Introduction

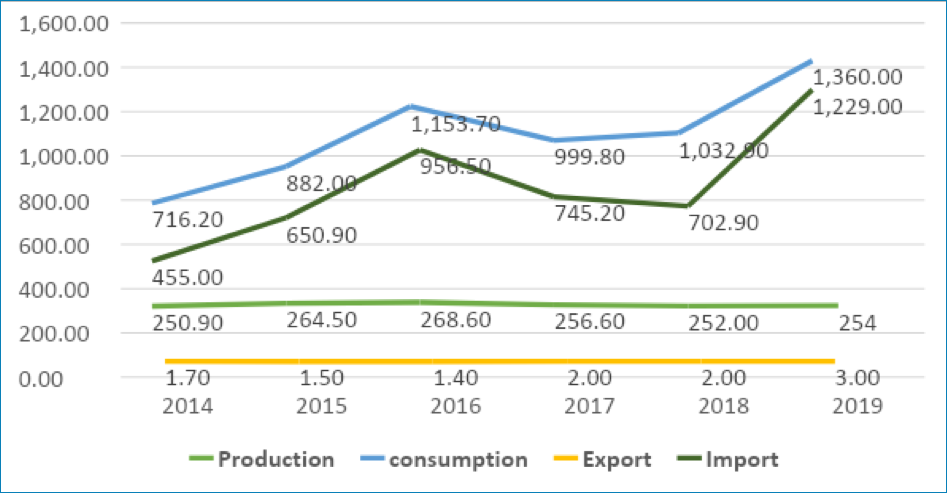

In 2019, sunflower oil import in China increased significantly by 74.8% to 1.23 million MT, overtaking soybean oil as the 3rd highest imported oil in the same year, which saw the consumption of sunflower oil surging to 1.36 million MT. Although this volume is insignificant compared to other 3 major vegetable oils, it is interesting to explore what factors have triggered such high import volume and what would be the market outlook of this vegetable oil in China.

Growing Global Output

The oil derived from sunflower seed is widely used around the world for cooking and frying, with most of the consumer packed manufacturers positioning it as a healthier option. Hence, the growing demand for sunflower oil has provided a major boost to the global sunflower oil market as more consumers are shifting their preferences to this cooking oil. Especially after going through the recent COVID-19 pandemic, people are expected to put more emphasis on health.

Several market reports forecasted that the sunflower oil Compound Annual Growth Rate (CAGR) will keep rising and is expected to reach 5% by the end of the year 2023. With the increase in output, the consumption of sunflower oil has also increased accordingly by 4.83 million MT or 31.8% from the year 2015 until the end of 2019.

Table 1: Global Supply and Demand for Sunflower Oil

| (‘000 MT) | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|

| Production | 15,304 | 16,517 | 18,961 | 18,899 | 20,513 |

| Exports | 7,516 | 8,975 | 10,584 | 10,154 | 12,068 |

| Imports | 7,458 | 8,854 | 10,618 | 10,079 | 11,880 |

| Consumption | 15,212 | 16,292 | 18,575 | 19,138 | 20,044 |

Source: Oil World

Both Russia and Ukraine, the two biggest producers of sunflower seed saw a drastic increase in sunflower seed planting and oil output in the past few years as farmers opt for this profitable crop over other oilseeds.

However, the increase in output resulted in lower prices of sunflower oil in local markets, driving producers to seek alternative markets abroad. Subsequently, the Asia became the prominent market for sunflower oils. Among the countries in the Asia, substantial demand came from developing countries such as China and India. These 2 populous countries are witnessing a rapid increase in their economies, resulting in increase in the disposable income of the people.

Supply and demand scenario in China

China is no doubt a net importing country for oils & fats, where less than 30% of oils & fats consumed is produced using local oilseeds or raw materials.

The local output of oilseeds has been stagnating over the years, while consumption continues to grow and subsequently resulting in increasing imports of oilseeds and oils annually. In recent years, the import of sunflower in China has increased gradually which is mainly due to the increased popularity of this category as well as the better margins prevailing in the market.

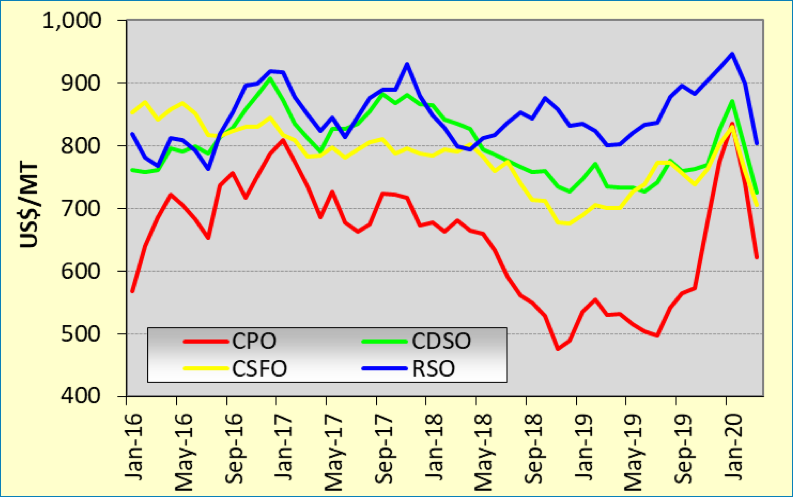

After steady growth of sunflower seed and oil output in Russia and Ukraine witnessed in the past 2 years, the surplus in supplies has lowered the price of sunflower oil and made it cheaper than soybean oil and rapeseed oil since Sep 2016 (Graph 1). This drew the interest of Chinese players to capitalize on the cost advantage and reap in the good margin as sunflower oil has been positioned as a premium cooking oil in China.

Graph 1: Price of Major Vegetable Oils

Table 2: Supply and Demand Scenario of Sunflower Oil in China

| (‘000 MT) | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|

| Production | 264.5 | 268.6 | 256.6 | 252.0 | 254.0 |

| Exports | 1.5 | 1.4 | 2.0 | 2.0 | 3.0 |

| Imports | 650.9 | 956.5 | 745.2 | 702.9 | 1,229.0 |

| Consumption | 882.0 | 1,153.7 | 999.8 | 1,032.9 | 1,360.0 |

Source: Oil World

Similar to soybean and rapeseed, the output of locally produced sunflower seeds in China is insufficient to meet the demand for its oil. What is different here is that China import soybean and rapeseed to supplement the crushing activities while the country only imports crude sunflower oil to feed the needs of this vegetable oil (Graph 2).

Graph 2: Supply and Demand Scenario of Sunflower Oil in China (‘000 MT)

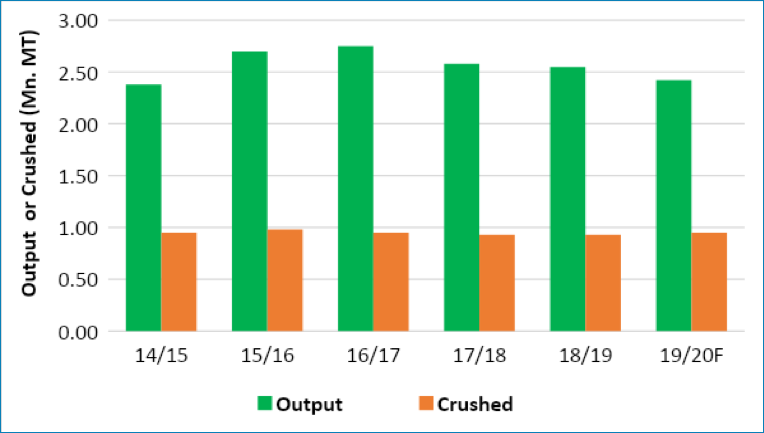

Interestingly, the sunflower seed production in China averages 2.5 million MT in the past several years. The output is primarily to satisfy for the use in food applications (mainly for snacks) instead of for edible oils.

The oil yield of local sunflower seeds is only 30-35% averagely, and only a small quantity of its output produces high-oil content sunflower seed (45-50% oil). Hence, the local crushing of sunflower seed is always below 1.0 million MT in the same period (Graph 3).

Graph 3: Sunflower seed Output and Crushed in China

Hence, with an attractive profit margin in cooking oil sector, higher disposable income, and growing attention on healthier foods among the Chinese, China’s consumption of sunflower oil increased significantly in recent years. From 0.72 million MT recorded in 2014, the sunflower oil consumed in China grew at a CAGR of 13.7% to 1.23 million in 5 years, the fastest among all major vegetable oils.

The outlook of sunflower oil demand in China and its implication to palm oil

There are currently more than 1,000 brands of sunflower oil in the Chinese market, but only a handful of these brands are commanding significant share in China. According to a market source, it is estimated that the top 10 major brands jointly command approximately 65% share of the sunflower oil market in China, and among them are none other than major brands such as Arawana (Wilmar), Fulingmen (COFCO), Mighty (Standard Foods, formerly owned by Quaker), Luhua (Luhua), Kuiwang (Jiangsu Golden Sun), Haishi (Shanghai Liangyou).

These brands have been capitalizing on the needs of the Chinese consumer for healthier options for cooking oils, and emphasizing features such as non-GMO, high-smoke point, high unsaturated fatty acid content. Some also trying to highlight that the high-oleic sunflower oil is as healthy as olive oil but at a cheaper cost and taste blander.

Although the volume of sunflower oil consumed in China is insignificant as compared to palm oil at the moment, the growing demand for sunflower oil in the cooking oil sector may serve as a hurdle for the entry of our palm based cooking oil, including the red palm oil into the country.

Considering that currently palm olein is mainly used in the food sector in China and has not made deeper inroads into the consumer cooking oil segment, Malaysian palm oil players could capitalize on the cost advantage of sunflower oil and also its lower cloud point, and first introduce the blended palm olein-sunflower oil into the Chinese market using palm olein CP6 or CP8. This would serve as the first step for the introduction of palm oil into cooking oil sector for broader segment.

Once red palm oil is being granted access into China, similar approach can be used and a blend of red palm oil and sunflower can be launched for the niche market which prefers premium and healthier cooking mediums. The is in view of the growing trend among Chinese consumer to purchase health foods especially after going through the recent covid-19 pandemic which has taken life of thousands in China.

Prepared By: Desmond Ng and Theventharan Batumalai

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.