| Regions | Jan-Jul 2020 (MT) | Jan-Jul 2019 (MT) | Diff. (MT) | Diff (%) | Jan-Dec 2019 (MT) |

|---|---|---|---|---|---|

| West Africa | 653,728 | 563,028 | 90,699 | 16.11 | 893,317 |

| East Africa | 498,779 | 309,583 | 189,196 | 61.11 | 680,525 |

| Southern Africa | 128,374 | 148,414 | (20,040) | (13.50) | 216,926 |

| Central Africa | 121,361 | 131,024 | (9,663) | (7.37) | 223,315 |

| Grand Total | 1,402,242 | 1,152,049 | 250,192 | 21.72 | 2,014,083 |

Table 1: Malaysian Palm Oil Exports to Sub-Saharan Africa (Jan-Jul 2020) Source: MPOB

From January to July 2020, the Sub-Saharan Africa imported a total of 1.4 million MT of Malaysian palm oil, an increase of 21.72% compared to the same period on the previous year. Western and Eastern Africa saw an increase in imports while Central and Southern Africa saw a drop in imports. Competitive price offered by the Malaysian palm oil as well as booming demand had contributed to the increase in imports by the West and East African countries. In contrast, economic downturn caused by COVID-19 had impacted the Malaysian palm oil imports by Central and Southern African countries. In view of this, the each region will certainly have its challenges and opportunities that will impact the imports of Malaysian palm oil for the second half of 2020.

Western Africa

West Africa is the largest market for Malaysian palm oil industry within Sub-Saharan Africa. Out of the total 1.4 million MT of Malaysian palm oil that was exported to this region up until July of this year, 653,727 MT were routed to western region.

| Countries | Jan-Jul 2020 (MT) | Jan-Jul 2019 (MT) | Diff. (MT) | Diff. (%) | Jan-Dec 2019 (MT) |

|---|---|---|---|---|---|

| Nigeria | 161,517 | 157,772 | 3,745 | 2.32 | 286,964 |

| Ghana | 132,328 | 80,089 | 52,239 | 39.48 | 152,721 |

| Togo | 115,982 | 64,520 | 51,462 | 44.37 | 85,340 |

| Benin | 62,627 | 87,266 | (24,639) | (39.34) | 119,875 |

| Mauritania | 60,688 | 52,379 | 8,309 | 13.69 | 82,865 |

| Others | 120,586 | 121,002 | (416) | (0.34) | 165,552 |

| Total | 653,728 | 563,028 | 90,700 | 13.87 | 893,317 |

Table 2: Malaysian Palm Oil Exports to Western Africa (Jan-July 2020)

Source: MPOB

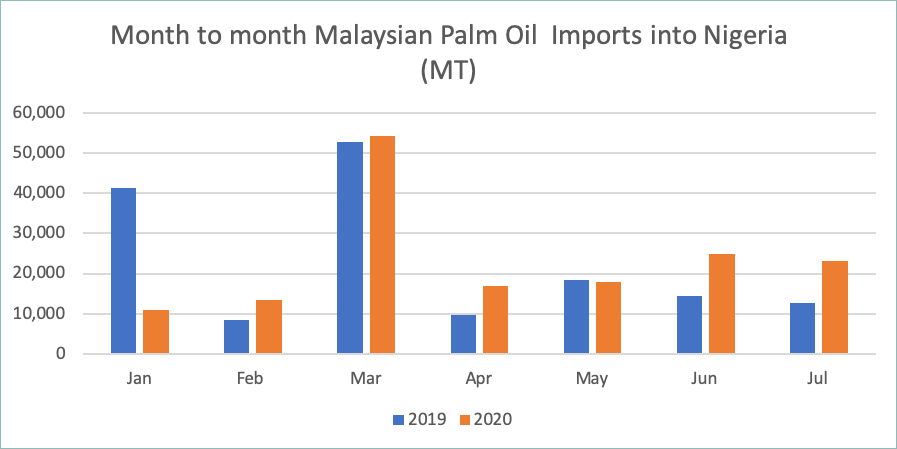

Western region has seen a 16.1% increase this year, compared to last year, with Ghana and Togo recording the most significant increase. Palm oil is locally produced in Africa, mainly in western region. Countries like Nigeria, Ghana, Cote D’Ivoire, Sierra Leone and Togo produces palm oil for local consumption. Yet, palm oil is increasingly imported into the region since local production is not sufficient to meet local oils and fats demand. While growing population and increased consumption are the main underlying reasons for this, the recent increase we see in these countries are partly due to the current situation with the pandemic. Many countries went into lockdown in affected areas with revised or shorter working hours that affected the palm plantations and therefore the production of palm oil was affected. To continue supplying palm oil for local consumption, palm oil producing companies and other importers increased the importation of palm oil in recent months. Another main reason for the increase is that in recent months, the price for imported palm oil has been lower than the locally produced oil. This has increased the interest to buy imported oils. Due to the low production, and higher production cost of local palm oil, increased MPO imports is seen up to July of this year. This has been reflected well in countries like Ghana and Togo. It is notable that Togo is a re-exporting destination where palm oil gets re-exported into other neighboring countries and the increase in Malaysian palm oil imports into Togo reflects the demand for palm oil from the neighboring countries as well. Nigeria on the hand, recorded a slight 3% increase in MPO imports in July compared to last year. As the largest economy in Sub-Saharan Africa, Nigeria relies heavily on exportation of crude oil which is the largest contributor to their foreign exchange earnings and government revenues. With crude oil plummeting early this year that led to weaker economy, Nigeria had a slow start in MPO imports. With a spike at the end of first quarter due to preparation for Ramadhan, Malaysian palm oil imports have now slowly picked up to be in the positive trend compared to last year’s import numbers.

Source: MPOB

Some of the most popular types of palm products that are imported into the region include crude palm olein, RBD palm olein and crude palm oil. The increase in MPO numbers in this region is due to the increased imports of crude palm olein. Ghana imported about two-fold of crude palm olein (101,598 MT) from January – July 2020 compared to the same period last year.

2020 West Africa Outlook

While the pandemic is slowly recovering and the lockdown restrictions are being eased, the impact of slow production of palm oil in Africa will be felt for the next few months, and possibly until the end of the year. Moreover, while an attractive price for imported palm oil continues, the export number for Malaysian palm oil will add up another 300,000 MT – 350,000 MT to reach over 1 million MT by end of the year for west African region.

Eastern Africa (Excl. Northeast Africa)

| Countries | Jan-July 2020 (MT) | Jan-July 2019 (MT) | Diff. (MT) | Diff. (%) | Jan-Dec 2019 (MT) |

|---|---|---|---|---|---|

| Kenya | 164,962 | 61,154 | 103,808 | 169.75 | 193,340 |

| Mozambique | 145,222 | 115,574 | 29,648 | 25.65 | 193,918 |

| Tanzania | 102,052 | 103,223 | (1,171) | (1.13) | 217,450 |

| Madagascar | 82,291 | 24,757 | 57,534 | 232.39 | 67,580 |

| Others | 4,251 | 4,875 | (624) | (12.80) | 8,237 |

| Total | 498,779 | 309,583 | 189,195 | 61.11 | 680,525 |

Table 3: Malaysian Palm Oil Exports to Eastern Africa (Jan-July 2020)

Source: MPOB

From January to July 2020, Malaysian palm oil exports to Eastern Africa recorded a 61.11% increase in comparison to the same period in the previous year. Kenya recorded the largest increase of MPO imports, increasing by 103,808 MT or 169.75% while Tanzania recorded a slight drop of 1.13%. The increase in imports in the region is attributed to the waiver of CPO export duty by the Malaysian government, in which Kenya and Mozambique had taken advantage of the waiver to increase their imports. Madagascar had also increased their imports by 232.39% compared to January-July of the previous year. This increase in imports is due to the booming domestic food processing industry in the country. COVID-19 lockdowns in the region had largely affected the HORECA sector in the first half of 2020 which in turn impacted the palm oil consumption in the sector.

2020 East Africa Outlook

That being said, CPO export duty waiver as well as COVID-19 will continue to become the drivers for Malaysian palm oil imports in the East African region. CPO export duty waiver will continue to benefit CPO importing countries such as Kenya, Mozambique, and Madagascar until the end of the year. As COVID-19 lockdowns in major cities are gradually lifted, consumption in the HORECA sector may see an increasing trend. Thus, keeping in view of the two market drivers, it is expected that that East African Malaysian palm oil imports for the year 2020 would be in the range of 700,000 MT to 750,000 MT.

Southern and Central Africa

| COUNTRY | Jan-Jul 2020 (MT) | Jan-Jul 2019 (MT) | Diff. (Vol) | Diff. (%) | Jan-Dec 2019 |

|---|---|---|---|---|---|

| South Africa | 127,754 | 147,574 | (19,820) | (13.43) | 216,406 |

| Angola | 82,421 | 88,148 | (5,727) | (6.50) | 147,554 |

| Congo Dem. Rep. | 24,340 | 31,760 | (7,421) | (23.36) | 43,657 |

| Cameroon | 13,154 | 4,738 | 8,417 | 177.65 | 17,731 |

| Others | 2,065 | 7,218 | (5,152) | (71.39) | 11,078 |

| Total | 249,735 | 279,438 | (29,703) | (10.63) | 440,241 |

Table 4: Malaysian Palm Oil Exports to Central & Southern Africa (Jan-July 2020)

Source: MPOB

The Southern and Central Africa regions consists of 16 countries which include the continent’s most advanced economy, South Africa, oil-exporter Angola, the biggest country in Sub-Saharan Africa, the Democratic Republic of the Congo, landlocked countries such as Botswana, Zimbabwe, Eswatini, Lesotho and few others smaller countries. These two regions imported slightly less than a quarter of a million (249,735 MT) of Malaysian palm oil in the Jan-Jul 2020 period. This volume of MPO imports represents 10.63% less compared to the same period last year.

There are four major importers of MPO in the region namely South Africa, Angola and the Democratic Republic of the Congo, and Cameroon. The total import of the other 12 countries in these regions amounted to less than 1 percent of the total exports by the region or 2,065 MT to be exact.

Southern Africa

South Africa, the biggest importer of MPO from the region took in 13.43% less so far this year. South Africa’s palm oil main consumption comes from fast-moving consumer goods (FMCG) and also from the HORECA sector. South Africa was already in recession before the pandemic struck, with recurring power cuts, plunging crude oil price and weak Rand.

The region economy that is badly affected by the Covid-19 pandemic is a very important factor that drives palm oil import, hence palm oil consumption. Based on the Africa Development Bank (AfDB) group, the economy of the Southern Africa region was set to grow by 2.1% in 2020 before the corona virus struck. Following the outbreak of COVID-19, growth in Southern Africa would drop to -6.6% before recovering to 2.2% in 2021. Based on the latest data, South Africa is the worst-hit country in Africa with 592,000 cases of Covid-19 and more than 12,200 deaths (sacoronavirus.co.za). As the largest economy in the region, the impact of Covid-19 in South Africa is projected to affect the rest of Southern Africa’s economies.

Angola is another important Malaysian palm oil importer in the Southern Africa region. The Angolan economy, the third-largest in sub-Saharan Africa region, is heavily influenced by the petroleum industry, which accounts for more than 50% of its GDP and is the main source of revenue for the country. Before the fall in crude oil prices in the last few years, the country posted one of the highest economic growth rates in the world, driven by its oil wealth. Until July this year, Angola palm oil import from Malaysia has reduced by 6.5% to 82.421 MT.

Central Africa

Central Africa region consists of eight countries namely: Cameroon, Central African Republic, Chad, Congo Republic (Brazzaville) , Democratic Republic of Congo (DRC), Equatorial Guinea, Gabon, São Tomé & Principe.

Democratic Republic of Congo (DRC) and Cameroon are the two importers of MPO from the Central Africa region. However, total import by these two countries is quite small in comparison to South Africa’s and Angola’s imports. In contrast to last year, DRC import until July this year dropped by 23.4% while Cameroon MPO imports increased to 13,154 MT from 4,738 MT. DRC is rich of natural resources such as oils, diamonds, gold, and other metal which it exports in large quantities. DRC economy has contracted this year due to weaker activity in the key mining industry, slumping commodities prices, and lower demand from DRC’s main trading partner, China.

2020 Central and Southern Africa Outlook

Unlike other regions in the SSA which imported more CPO/CPL, major imports of MPO from Southern and Central Africa region are in the form of RBD palm olein (56.7%). The import of CPO/CPL from the region so far this year is only 10,309 MT. The suspension of CPO export duties by the Malaysian government is therefore is only having very minimal effect on the region MPO import.

Taking into account all the situations mentioned above, it is projected that the Southern and Central African region will import about 396,000 MT of MPO, or 10% less than the last year’s total of 440, 241 MT.

However, from next year forward, with the improving economy and the pandemic will be behind us, there is good potential for an increased in MPO imports by the region. Except South Africa with per capita consumption of 24.6 kg, other countries’ caput usage are quite low (<10.0 kg). Therefore, there is plenty of room for an increase in palm oil imports next year post COVID-19 and recovery in crude oil and commodities prices.

Prepared by: Karthigayen Selva Kumar , Iskahar Nordin , Fazari Radzi

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.