Iran market overview

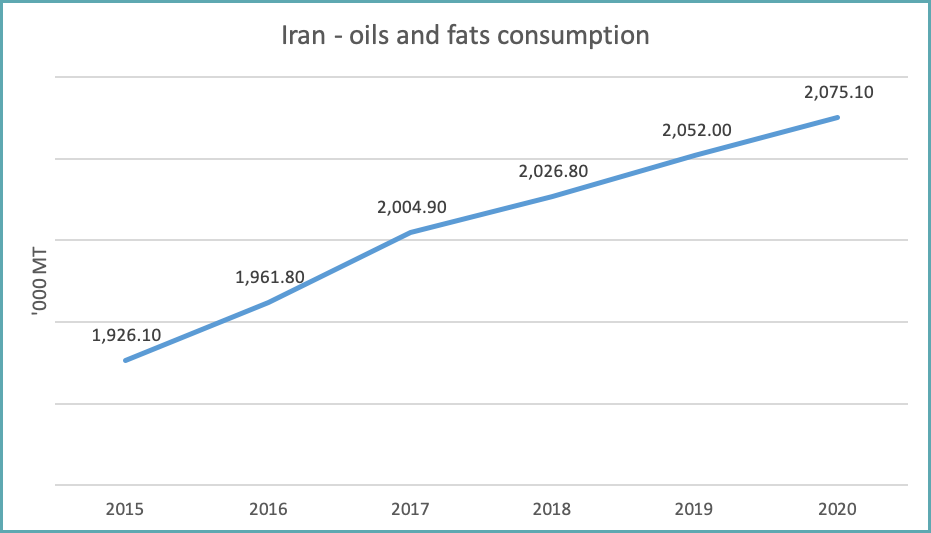

Iran is an important market for oils and fats, with the consumption already reached two million MT a year and relatively high consumption per capita at 24 kg. A high population of 84 million would also encourage the higher intake of oils and fats in the country

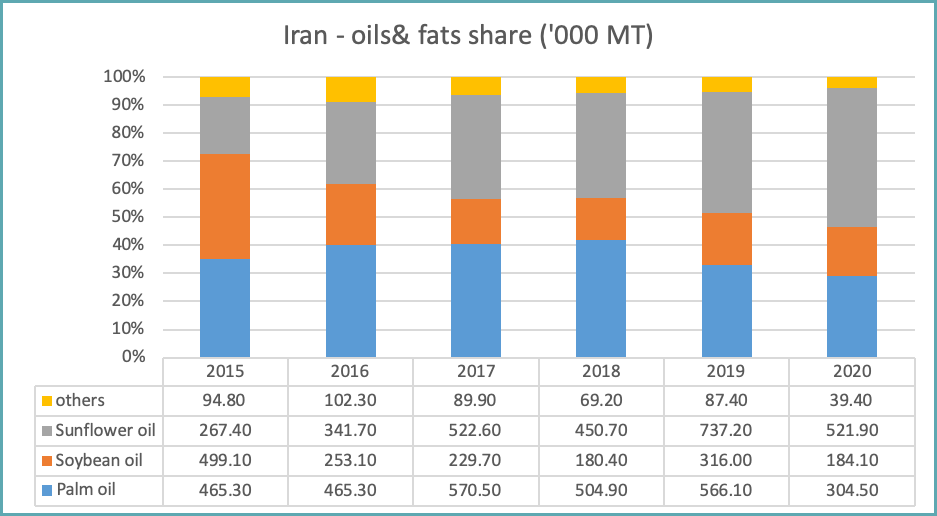

Last year, even during the global economic downturn, Iran’s consumption of oils and fats maintained its upward trend. However, the total import of oils and fats in 2020 was recorded lower, including palm oil. This was mainly due to higher importation of seeds and local production of oils, particularly higher crushing of soybean seeds to support a higher requirement of local soybean meal.

Sunflower, soybean and palm oil are the top three vegetable oils imported by Iran, covering more than 90 per cent of the total oils and fats imported every year. However, the volume was recorded lower last year due to the higher local production as mentioned above. As a result, palm oil was registered lower last year at only 304,500 MT, dropped by 261,600 MT compared to the previous year. Sunflower and Soybean oil import was also had a similar downward trend dropped by 215,300 and 131,900 MT, respectively.

Iran’s drop in palm oil imports affected the total Malaysian palm oil (MPO) export into this country as MPO captured more than 80 per cent of the palm oil market in the country for the last five years. In 2020, MPO gained 86 per cent of the palm oil market, recorded slightly lower than the previous year, which was the highest at 98 per cent. However, the lower import in 2020 seemed to be only a temporary trend, as the first half of MPO export to Iran started to show an improvement.

MPO export performance first half 2021

Iran imported 309,704 MT of MPO in the first half of 2021, accounted a significant increase of 246,665 compared to the same period last year. The MPO value received was also very encouraging, supported by a better price in the first half of 2021. The total was registered at 1.282 million ringgit, a hike of 673% for the period. RBD Palm Olein was the highest, representing 82 per cent of the total MPO exported to Iran. Higher demand for RBD Palm Olein came from industrial usages such as the production of fat products, frying and HORECA sector. Apart from that, Palm Olein is also used as blended cooking oil for the household.

| Products | Jan-June 2020 (MT) | Jan-June 2020 (RM Mil) | Jan-June 2021 (MT) | Jan-June 2021 (RM Mil) |

|---|---|---|---|---|

| COOKING OIL | 15,409 | 42.12 | 2,848 | 13.19 |

| PALM MID-FRACTION | 435 | 2.66 | – | – |

| RBD PALM OIL | 24,516 | 64.45 | 52,502 | 246.13 |

| RBD PALM OLEIN | 22,320 | 55.49 | 253,311 | 1,019.18 |

| RBD PALM STEARIN | 360 | 1.26 | 1,044 | 4.34 |

| TOTAL | 63,039 | 165.98 | 309,704 | 1,282.84 |

Source: MPOB

The local government highly controls the importation of commodities including the oils and fats products. This year, their current policy and enforcement support the higher intake of MPO into the country. Two main factors which are highly pushing the import of palm oil into the country are the competitive exchange rate facilities for the USD to Iranian riyal given to the importers and an increase in the import quota of palm oil.

Palm oil has been put under the Iranian subsidies scheme since 2018, the same benefit as sunflower oil and soybean oil. Under the scheme, the palm oil importers could apply for a lower exchange rate to get USD for importing the products from the Central Bank of Iran, which is almost ten times lower than the current open market rates. However, the vegetable oils imported under the subsidies schemes are only for domestic use.

The second factor that supported the increase of imports is the increase in palm oil import quota to 240,000 MT for six months until September 2021. The import quota potentially will be extended to another six months to the second half of this year to bring 480,000 MT in total. We estimated that Iran could absorb more than that this year. In fact, it was recorded higher in 2017, 2018 and 2019 at 570,500 MT, 504,900 MT and 566,100 MT, respectively.

MPO export estimation in the second half of 2021

Looking at the current trend with an additional 52,145 MT of MPO export to Iran in July, this year we may witness the highest export of MPO into this country with more than 600,000 MT. Furthermore, a recent Malaysian minister meeting with the Government Trading Corporation of Iran (GTC), the arms of the Iranian government in acquiring staples goods, including vegetable oils for the country, would bring another positive outlook for MPO export to Iran.

The palm oil price trend in the world market would be another factor that needs to be monitored. There is always another alternative for the Iranian government to avoid this and limit the importation of palm oil by reducing the import quota of palm oil, which only be known by the end of September. To accommodate the local vegetable oils requirement, they may increase the oil seeds crushing such as soybean, as the Iranian government did last year.

Prepared by: Mohd. Suhaili Hambali

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.