SPECIAL MARKET FOCUS ON GLOBAL PALM OIL MARKT OPPORTUNITIES AND ISSUES

MPOC POINTERS, 29 JANUARY – 4 FEBRUARY 2018

2018 GLOBAL PALM OIL MARKET TRENDS AND OPPORTUNITIES

GLOBAL PALM OIL MARKET FOCUS

A special section was created to focus on opportunities for Malaysian palm oil at the first palm oil internet seminar (POINTERS) for this year, organised by the Malaysian Palm Oil Council (MPOC) from Jan 29 to Feb 4, 2018. This resulted from a presentation by four renowned international speakers, covering topics on the Pakistan’s edible oil market, India’s surfactant market and Ukraine’s and Russia’s margarine and industrial fats markets. Another speaker shared on the roles of Indonesian smallholders in the palm oil supply chain.

Mr. Rasheed Janmohammed of the Pakistan Edible Oil Refiners Association (PEORA) presented on ‘Emerging Trend in Pakistan Edible Oil Market for Palm Oil’; Dr. Rajeev Churi from the Oil Technologists Association of India presented on ‘Opportunities for Malaysian Palm Oil in India’s Surfactant Market’; Ms. Olga Mozgova of Ukraine Agro Consult shared on ‘Ukraine and Russia Margarine and Industrial Fats Market’; and Mr. Dono Boestami from Indonesian Palm Oil Fund Management Agency (BPDPKS) presented on ‘Smallholders in Indonesian Palm Oil Supply Chain and BPDKS Role’.

Views and Analyses from Expert Speakers

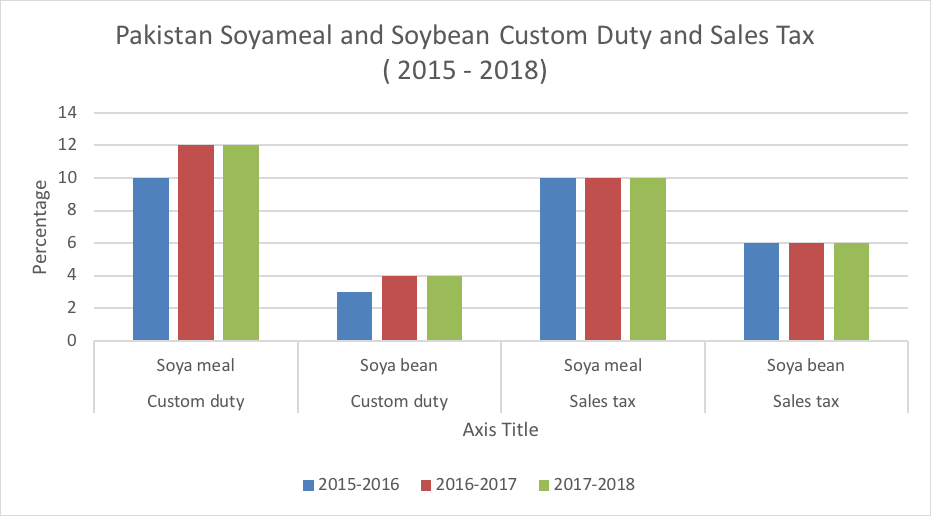

Mr. Rasheed Janmohammed shared his views with the participants on changes in Pakistan’s oilseeds and edible oil market trend. He foresees that RBD palm oil imports by Pakistan will drop in the future as the country switches its consumption from the thick vegetable oil widely used there, vanaspati, to the healthier RBD palm olein. Another discernible trend is high soybean import by the country, which rose by 972,967 MT or 104% to 1,097,902 MT in 2017. This is a continuation of Pakistan’s 2016 soybean import trend, where it registered a rise by 355,211 MT or 61.2% to 934,935 MT. The increases in soybean imports in the previous two years were driven by the revision of tariff in favour of soybean imports over soymeal since 2015. (Refer to the Chart below).

Source : MPOC Pakistan office

Mr. Rasheed also reported that edible oils have been incredibly overbought in Pakistan in 2017. In 2017, Pakistan’s edible oil imports registered a substantial increase of 480,513 MT or 18.6% to 3,050,643 MT, compared with a drop of 129,248 MT or 4.8% to 2,570,130 MT in 2016. The overbuying has created pressure on local market prices and logistical challenges. The stock level registered almost 290,000 MT at the end of 2017. This volume is considered to be high as the country’s optimum level of stock is between 200,000 – 225,000 MT. The situation has put selling pressure on the local ex-tank market. In this situation, the local market is selling palm oil at a discount of USD 15 – 20, as compared to imports.

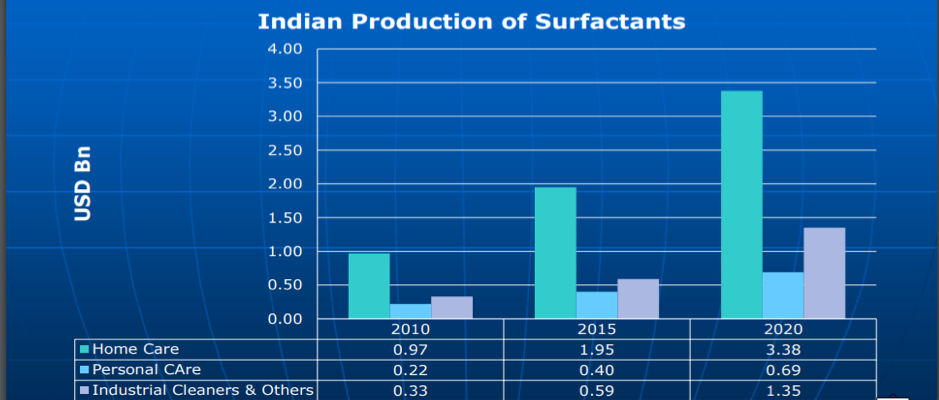

Dr. Rajeev Churi reported that India’s surfactant industry offers opportunities for more palm oil uptake, not only in conventional applications but also in new applications. He claimed that in conventional applications, there are great potentials for greater consumption of oleochemical products in the rural areas. He projects that alternative lower quality personal care products usage will be reduced in the rural areas in favour of oleochemical-based personal care products as the country develops.

Dr. Rajeev also projected that rural market oleochemical product demand will increase from USD29.4 billion currently to USD220 billion in 2025. Other factors which support the growth of oleochemical usage in India is that it is safer to use, compared to mineral feedstock, and is also environmental friendly, biodegradable, causes less pollution and is sustainable. On the new applications, Dr. Rajeev reported that there is a growing usage of amino acid-based surfactant produced from palm oil and alpha sulphonated ethyl esters produced from palm oil in India.

Source : www.pointers.org.my

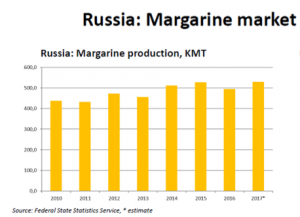

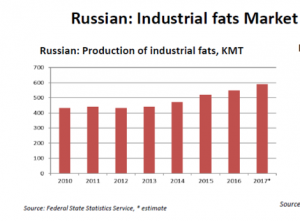

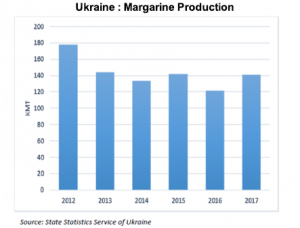

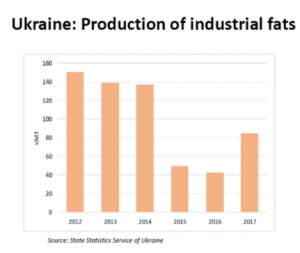

The industrial fats markets of Ukraine and Russia have similar production trends, where fats and margarines are produced by large specialised plants. The productions peak during the fall and winter seasons, with strong competition and volatility in demand. According to Ms Olga Mozgova, the increase in production in 2017 was contributed by the process of stabilisation and recovery of margarine product markets in both countries. Russian margarine production in the recent years followed no steady trend.

Ms Olga reported that margarine production is dominated by solid margarine at 77.9%, rising by 15.1% as compared to 2010, cheese production rising by 26.7% as compared to 2016 while industrial production of short shelf-life bakery items decreased from 6.8 million MT in 2010 to 6. 1 million MT in 2017. In Ukraine, margarine production dynamics gained an upward trend in 2017, when it rose by 17% as compared to 2016. Some of the positive growth drivers in the markets are demand from foreign markets, local food industry growth and healthy lifestyle awareness. However, difficult situations related to the Crimea annexation and anti-terrorist operations in the eastern region of Ukraine, where some of the production facilities are located, have had a negative impact on industrial fats production.

Ms Olga informed that Russia and Ukraine have introduced new food regulations, which lowered the permissible limits of trans fat in edible oil products. This development favours palm oil import as palm oil is trans fat free. Beginning January 2018, a new standard for the content of fatty acid trans-isomers oils and fats products came into effect in Russia. Under this regulation, the content of trans fat in solid margarines, soft and liquid margarines, milk fats substitutes and special purpose fats should not exceed 2% of the total fats content in food products. Meanwhile, in Ukraine, restrictions on the content of fatty acid trans-isomers are applicable only for soft and sandwich margarines, spreads and fatty mixtures, margarines (not more than 8%) and fats for the dairy industry (not more than 15%).

In Indonesia, smallholder farmers play a very important role, where they make up for almost half of Indonesia’s palm oil plantations. Mr. Dono Boestami informed that their productivity level is low, at 2-3 tonnes per hectare (ha) compared to 5-6 tonnes per ha for the big plantations. The low productivity of the smallholder farmers will increase the risk of illegal land clearings. Replanting programmes can also help to increase their productivity and support the farmers in increasing productivity by reducing the need for land clearings. A total of 2.4 million ha of replanting can increase productivity by up to 7.2 million tonnes of CPO per year. At the same time, this will save one million hectares of forests from land clearings and encroachment for agriculture.

Conclusion

The above four speakers have shared their insights according to their areas of expertise. Dr. Rajeev’s presentation showed that the consumption of oleochemicals in India is increasing. He reported that there is a growing usage of amino acid-based surfactants and alpha sulphonated ethyl esters produced from palm oil in India. He projected that there are great potentials for more oleochemical products consumption in the rural areas as alternative lower quality personal care products usage will be reduced as the region develops. Mr Rasheed informed that RBD palm olein intake in Pakistan will be higher as the country is switching its consumption from vanaspati to RBD palm olein in blended form. He updated that the preference on pure palm olein is very low among Pakistanis.

Ms Olga is of the view that the future for the margarine and industrial fats markets in Ukraine and Russia will be positive, supported by the growing local and foreign food industry demands, as well as healthy lifestyle awareness. New food regulations that limit the trans fat content in edible oil products is another factor which will enhance the prospect of high uptake of palm oil.

Mr Dono Boestami reported that there is a replanting scheme for smallholders in Indonesia, which is operated by the Indonesian Palm Oil Fund Management Agency (BPDPKS). He claimed that there are opportunities for Indonesia to raise the country’s palm oil production substantially by improving the productivity of the smallholders. This is because the current smallholders’ productivity is very low at 2-3 tonnes compared to 5-6 tonnes for the large plantations. Besides, the smallholder sector is large. It accounts for approximately half of Indonesia’s total oil palm planted area.

(Details of this presentation and discussion can be viewed in the POINTERS website at www.pointers.org.my. For further query you may contact the author Nur Adibah Mohd Razali at nuradibah@mpoc.org.my)