South America’s economy is losing momentum in the aftermath of the pandemic, even as businesses reopen and majority of the population is vaccinated. Lockdowns imposed at the start of the pandemic to curb the spread of the virus has resulted in lower consumption of goods and services, as household income and employment fell. High inflation, rising interest rates, supply-chain disruptions, political instability and fading corporate confidence are constraining commercial activities.

The pandemic has aggravated Brazil’s long-term problems of low growth, high debt, high poverty rate and inequality. Inflation has slowed the expansion of Brazil’s industrial production. Argentina’s economic administration has tightened exchange controls and resorted to price controls to combat inflation caused by monetary borrowing to avoid a currency crisis. Colombia, the fourth-largest economy within South America witnessed a 12-month inflation of 4.58% in October 2021, far from the monetary authority’s target and its public finances remain shaky as political instability looms ahead of the 2022 presidential election. In the third quarter of 2021, Mexico’s GDP dropped by 0.2% whereas Venezuela’s hyperinflationary economy remain unchanged. Poverty crisis in Peru has worsened during the lockdown while the newly elected president of Ecuador will face an economy that has contracted by 10% with a debt that amounts to 60% of the country’s GDP.

Palm Oil Market Overview

Graph 1: Total Palm Oil Consumption (2020)

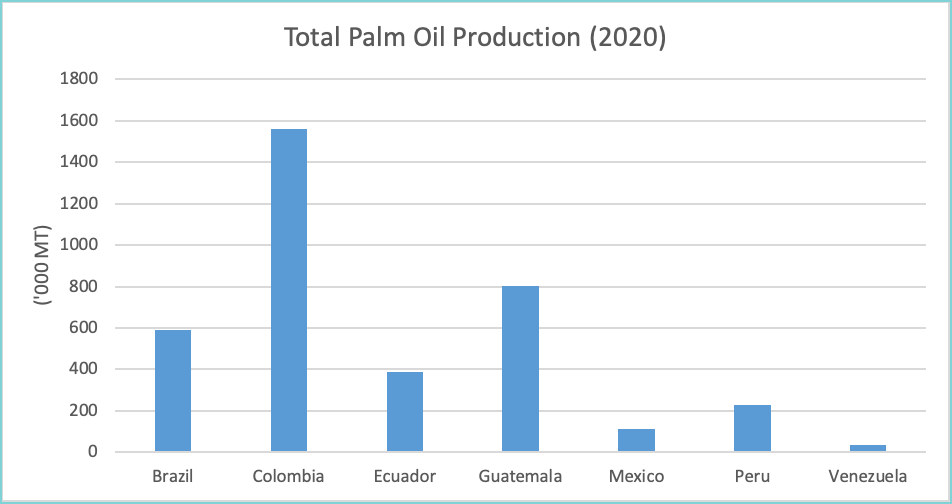

The top three palm oil consumers from the South America are Colombia, Brazil and Mexico (refer to Graph 1). The largest palm oil consumption was recorded by Colombia at 1,140,000 MT in 2020 where only 190,000 MT from that amount is imported. Domestic palm oil production by Colombia is around 1,700,000 MT, making it the largest producer from the South American region. Second largest palm oil consumer is Brazil, with around 930,000 MT of palm oil consumption where 34.4% of it is imported. Domestic palm oil production by Brazil is around 620,000 MT. Mexico is the third largest palm oil consumer around 593,000 MT while palm oil import is around 473,000 MT. Its domestic palm oil production is small at around 118,000 MT. Other major palm oil producer from the South American region include Guatemala, Ecuador and Peru (refer to Graph 2). On the other hand, Argentina is the world’s largest soybean oil exporter while Brazil is one of the top soybean producer.

Graph 2: Total Palm Oil Production (2020)

2022 Palm Oil Market Prospect

Colombia’s consumption and export of palm oil in 2022 is forecast to be on the rising trend due to the rising domestic demand from non-food sectors and foreign demand for its certified sustainable palm oil. Being the largest producer of palm and palm kernel oils in South America, the country has continuously increased its production of certified palm oil under the Sustainable Palm Oil Program’s National Strategy. The National Federation of Oil Palm Growers, Fedepalma has adopted voluntary sustainability standards such as RSPO, ISCC, and Rainforest Alliance Colombia making the country an important certified palm oil supplier to the European market. Colombia is also producing palm oil for non-food sector mainly biodiesel and biomass which resulted from the palm oil extraction process.

Agropalma, Brasil BioFuels (BBF, formerly Biopalma), and Palmaplan are among Brazil’s major palm oil producers. The biggest part of Brazilian palm oil production comes from the territory of Pará, however, the national production cannot supply the internal demand, which means that the country imports palm oil instead of opening up new growing areas. Brazil primarily uses palm oil as an edible oil and for the production of lubricants and greases. PKO is used for cosmetics, confectionary fats, and detergents. The Brazilian government is also increasingly promoting palm oil-based biodiesel where the use of palm oil as feedstock for biodiesel has continuously increased. Expansion of Brazilian biofuel production has the potential to support the country towards a low- carbon economy and rising domestic consumption will further boost its import demand in 2022.

Mexico imported around 80% of the palm oil it consumes. 2022 palm oil import by Mexico is expected to rise with Mexican consumers becoming more health-conscious in their food selections. This shift in consumer preferences are projected to open up new opportunities for edible oil producers where palm oil is crucial in the food processing sector. Mexico is also PepsiCo’s largest sourcing market for palm oil in South America. Other large buyers such as Bimbo Group and Mead Johnson also preferred to source for certified sustainable palm oil from Mexico due to its strategic location. As a result, Mexico has to rely on palm oil import to fulfil these demands.

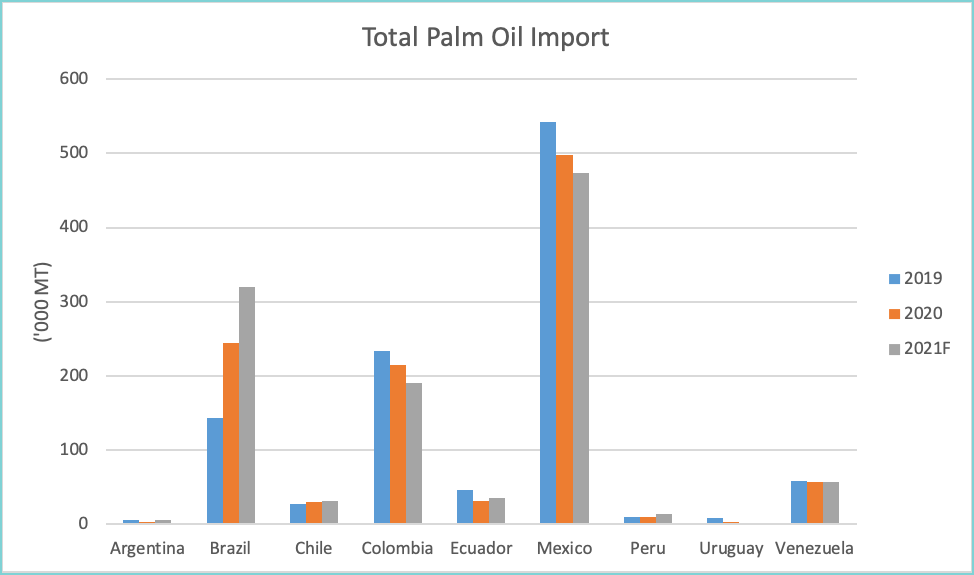

Graph 3 : Total Palm Oil Import

Overall, palm oil import demand from the South American countries for the year 2022 is expected to be supported by domestic consumption and for re-export to neighbouring nations. The proximity of the area to the European and North American continents makes it an ideal location for palm oil export centre. Furthermore, because their domestic palm oil production is insufficient to meet export demand, the region need to outsource from Malaysia or Indonesia. Despite the global economic downturns, supply chain disruptions and Covid-19 prolonged outbreak, the outlook for the South American palm oil import is projected to remain strong in both the food and non-food sectors.

Prepared by Nur Adibah Mohd Razali

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.