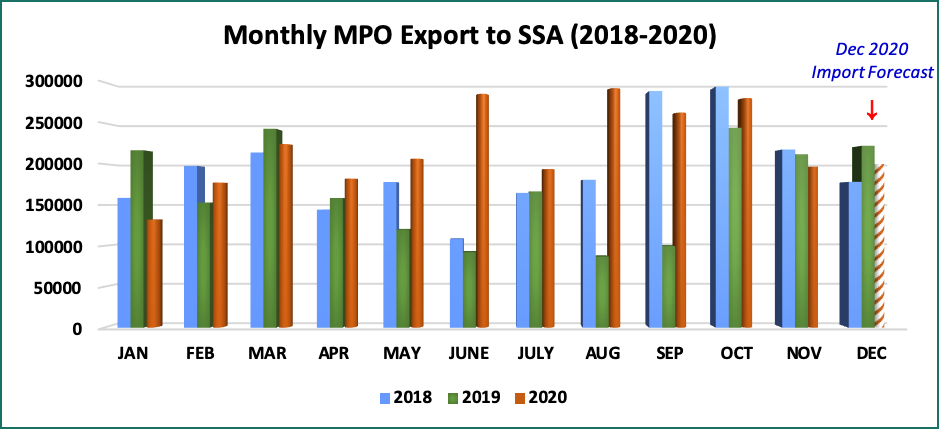

Based on the latest import data available until November 2020, the countries in the Sub-Saharan Africa region are poised to have the largest increase in MPO import volume this year. If the import trend continues towards the end of the year, the region will register around 2.62 – 2.66 million MT of MPO import volume. Compared to last year’s import volume of 2.01 million MT, this will represent a massive 30-35 % in MPO imports by the region. For the record, the largest MPO import volume ever recorded by the region was 2.43 million MT achieved in 2017.

Malaysian palm oil imports by the countries in the Sub-Saharan Africa region have increased significantly during Jan-Nov 2020 period compared to the same period last year by 36.3% from 1.79 million MT to 2.44 million MT. In terms of value, this represents an increase of 61.2% from RM 4.348 billion to RM 7.011 billion. This impressive import performance is contributed by the increase in the import volume of CPO/CPL from major buyers such as Kenya, Mozambique, Nigeria, Ghana, Togo, and Madagascar. Kenya is the top importer of MPO from the region with a 119.8% increase from just 187,479 MT last year to 412,152 MT so far this year.

Crude palm oil/olein and RBD palm olein are 2 majors MPO palm oil products exported into the region with each product made up of about 85.0 % and 33.5% respectively. The import volume of CPO/CPL jumped substantially by more than 127 %from 691,603 MT in Jan-Nov 2019 to 1,279,667 MT in Jan-Nov 2020 period. The surge in demand for CPO/CPL from Malaysia this year can be attributed to several factors. Firstly, for most countries, the import duty imposed on processed palm oil is much higher than that of CPO/CPL. Therefore, these countries opt to import CPO/CPL instead of processed palm oil especially for countries that have large refining capacity. Despite the rise in CPO export prices in the last few months, Malaysian CPO/CPL is still attractive to African buyers since the Malaysian government gives 100% exemption on crude palm oil export duty.

Secondly, from the data that have been made available, Indonesia has not been able to export CPO to several African countries as Indonesia has to fulfil its domestic requirement and biodiesel mandate, and to cater demand from other CPO importing countries such as India and EU countries. All these factors led to a substantial rise in Malaysian CPO/CPL by Kenya, Nigeria, Mozambique, and Ghana.

Another major factor that drives palm oil usage in SSA is the level of customer demand provided by the growing population. This growth trend is projected to continue in the next few months, and at a higher rate in the post-pandemic period, where palm oil is used as a major food source for both household consumption for local dishes, as well as manufacturing and in the HORECA sectors.

Other countries in the region that have shown a considerable increase in MPO include Mozambique and Togo. Despite having a free trade agreement with Indonesia, Mozambique continues to import a substantial amount of MPO. Besides fulfilling its domestic requirement part of Mozambique palm oil import is also rerouted to neighbouring countries such as Malawi, Zimbabwe, and Zambia. Part of MPO import by Togo is also channelled to the neighbouring countries such as Nigeria, Niger, Burkina Faso, and Senegal.

Madagascar also shows great potential to be a good market for MPO import is Madagascar. Most Malaysian palm oil imports from Madagascar are in the form of CPO/CPL which has grown from 36,226 MT to 64,952 MT during the Jan-Nov 2020 period. The increase in MPO imports in Madagascar can also be attributed to growing domestic demand driven by changing tastes and the growth in the food processing industry.

Considering all the above-mentioned factors and trends, the growth of Sub-Saharan Africa as a major market destination for Malaysian palm oil is very remarkable for this year, and the course is likely to continue in the years to come.

Prepared by Iskahar Nordin

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.