Background

Saudi Arabia has experienced a major transformation since King Salman bin Abdulaziz Alsaud ascended the throne in 2015. Together with his Crown Prince, the popular Prince Mohammed bin Salman, he has transformed the Kingdom’s economic and social sectors. Ever since, Saudi Arabia has been receiving an increased number of visitors – both pilgrims and tourists. The number is expected to reach 100 million per year in 2030.

Saudi Arabia has taken all the necessary steps to prepare itself to meet this new development, including building new hotels, business centers and food outlets in its major cities. Saudi Arabia are also gradually preparing themselves to be self-sustainable in the food security sector. Through their investment arm company ‘PIF’, they have invested heavily in the agriculture and livestock sectors. The demand for animal feed has increased steadily in the Kingdom and, it has opened a window of opportunity for Malaysian palm kernel cake suppliers to penetrate the market.

Saudi Arabia Animal Feed Industry

Saudi Arabia is one of the leading markets for animal feed products. The animal feed market of Saudi Arabia is showing steady growth when compared to other countries in the Middle East region. The quality food products of Saudi Arabia, alongside the country’s increased meat and processed food consumption, is one of the major factors contributing to the market growth of its animal feed market. The presence of key players and companies in the global food industry has also led to the market growth of Saudi Arabia’s food market. Saudi Arabia’s animal feed market was valued at USD2,410.097 million in 2020 and is anticipated to grow at a CAGR of 5.31%, to reach USD3,462.135 million by 2027.

The Saudi Food and Drug Authority (SFDA) stated that approximately 28,316 tonnes of meat was produced in Saudi Arabia in 2020 for domestic consumption and needs and the demand for processed meat and meat products will grow in the coming years due the increase of the Saudi Arabian HORECA and Tourism sectors. In tandem with the demand, Saudi Arabian domestic farming and poultry has expanded which create a strong demand in the animal feed market.

Palm Kernel Cake Export

Table 1: PKC Import in Saudi Arabia (1,000 MT)

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022E | |

|---|---|---|---|---|---|---|

| Malaysia | 129 | 142 | 123 | 231 | 169 | 116 |

| Indonesia | 155 | 237 | 237 | 199 | 211 | 204 |

| Total | 284 | 379 | 360 | 430 | 380 | 320 |

Source: Oil World & MPOB

Malaysia and Indonesia are the main exporters of palm kernel cake to Saudi Arabia for its animal feed industry, with the Kingdom having imported more than 280,000 MT of palm kernel cake annually for the past 5 years. Major companies such as Arasco Feed Mill prefer to use palm kernel cake due to its competitive price and its continuous supply. Despite stiff competition from soybean meal that is produced locally, palm kernel cake has managed to gain a substantial market share in the animal feed sector.

As seen in Table 1 above, Indonesian import holds a slight advantage over that of Malaysia’s. Even though Malaysian companies have a good relationship with most of the local importers, the competitive price offered by their Indonesian counterparts is the main factor that their neighbour have gained a bigger market share.

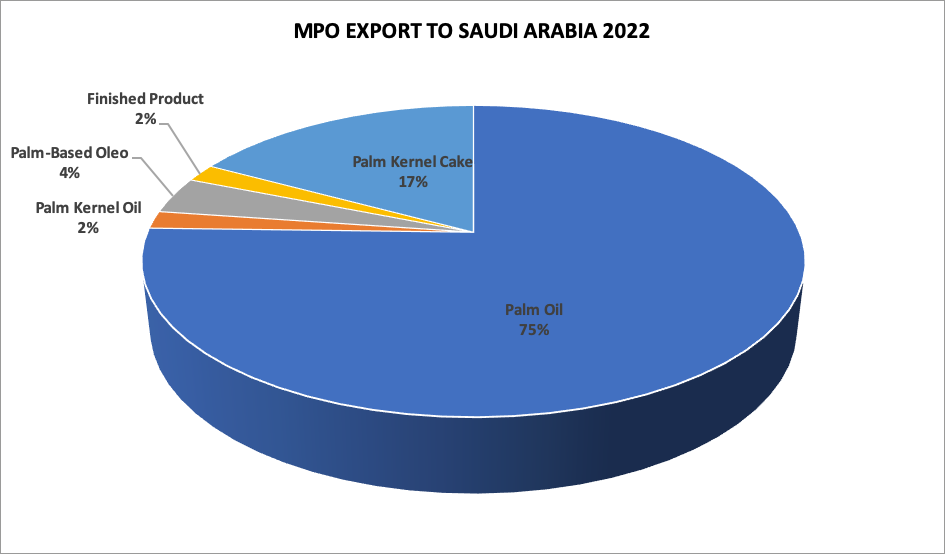

Regardless of the competition from Indonesia, palm kernel cake is the second most imported palm product by Saudi Arabia from Malaysia. It makes up 17% of the total export of palm oil products to Saudi Arabia.

Conclusion

Saudi Arabia has been intensifying its investment in its agricultural and livestock industry in order to ensure that their food security agenda meets the set target. It was reported by the Minister of Industry and Mineral Resources that the Kingdom’s food industry is set for a USD$20 billion boost by 2035 as it opens up to new investments. The decision is also in line with the country’s aim to double agricultural exports from USD$3.7 billion in 2022 to $10.9 billion in 2035, as per the objectives of the National Industry Strategy, which aims to promote food security and economic diversification measures outlined in the Vision 2030 blueprint.

Saudi Arabia’s animal feed sector is one of the sectors that will benefit from the new investment. The Kingdom needs a bigger supply of animal feed to ensure it can achieve the goal of its food supplies becoming self-sustainable. Furthermore, the increasing health consciousness of its people is leading to the need for quality food and food products in the Saudi Arabian market. The quality of food and food products ensured by the Saudi government is pushing the market for good and quality food in Saudi Arabia and in turn, the quality meat products processed in the country have led to the need for quality domestic farming and poultry, as well as the subsequent rapid increase in the demand for animal feed in order to attain good and quality meat production. The investments made by the Saudi government in domestic cattle farming and poultry, as well as the welcoming of major companies into the animal feed market are boosting the growth of the animal feed market in Saudi Arabia.

Source:

- Statista

- MPOB

- Oil World

- Arab News

- Saudi Gazette

- Knowledge Sourcing Intelligent

- Market Research.com

Prepared by: Muhammad Kharibi

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.