The COVID-19 pandemic is disrupting value chains worldwide. Used Cooking Oil, an essential ingredient in Europe’s biofuels-mix, is no exception. This article looks at the current situation.

Background: Why is Used Cooking Oil Important to Europe?

To understand Europe, you need to master the world of acronyms. Even something so mundane as used cooking oil (UCO) becomes a complex phenomenon in the hands of European Union (EU) lawmakers when it is turned into used cooking oil methyl ester (UCOME).

The European Commission, as it were the executive branch of the European institutions, in November 2016, published what is called the “Clean Energy for all Europeans” initiative. In its wake, the EU institutions revised the existing Renewable Energy Directive (RED). Finally, in December 2018, what is now known as RED II (that is the Roman numeral “2”, indicating the second revision of the Directive) entered into force.

A directive is a legal act of the European Union requiring the member states to amend their national laws in such a way that they achieve the results mandated in any given directive.

In the case of RED II, one declared goal is to “decarbonize” the European transport sector. That involves replacing fossil fuels with renewable energy. “Renewable energy” in this context means biofuels, that is, liquid fuel for transport produced from biomass.

The mandate in the RED is that the transport sector reaches 14% of renewable energy by 2030. How exactly the Directive wants to achieve this is difficult to explain. There is an immensely complex web of different classes of biofuels with varying energy content linked to a complicated system of how to count energy content, emissions, and contributions towards greenhouse gas (GHG) reductions.

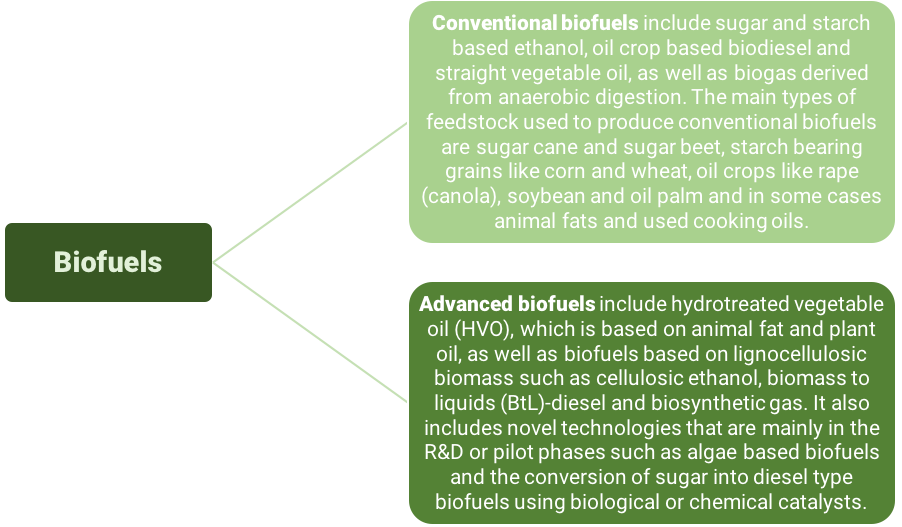

In a nutshell, the provisions of the RED II amount to a move away from so-called conventional biofuels towards advanced biofuels.

Source: APEC (Asia-Pacific Economic Cooperation)

Annex IX of the RED lists the feedstock that can be used to produce advanced biofuels. Part A of the Annex contains feedstock like algae, animal manure, or palm oil mill affluent and empty palm fruit bunches.

Part B lists as possible feedstock used cooking oil and animal fats with high risk for human health or suitable for soil enhancement and the chemical industry.

European Transport and Biodiesel

In Europe, as opposed to other regions, diesel fuel is by far the most important fuel. It accounts for more than half of all fuels consumed in passenger cars (compared to around 2.5% in the United States, for example) and for 98% in trucks, according to ACEA, the European Automobile Manufacturers Association.

Given these characteristics of the European transport sector, the decarbonization targets contained in the RED II put biodiesel front and center.

Biodiesel – or, in chemical terms, fatty acid methyl ester (FAME) – is a fuel that is equivalent to mineral diesel fuel in terms of its use. That means it can be blended with fossil diesel at practically any proportion without the need to alter the vehicle engines.

The industry obtains biodiesel through a chemical process from vegetable or animal fats and oils used as raw materials.

And that is where the cooking oil comes in. In the past few years, UCO as a feedstock for biodiesel has grown significantly in importance.

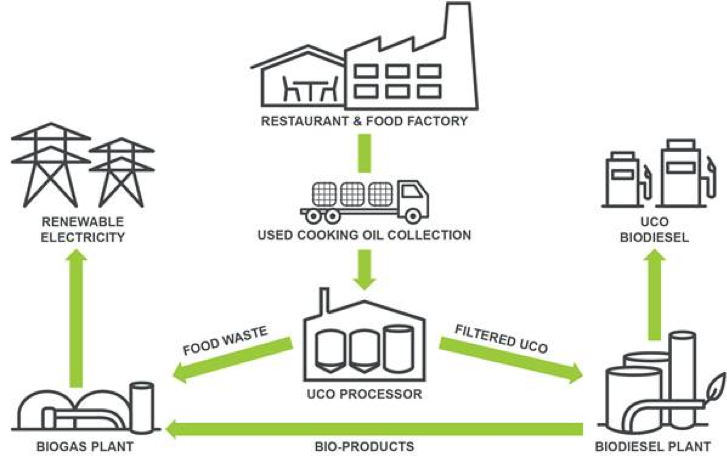

The production process roughly is as follows: Oil used for cooking or frying, mostly in restaurants (including fast-food chains) or in industrial food production, is collected by specialized companies.

Once the UCO has been obtained, it is cleaned and treated in the UCO processor plant and turned into a form of FAME known as used cooking oil methyl ester (UCOME).

Used Cooking Oil as Renewable Energy

Source: European Waste-to-Advanced Biofuels Association (ewaba)

The requirements of the RED II have made UCOME a central component in the European biodiesel mix. The amount produced in 2019 accounted for almost 20% of European biodiesel production. UCOME imports into EU reached 3.18 M MT in 2019, down by 5% compared to 2018.

The reason for UCOME’s success is its much higher greenhouse gas savings potential compared to available alternatives. Another important factor is that UCO-based fuels count double when calculating their contribution towards the 14% renewable energy target.

According to greenea, a leading European waste-based feedstock and biodiesel broker, UCO collected within the EU normally accounts for around 1.1 M MT or 40% of UCO total demand.

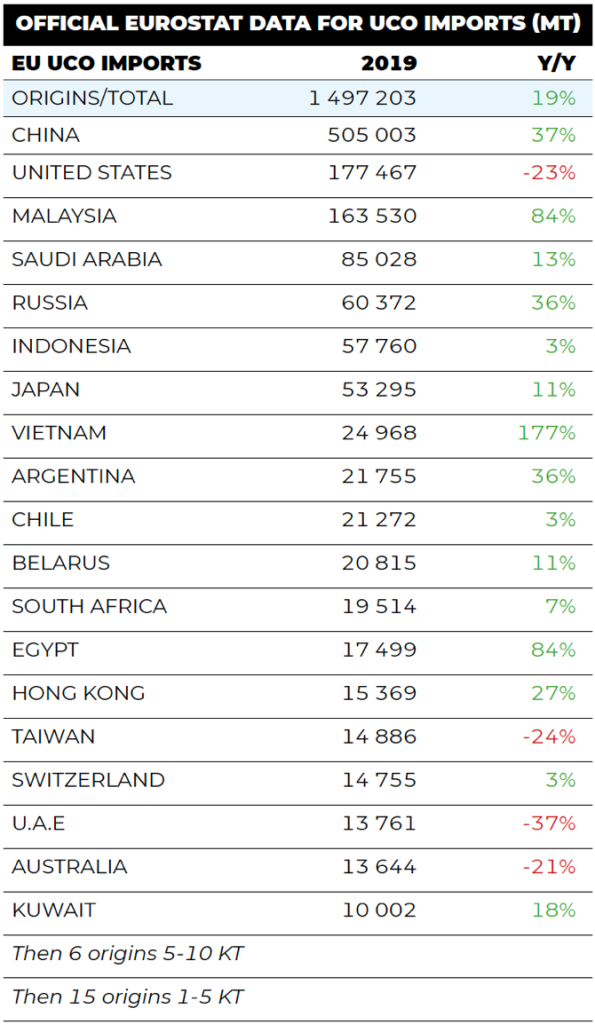

The rest must be bought in by markets abroad. (Pls refer to table 2).

Main importing countries were the Netherlands (serving as a distribution hub with its Port of Rotterdam), Spain (with one of the highest production capacities in the EU) and the UK (a big biodiesel consumer). Major producing companies include Italy’s Eni and France’s Total.

UCO and the Coronavirus

COVID-19 is threatening the European UCOME market in two ways: supply and demand-side shocks.

UCO supply chains are still rather unsophisticated. Mostly small local companies collect the feedstock from bars, restaurants, and fast-food chains. The problem is that in many countries across the world, these have been closed for weeks following the Coronavirus outbreak.

The result is self-evident: with next to no food being cooked and fried outside the privacy of people’s homes, there simply is no UCO to collect. Biodiesel producers expect the decline in European waste oil collection during March 2020 to be around 70 – 90 %.

Thus, UCOME producers turn to previously collected cooking oil in storage. That is, however, only an extremely limited alternative as UCO quickly turns rancid.

What is worse, the UCO production lost in the lockdowns during to COVID-19 crisis will not be recovered later. People who now cannot go out for a burger will not eat two once the restrictions are lifted.

Equally grim is the outlook on the demand side. In the first quarter of 2020, Western Europe reports a drop in diesel consumption between 60-70 percent.

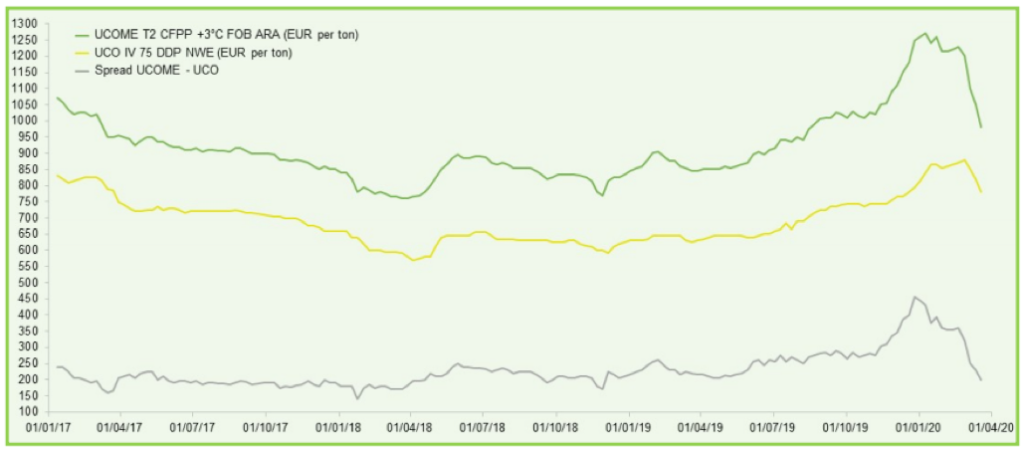

Both supply and demand effects push prices lower. For instance, Fastmarkets energy census reports that prices for FAME biodiesel (quoted as ARA, meaning the Amsterdam-Rotterdam-Antwerp trading hub), have traded as low as $548 per metric ton (mt) in the first half of March 2020, compared with around $950/mt at the start of 2020.

UCOME started the year at close to $1,500/mt, with premiums of $865/mt over gasoil, falling to around $1,006/mt.

With the COVID-19 outbreak, UCO and UCOME prices drop sharply

In short: the margins which UCOME producers became used to in 2019 will decrease and will probably return to the level of previous years.

In its April 2020 Market Watch greenea therefore concludes:

“To survive in this environment, producers will have to reduce production in April and May, or even temporarily shut down their plants. This seems inevitable for some leaders. Why would they produce when there is no new demand to cover?”

But even if demand would come back from the dead, other supply chain problems loom. Some European seaports report difficulties discharging UCO deliveries because of a reduced workforce due to stay-at-home-orders and furlough agreements.

Overall, this scenario amounts to an extremely complicated situation for the UCOME industry. It is difficult to tell what the long-term effects will be on a market battling with unprecedented pressure from flagging supply and demand simultaneously.

When will things for UCO traders and UCOME producers go back to normal? Perhaps never. COVID-19 has revealed Europe’s dependency on international supply chains. Its car industry is paralyzed when parts from China do not arrive. Governments strive to make sure that medication and protective gear are produced domestically in the future.

In this environment of a resurgence of economic nationalism, it is possible that imports of all kinds, including UCO, will come into focus. Already European UCOME producers are actively thinking about switching to the production of first-generation biofuels made from vegetable oil, like, for example, rapeseed methyl ester (RME).

Conclusion

EU-legislation in the form of the Renewable Energy Directive has caused UCOME biodiesel to take a market share of around 20 percent.

Now, COVID-19 is stopping the market in its tracks. The collection of raw material has practically ceased. And as Chinese restaurants begin to open for business

again, the demand for transport fuels in Europe has dropped at rates never seen before.

As the pandemic progresses, it becomes clearer that restrictions like travel bans, the prohibition of mass sports and music events, and the – perhaps repeated – closure of restaurants will be the new normal for probably at least a couple of years.

Prepared by MPOC Brussels

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.

Appendix

Table 1: EU FAME Imports 2019 (MT) – UCOME accounted for 21% of total

Total EU FAME Imports 2019: 3,178,632 MT; down 5% compared to 2018

Table 2: European Union Top Ten UCO Importing Countries 2019 (MT)

Total EU UCO Imports 2019: 1,497,203 MT; up 19% compared to 2018