Overview of the Nigerian Palm Oil Situation

Nigeria is a palm oil-producing country, producing a total of 1.22 million MT in 2019 (Oil World, 2020). It is the fifth-largest palm oil-producing country behind Indonesia, Malaysia, Thailand, and Colombia. With a population of more than 200 million, its total edible oil consumption stood at 3.22 million MT, with per capita consumption of 16kg of oils and fats in 2019. The palm oil downstream sector in Nigeria is diverse, with refineries catering to the production of diverse palm oil fractions. However, the upstream sector, to a large extent, are underdeveloped. According to the Plantation Owners Forum of Nigeria (POFON), 80% of palm oil planted areas are either wild trees or managed by smallholders and medium-sized plantations with an estimated oil yield of fewer than 0.5 tonnes per hectare. 20% of the planted areas are managed by commercial estates with an estimated oil yield of 1 to 2.3 tonnes per hectare. This gap in production and demand had led to Nigeria being a net importer of palm oil to satisfy local demand.

Total oil and fats import for the year 2019 stood at 1.37 million MT, with palm oil accounted for 97% of the total edible oils imported in the country. Total palm oil imports were on a downward trend since 2017. This trend is attributed to the increasing local production of palm oil since 2015 as well as cross border trade ban between Nigeria’s neighbors, namely Ghana, Togo, and Benin.

MPO Export Performance January-September 2020

| Product | Jan-Sep 2020 (MT) | Jan-Sep 2019 (MT) | Change (MT) | Change (%) | Jan-Dec 2019 (MT) |

|---|---|---|---|---|---|

| Crude PO | 196,363 | 130,808 | 65,555 | 50.12 | 228,497 |

| Refined PO | 30,981 | 39,236 | (8,255) | (21.04) | 58,467 |

| Total | 227,343 | 170,044 | 57,300 | 33.70 | 286,964 |

Table 1: Nigeria MPO Imports January-September 2020

Source: MPOB

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | |

|---|---|---|---|---|---|---|---|---|---|

| 2020 | 10,933 | 13,417 | 54,278 | 16,994 | 18,008 | 24,826 | 23,061 | 60,586 | 5,241 |

| 2019 | 41,281 | 8,532 | 52,872 | 9,795 | 18,318 | 14,365 | 12,609 | 6,914 | 5,357 |

Table 2: Nigeria MPO Import Trend January-September 2020 (MT)

Source: MPOB

From January to September 2020, MPO exports to Nigeria recorded a 33.7% increase in comparison to the same period in the previous year. Crude palm oil saw an increase in exports by 50% while refined palm oil saw a drop of 21%. CPO export duty exemption announced by the Malaysian Government had resulted in the increase of CPO imports into Nigeria, which explains the surge of imports recorded with August 2020 MPO arrivals.

Source: Oil World

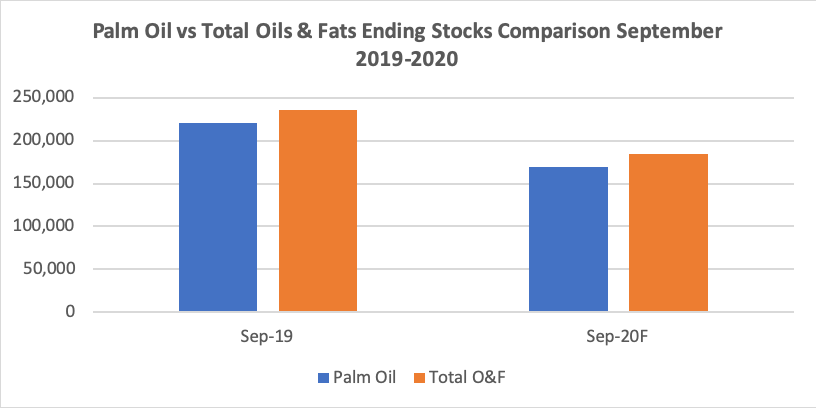

Palm oil stocks were on a downward trend from a high of 220,000 MT in September 2019, to a low of 100,000 MT in March 2020. Since then, palm oil stocks have been building up, with Oil World estimating the September 2020 figure standing at 169,000 MT. COVID-19 impact on the HORECA sector demand for palm oil had led to the build-up of stocks in the period of March-September 2020. However, when compared to the previous year, a drop of 23% was recorded, in part due to lockdowns affecting and reducing the local production of palm oil.

Current Market Situation

The #EndSARS protest against police brutality had put the State of Lagos on high alert, with peaceful protest turned violent were reported at Lekki Toll gate, one of the main commercial roads in Lagos. Logistic operations were disrupted since the start of the protest on the 8th of October, with the Governor of Lagos imposing a 24-hour curfew for the whole state of Lagos which has been lifted as of 1st November 2020. Due to this reason, oils and fats stock figures may continue to increase for November 2020, which may lead to a drop in demand for imported oils until the end of 2020.

Also, Nigeria is experiencing a surge in food prices, coupled with poor purchasing power. The increase in food prices is attributed to food crop farmers being unable to produce enough for domestic consumption, as well as rising local petrol price which led to increase in cost of living expenses. Local stakeholders had also raised the issue of an impending food shortage to the Government.

That being said, MPO imports into Nigeria is mainly being driven by CPO export duty exemption announced by the Malaysian Government, which will continue to benefit Malaysian CPO export to Nigeria until the end of 2020. However, it is expected that local stocks of edible oils would see an increasing trend, which may lead to a drop in monthly imports at least until the end of 2020. In lieu of this, the surge in food demand may also create an avenue for deeper penetration of MPO in the food sector, especially in FMCG products, which can be capitalized further to increase MPO imports into Nigeria.

Prepared by Fazari Radzi

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.