MPOB data shows that export of MPO during Jan. – May period of 2020 to Bangladesh witnessed a significant growth to the tune of about 8 folds as compared to the corresponding of period of 2019 (Table – 1). Price competitiveness of MPO during the period contributed greatly towards this remarkable growth. Market sources expects, increasing trend of import of MPO would continue in June 2020 also. As indicated earlier, price competitiveness of MPO during the said period compared to IPO was the main the reason of shift of supply sources to Malaysia from Indonesia.

Table–1: Export of MPO to Bangladesh (MT) |

||||

|---|---|---|---|---|

| Origin | Jan – May 2020 | Jan – May 2019 | Changes | Changes |

| (Vol.) | (%) | |||

| Malaysia | 183,201 | 20,925 | +162,276 | +775.51 |

| Source: MPOB Data | ||||

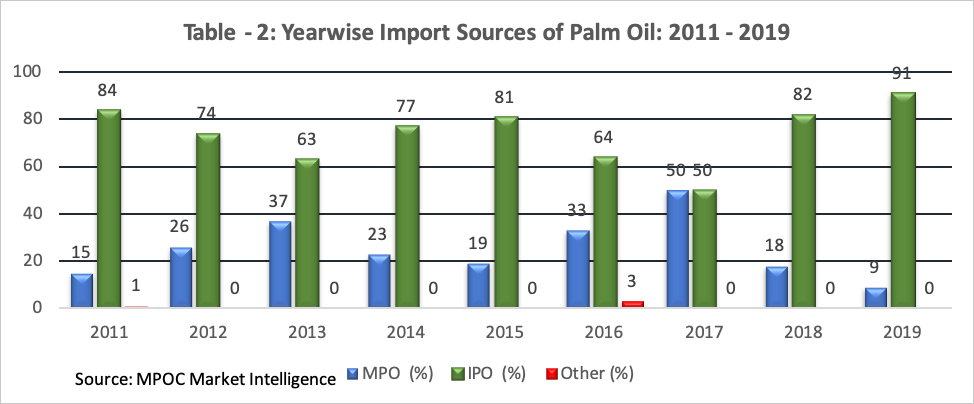

Since 1993 to 2005, Malaysia was the major supplier of palm oil to Bangladesh with an exception from the year 2000 to 2003. Later, Malaysia lost its position as a major supplier of palm oil to Bangladesh. This was mainly because of price competitiveness of IPO. In addition, lack of active presence of MPO suppliers and attractive trading terms offered by Singapore based trading houses who are linked to IPO supply, also contributed to increased supply of IPO in Bangladesh market.

Considering the prevailing controlled economic activities, caused from COVID – 19 since March 2020, it is expected that in the 3rd quarter of 2020 there is a need to import about 350,000 to 400,000 tonnes of palm oil into Bangladesh. It is expected that increasing trend of import of MPO would continue subject to the prevailing price advantages of MPO against IPO. Since Bangladesh is price sensitive market, price plays key role in source determination.

Prevailing Oils and Fats Market Scenario:

Bangladesh is a liquid oil market and almost 85 – 90% of its annual consumption of about 3 million tonnes oils and fats is in liquid form. Among the three major edible oils consumed in the country, namely palm oil, soyabean oil and mustard oil, palm oil is the leading edible oil since 2003. Market potential for palm oil in Bangladesh is wide compared to other two edible oils mainly because of price factor. Expanding market of super olein and gradual growth of processed food industries and HORECA sector are contributing greatly in the gradual expanding market of palm oil in the country.

Super olein is sold mainly as cooking oil and very popular among the lower income groups of the consumers due to its lower price. Palm olein is mainly used by vanaspati producers, food processing industries and HORECA sector. These sectors prefer palm olein because of its lower price and long shelf life. In addition, there are rooms for further increase of consumption of palm olein in the fast food chain and in the bakery and confectionary sector. Keeping pace with the socio-economic growth of the country, demand of processed food items is also growing as the food habit and life style changes/shift.

Table -3 shows the consumption of oils and fats in Bangladesh is increasing with an average growth of about 8% to 10% per annum with an exception in 2019. In 2019, annual consumption of oils and fats dropped to 3.39% mainly due to decline in consumption caused from economic hardship of the consumers. The average per capita consumption of oils and fats in Bangladesh is approaching to 19 kgs. To meet the increasing demand, it is expected that total import of major three oils would increase to about 3 million tonnes by 2021. Import of palm oil would also increase and expected to reach at least 1.7 million in 2021. Table -4 provides a clear picture about the import trend of major 3 oils in Bangladesh.

Table – 3: Year wise Consumption of Oils and Fats: 2013-2019

In Million Tonnes

| Year | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|---|---|---|---|---|---|---|

| Quantity | 3.05 | 2.95 | 2.70 | 2.48 | 2.22 | 2.04 | 1.86 |

Source: Oil World Annual

Table –4: Year wise Import Trend of Major Three Edible Oils: 2013-2019

In Million Tonnes

| Commodity | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|---|---|---|---|---|---|---|

| Palm Oil | 1.56 | 1.72 | 1.54 | 1.37 | 1.45 | 1.24 | 1.25 |

| CDSBO | 0.84 | 0.88 | 0.89 | 0.74 | 0.58 | 0.49 | 0.37 |

| Rapeseed/ Mustard Oil | 0.17 | 0.16 | 0.19 | 0.08 | 0.04 | 0.01 | 0.03 |

| Total | 2.57 | 2.76 | 2.62 | 2.19 | 2.07 | 1.74 | 1.65 |

Source: Oil World Annual

Note:

Palm oil refers to CPO, CPL and RBD PO/PL

Rapeseed/Mustard oil quantities are oil equivalent of imported rapeseeds/mustard seeds @ 38% oil extraction

Investment Potentials:

Considering the growth potential, there is no better option to sustain and also to increase the MPO’s share in the market than to invest in edible oil refining sectors of Bangladesh by Malaysian investors. That will not only contribute to increasing MPO’s share in Bangladesh, but will also assist in the entry into the Indian market using South Asian Free Trade Agreement (SAFTA) guidelines. Under the agreement, SAARC member countries can export commodities to any of the member countries at 50% reduced tariff than that of the prevailing tariff on the commodity in question.

Meanwhile, Govt. of Bangladesh has declared lucrative facilities for Foreign Direct Investment (FDI). Any foreign investors could avail the declared facilities through investment in govt. economic zones. Some of the declared facilities are as follows:

- Providing required developed land in govt. economic zones with utilizes.

- 5 to 10 years of Tax Holiday and reduced tax depending on area

- 50% of income derived from export is exempted from tax

- Tax exemption on royalties, technical knowhow and technical assistance fees and facilities for their repatriation.

- Tax exemption on interest paid on foreign loan.

- Exemption of customs duties on import of capital machineries

- Exemption of import duties on raw material used for producing export goods.

- 100% ownership is allowed and ensures legal protection to foreign investment in Bangladesh against nationalization and expropriation under Foreign Private Investment (Promotion & Protection) Act. 1980

- Full repatriation of capital invested from foreign sources will be allowed. Similarly, profits and dividend accruing to foreign investment may be transferred in full. If foreign investors reinvest their dividends and or retained earnings, those will be treated as new investment.

- Facilities for repatriation of invested capital, profits and dividends

- Foreign Investors are allowed to have access to local banks for working capital requirements.

- One stop service offered by Bangladesh Investment Development Authority (BIDA) towards land acquisition, utilities services, trade license, import permits etc.

Given the above scenario, the promise of investment is a positive opportunity for anyone interested in MPO market share in the short and long term.

Prepared by Fakhrul Alam

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.