience Stores in South Korea

In recent years, convenience stores have grown significantly in popularity and size, transforming the retail industry in South Korea. The convenience stores, also known as “CVS” or “convenience mart”, have become an integral part of South Koreans’ daily lives. Convenience stores have become popular in South Korea due to their long operation hours, diversified product offerings, and advantageous locations.

The main factors attributed to the exceptional growth of convenience stores in South Korea are shifting consumer lifestyles, the demand for convenience, evolving product offerings, and intense competition among major convenience store chains.

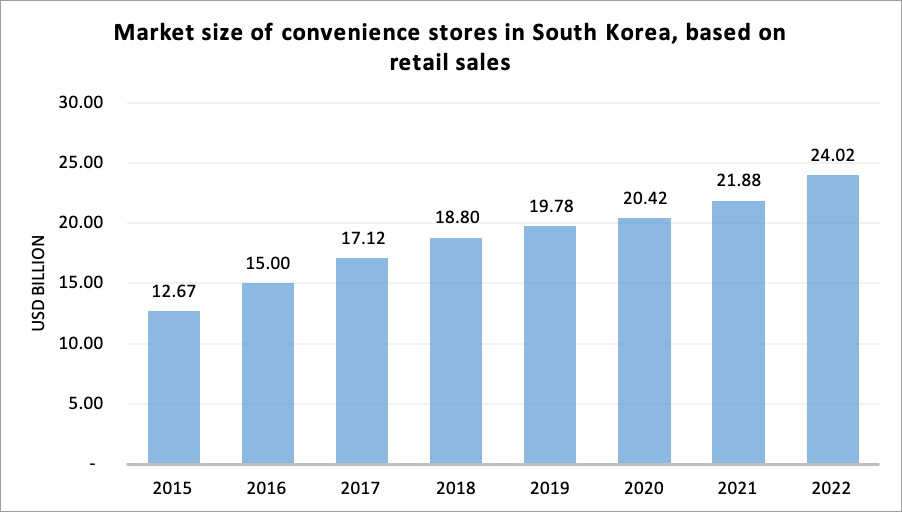

Based on sales revenue, the market size of convenience stores in South Korea grew by 89% to USD24.02 billion in 2022, from USD12.67 billion in 2015. The average year-on-year growth of the market size is 9.67%. This growth experienced a slowdown from 2019 to 2021 due to the Covid-19 pandemic, but it picked up again in 2022. According to industry estimates, more than half of these sales are food sales. After department stores, convenience stores have emerged as the second-largest offline retail channel in South Korea.

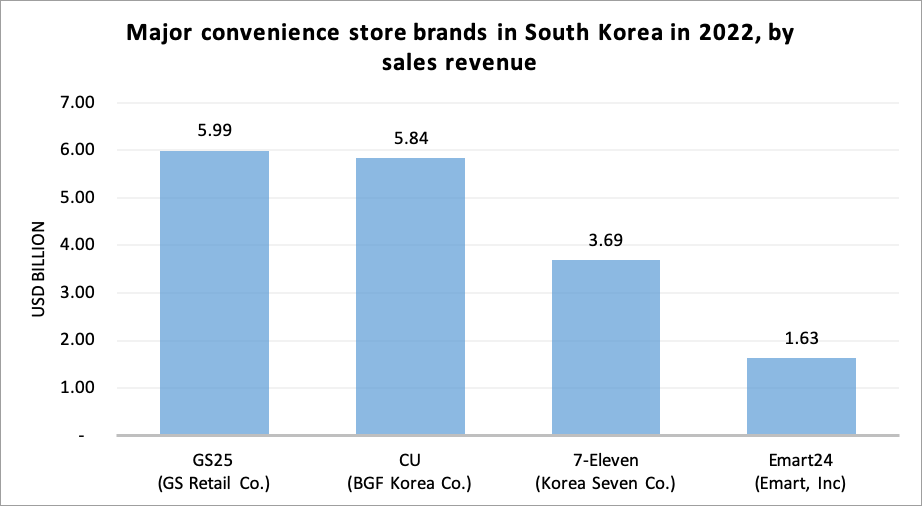

CU Mart, GS25, 7-Eleven, and Emart24 are the leading convenience store brands in South Korea. In 2022, CU Mart and GS25 were the top two brands, with a total of 16,787 and 16,448 stores respectively. However, in terms of sales revenue, GS25 was the top performer in 2022 with a total sales revenue of USD5.99 billion, as compared to CU Mart at USD5.84 billion. Convenience stores in South Korea offer a wide range of products and services such as snacks and beverages, basic groceries, ready-to-eat meals or prepared foods, fresh produce, household supplies, and personal care products. In addition, convenience stores in South Korea also provide services such as bill payments, parcel deliveries, and ticket purchases.

Prepared Foods or Ready-to-Eat Meals at South Korea’s Convenience Stores

Convenience stores in South Korea have responded to consumer demands by adjusting and introducing innovative offerings. They provide a wide selection of ready-to-eat meals, salads, fruits, and other fresh items, fulfilling the needs of busy consumers who seek convenience and nutritious options.

Prepared food, also known as “dosirak” or “bento” in South Korea, is widely available and popular among busy individuals who seek convenient meal options. Dosirak typically consists of a balanced combination of rice, protein (such as meat, fish, or tofu), and vegetables, and is occasionally accompanied by side dishes such as kimchi. As consumer lifestyles continue to evolve, the demand for ready-to-eat meals is likely to remain strong.

Based on a survey conducted in March 2023 among convenience store customers in South Korea, dosirak and kimbap are the most frequently purchased items, accounting for approximately 52% of respondents. Following closely behind are instant noodles and snacks. Besides dosirak, South Korean ready-to-eat meals that are available in convenience stores are hot noodles, fried chicken, kimbap (rice and ingredients rolled in seaweed), dumplings, and pre-packaged salad. These options cater to consumers who want a quick and satisfying meal on the go.

Palm Oil in South Korea

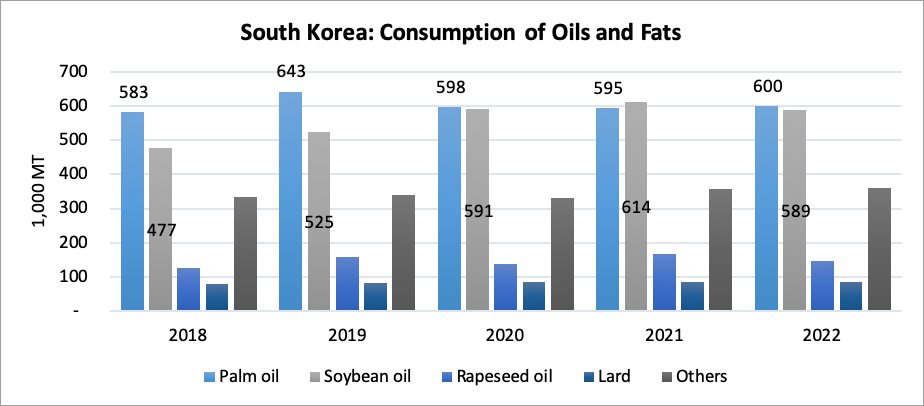

South Korea is one of the importers of Malaysian palm oil in the Asia Pacific region, and the average consumption of oils and fats in South Korea over the past five years is 1.7 million MT. The most consumed oils are palm oil and soybean oil, which account for 34.8% and 32.2% of the total oils and fats consumption, respectively.

Most soybean oil is consumed at hotels, restaurants, and institutional (HRI) sectors, as well as at home. Soybean oil has traditionally been the primary choice as salad/cooking oil, but it has now been increasingly replaced by canola oil, rapeseed oil, corn oil, olive oil, and potentially palm olein. Palm oil meanwhile has established itself as an excellent medium for making instant noodles, frying snack foods, and producing solid fats due to its greater functionality and lower cost as compared to soybean oil. Additionally, palm oil is being used in the biodiesel sector in South Korea.

Palm oil import in South Korea has been experiencing slow growth in the past five years. The average annual growth from 2019 to 2022 was 0.47% due to the demand disruption during the Covid-19 pandemic. As reported by USDA, the low palm oil import into South Korea was also due to lower demand for biodiesel production. The biodiesel sector had been the main driver of rising palm oil imports into the country since 2007/08 and over the years, palm oil use in biodiesel increased due to its price competitiveness over soybean oil. However, the narrowing gap between soybean oil and palm oil prices has been driving the resumption of soybean oil use in the biodiesel sector in South Korea. This translated into a slight drop in the share of palm oil used in the biodiesel sector.

Potential Growth Sectors in South Korea

- Hotel, Restaurant & Catering (HORECA) industry: Most of South Korea’s imports of palm oil are mainly for their food manufacturing industries i.e. ramen, chips frying, biscuits, ice cream, and packed oil. As these industries have reached a mature stage in the industry lifecycle, Malaysian palm oil imports have seen marginal growth over the years. However, the growth opportunities that can be seen in South Korea are in professional kitchens whereby restaurants, cafes, and the food service industry are seen showing steady growth, and in which soybean oil is currently dominating. The middle-income population is recorded as the fastest-growing segment, opening up opportunities in the food industry as consumers are more willing to spend – a trend identified for aggressive expansion by major food companies.

- Renewable Energy – Biofuel: It is estimated that 55% of palm oil is used for biofuel. However, the consumption of palm oil for biofuel is limited due to its high freezing point which discourages its usage between October and February. During these months, palm fatty acid distillate (PFAD), and used cooking oil are predominantly used for biodiesel. Soybean and rapeseed oils can be used in the winter but are rarely used because of their unfavorable price spread as compared to the alternatives. The current mandate for biofuel is B3.5 and recently, the Korean government has set the target for biofuel mandate to B8 by 2030. This particular development in the biofuel mandate has made the potential growth of palm oil import into the country even more promising.

Palm Oil Growth Opportunities in the Prepared Foods Market

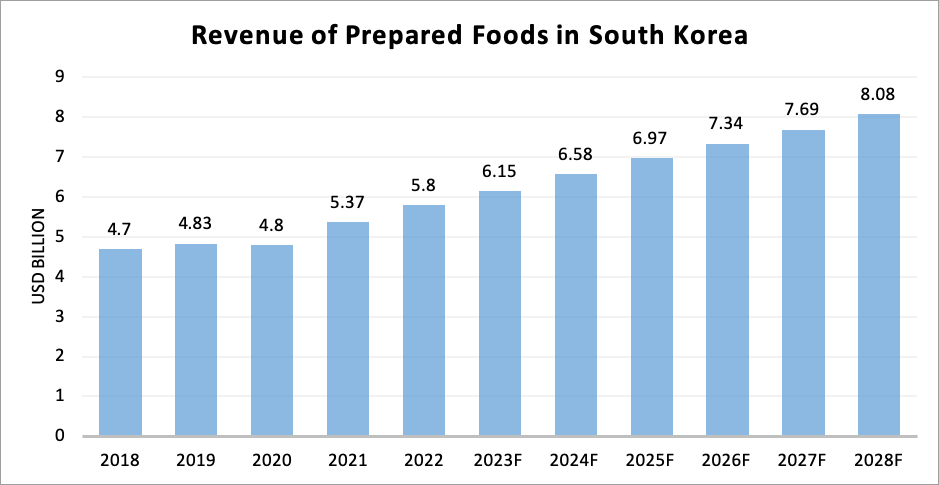

The South Korean prepared foods market demonstrated a favorable compound annual growth rate (CAGR) of 4.3% from 2018 to 2022, reaching a sales value of USD5.8 billion in 2022. This indicates a notable increase of 8% when compared to the previous year, 2021. The market experienced its strongest performance in 2021, exhibiting a growth rate of 11.9% as compared to the previous year, while its weakest performance was observed in 2020, with a growth rate of -0.62% over 2019. The drop in the growth rate in 2020 was due to the lockdown directive issued by the government during the Covid-19 pandemic.

The remarkable growth in the consumption of prepared foods in South Korea is driven by changing lifestyles, increasing urbanisation, and evolving dietary preferences. The revenue of the prepared foods market in South Korea is expected to amount to USD8.08 billion in 2028 with a CAGR of 5.61% (2023-2028). Amidst this growth, palm oil has emerged as a promising ingredient, offering various opportunities for expansion and utilisation in the ready-to-eat meals market.

The growth opportunities for palm oil in South Korea’s prepared foods sector are significant. Palm oil’s characteristic as a versatile oil that can enhance the texture and shelf life of foods, combined with its competitive pricing as compared to other oils, makes it a viable ingredient choice in the prepared foods sector. The growth of palm oil use in the prepared foods sector can be achieved through collaborative efforts between Malaysian palm oil suppliers and convenience store players in South Korea. Responsible sourcing of palm oil can further promote its utilisation in the prepared foods sector, catering to the evolving demands of South Korean consumers.

Source:

- USDA

- Statista

- Oil World

- CEO Score

- Trendmonitor

- MOTIE (South Korea)

- Korea JoongAng Daily

Prepared by: Rina Mariati Gustam

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.