The double-whammy to palm oil demand from a trade spat with India and the coronavirus in China is likely to prove only temporary, according to FGV Holdings Bhd., one of the world’s largest producers.

That’s because supplies are low this quarter, and food and fuel demand is set to stay robust over the long term, according to Chief Executive Officer Haris Fadzilah Hassan. India and China are the two biggest importers of palm, the world’s most consumed cooking oil.

“January to March will see low production, and it coincides with a period when the demand is stressed due to Wuhan and India,” Haris said in his first foreign media interview from the company’s headquarters in Kuala Lumpur. Demand will “correct itself” and prop up prices, he said.

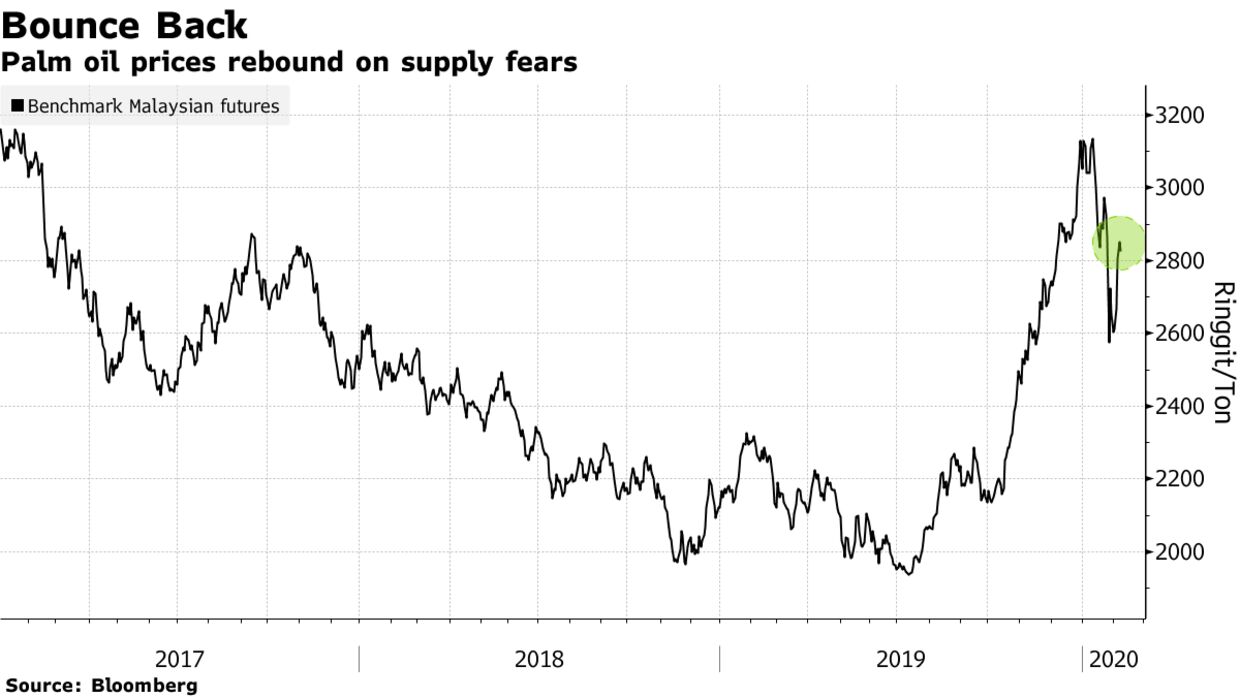

A blistering price rally was shattered last month by the outbreak of the coronavirus and a deepening trade spat with India. People in China are staying at home and avoiding restaurants and hotels, curbing demand, while India is restricting imports of refined oil, which is hurting Malaysia amid political tensions. Still, after their steepest monthly loss in seven years in January, prices rebounded this week on the back of a supply squeeze in Malaysia.

While orders from India have dropped by about 10% to 15% for February and March, FGV will look to replace that shortfall with shipments to other markets such as Pakistan, Haris said, without specifying a comparative period for the decline. The exporter has minimal exposure to China as it doesn’t have long-term contracts with buyers there, he said.

“We’re not too worried; it’s a temporary setback for our country,” said Haris, who took the helm at FGV in January 2019. “In the whole scheme of things, we’ll have demand and supply that’ll move once these issues are managed.”

Spot prices of crude palm oil may trade in the range of 2,500 ringgit to 2,575 ringgit a ton in the next three months, and from 2,500 ringgit to 2,700 ringgit in the long term, Haris said. Palm needs to be “in an equilibrium” where it’s still attractive to use in food and fuel versus alternatives, he said.

Malaysian February spot prices were trading at 2,876 ringgit a ton on Feb. 7, according to the Malaysian Palm Oil Board. Benchmark futures posted their best week since 2016, with an advance of almost 8%.

Syed Mokhtar

FGV expects to conclude the sale of its 50% stake in loss-making Trurich Resources Sdn., which houses plantation assets in Indonesia worth 1 billion ringgit ($242 million), by the first quarter of this year, said Haris. Malaysia’s pilgrim fund Lembaga Tabung Haji owns the rest of Trurich, which controls 42,000 hectares of oil palm estates in Kalimantan, Indonesia.

Trurich’s board is negotiating with the final two potential buyers, Haris said. The sale became more protracted than anticipated partly because valuations had to be adjusted after the sudden surge in palm oil prices, he said.

After a leadership tussle and graft scandal in 2017, FGV’s new management is pushing ahead with a transformation plan that includes selling off non-performing assets, cutting costs and boosting productivity at palm operations. The shares jumped in December on speculation tycoon Syed Mokhtar Albukhary bid for a stake. Haris said FGV had not received a formal proposal.

Source : Bloomberg