Introduction

The United Arab Emirates (UAE) is a strategic hub in the Middle East, offering numerous opportunities for Malaysian palm oil industry players. As a global logistics and re-export centre, Dubai plays a pivotal role in connecting diverse markets in many continents. With its state-of-the-art infrastructure and efficient transport networks, Dubai is an ideal entry point for the Malaysian palm oil industry to expand into the Middle East and beyond. Its strategic location and business-friendly environment attracts multinational corporations, investors, and entrepreneurs, making it a thriving hub for trade.

The UAE’s economic diversification has created a conducive environment for various industries, including palm oil. The nation’s strong focus on sectors such as hospitality, tourism, finance, and trade has paved the way for palm oil’s growth and acceptance for food and non-food applications. Malaysian palm oil exporters can capitalise on Dubai’s global standing and the UAE’s economic diversity to establish a solid foothold in the Middle East market. The UAE’s favourable business policies, well-established trade relationships, and robust logistics capabilities provide a suitable platform for the flourishing of Malaysian palm oil.

Demand Potentials of Malaysian Palm Oil in UAE

The global palm oil market holds immense significance as one of the most versatile and widely used vegetable oils. Its unique properties, including high yield, excellent cooking characteristics, and versatility in various applications, have made it a staple ingredient in food, cosmetics, and biodiesel industries.

The palm oil industry in Malaysia has experienced significant growth and established itself as a global leader in certified palm oil through the Malaysian Sustainable Palm Oil (MSPO) certification scheme. Malaysia has leveraged on its competitive advantages, such as advanced cultivation techniques, a robust supply chain, and a focus on quality, to become one of the largest palm oil producers and exporters in the world. The industry’s commitment to sustainable practices, including certifications such as the MSPO, has further enhanced Malaysia’s reputation as a responsible palm oil supplier.

The UAE market presents tremendous potential for Malaysian palm oil exporters. The country’s increasing population, driven by a rising influx of expatriates and growing economic opportunities, has led to an upsurge in demand for palm oil. This demand extends across various sectors, including food, cosmetics, and potentially in palm-based biodiesel production for the re-export market in the region.

In the food sector, palm oil is extensively used in cooking oil, margarine, snacks, confectionery, and a range of processed food products. The UAE’s diverse population, with a mix of nationalities and culinary preferences, contributes to the demand for various palm oil-based food products.

Additionally, the cosmetics industry in the UAE has witnessed significant growth, driven by a rising awareness of personal grooming and beauty care. Based on a study conducted by BlueWeave Consulting, the UAE cosmetics market is likely to grow at a CAGR of 4.1% by 2027. Palm oil and its derivatives are key ingredients in a wide range of cosmetic and personal care products. With an increasing consumer demand for natural and sustainable products, Malaysian palm oil, known for its quality and sustainability, holds great potential in this sector.

UAE – Malaysian Palm Oil imports

| PRODUCT | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| RBD PL | 39,435 | 53,145 | 63,011 | 80,135 | 228,965 |

| RBD PO | 668 | 4,966 | 20,944 | 21,818 | 32,194 |

| RBD PS | 3,052 | 3,034 | 1,671 | 5,176 | 9,805 |

| RBD PL – Certified palm oil | 130 | 272 | |||

| RBD PO – Certified palm oil | 1,590 | 4,206 | |||

| RBD PS – Certified palm oil | 1,051 | 1,986 | 1,708 | ||

| Other palm oil products | 13,375 | 14,476 | 15,352 | 24,067 | 70,486 |

| Total | 56,530 | 75,621 | 102,159 | 134,772 | 347,636 |

| Total Certified Palm oil | 1,181 | 3,576 | 6,186 |

Source: MPOB

The table above offers insights into the trends of palm oil imports by the UAE, as well as the potential and key products imported. Over the analysed period from 2018 to 2022, the UAE’s palm oil imports exhibited a favourable upward trend. Import values consistently increased, with a significant rise from 56,530 MT in 2018 to 347,635 MT in 2022. Notably, that year’s total imports saw a substantial surge, reaching a peak of 347,635 MT. Additionally, a favourable trend was also shown in the imports of certified palm oil into the country, increasing from only 1,181 MT in 2020 to 6,186 MT in 2022.

A significant increase was recorded for RBD PL (Refined, Bleached, and Deodorised Palm Olein) in 2022, more than tripling the figure as compared to the previous year and emerging as a key palm oil product imported by UAE. Its import volumes also displayed consistent growth, reaching a substantial value of 228,965 MT in 2022. Moreover, “Other palm oil products”, mainly packed cooking oil, also experienced significant expansion, peaking at 70,486 MT in 2022. These trends indicate an increasing demand for Malaysian palm oil products, highlighting their potential significance to the country.

Following these trends and understanding the current market potential in the UAE, Malaysian palm oil exporters should grasp this opportunity and tailor their strategies to meet the market’s specific demands. By offering high-quality, reliable, sustainable, and traceable palm oil products, they can tap into the growing demand and establish a strong presence in the UAE market.

UAE as re-export Hub and Expansion Point for Malaysian Palm Oil Export

As a major re-export hub, the UAE serves as a gateway to neighbouring countries in the Middle East, North Africa, and beyond. Apart from being ideal location for the re-export market, a strong demand in the domestic market, as mentioned above, is essential to Malaysian players for them to be established in the country by supplying palm oil products for the domestic market, on top of the further processing of the products or by transiting for the export market.

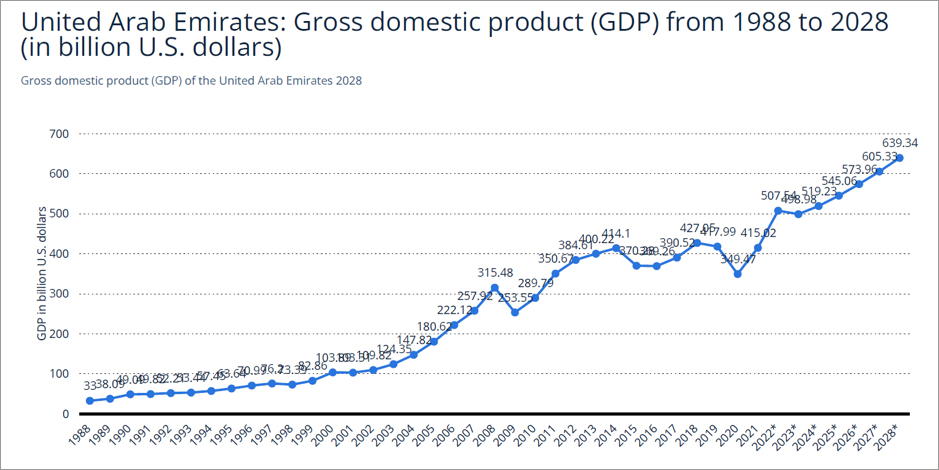

The growth of UAE’s GDP from USD253.55 billion in 2010 to an expected USD639.34 billion in 2028 signifies a thriving economy. This robust economic growth is a significant factor that supports the UAE’s position as an excellent venue for the re-export market.

As UAE’s GDP grows, so does the disposable income of its residents. This rise in consumer spending power creates a favourable environment for the re-export market. With more disposable income, consumers are willing to explore a wider range of products and allow re-exporters to cater to consumers’ diverse tastes and preferences in the UAE. Besides this, the following are some other supporting factors that could make UAE a good re-export hub for Malaysian palm oil:

The presence of a multicultural population: The diverse mix of nationalities present in the UAE, with expatriates forming a significant portion of the population, provides a strong support system for managing and marketing products in the re-export market.

Strong Logistics Infrastructure: The UAE has heavily invested in developing world-class logistics infrastructure, including ports, airports, and transport networks. This robust infrastructure facilitates the efficient movement of goods, making the UAE an attractive hub for re-export activities.

Favourable Business Environment: The UAE offers a business-friendly environment characterised by political stability, favourable trade policies, and ease of doing business. The UAE is ranked 16 among 190 economies, with a DB (Doing Business) Score of 80.9 according to the World Bank annual ratings (2020).

Strategic Geographical Location: The UAE’s geographical location in the middle of Europe, Asia, and Africa makes it an ideal re-export hub. Its proximity to key markets enables the efficient distribution of goods to various regions.

Conclusion

The UAE presents a compelling opportunity for Malaysian palm oil exporters to expand their presence in the global market through re-export. UAE’s strategic location, robust logistics infrastructure, favourable business environment, and growing GDP contribute to its status as a thriving re-export hub. Leveraging on its multicultural population, Malaysian palm oil producers can tap into expatriates’ diverse expertise, language skills, and market access, facilitating effective management and marketing of their products. Furthermore, highlighting Malaysia’s unique selling points, such as the MSPO certification scheme for sustainable practices, superior quality, and traceability, will enhance the appeal of Malaysian palm oil in the UAE market. By capitalising on these advantages, Malaysian palm oil exporters can seize on the opportunities presented by UAE’s re-export market, establishing strong partnerships, expanding their customer base, and contributing to the growth of the Malaysian palm oil industry in the region.

Prepared by: Mohd. Suhaili Hambali

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.