The evolution of life and lifestyles can be clearly observed throughout the history of the world. Pakistan is no different and the lifestyles of people here have seen major changes since its inception more than 70 years ago. With increasing globalization and the shrinking of the world, the Pakistani lifestyle has changed rapidly.

The last decade has especially transformed the Pakistani consumer lifestyle. This can be attributed to many reasons including a movement of the population from rural to urban areas, increasing industrialization, an increase in per capita income and the rapid increase in technology and communications to name a few. This has led to wide-reaching changes which include variations in family structures, fashion, recreation and food.

With an increase in disposable income, there has been a shift in consumer tastes from traditional eating behaviors. Now an increasing number of Pakistani consumers dine out regularly and want to eat foods different from the traditional Pakistani dishes. The changing eating habits of the Pakistani consumer can be clearly seen from the mushrooming of international food chains, cafes and international cuisine restaurants across the country. The popularity of these chains is also due to the fact that many of these cater to the middle and lower classes which make up the majority of the population.

The fast-food industry in Pakistan which commenced in 1997 with launch of McDonalds has grown extensively over the past two decades. This industry has registered a growth of 15% in the first 10 years and then continued to grow consistently and attracts new players both local and international every year. Leading international chains like McDonalds, Pizza Hut, Dominos, Hardees, Burger King, KFC, Nando’s, Papa Johns, Subway and others are immensely popular. Despite difficult economic, security and political conditions, new international food chains, such as Papa Roti, Johnny Rockets, Baskin Robin, Illy, Café Barbera have opened outlets in Pakistan in the last few years which shows the potential of this market.

The trend of snack foods and fast food is rapidly increasing and will continue to grow. The developing fast food and snack food market means more opportunity for the usage of palm oil and its fractions. As palm oil is the preferred choice in the confectionary, baking and frying industries, this presents a promising opportunity for the growth of the palm oil market in Pakistan.

Before the advent of the fast food industry, palm oil was mainly used in making Banaspati which is the predominant cooking medium in Pakistan. In the last decade, palm oil usage in Pakistan has expanded to various industries and a wide range of palm oil fractions are being imported in the country. Fast food and snack food industry is one of the biggest consumers of palm olein and it is being used by most of the industry leaders for frying purposes. This trend is also filtering down to smaller manufacturers both in the organized and unorganized sectors. Palm olein is being imported directly from Malaysia by some international chains and at the same time, palm olein based specialized frying oil is also being produced by local industry. Two brands of super olein in commercial packaging are also available in the market. Other positive indications are the installation of fractionation units in the country and the increasing trend of palm olein blending in soft oils especially in the summer.

The increased usage of palm oil in commercial frying and various food applications has also resulted in the increase in the imports of palm oil based packed products and specialty fats.

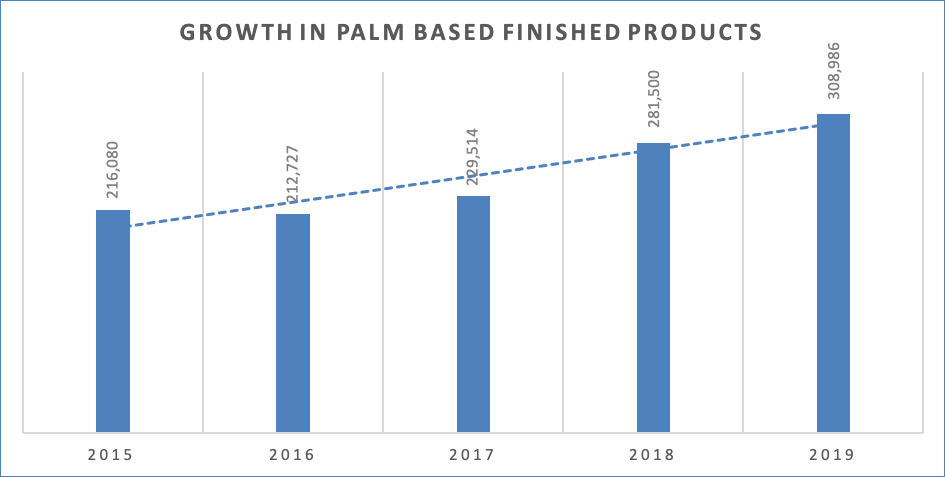

Following chart shows the import trend of these products in the past 5 years.

Chart 1: Imports Trend of Palm Based Finished Products

The import of palm based packed products from Malaysia has increased from 216,080 MT in 2015 to 308,986 MT in 2019. This category has registered an increase of 43% over the period of 5 years. The packed products category includes packed cooking oil, shortening, palm kernel oil and margarine. These products are becoming an integral part of confectionary, fast food and dairy industry in Pakistan.

The

following table shows the volumes and growth of each product within the packed

products category.

Table 1: Packed Products Share and Growth

| Year | Cooking Oil MT | Shortening MT | Palm Kernel Oil MT | Margarine MT |

|---|---|---|---|---|

| 2015 | 155,588 | 7,705 | 5,200 | 960 |

| 2016 | 156,690 | 8,786 | 5,223 | 939 |

| 2017 | 168,502 | 9,115 | 6,330 | 952 |

| 2018 | 192,171 | 10,877 | 4,558 | 858 |

| 2019 | 208,908 | 12,356 | 13,273 | 958 |

Source: MPOB Data

The import of almost all packed products from Malaysia have registered increase in the last 5 years. Import of packed palm olein has increased by almost 34% (from 155,588 MT in 2015 to 208,908 MT in 2019) which is mainly due to its incrased usage in commercial frying and dairy industry. The import of palm kernel oil and shortening has also registered an increase of 155% and 60% respectively.

Potentail Areas of Growth

The evolution of the consumer lifestyle in Pakistan has resulted in many areas of potential expansion for the palm oil market. These include the areas of confectionary, frozen food, ice cream and chocolate, soaps and oleo chemicals, paints and pharmaceuticals, dairy and creamers and animal feed. Palm oil consumption would increase in the food industry especially and will be an area of opportunity and focus. While the traditional ghee and oils remain, but now specialized oils and fats use will increase, where palm oil can play a big role.

With a population of approximately 220 million and a population growth rate of 2%, Pakistan will always remain a net importer of oils and fats. With increasing consumer awareness and exposure to education, the internet and social media, the versatility of palm oil and its uses will continue to come to the forefront. Palm oil is the most suitable for Pakistani manufacturers and consumers and there is a strong Malaysian presence with joint ventures in the country. Additionally, with its logistic advantage over competition such as soft oils, the multi-purpose palm oil can continue to make inroads in the Pakistani market.

Prepared by Faisal Iqbal

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.