1.0 Overview of the Glycerin Product Market

Glycerin is a colourless or yellowish transparent viscous liquid that is also non-toxic, odourless, non-corrosive, and has strong moisture absorption. It is an important chemical material, which can be used to produce epichlorohydrin and is widely used in the daily chemical, pharmaceutical, coating, and polyurethane industries.

Glycerin can be divided into refined glycerin and hydrolysed glycerin, depending on its processes and raw materials. The raw material of refined glycerin is crude glycerin, which is a by-product of biodiesel production from palm oil, soybean oil, or mixed oils. Hydrolysed glycerin is a by-product resulting from the manufacturing of fatty alcohol or fatty acid from palm oil.

The proportion of refined glycerin production in China is significantly higher than that of hydrolysed glycerin. As the raw material for refining glycerin, more than 95% of crude glycerin is imported from abroad, and palm oil, the raw material for hydrolysing glycerin, is imported from Southeast Asia. China’s glycerin refining/production capacity has expanded year by year in the past five years, but the fact is the country has to rely on imports for raw materials. Hence, as a major producer in the world, China is also a major importer of crude glycerin.

The main raw materials of glycerin are oils and fats (animal fat and vegetable oil) regardless of the processes used. The production of 10 MT of biodiesel will churn out 1 MT of crude glycerin with 80% concentration as a by-product, while the production of refined glycerin requires about 1 MT of crude glycerin with 80% content. In the production process of hydrolysed glycerin, 1 MT of hydrolysed glycerin is produced with every 10 MT of fatty alcohol/fatty acid. As such, refined glycerin is greatly affected by the output of biodiesel and the price of crude glycerin, while hydrolysed glycerin is to some extent affected by the price of refined glycerin.

Glycerin is mainly used to produce epichlorohydrin in China. It is also used in daily chemicals, medicine, and coatings, but is mostly used as an additive in small quantities. The proportion of epichlorohydrin produced via the glycerin route in the consumption of glycerin has been constantly increasing in recent years. In 2022, the proportion of epichlorohydrin consumed in the downstream sectors of glycerin was estimated to exceed 60%.

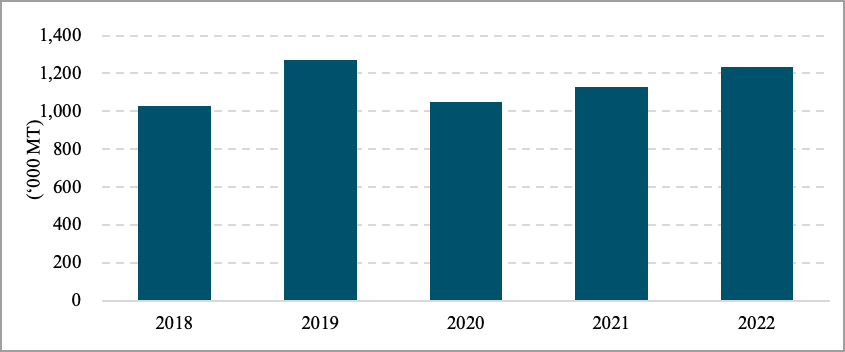

The price of glycerin is mainly affected by raw materials. In 2022, the price fluctuations of glycerin compounded. In the first half of the year, glycerin price was at a high level, but it then declined rapidly. As the supply of crude glycerin was lower than that of the previous year, it was estimated that the import of crude glycerin in 2022 was at 1.24 million MT, the overall output (including refining and hydrolysis levels) of glycerin in 2022 was at about 600,000 MT, the downstream consumption was at 1.115 million MT, and the import dependency was about 82.51%.

2. Supply of Glycerin

In recent years, the main global glycerin production capacity is still concentrated in Southeast Asia, while China is a major consumer country. As the world’s largest glycerin producing countries, Indonesia and Malaysia have shown an upward trend in their production capacities, but the growth rate has slowed down. This is partly due to the shift in the area of focus on production capacity from Southeast Asia to China. Nevertheless, Indonesia and Malaysia remain the main exporters of glycerin, while China and Europe in Asia are its major import regions. In the past two years, the export of glycerin from Southeast Asia to Europe has recorded a bigger growth.

2.1 Glycerin Refining/Production Capacity in China

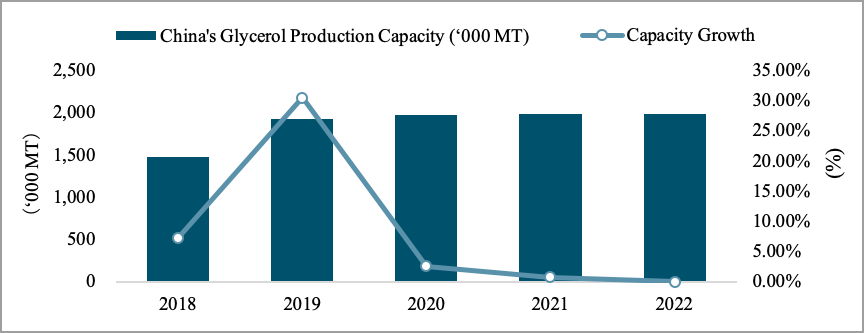

In 2018-2022, China’s glycerin production

capacity showed a growth trend, but this growth rate has slowed down. The

production capacity in 2022 was at 1.99 million MT/year, without new capacity

compared to 2021. The compound growth rate in the recent five years was at 7.77%.

As raw materials are highly dependent on imports, it is estimated that China’s refining/production

capacity will remain at 1.99 million MT in 2023, with no significant increase as

compared to the end of 2022.

Chart 1 – China’s Glycerol Production Capacity

Table 1 – Selected Glycerin Refining Capacities in China (Unit: ‘000 MT)

| Name | Capacity |

|---|---|

| Shuyang Guangyuan Glycerin Plant | 30 |

| Qingyuan Futai Glycerin Refining Co., Ltd | 20 |

| Zhongshan Hualong Glycerin Products Co., Ltd | 20 |

| Taishan Changshun Glycerin Products Co., Ltd | 20 |

| Sichuan Shifang Tianxiang Biotechnology Co., Ltd | 18 |

| Shandong Linyi Runli Oil Chemical Co., Ltd | 20 |

| Tangshan Xuyang Chemical Co., Ltd | 150 |

| Jiangsu Xinhua Glycerin Technology Co., Ltd | 100 |

| Weifang Yilan Chemical Co., Ltd | 60 |

| Shandong Fufu New Material Technology Co., Ltd | 130 |

| Langxi Jinghe Biological New Material Co., Ltd | 36 |

| Anhui Tianchang Kangning Oil | 230 |

| Jiangsu Honghai Grain and Oil Technology Co., Ltd | 200 |

Source: www.SCI99.com

Table 2 – Selected Hydrolysed Glycerin Capacities in China (Unit: ‘000 MT)

| Name | Capacity |

|---|---|

| KLK Oleo (Zhangjiagang) Co., Ltd | 25 |

| NICE Group Co., Ltd | 15 |

| Teck Guan (China) Hi-Tech Co., Ltd | 15 |

| Dongmaczc (Zhangjiagang) Co., Ltd | 12 |

| Jiangsu Jielilai Technology Co., Ltd | 20 |

| Zhejiang Jiahua Group Co., Ltd | 13 |

| Deeno Daily Chemical | 6 |

| Shandong Jinda Shuangpeng Group Co., Ltd | 8 |

| Nantong Keta Chemical Technology Co., Ltd | 20 |

| Hangzhou Oils & Fats Chemical Technology Co., Ltd | 50 |

| Sichuan Tianyu Oleochemical Co., Ltd | 3.2 |

Source: www.SCI99.com

There are many refining/production companies in China’s glycerin industry, most of which are small set-ups, and the utilisation rate is low. The production capacity of refined glycerin accounts for the major share, and the operating rate of refined glycerin factories mainly depends on the amount of imported crude glycerin. In recent years, the utilisation rate of glycerin refining equipment in China was lower than that of hydrolysis. Therefore, the capacity of China’s glycerin industry may experience a decrease in the near future.

In 2022, China’s top-10 refined glycerin enterprises accounted for 47% of the total capacity, which was the same as 2021. China’s glycerin production capacity was concentrated in East China, which was also the main consumption area of glycerin. The production capacity in East China accounted for 83% of the total capacity in 2022, similar to 2021. The production capacity in North China was at 9%, unchanged from 2021, while South China accounted for 6%.

At present, refining glycerin is the mainstream process, accounting for about 80% of all production capacity. In the past 10 years, the proportion of the refining process has been increasing, and the trend of the refining industry being the mainstream process in the glycerin sector will not change in the near future.

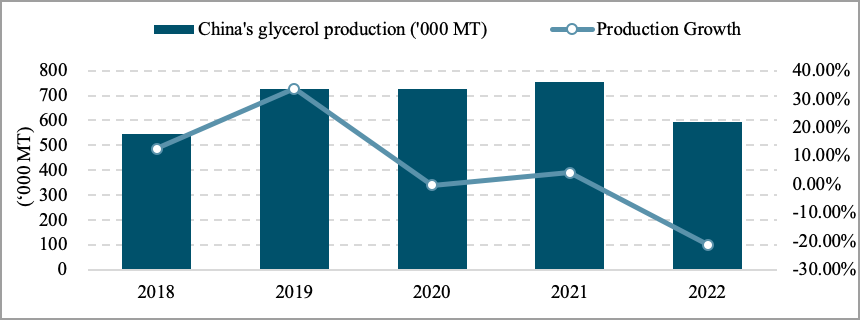

2.2 Glycerin Production in China

In the last five years, the output of glycerin in China has shown a trend of increasing at first before decreasing afterwards. In 2022, China produced a total of 595,700 MT of glycerin, a decrease of 21% when compared with 2021, and a five-year compounded growth rate of 2.3%, a decrease of 6 percentage-points as compared to the period of 2014-2018. In the last five years, the overall capacity utilisation rate of glycerin is lower than 50%, which is in a state of severe overcapacity.

Chart 2 – China’s Glycerol Production 2018-2022

2.3 China’s Glycerin & Crude Glycerin Imports

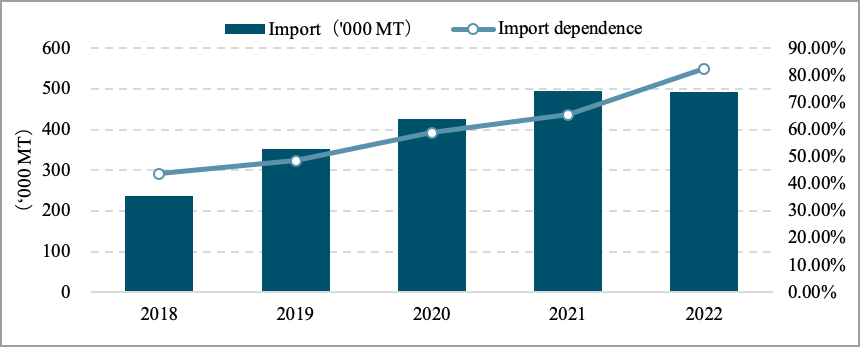

2.3.1 Import of Glycerin & Crude Glycerin

In the 2018-2021 period, due to the increase in the demand for glycerin, especially the demand for bulk glycerin for the production of glycerin-based epichlorohydrin, the import volume of glycerin kept increasing before hitting its highest level in 2021.

According to the data released by the General Administration of Customs of China, the total import of glycerin products in 2022 was 491,500 MT, slightly decreasing by 0.71% when compared with 2021, and the import dependence of China’s glycerin products was around 82.51%, increasing by 17% from 2021.

The

main reasons for the decrease in glycerin import in 2022 are: 1) The price of

imported glycerin rose in the first half of 2022, and traders were cautious in

taking orders; 2) In the second half of 2022, the price of imported glycerin

fell rapidly, traders and downstream companies had obvious intention to leave

the market to avoid risks; 3) The demand for imported glycerin in other

countries increased in 2022, leading to the lower import in China.

Chart 3 – China’s Glycerin Import Volumes and Dependence 2018-2022

Chart 4 – China’s Crude Glycerin Imports 2018-2022 (‘000 MT)

2.3.2 Source Countries of China’s Glycerin & Crude Glycerin Imports

In 2022, Southeast Asia remained the main source of imported glycerin, and Indonesia alongside Malaysia are still the major exporters to China. In 2022, China’s imports from Indonesia accounted for 66% of the total import, an increase by 7% from 2021. This is due to its price advantage over Malaysia in some months, which attracts traders to purchase from Indonesia. In 2022, Malaysian glycerin accounted for 16% of the Chinese market, down by 3% from 2021.

In 2022, the main importing region of China was Jiangsu (also the main consumption area), which accounted for 29%, down by 4% from 2021. The second was the Guangdong Province, accounting for 18%, up by 2% from 2021. Other regions accounted for a small proportion and have little influence on the market.

Chart 5 – China’s Sources of Origin for Imported Glycerin (2021 & 2022)

Chart 6 – China’s Major Glycerin Importing Regions (2021 & 2022)

China’s main trading partners in importing crude glycerin are Southeast Asia and South America. Southeast Asia, led by Indonesia and Malaysia, accounts for more than half of the total import. In 2022, the import from Indonesia and Malaysia accounted for 49% and 6% respectively. Indonesia remains the largest trading partner of crude glycerin for China. In addition to this, the 2022 import of Brazil’s crude glycerin increased to 25% from 22% in 2021, driven mainly by low prices.

In 2022, the main importing region of crude glycerin in China was the Jiangsu Province, which accounted for 38%, an increase of 5% over the previous year. Beijing’s import accounted for 9%, down by 8% y-o-y, and the Zhejiang Province accounted for 22%, an increase of 6% over the previous year.

Chart 7 – China’s Sources of Origin for Imported Crude Glycerin (2021 & 2022)

Chart 8 – China’s Major Crude Glycerin Importing Regions (2021 & 2022)

The second part of this report containing consumptions trends, supply & demand scenario and outlook will be published next week.

Prepared by MPOC Regional Office, China

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.