3. Demand Trend of Glycerin Products in China

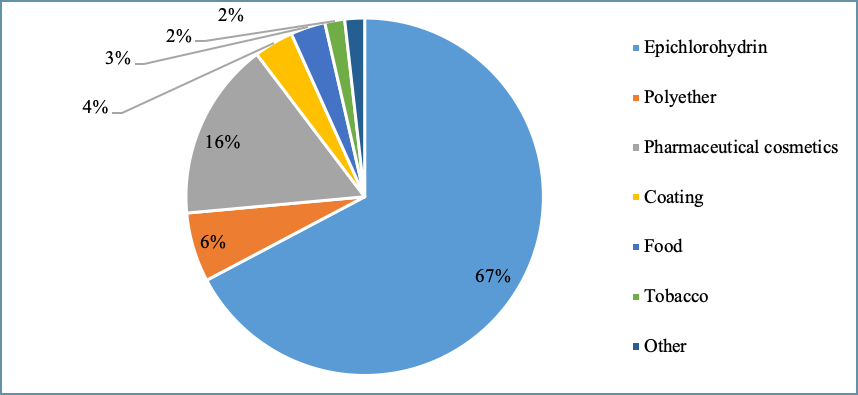

In 2022, epichlorohydrin that is manufactured via the glycerin method was the main downstream product of glycerin, and the proportion of this downstream consumption increased from the previous year. As several sets of glycerin-based epichlorohydrin set-ups are planned in 2022-2023, epichlorohydrin will be the main growth point of glycerin downstream consumption in these two years.

3.1 Analysis of the Glycerin Consumption Trend in China

Since 2018-2021, the downstream consumption of glycerin has increased, boosted mainly by the increase in the downstream epichlorohydrin industry’s consumption. In 2022, the downstream consumption of glycerin was at 1.12 million MT, a decrease by 185,000 MT, or 14%, from 1.30 million MT in 2021. This decrease was due to the decrease in the output of epichlorohydrin, and the consumption of glycerin in other downstream areas also decreased slightly y-o-y.

Chart 9 – China’s Downstream Demand for Glycerin 2018-2022

3.2 Glycerin Downstream Consumption Structure in China

The downstream applications of glycerin are varied and involve many sectors, and its largest downstream application is as a direct feedstock in the production of epichlorohydrin. Whereas in other downstream applications, it is used mainly as an additive in small quantities.

Chart 10 – Proportion of Glycerin Downstream Industries in China in 2022

From 2018 to 2022, the proportion of epichlorohydrin in downstream consumption increased from 40% to 67%. Because of the high input of glycerin in producing epichlorohydrin, 1.15 MT of glycerin is needed to produce per MT of epichlorohydrin. In other downstream markets such as polyether, medicine, and food, glycerin is used as an additive in small amounts.

In 2022, epichlorohydrin production remained the main application of glycerin, increasing to 67% from 66% in 2021. In 2022, the capacity of epichlorohydrin was at 1.61 million MT, and the operating rate was at 69.06%. The output of epichlorohydrin by the glycerin method was 747,200 MT, consuming about 860,000 MT of glycerin.

3.3 Glycerin Downstream Consumption Region in China

East China has always been the main distribution area of glycerin and it’ [MM1] downstream in China due to its convenient transportation, developed economy, short distance between upstream and downstream, and perfect industrial chain, with Central China and North China following behind.

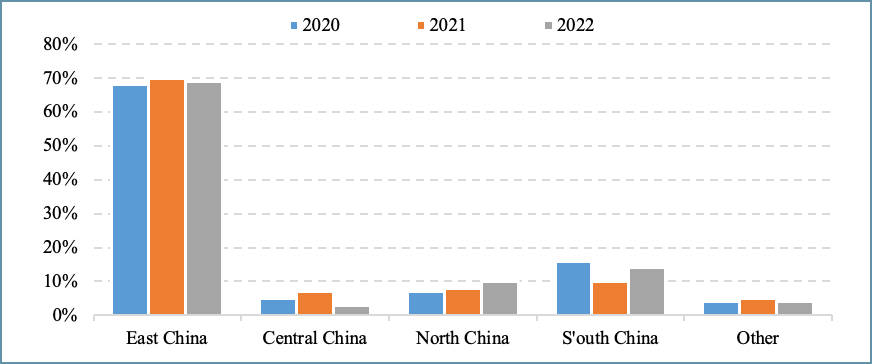

Chart 11 – Regional Proportions of Downstream Glycerin in China 2020-2022

In 2022, the

distribution of downstream glycerin in East China accounted for 69% of the

country’s total, and most downstream epichlorohydrin and polyether industry

devices were located in East China. Due to the increase in the numbers of

polyether and other industrial enterprises in North China and South China, the

proportions have also increased, making the changes in other regions less

apparent.

3.4 Supply & Demand Balance of Glycerin in China

Table 3 – Supply And Demand Balance of Glycerin in China (‘000 MT)

| Item | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Initial inventory | 35 | 92 | 249 | 361 | 307 |

| Output | 545 | 727 | 725 | 755 | 596 |

| Imports | 238 | 352 | 426 | 495 | 492 |

| Total supply | 817[MM3] | 1,171 | 1,400 | 1,611 | 1,394[MM4] |

| Exports | 2 | 2 | 8 | 4 | 6 |

| Downstream consumption | 724 | 920 | 1,031 | 1,300 | 1,115 |

| Total demand | 725[MM5] | 922 | 1,039 | 1,304 | 1,121 |

| Ending inventory | 92 | 249 | 361 | 307 | 274 |

| Reasonable inventory | 60 | 90 | 150 | 250 | 280 |

| Balance | 32 | 159 | 211 | 57 | -6 |

Source: General Administration of Customs of China & www.SCI99.com

Note:

- Total supply=output+import+opening inventory; Total demand=downstream consumption+export; Ending inventory=total supply-total demand; Balance difference=closing inventory-reasonable inventory.

(2) Reasonable inventory generally refers to an ideal state, that is, not only the quantity of inventory can meet the short-term demand safety under emergencies but also does not occupy too much working capital to have an impact on production and operation.

According to the table above, the balance difference in 2022 is negative, which means the market was in a state of supply shortage. In the past five years, the market supply has changed from surplus to shortage. China’s glycerin supply in 2022 decreased by 331,200 MT from 2021. The reasons are as follows: 1. The supply of crude glycerin from abroad was tight in the first half of the year; 2. The price of glycerin fell from a high level in the second half of the year, and the enthusiasm for refining glycerin plants declined. The total demand in 2022 was lower than that of 2021, during which the demand for glycerin from glycerin-based epichlorohydrin decreased, bringing down the overall demand.

4.0 Outlook of China’s Glycerin Industry

4.1 The Forecast of China’s Glycerin Market Supply in 2023

China’s glycerin supply in 2023 is forecast to increase as compared to that of 2022, with an estimated supply of 600,000 MT, an increase of 4,000 MT compared to 2022. Due to the additional new capacity of epichlorohydrin plants in the future, the total output of glycerin will surpass the number recorded in 2022. However, the glycerin capacity increment will be limited in the next five years, mainly due to the existence of idle capacities in the country, and the preference of some private investment funds to enter the market via the upgrading of old units.

In the global market, the demand for glycerin in Europe and other countries will decline, and as a result, the quantity of Southeast Asian products entering China will increase. Overall, the global glycerin supply will show an increasing trend in the next five years.

4.2 Forecast of China’s Downstream Consumption of Glycerin in 2023

In 2022 and 2023, multiple sets of glycerin-based epichlorohydrin units were and will be added, and epichlorohydrin output will be the main growth factor of glycerin downstream consumption. It is estimated that the downstream consumption of glycerin in China will increase by 150,000 MT from 1.3 million MT in 2021 to 1.45 million MT, or an increase of 12%, and with the demand from daily chemical and pharmaceutical industries increasing marginally, the growth of glycerin used in daily chemical and pharmaceutical industries will shrink.

The share of the epichlorohydrin industry in the consumption structure of the glycerin downstream industry will continue to increase. It is expected that the proportion of epichlorohydrin demand in glycerin will increase from 67% to more than 70% by 2027. At the same time, with the improvements in living standards, the consumption of daily cosmetics will increase, and the demand for daily chemical cosmetics from the downstream sectors of glycerin will increase from 16% to 20%. The paint industry has a low acceptance of high-priced glycerin and uses other products as a substitute for glycerin. With the tight supply of glycerin becoming the new normal in the future, the share of the paint industry in the downstream demand for glycerin will drop from 4% to 2%. Overall, by 2027, the downstream demand for glycerin will reach 1.5 million MT, an increase of 35% over 2022.

4.3 Future Development Trend of the Global Glycerin Industry

4.3.1 Impact of Macro Environment on the Glycerin Market

In 2023, under major central banks’ tightening of monetary policies, led by the Federal Reserve, a serious global economic recession is expected to unfold. Global commodity prices may continue to decline and are expected to gradually reach the bottom in the second half of the year. Therefore, it is difficult to rely on the macro environment to drive the price of glycerin to a new high, and the price in 2023 may be lower than that of 2022.

4.3.2 Impact of Industrial Policies on the Glycerin Market

Since the biodiesel policy determines the output of crude glycerin, the development of the biodiesel sector has become the focus among the glycerin players. In 2021, the price of vegetable oil reached its highest level, which also led to the decline of the price advantage of using vegetable oil to produce biodiesel. The reduction in biodiesel output led to the reduction in crude glycerin output, which led to the rise in glycerin prices. In 2022, the price of vegetable oil dropped from a high level, and the output of biodiesel increased. It was expected that the price of vegetable oil will fall in 2023, which will improve the cost advantage of biodiesel production.

In 2022, Indonesia decided to increase the blending ratio of biodiesel from 30% to 35%, while Brazil reduced its blending ratio from 13% to 10%. However, biodiesel policies may change, and the blending rate of the major producing countries may be increased. Hence, the output of crude glycerin may increase driven by the increase in biodiesel output, which may subsequently bring down the price of glycerin.

4.3.3 Impact of Main Factors on Glycerin Price in 2023

The main driving factors of glycerin price in 2023 will be the cost of raw materials, industry supply and demand, macro environment, and market mentality. As the main raw material in glycerin production, crude glycerin will be the main price driver of the glycerin market in 2023.

Table 4 – Main Influencing Factors of the Glycerin Industry

| Influence Factor | Degree of Influence |

|---|---|

| Crude glycerin | ★★★★★ |

| Domestic S&D | ★★★★ |

| Industry policy | ★★★ |

| Macro environment | ★★ |

Source: www.SCI99.com

The impact of supply and demand in China on the price of glycerin will be strengthened. The low inventory of glycerin in 2021 and 2022 has greatly driven up the prices. It is expected that the supply shortage will change in 2023, and downstream demand will become the main driving force behind market prices.

4.3.4 China’s Glycerin Supply and Demand Balance Forecast in 2023-2027

Based on the glycerin industry’s upstream and downstream markets, the supply-demand balance forecast for the next five years are as follows:

Table 5 – Forecast of Glycerin Supply & Demand Balance 2023-2027 (‘000 MT)

| Item | 2023E | 2024E | 2025E | 2026E | 2027E |

|---|---|---|---|---|---|

| Initial inventory | 274 | 298 | 300 | 290 | 228 |

| Yield | 780 | 800 | 860 | 880 | 920 |

| Import volume | 500 | 510 | 520 | 520 | 560 |

| Total supply | 1,554 | 1,608 | 1,680 | 1,690 | 1,708 |

| Exports | 6 | 8 | 10 | 12 | 15 |

| Downstream consumption | 1,250 | 1,300 | 1,380 | 1,450 | 1,500 |

| Total demand | 1,256 | 1,308 | 1,390 | 1,462 | 1,515 |

| Ending inventory | 298 | 300 | 290 | 228 | 193 |

| Reasonable inventory | 280 | 290 | 320 | 320 | 320 |

| Balance | 18 | 10 | -30 | -92 | -127 |

In the next five years, it is expected that China’s glycerin market could be in a state of supply shortage. This is due to the opinion that although the total supply (both domestic production and import) will increase, China’s demand growth is expected to outgrow its supply, mainly affected by the increase in the downstream production capacity of glycerin-based epichlorohydrin. Hence, in the near future, the tight supply will provide some support to the glycerin market price.

Prepared by MPOC Regional Office, China

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.

[MM1]Is this supposed to be ‘its’? I am unable to infer.

[MM2]There’s a stray apostrophe in ‘South China’ in the chart

[MM3]Should be 818

[MM4]1395

[MM5]726