| Regions | Jan-Aug 2020 (MT) | Jan-Aug 2019 (MT) | Diff. (MT) | Diff (%) | Jan-Dec 2019 (MT) |

|---|---|---|---|---|---|

| West Africa | 764,672 | 602,266 | 162,405 | 21.24 | 893,317 |

| East Africa | 648,095 | 343,072 | 305,023 | 47.06 | 681,761 |

| Southern & Central Africa | 282,746 | 293,022 | (10,276) | (3.51) | 440,242 |

| Grand Total | 1,695,512 | 1,238,360 | 457,152 | 36.91 | 2,015,320 |

Table 1: Malaysian Palm Oil Exports to Sub-Saharan Africa (Jan-Aug 2020)

Source: MPOB

From January to August 2020, the Sub-Saharan Africa region imported a total of 1.69 million MT of Malaysian palm oil, an increase of 36.91% compared to the same period on the previous year. Western and Eastern Africa saw an increase in imports while Central and Southern Africa saw a drop in imports. Major importing countries in each region play a very crucial role as anchor markets for palm oil demand and an overview of the current situation of the countries is needed to determine the market dynamics of each region. The major importing countries are Nigeria (West Africa), Kenya (East Africa), and South Africa (Southern Africa).

Nigeria

As the country with the largest population in Sub-Saharan Africa, Nigeria is the largest importer and consumer of palm oil in the region. According to Oilworld, Nigeria’s total consumption of edible oils accounted for 3.2 million MT in which palm oil had a consumption share of 80% in 2019. Imports of edible oils constitute to 42% of the total consumption in 2019 which had been decreasing for the past three years contributed by increasing local production.

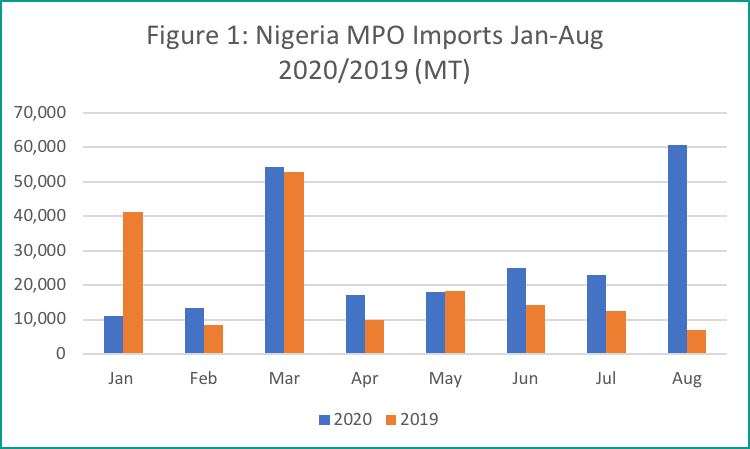

From January to August 2020, Nigeria imported a total of 222,103 MT of Malaysian palm oil, an increase of 34.86% compared to the same period of the previous year. This increase is attributed to the CPO export duty exemption announced by the Government of Malaysia in June 2020 which had benefitted Nigeria greatly as the country is a major CPO importer as seen in July and August import figures above. The international palm oil price decline coupled with the duty exemption has led to imported palm oil being more competitively priced than locally produced oils. Furthermore, a widespread call was made for the empowerment of the Nigerian palm plantation industry. In addition, Nigerian President, Muhammadu Buhari, through his official Twitter account, reiterated Nigeria’s stance on barring food importers (palm oil included) from access to foreign exchange services in September 2020. Keeping in view of these situations, both Malaysian and Nigerian Governments’ policies will become the key driver for palm oil demand in Nigeria. CPO export duty exemption had greatly benefitted in Malaysian palm oil exports to the country and the exemption will continue until the end of 2020. However, should the Nigerian Government introduce new policies with regards to Nigerian palm oil development, it may impact the palm oil imports into the country.

| Strength | Weakness |

|---|---|

| Largest consumer of palm oil in the Sub-Saharan Africa | Limited supply of locally produced palm oil |

| Opportunities | Threats |

| Palm oil supply-demand gapExemption of export duty on Malaysian CPO until December 2020 | Competition from locally produced palm oil |

Table 1: SWOT analysis on Nigerian palm oil demand

Kenya

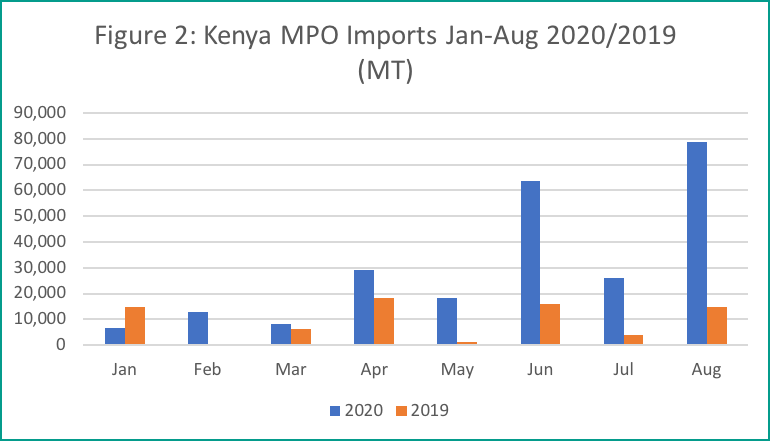

Kenya recorded the largest increase of Malaysian palm oil imports from January to August 2020, importing a total of 243,610 MT of MPO, an increase by 167,461 MT compared to the same period of the previous year. Prior to 2020, Kenya imports palm oil in large numbers typically in September to December for re-stocking activities. This trend is a stark contrast in 2020 whereby palm oil imports has shown a significant increase even as early as the month of April. The increase in imports in the Kenya is mainly attributed to the waiver of CPO export duty by the Malaysian government as evident in the June 2020 imports, which resulted in MPO being more competitively priced compared to other oils. In addition, the locust invasion had destroyed many local staple food crops such as rice, maize, and potato crops, which had led to increase in food demand in the country.

That being said, the Kenyan food demand increase due to the desert locust invasion is expected to help increase the demand for palm oil into the region. As with Nigeria, CPO export duty exemption will also benefit MPO imports by Kenya being a price-sensitive market.

| Strength | Weakness |

|---|---|

| Steady demand for crude palm oilLargest palm oil consumer in East Africa | Price sensitive marketLocust invasion destroyed many staple food crops |

| Opportunities | Threats |

| Booming demand in the food sectorExemption of export duty on Malaysian CPO until December 2020 | Competitively priced Indonesian palm oil |

Table 2: SWOT analysis on Kenyan palm oil demand

South Africa

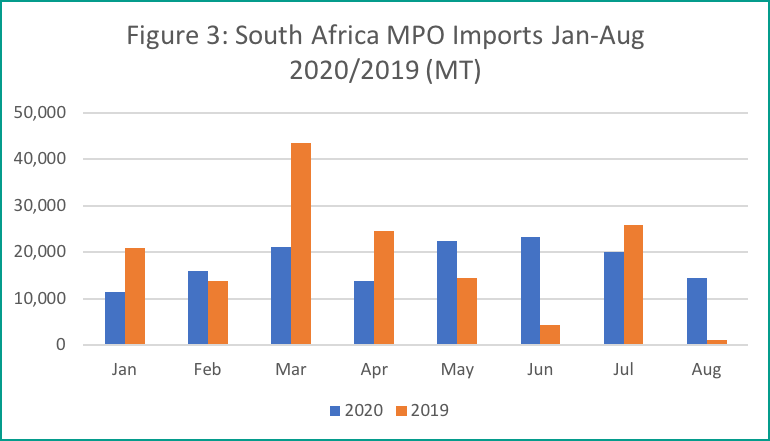

South African MPO imports registered a total of 142,713 MT from the period of January to August 2020, a decline of 4% compared the same period last year. Palm oil is mostly consumed by the retail and HORECA Sector in South Africa, which in an analysis by South Africa – Towards Inclusive Economic Development (SA-TIED) Project estimated that retail sector will experience an estimated decline of 30% to 60% decline in GDP contribution while the HORECA sector will suffer an estimated decline of more than 60%.

The suspension of CPO export duties by the Malaysian government had very minimal effect in South Africa, being a major RBD palm oil importer. Also, being a price-sensitive market, Malaysia is unable to compete with the more competitively priced Indonesian palm oil. With the HORECA and retail sectors being affected, price will come to play as the major demand driver in the country.

| Strength | Weakness |

|---|---|

| Largest consumer of palm oil in Southern AfricaDiverse palm oil downstream sector portfolio | Price sensitive marketFood regulations influenced by European StandardsNon-CPO importing country |

| Opportunities | Threats |

| Gateway to Central AfricaBooming demand in FMCG sectorIncrease in consumption of household items especially in the lower income population | Competitively priced Indonesian palm oilCovid-19 impacting various palm oil consuming sectors |

Table 3: SWOT analysis on South African palm oil demand

Prepared by Fazari Radzi

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.