The Maghreb region comprises Algeria, Morocco, Mauritania, Libya and Tunisia. This region is home to more than 100 million people. Among the countries in this region, Algeria, Morocco and Tunisia are the most developed nations in the region as well as on the African continent. The mainstay of the region’s economy is the service and industry sectors, contributing more than 85% to the GDP of the region. On the other hand, the agriculture sector contributes about 13% to the overall GDP in most countries, with the exception of Libya with very little input from agriculture sector.

Agricultural activities in this region are rather limited due to the scarcity of water and arable land, as well as climate change. Most of Maghreb countries produce staple goods such as grain, raw edible oil and raw sugar, but the production level is insufficient to meet the demand. Thus, the Maghreb region has to depend on imports for their supply of basic staple foods, particularly grain. While the region is dependent on import for its domestic food requirements, grain imports is also crucial to its livestock industry. The region is currently experiencing a record high inflation level brought on by the COVID-19 pandemic in 2020 and 2021, in which the aftermath felt by the region is more severe due to its vulnerable food systems.

While the region is working on improving their agricultural output, Morocco, Algeria and Tunisia have emerged as among the top ten olive producers in the world. In fact, Morocco is the largest table olive producer, while Tunisia is the third largest olive oil producer in the world. These three markets produced around half a million MT of olive oil over the last five years. Other vegetable oils produced include soybean oil and sunflower oil, but the production of these two oils is minimal.

The production of olive, soybean and sunflower oils is inadequate in addressing the short supply of vegetable oil domestically, thus import is crucial to meet the demand. With most efforts focused on improving wheat and grain productions, the need will continue to be fulfilled through import.

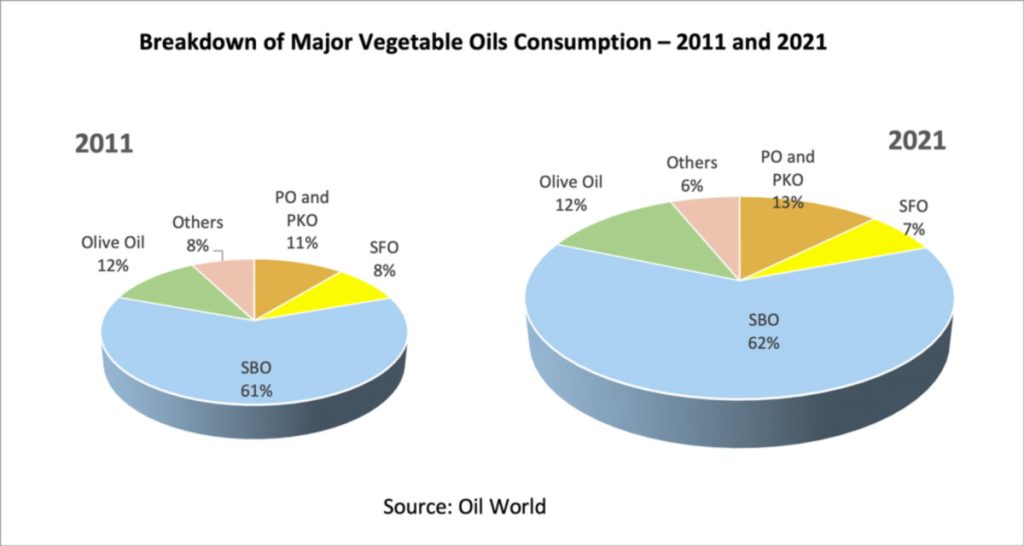

Annually, the Maghreb region consumes around 2.4 million MT of various oils and fats for its domestic use. The oils and fats consumption basket in 2021 comprised soybean oil (62%), palm oil and palm kernel oil (13%), olive oil (12%), sunflower oil (7%), and the remaining 6% were made up of other type of oils and fats. Generally, the consumption pattern of major oils has not changed in terms of percentage of consumption in the last ten years.

The share of palm oil and palm kernel oil consumption grew marginally from 11% in 2011 to 13% in 2021. In terms of volume, it has expanded to 300,700 MT from 176,400 MT. Most of the palm oil consumption was recorded in the Algerian market, where palm oil and palm kernel oil consumption went up from 62,600 MT in 2011 to 176,600MT in 2021. Being the largest market in the Maghreb region, most of the palm oil went to Algeria, followed by Tunisia and Morocco.

In terms of palm oil consumption by each market, Algeria accounts for 15% of the total palm oil consumed in this region, followed by 5% in Morocco, and 19% in Tunisia. Palm oil is mostly used in the food sector, mainly as raw material for margarine and vegetable ghee, as well as in the bakery sector. The liquid oil sector is largely dominated by soybean oil, primarily due to the consumers’ preference for soft oil and the tax advantage enjoyed by soybean oil in the Algerian market.

The Malaysian palm oil is also competing in the region against other suppliers, especially Indonesia. Out of the total palm oil amount imported by Maghreb, the Malaysian palm oil only accounts for 17% of the total palm oil import into the region. However, over the last five years, products such as shortening, vegetable fat and cocoa butter substitute from (CBS) Malaysia have made their way into the region.

Export of Malaysian Palm Oil Finished Products into Maghreb Region

| 2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|

| Shortening | 3,900 | 6,759 | 7,984 | 5,891 | 7,363 |

| Vegetable Fat | 1,183 | 7,430 | 11,790 | 5,159 | 12,283 |

| CBS | 398 | 485 | 158 | 2,526 | |

| 5,083 | 14,587 | 20,259 | 11,208 | 22,172 |

Source: MPOB

While the Maghreb region is a concentrated market for soybean oil, perhaps an area that Malaysian suppliers should focus on is niche segments such as shortening, vegetable fats, as well as specialty fats. However, these areas would require technical assistance where special formulations on palm oil application is required. MPOC, through its Technical Marketing Programme, is addressing the need of Maghreb food manufacturers by promoting the use of palm-based fats in complementing the needs of their food industry.

Prepared by Fatimah Zaharah

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.