The West of Suez region covers 10 countries, namely Algeria, Djibouti, Egypt, Eritrea, Ethiopia, Libya, Morocco, Somalia, Sudan, and Tunisia. The West of Suez countries, with its huge population of about 385 million is a net importer of oils & fats. The region mainly depends on imports to satisfy its needs for oils and fats. Imports of oils and fats in 2019 were recorded at 4.99 Mn MT. The region is dominated by soft oils with 61% of the total oils and fats market share. Palm oil imports into the region reached 1.93 Mn MT, it constitutes 39% of the total oils & fats imported to the region in 2019.

In 2020, the coronavirus pandemic has unleashed a series of unprecedented events affecting the oils and fats industry. The Palm market will be reset to a new normal which going forwards in a post COVID-19 era, which will be continuously redefined and redesigned. Loading and unloading of goods need to go through some additional procedures including the personnel. The outbreak of COVID-19 and subsequent lockdowns have raised alarms, which will be causing the interruption in the supply and demand of goods.

Malaysian Palm Oil Performance

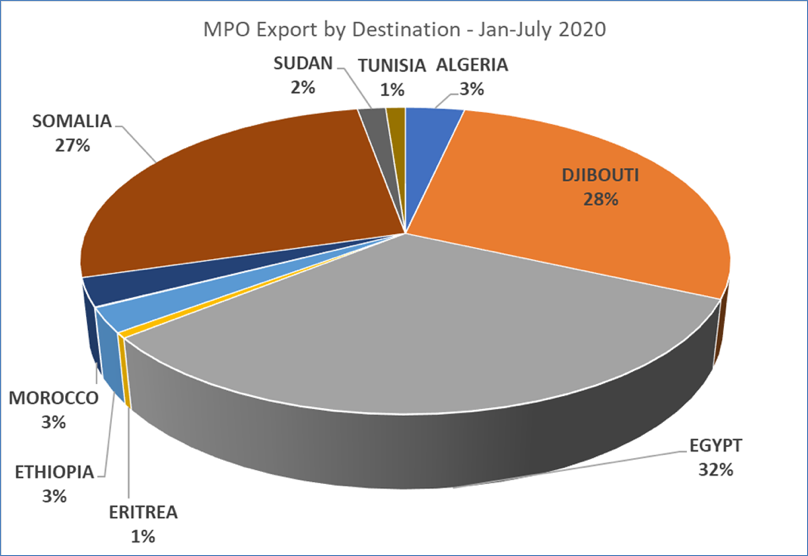

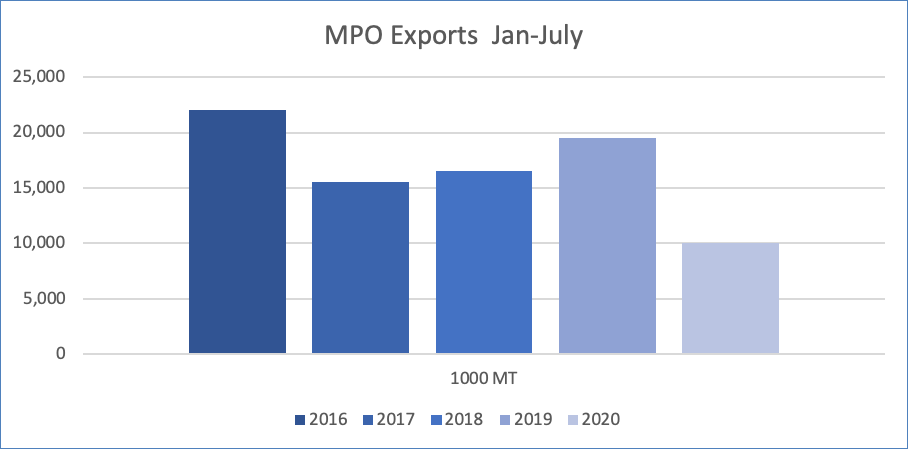

During Jan-July 2020, Malaysian palm oil export to the region recorded at 288,029 MT compared to 199,495 MT in Jan -July 2019, exports increased by 44.4% or 88,534 MT.

Egypt is the top importer, accounting for 32% of the total export to the region, exports to Egypt increased by 148% to record 93,589 MT compared to 37,761 MT same period last year. Djibouti is ranked second, accounting for 28% of the Malaysian exports, exports increased by 128%. Somalia is the third major destination for palm oil export recorded at 77,038 MT with a share of 27% of the total export. Exports to Somalia increased by 36%. Exports to Morocco significantly increased to a record 8,501 MT compared to 965 MT in Jan-July 2019, which were mostly CPO. Exports to Ethiopia are badly hit to record 82% decline compared to same period last year due to foreign currency shortage and record high sunflower oil imports. Exports to Algeria also decreased by 49%.

| Malaysia Palm Oil Export to West of Suez | ||||

|---|---|---|---|---|

| Country | Jan-July 2020 | Jan-July 2019 | Change (Vol.) | Change (%) |

| ALGERIA | 10,033 | 19,556 | -9,523 | -49 |

| DJIBOUTI | 81,398 | 35,737 | 45,661 | 128 |

| EGYPT | 93,589 | 37,761 | 55,828 | 148 |

| ERITREA | 1,656 | 2,102 | -446 | -21 |

| ETHIOPIA | 7,439 | 41,109 | -33,670 | -82 |

| LIBYA | 249 | 444 | -195 | -44 |

| MOROCCO | 8,501 | 965 | 7,536 | 781 |

| SOMALIA | 77,038 | 56,825 | 20,213 | 36 |

| SUDAN | 4,792 | 4,666 | 126 | 3 |

| TUNISIA | 3,334 | 330 | 3,004 | 910 |

| Grand Total | 288,029 | 199,495 | 88,534 | 44.4 |

| Source: MPOB | ||||

Egypt: Remain Strong in the Palm Oil Imports

Palm oil imports and consumption remain strong despite the slowdown of the economy in some countries in this region especially Egypt. This is due to the size of the population and low per capita consumption which provides the basis for further increase in oils and fats intake. This is supported by strong growth in the food industry segment which stimulates the demand for palm oil. Palm oil meets the technical and economical requirements of this market segment.

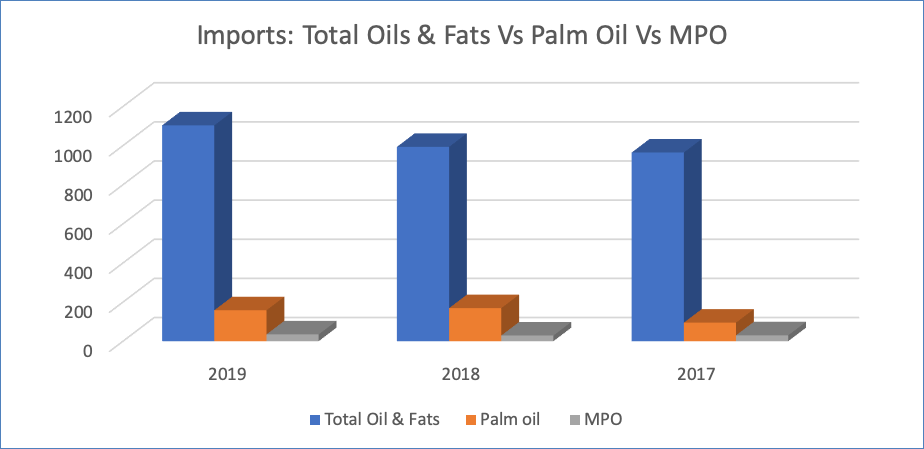

Egypt is the biggest importer of palm with a share of 51% of total palm oil imports in the West of Suez region. In 2019, Egypt’s imports of palm oil reached approximately 988 Thousand MT. Egypt’s total imports of palm oil in Jan-July 2020 increased by 6% (36,523 MT) to record 651,231 MT as compared to 614,708 MT recorded in the same period last year. The shortage of Indonesian palm oil in the region had supported the increase MPO into the country. Imports of MPO showed an increase of more than 140% for the first half this year compared to the corresponding period of the last year.

Ethiopia: Changes in Palm Imports

Ethiopia is the second most populous nation in Africa after Nigeria, with about 109.2 million people (2018). The country’s population is growing at a rate of 3% annually. However, it is also one of the poorest, with a per capita income of $783. By 2025, Ethiopia aims to reach lower-middle-income status. The market size provides a huge market potential for consumer goods.

Sesame seed is an important contributor to the Ethiopian economy. Most of the sesame seed produced in the country went for export and contributed about 18% of the foreign exchange earnings of the country. Production of oils and fats only supplement 10% of the domestic requirement. The production has been stagnant over the last 8 years and therefore the country has to depend heavily on imports. Per capita consumption is only 5.3 kg. The need to improve country’s per capita consumption will create an avenue for further increase in oils and fats import especially for palm oil due to its competitive price and import’s tariff.

In Ethiopia, there is a wide misconception on palm oil among the public due to its high saturated fat content which is linked to heart diseases. These health concerns from the public have got listening ears from the government side, who has instructed to make certain investigation of how palm oil could be substituted by other soft oils. MPOC on the other hand had worked on this issue joined along with local authorities and industry players, including the ministerial visits. Several programs are still in progress to address this misconception and expand the MPO market size in Ethiopia.

Ethiopia is an import-dependent and supply-constrained country, the pandemic severely affected imports. Shipping lines are affected by travel bans and take more time for the cargo mobilized. The situation gives negative implications on palm oil imports into the country leading to a severe shortage of the commodity in the market as well as higher prices. This includes affecting the service sector, hotels, restaurants, and tourism sector. Noting that the service sector contributes over 45% of GDP, the impact of such reductions might affect the larger economy.

According to the GAIN report, total edible oil consumption in CY 2020 estimated at 615,000 metric tons, of which 95 percent imported. Most of the oil consumed is mainly imported palm oil, followed by sunflower oil and locally produced Niger seed oil. Small amounts of soybean, linseed, groundnut, and cottonseed oils are also consumed. The Government of Ethiopia subsidizes edible oil imports and sets the selling price to make it more affordable to the consumers. The government distributes the imported oils to district unions for sale under mandated tariffs. The government in return supports the companies by giving duty-free privileges and foreign currency exchange.

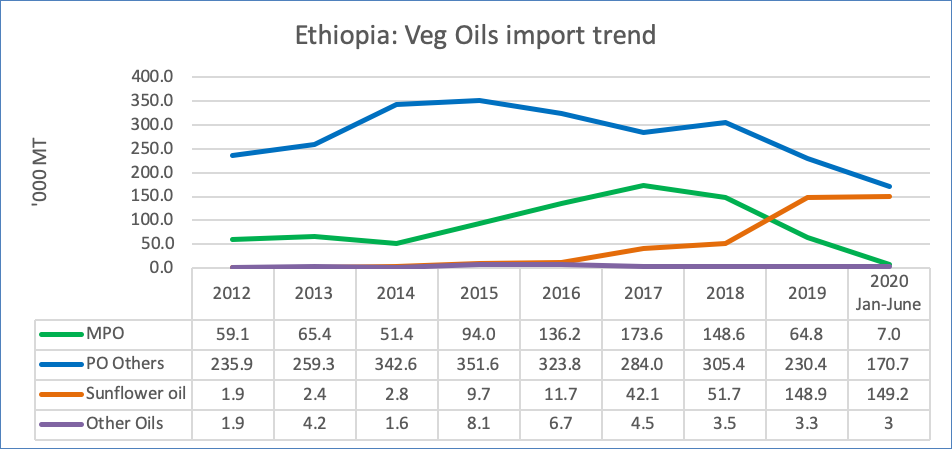

Foreign currency shortage has shown some impact on the imports of oils and fats into the country. 2019 imports recorded a drop by 13.8% compared to the previous year from 509 thousand MT to 447 thousand MT. Palm Oil imports dropped by 159 thousand MT compared to 454 thousand MT of total import in 2018. But the import of sunflower oil increased from 52 thousand MT to 149 thousand MT in 2019. The same trend happened this year. For the first half of this year, imports of sunflower oil recorded at 119 thousand MT, which already exceeded the total import last year 65 thousand Mt. Two main factors that support the increase was due to the credit facilities given the supplier of sunflower oil and import tax relief given by the local government. Previously, all kinds of imported soft oils are subject to Custom duty (30%); VAT (15%); Sur Tax (10%) and Withholding tax (2%).

Algeria – soybean oil dominate the market

Algeria is a predominantly liquid market and is a net importer of oils and fats, produces only 9.2% of the total oils and fats required by the country. The oils produced are mainly olive oil. Requirements are largely met by the imports of oils and fats, which is mainly soybean oil, followed by palm oil and sunflower oil.

Cevital is the biggest oils and fats importer and is the single largest palm oil buyer. Several new companies are keen to develop more palm-based products, but logistics issues and landed price are the major challenges holding back higher consumption of palm oil in Algeria. Another constraint that is facing palm oil and its products was the high import duty for bulk RBD palm oil products is 30% compared to crude edible oils at 5%. In the liquid oil market, palm olein is not widely used in frying due to the clouding problem during winter.

Algeria’s total oil & fats imports reached 1.1 Million MT in 2019, while their consumption reached 1.06 million MT in the same year. Soybean oil dominates the imports as it represents 78.3% of the total imports, followed by palm oil 14.3% then 3.8% sunflower oil, the rest of the oils & fats are only 3.5% of the total imports in 2019.

The Soybean oil imports are growing steadily since 2015 except for a slight drop in 2018, while palm oil and sunflower oil witnessed a slight increase the same year. Soybean oil increased again in 2019 by 16.8% to reach 864.3 thousand MT.

For the period of Jan – July, MPO exports to Algeria decreased by 49% from 19,556 thousand MT in 2019 to 10,033 thousand MT in 2020. The main products that witnessed a drop in the exports are RBD palm oil drop dropped from 9,604.71 MT in Jan -July 2019 to 3,910.38 MT, RBD Palm Stearin from 3,195.76 MT to 1,599.44 MT. This was due to the increase in home cooking during the pandemic Covid-19, and soybean and sunflower are the only cooking oils available in the market, whereas palm oil is used in the HORECA sector and Industry. However, the RBD Palm Olein witnessed a slight increase from 683.3 MT to 858.36 MT.

The soybean oil captured the Algerian market for many years and continued expansion of the soybean industry in the country. Last year, a new player called SIM Group had entered the market with a new crusher plant for the soybean. They have many types of products like, flour, pasta, mineral water, and jam. In February 2020 SIM introduced a Soybean cooking oil brand called Bahia. The first cooking oil produced by SIM Group in the Algeria market. P

Prepared by Mohd. Suhaili Hambali

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.