Kenya, often referred to as the economic, commercial, and logistics hub of East Africa, has experienced consistent growth and transformation over the years. According to World Bank data, its Gross Domestic Product (GDP) in 2022 was approximately 113.42 billion US dollars, making it the third-largest economy in Sub-Saharan Africa. Kenya is also a prominent member of the Common Market for Eastern and Southern Africa (COMESA) and the East African Community (EAC).

The country’s diverse economy has strong agriculture, manufacturing, and services sectors. Its strategic geographic location, access to key international shipping routes, and well-developed port infrastructure bolsters its position as an important regional trade player.

Rapid population growth has also been a feature of Kenya, with current estimates suggesting a population well over 54 million in 2022, growing at an annual rate of 2%. The rising middle class in Kenya, with more disposable income, is driving changes in consumption patterns, leading to increased demand for diverse food products, including those utilising palm oil as an ingredient.

Edible Oil Trend Consumption in Kenya

Kenya stands out as one of the few countries where palm oil is the primary edible oil for both commercial and household use. It constitutes over 90% of the nation’s edible oil consumption. In 2022, palm oil accounted for 97% of this consumption. The demand for palm oil is rising, driven by Kenya’s growing population. However, local production is unable to meet this increasing demand, positioning palm oil as a crucial, competitively priced vegetable oil in the Kenyan market.

| 2018 | 2019 | 2020 | 2021 | 2022 | |

|---|---|---|---|---|---|

| Palm oil | 700.7 | 744.7 | 759.9 | 777.6 | 723.1 |

| Palm kernel oil | 24.7 | 13.6 | 13.4 | 15.2 | 8.8 |

| Sunflower oil | 8.5 | 8.8 | 7.2 | 8.4 | 8.8 |

| Soybean oil | 3 | 6.8 | 6.5 | 5.4 | 1.0 |

| Rapeseed oil | 4.1 | 5 | 3.3 | 2.3 | 2.6 |

| Corn oil | 5.6 | 4 | 3.4 | 2.7 | 1.4 |

| Tallow & Grease | 2.3 | 2.1 | 1.4 | 1.3 | 0.9 |

| Cotton oil | 0.8 | 0.7 | 0.8 | 0.8 | 0.8 |

| Butter, as fat | 0.4 | 0.4 | 0.4 | 0.5 | 0.5 |

| Coconut oil | 0.2 | 0.2 | 0.3 | 0.4 | 0.5 |

| Castor oil | 0.2 | 0.2 | 0.3 | 0.3 | 0.3 |

| Total | 750.5 | 786.6 | 796.8 | 814.7 | 748.5 |

| % of palm oil | 93% | 95% | 95% | 95% | 97% |

Source: Oil World

Kenya – Malaysia Palm Oil Trade

As the world’s second-largest palm oil producer, Malaysia has played an important role in meeting Kenya’s growing demand. The expansion of palm oil trade to East Africa has not only been a boon for Malaysian exporters but also for the Kenyan market, which relies on the commodity for various uses in the food industry and beyond.

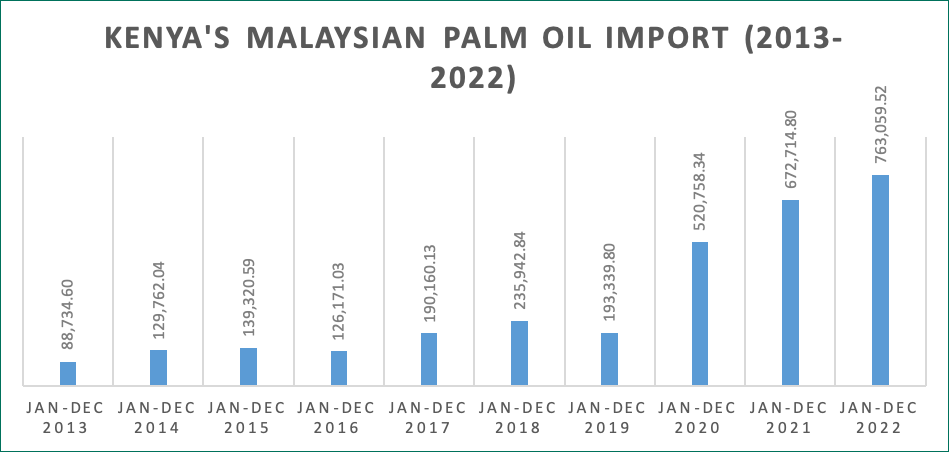

The palm oil trade between Kenya and Malaysia has seen significant growth since 2013. Over the past decade, Kenya’s import of Malaysian palm oil has expanded dramatically, reflecting the country’s escalating demand as its economy grows. In 2013, Kenya imported approximately 88,000 metric tonnes of palm oil from Malaysia, a figure that has seen a notable increase year on year. By 2022, imports surged to over 763,000 metric tonnes, underscoring Kenya’s position as a key destination for Malaysian palm oil.

Malaysia is also dominating its position as the most preferential palm oil supplier to Kenya in recent years. 97% of the total palm oil imported to Kenya comes from Malaysia.

| 2018 | 2019 | 2020 | 2021 | 2022 | |

|---|---|---|---|---|---|

| Total Palm oil import | 764 | 915.3 | 943.4 | 839 | 789.3 |

| MPO | 235.90 | 193.30 | 520.80 | 672.70 | 763.10 |

| MPO share | 31% | 21% | 55% | 80% | 97% |

Source: Oil World & MPOB

The trend of increasing imports of Malaysian sustainable palm oil into Kenya has continued into 2023. As of November 2023, Kenya has imported 784,850 metric tonnes (MT) of palm oil from Malaysia, surpassing the total amount imported in 2022 and showing a 13% increase compared to the previous year. The projections for the rest of 2023 are also optimistic, with anticipated imports exceeding 850,000 MT, marking an 11% increase from 2022.

Preferred Malaysian Palm Products in Kenya

Malaysian Crude Palm Oil (CPO) and Crude Palm Olein (CPL) dominate the import market share in Kenya’s palm industry. However, a significant rise in cooking oil imports has been witnessed, surging from 5,000 to 10,000 tonnes annually to an impressive 60,721 tonnes from Jan to Nov 2023. Compared to the same period in 2022, which is around 13,323 MT, the increase is around 365%. This is primarily due to the quota for the duty-free import of refined palm oil given by the government to control the increasing cooking oil prices domestically.

Palm kernel oil imports in Kenya also significantly increased from 5,313MT in 2022 to 13,876MT in 2023, a 161% increase. This surge aligns with the regional demand for beauty and personal care products. Known for its rich antioxidants and vitamin E content, palm kernel oil is increasingly used as a skin moisturiser and hair growth enhancer, contributing to its rising popularity in the personal care sector in Kenya.

Future Outlook for Palm Oil Trade Between Kenya and Malaysia

Looking ahead, despite the inevitable challenges price volatility, and competition from other oil sources. The palm oil market in Kenya is expected to continue its growth trajectory. Palm oil import from Malaysia is estimated to reach nearly 1 million MT in the year 2024

The escalation of palm oil imports into Kenya in the coming years is inevitable due to the expansion of Kenya’s food and non-food industry driven by strong economic growth. With an uptick in urbanisation, there has been a rise in demand for various food products, from cooking oils to snacks, baked goods, and non-food products such as oleochemicals for personal care and beauty products.

Furthermore, regional trade agreements among the East African Community and infrastructure developments, like the expansion of the Port of Mombasa and improved road networks, have improved the movement of goods. These logistics and trade facilitation enhancements allow Kenya to handle the increased inflow of palm oil and its distribution efficiently, serving its domestic market. Furthermore, Kenya’s role as a regional trade hub may amplify this growth, as it meets its domestic demand and supplies palm oil to neighbouring landlocked countries.

Hence, maintaining and focusing on Kenya as the regional hub is crucial for the Malaysian palm oil sector, as the country emerges as a significant market. This focus reflects Kenya’s growing economic stature and highlights Malaysia’s vital role as a leading palm oil supplier in Africa. By nurturing this relationship, Malaysia sets a precedent for future trade partnerships in other Sub-Saharan countries, demonstrating a successful model of international collaboration in the palm oil industry.

Prepared by: Theventharan Batumalai

MPOC Sub-Saharan Africa

*Disclaimer: This document has been prepared based on information from sources believed to be reliable, but we do not make any representations as to its accuracy. This document is for information only, and the opinion expressed may be subject to change without notice. We will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use, misuse, or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our discretion without giving any prior notice.