Introduction

As the most consumed vegetable oil, sunflower oil is the popular oil in Turkey especially for household consumption and based on statistics is continuing to increase. The higher sunflower oil consumption is mainly due to the increase in population and the lack of affordably-priced alternative oils because Turkey does not approve any genetically modified corn or soybeans for food use. Nuts oil and olive oil cannot replace sunflower oil because of insufficient output and high price. Therefore as palm oil is naturally produced and free of GMO, it can be blended with other oils or be an alternative for sunflower oil.

Global Output of Sunflower Oil

Sunflower oil is widely used as cooking and frying oil around the world. The oil derived from sunflower seed is considered as healthy choice among the consumers. Hence, the growing demand for sunflower oil has provided a major boost to the global sunflower oil market as more consumers are shifting their preferences to this cooking oil.

As we can see from the table 1, global supply and demand for sunflower oil declined in 2021 because of covid pandemic. The Covid-19 pandemic has posed a major impact on vegetable oils demand, including sunflower oil. On the global level, the worldwide lockdowns called by many countries have resulted in the closing-down of food businesses. The current war between Russia and Ukraine, the two largest producers and exporters of sunflower oil has resulted in a supply destruction of sunflower oil. Supplies are tight and demand shifted to other vegetable oils such as palm oil and it is likely that global supply and demand for sunflower oil looks diminishing in 2022.

Table 1: Global Supply and Demand for Sunflower Oil

| (‘000MT) | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|

| Production | 18,961 | 18,899 | 20,513 | 21,316 | 18,939 |

| Exports | 10,584 | 10,154 | 12,068 | 13,634 | 11,064 |

| İmports | 10,618 | 10,079 | 11,880 | 13,606 | 11,064 |

| Consumptions | 18,575 | 19,138 | 20,044 | 21.459 | 19,161 |

Source: Oil world

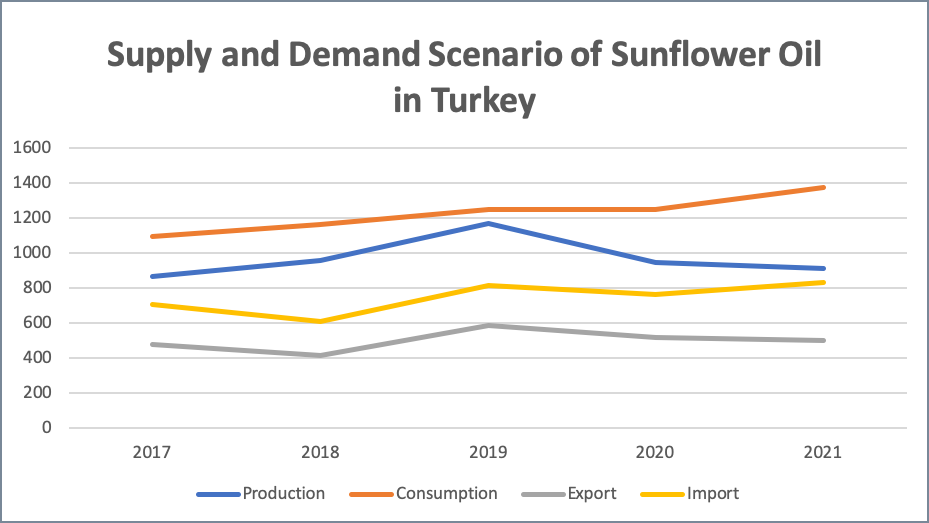

Supply and Demand Scenario in Turkey

Sunflower oil is the most consumed and popular commodity in Turkey and the largest importer of sunflower oil in vegetable oil market globally. Almost 90% percent of population use it as cooking oil for home use and local production of SFO is not sufficient in Turkey. The deficit in supply to meet this demand is by importing Russia and Ukraine. The local output sunflower oil has been stagnated over the last few years and resulted an increase in import of sunflower oil by 25% between the 2017 -2021 period.

Due its strategic location and advanced oils and fats industry, Turkey also exports sunflower oil to mainly North Africa, İraq, Georgia and Syria. The government provides incentives to sunflower oil refineries under inward processing regime in which import duty is 0% to encourage exports. This creates added value products and increase the capacity usage of refineries.

However, the war between Russia and Ukraine which has caused supply destruction of sunflower oil for to other countries has not affected Turkey as much and is currently having no issue of supplying SFO from black sea region. High imports of sunflower oil recently from Russia led to an accumulation of stocks and ease fear of shortage until August.

Table 2: Supply and Demand Scenario of Sunflower Oil in Turkey

| (‘000 MT) | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|

| Production | 869 | 960 | 1.170 | 945 | 915 |

| Exports | 480 | 415 | 585 | 520 | 500 |

| İmports | 705 | 610 | 815 | 765 | 835 |

| Consumptions | 1.094 | 1.165 | 1.250 | 1.250 | 1.375 |

Source: Oil world

Conclusion

Consumption of sunflower oil is steadily increasing every year as population grows. Positive perception, acceptance and growing demand for sunflower oil may serve as a hurdle for the entry of palm-based cooking oil. The high demand for edible oils in Turkey does not look to reduce as the country has a vibrant tourism industry which especially the food and catering sectors.

Based on latest statistics, Turkey imported almost 180,000 MT palm oil in the first quarter of 2022, and this is 20% higher than the volume imported during the same period of 2021. The widening discount of palm oil to sunflower oil has seen a shift in the consumption of oils and fats to prefer palm oil. Malaysian palm oil players could capitalize on the cost advantage of palm oil and also its lower cloud point by first introducing the blended palm olein-sunflower oil into the Turkish market using palm olein CP6 or CP8. This would serve as another step to enhance palm oil into cooking oil sector for broader segment.

Prepared by: Hakan Alkan

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.