The most populous nation in the world has an exquisite cuisine taste that is loved by many regardless of geographical identity. One of the major oilseed crops in China, the rapeseed or locally known as yóucài has a deep impact on Chinese culinary arts due to its mild taste, high smoking point, and rich in nutrients such as mono-saturated essential fatty acids. The rapeseed which accounted for approximately 11% of the world’s oilseed usage, is widely used in China since 5000 BCE (OCL journal, 2016). Due to the preferential taste and health benefits, China has been one of the largest rapeseed consumers.

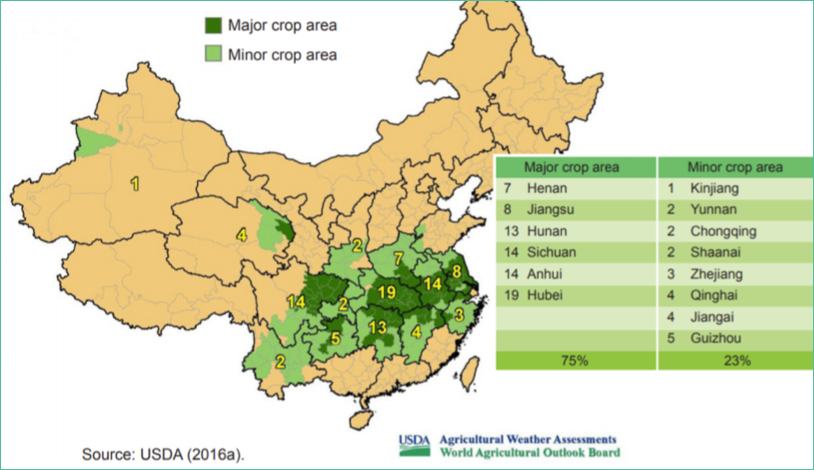

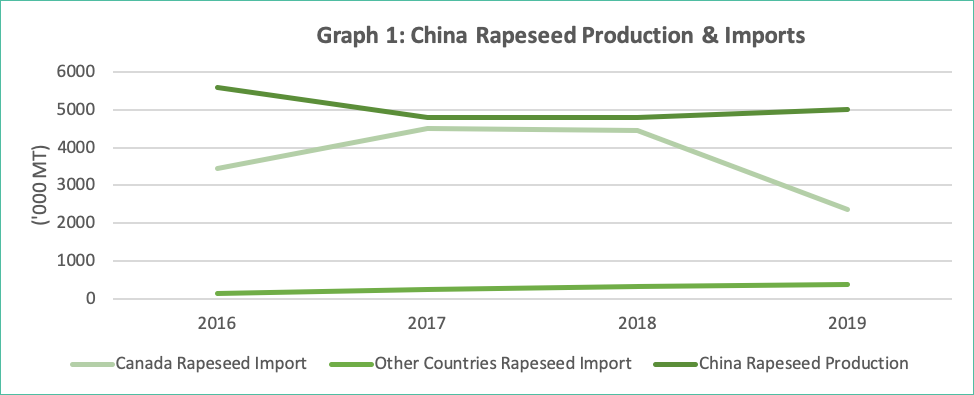

Apart from being one of the major rapeseed cultivators, accounted for approximately 8.2% global production in 2019, China imported rapeseed mostly from Canada to fill the needs (Refer to chart 1) for its domestic consumption. Canada has been supplying almost 50% of China’s rapeseed requirement apart from its domestic production. The 5 Million MT of rapeseed production in 2019 (refer to graph 1) represents 11.1% of the total oilseed production of China. The main cultivating regions are in the central part of China, namely, Hubei, Hunan, Anhui, Jiangsu, and Henan.

The Political Economy of the Rapeseed Import in China

Several developments over the years have changed the pattern of the rapeseed import of China. In early 2016, China only allowed non-rapeseed producing regions (e.g. Guangdong, Guangxi) to import rapeseed because of phytosanitary concern. In addition, Canada exporters are also required to obtain a Chinese phytosanitary certificate which requires the oilseed to undergo rigid inspections for blackleg disease and other quarantine pests.

Furthermore, the government of China also implemented stringent standards on Canadian rapeseed export whereby not more than 1% of foreign impurities other than whole, split broken seed to be allowed in the rapeseed shipments compared to the normal 2.5%. This has caused a significant increase in the processing costs to remove the impurities for the Canadian rapeseed shippers thus increase the price of the rapeseed in the market.

The rapeseed industry was impacted further during the Sino-Canada spat in August 2018. The arrest of Huawei’s Chief financial officer, Meng Wanzhou in December 2018 escalated the Sino-Canada spat which eventually pushed China’s rapeseed import from Canada further down. Due to this development, China’s rapeseed imports from Canada drop substantially by 46.9% or 2.1 million MT from 4.4 million MT in 2018 to 2.3 million MT in 2019. Reflecting on the sharp drop in China’s rapeseed imports, the rapeseed crushing for 2019 declined by 1.5 million MT or 16.0% to 7.8 million MT. As a result, rapeseed oil production dropped by 16.0% or 585,400 MT to 3.1 million MT in 2019.

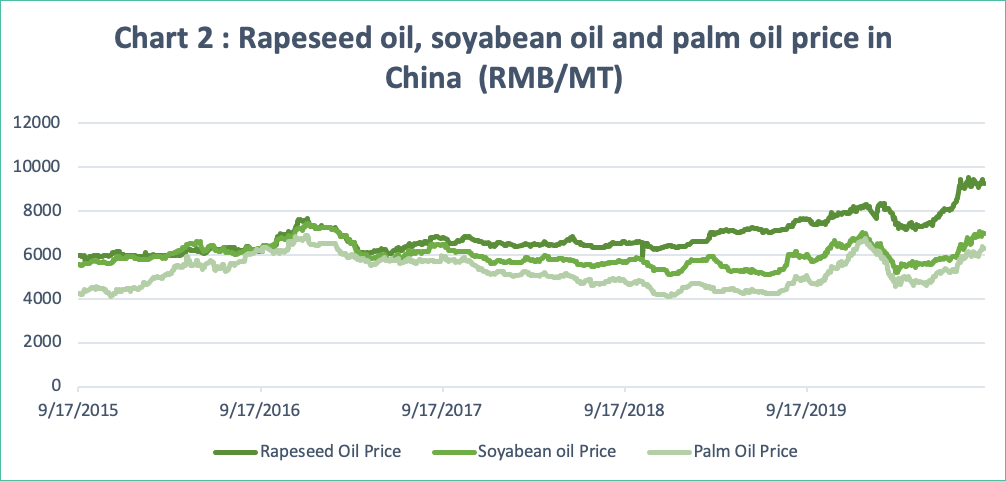

Bilateral talks are in progress to restore gain full access for Canadian rapeseed to China, but Canada’s two largest rapeseed exporters remain suspended by China (USDA, 18 Sept 2020). Imports of rapeseed from other Canadian exporters continued to be accepted with the existing stringent regulations. The reduction in the rapeseed oil availability and a stringent regulation from the Chinese government for Canadian rapeseed imports led the premium of the rapeseed oil price over other edible oils to increase. (Refer to chart 2).

Source: Bloomberg

Significance of Rapeseed in Palm Oil Import

The declining rapeseed import helps to give advantage for palm oil to grab some market share in China’s oils and fats market in 2019. China’s palm oil imports rose by 42.5% from 5.4 million MT to 7.7 million MT the year. Despite the clouding nature of palm oil in temperate conditions which makes palm oil a less suitable substitute for rapeseed oil, palm oil projects its competitive advantage in its application such as good frying medium, high smoke point, and cost-effectiveness. This led palm oil to benefit from the reduction in rapeseed oil supply in the market.

However, with the recovery of soybean oil production in 2020 as the ASF outbreak in China subsides, and the declining use of RBD PL in the biofuel sector, China’s palm oil imports are expected to decline in 2020 between 1 Million MT to 1.2 Million MT (MPOC China’s estimate).

According to the market intelligence by MPOC’s Shanghai office, at least 500,000 MT of RBD PL imported in 2019 was used to blend with kerosene to produce a blend of fuel similar to biodiesel. This fuel is mainly used by farms in their in their machineries especially in the Guangdong province. The current low petroleum price makes the blending not viable to be used thus it is expected that the imports of China’s RBD PL imports for this purpose will be reduced.

Although China’s palm oil imports in 2020 are expected to decline, we expect that Malaysia’s palm oil export to the country to rise. The primary reason for the expected rise in Malaysia’s export is the reduction in the availability of Indonesian palm oil for exports due to the country’s rising biodiesel mandate and the reduction in CPO output. Malaysia’s palm oil exports to China are anticipated to increase between 500,000 MT to 600,000 MT. For the January – August 2020, Malaysia’s palm oil to China has already increased by 447,445 MT or 32.1% to 1.8 million MT. The reduction of the rapeseed import is a contributing factor that mitigated China’s projected drop in palm oil import in 2020 as soybean oil production recovers along with the hog industry recovering from the ASF outbreak.

Prepared By: Theventharan Batumalai and Lim Teck Chaii

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and the opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.