Abstract

Malaysia, as the second biggest producer of palm oil in the world, aspires to increase its export of high-value-added products. For the year 2022, palm-based oleochemicals from Malaysia constituted 11% of total exports. This article aims to provide a deep dive into the potential of palm-based oleochemicals to add value in Sweden, particularly in the personal care and beauty industry. The surge in the end-use industries such as personal care and soaps has created a significant potential for Malaysian downstream players to export their value to Sweden. The key drivers for the growth of this segment, as well as the export performance of palm-based oleochemicals from Malaysia to Sweden from the year 2018 to 2022, are shared in-depth. As an additional information piece, the four biggest brands/manufacturers of personal care and beauty products from Sweden that use sustainable palm oil are also featured in the article, along with their respective sustainability pledges.

Introduction

Sweden is the third largest country in the European Union (EU) by area, with an approximate size as California. Despite the vast area, 67% of its land area is covered by woodland[1]. Sweden has a population of 10.38 million, with a very high urbanisation rate of 88%[2]. Despite its relatively small population, the country is one of the strongest economies in the world.

Figure 1: Sweden, flanked by its neighbours, Norway and Finland. The capital of Sweden is Stockholm. Sweden is rich in woodlands, and this contributes to its high urbanisation rate.

The Economic Outlook of Sweden

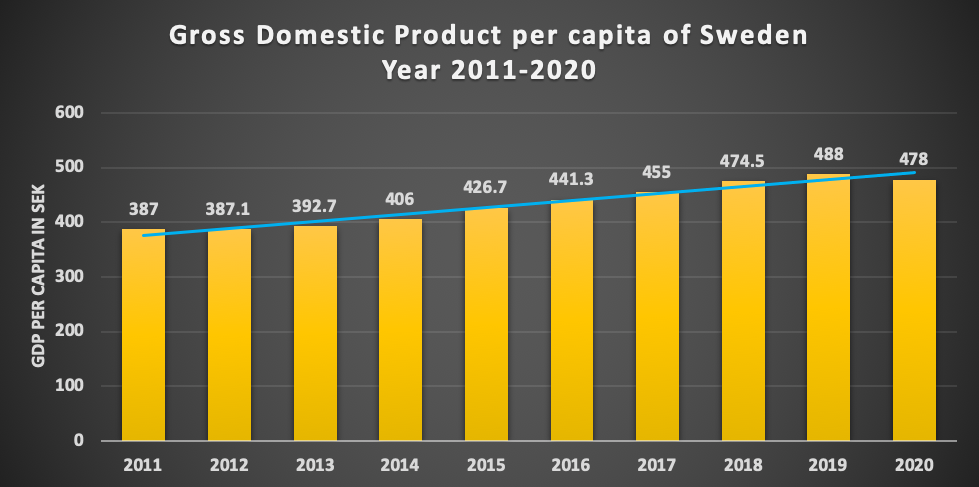

Figure 2: The Gross Domestic Product (GDP) per capita of Sweden in current prices from 2011 to 2020 (in thousand SEK). Source: Statistics Sweden[3]

Sweden has had a very strong growth of GDP per capita from 2011 to 2019, as illustrated in Figure 2. This growth trend was even more pronounced from the year 2014 when it broke the threshold of 400,000 SEK. The strong GDP per capita, despite its stable population growth, indicates that its productivity has been increasing steadily. The trend reversed in the year 2020, as evident in other nations too, due to the pandemic. Sweden also raised eyebrows with its then-controversial stand on herd immunity. Sweden insisted on not imposing a lockdown when most developed and developing nations in the world opted for the strictest measures in controlling the spread of Covid-19.

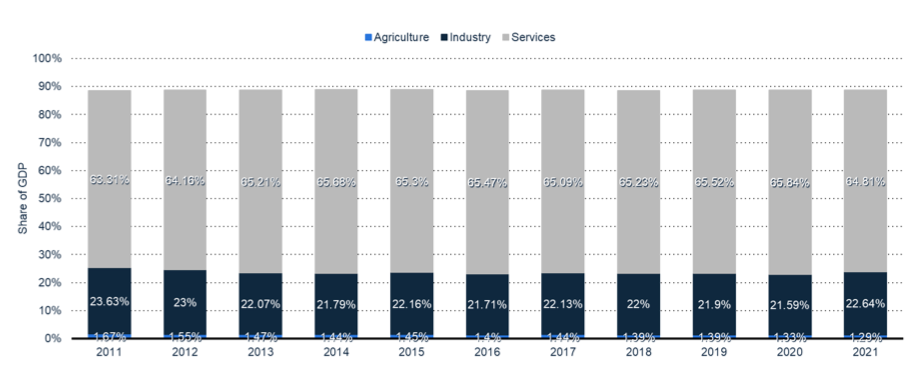

The GDP driver of Sweden is fuelled mostly by its services sector, at more than 63% from the year 2011 to 2021, as illustrated in Figure 3. This is followed by industries with a range of 21-23% as the driver of its GDP. Agriculture contributed to less than 2% of its GDP.

Figure 3: Distribution of Gross Domestic Product (GDP) across economic sectors from 2011 to 2021. Source: World Bank[4]

Personal Care, Beauty, and Household Care Products in Sweden

A report by Cosmetica Italia (2022) confirmed that the consumption value of cosmetics and personal care in Sweden reached as high as €2.23 billion in the year 2021. It has grown from €1.73 billion in the year 2013[5].

With such strong consumption of personal care and beauty products, it is no surprise that Sweden is the home of various multi-million dollar beauty and cosmetics brands. Among the successful personal care and beauty products from Sweden are Oriflame, KICKS, Rituals, and Orkla. Most of these brands too, use palm oil as ingredients and have pledged to source sustainable palm oil for use in their products.

Figures 4-7: Oriflame, Rituals, KICKS, and Orkla Care are among the most successful personal care and beauty product brands that use sustainable palm oil in their products. Malaysian palm-based oleochemicals have tremendous potential to meet the demand from this sector

Figure 8: Strong business establishments in personal care, beauty, and household care products in Sweden

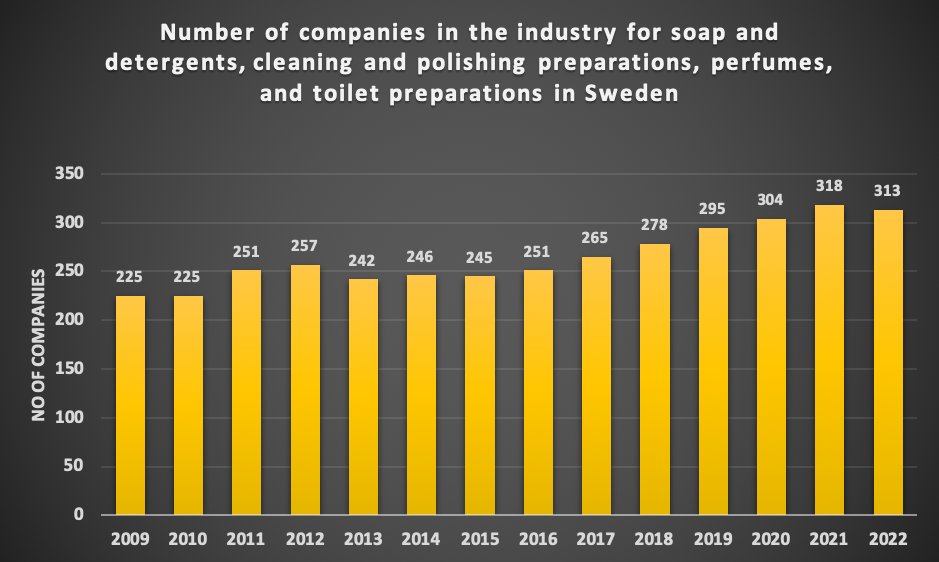

Sweden also has had more than 300 business establishments for soap and detergents, cleaning and polishing preparations, perfumes, and toilet preparations since the year 2020, as shown in Figure 8. Before that, Sweden ranged between 225 and 295 business establishments in this sector. The surge in the end-use industries such as personal care, food and beverages, and soaps have contributed to this trend in Sweden.

The growing number of these business establishments as well as the robust consumption of personal care and beauty care products indicate a promising outlook for palm-based oleochemicals from Malaysia.

Import of Oils and Fats and their Derivatives from Sweden

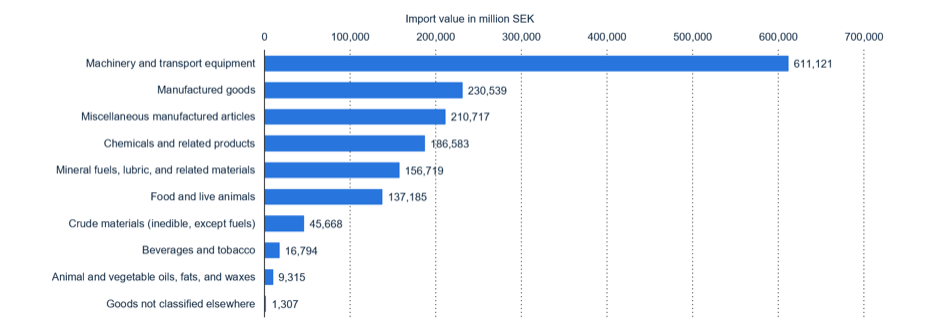

As illustrated in Figure 9, Sweden imported animal and vegetable oils, fats, and waxes worth 9.3 billion SEK in the year 2021, including palm oil from Malaysia. Sweden also imported chemicals and related products worth 186 billion SEK, including palm oil-based oleochemicals.

Palm-based oleochemicals from Malaysia have ample room for growth in Sweden. This growth is also expected for at least five years. In addition to the growing consumption of personal beauty products as described earlier, the growth is also expected from demographics that demand vegan beauty and household products.

Figure 9: Value of Imported Goods into Sweden in 2021, by commodity (in million SEK). Source: Statistics Sweden[6]

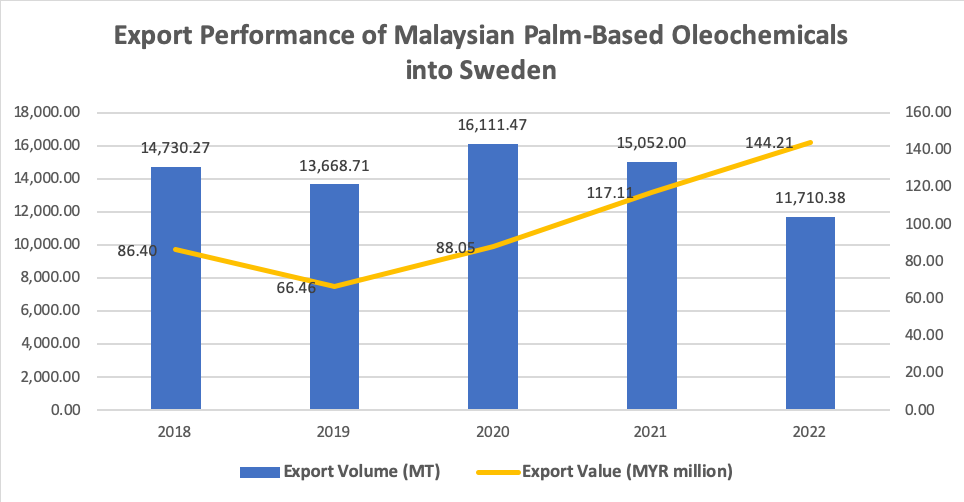

As shown in Figure 10, the demand for palm-based oleochemicals from Malaysia is substantial. The export performance of palm-based oleochemicals from Malaysia to Sweden for the past five years has been good, albeit with mild fluctuations on a yearly basis. From the year 2018 to 2022, Sweden imported more than 70,000 MT of palm-based oleochemicals from Malaysia, totalling RM502 million (equivalent to 1.2 billion SEK) in export revenue.

Figure 10: Export Performance of Palm-Based Oleochemicals from Malaysia to Sweden (2018-2022). Source: MPOB

The export revenue of palm-based oleochemicals from Malaysia to Sweden has been growing at a CAGR of 10.8%. Additionally, the export volume of palm-based oleochemicals peaked in the year 2020. The year 2022 recorded the lowest export volume from Malaysia to Sweden, at 11,710 MT.

Despite the dip in imports in the year 2022, the situation signifies that there is potential for the downstream sector to recover the loss in market share in Sweden. The decline in imports is likely due to the shift to other substitutes of oleochemicals, following the elevated prices of palm oil in 2021 and 2022. The high prices of crude palm oil have a spill over effect on its derivatives as well and this is likely to be a contributing factor in Sweden’s decline in imports from Malaysia for the past year.

Three Major Palm-Based Oleochemicals Exported from Malaysia to Sweden

Three of the most sought-after palm-based oleochemicals and derivatives that were imported by Sweden are palmitic acid, oleic acid, and capric acid. Palmitic acid is one of the key palm-based oleochemicals and derivatives that were imported by Sweden. Sweden imported about 5,000 MT of palmitic acid from Malaysia in the year 2022, valued at RM29 million[7]. Palmitic acid is a saturated long-chain fatty acid with a 16-carbon backbone. It is also known as hexadecanoic acid. This derivative is commonly used as an emollient and surfactant in cosmetics and personal care[8]. It is commonly found in personal care and hygiene products such as bar soaps and body washes. Palmitic acid is also found in moisturisers, lotions, and facial treatment creams (excluding eye-specific products). Leave-on facial masks and peel-off facial masks also commonly contain palmitic acid. In addition to facial products, hair care and styling products such as detanglers, leave-in hair conditioners, and shampoos also contain palmitic acids.

Another palm-based oleochemical that is much sought-after in Sweden is oleic acid. Oleic acid is a mono-unsaturated omega-9 fatty acid found in various animal and vegetable sources[9]. Sweden imported a total of 2,500 MT of oleic acid from Malaysia in the year 2022, worth RM28 million[10]. However, there was a 58% Y-o-Y decline in imports. It is used in various applications such as lubricants and sealants, especially as fabric paints and sealers. In the textile industry, oleic acid is particularly valuable in waterproofing fabrics[11].

Capric acid is also a valuable oleochemical that is derived from palm oil. It is also known as decanoic acid. Sweden imported a total of 1,739 MT of capric acid from Malaysia, valued at RM44.3 million[12]. It is a C10 saturated fatty acid that is derived from palm kernel oil[13]. Its industrial use includes the manufacturing of lubricants and greases. This derivative is valuable in this aspect as it provides superior quality as barrier layers in lubricants, dyes, and grease products. It is also used in perfume and food artificial flavourings. Within the beauty and personal care industry, capric acid is valuable as a solvent in topical applications like ointments and creams. It can also be formulated as a thinning agent in beauty products. Due to its superior quality as an emollient and emulsifier, manufacturers prefer capric acid in producing esters for rubbers and plastics, as well as in producing sanitisers.

Conclusions

Malaysian palm oil downstream players have an immense opportunity to add value to the personal care, beauty, and household care product segment in Sweden. With the support of major manufacturers, brands, and retailers from Sweden on the sustainable sourcing of palm oil, there is ample opportunity for Malaysian players to tap into the Swedish market. Malaysian downstream players have the potential not only to revisit their export performance in the year 2020 with 16,000 MT, but to surpass the export volume of 18,000 MT. Malaysia palm oil and its derivatives are also sustainably certified under MSPO, using strong traceability features. The strong research and development (R&D) conducted by the downstream players in Malaysia is also an added advantage in providing great value to the personal care and beauty industry in Sweden. Therefore, Malaysian downstream players are strongly encouraged to consider Sweden as their destination market for the export of palm-based oleochemicals.

Appendix

Shown below are the personal care and beauty brands from Sweden and their respective pledges on sourcing palm oil. Please refer to the links shown below.

[1] https://ec.europa.eu/eurostat/en/web/products-eurostat-news/-/edn-20180606-1

[2]https://www.statista.com/topics/2406/sweden/#topicOverview

[3] https://www.statista.com/study/83227/key-economic-indicators-of-sweden/

[4] https://www.statista.com/statistics/375611/sweden-gdp-distribution-across-economic-sectors/

[5] https://www.cosmeticaitalia.it/documenti/a_centrostudi/beauty_report/interno_completo_EN.pdf

[6] https://www.statista.com/study/83227/key-economic-indicators-of-sweden/

[7] Malaysian Palm Oil Board (2022)

[8] https://pubchem.ncbi.nlm.nih.gov/compound/Palmitic-acid#section=Uses

[9] Choulis, N.H (2011) ; Side Effects of Drugs Annual

[10] Malaysian Palm Oil Board (2022)

[11] https://pubchem.ncbi.nlm.nih.gov/compound/Oleic-acid#section=Metabolism-Metabolites

[12] Malaysian Palm Oil Board (2022)

[13] https://hmdb.ca/metabolites/HMDB0000511

Prepared by Hajar Shamsudin

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.