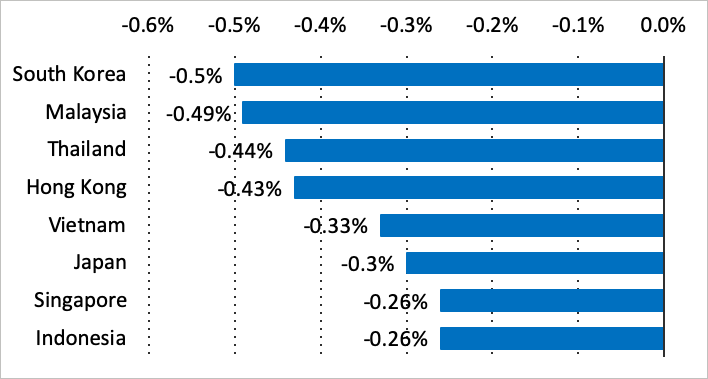

The Asia Pacific (excluding China) is one of the vibrant economic regions in the world. In 2019, the total GDP value of Asia Pacific was USD 11.55 trillion which is contributed about 13.2% to the global GDP value. The Asia Pacific includes several emerging countries like Indonesia, Malaysia, Philippines, South Korea, Taiwan and Thailand. These emerging countries contribute enormously to the growth of the Asia Pacific economy. However, the Asia Pacific region has also been hit hard by the coronavirus pandemic in the first quarter and is recovering from a severe recession. Most of the countries in the world anticipated a negative economic growth for the year 2020. The chart below shows the forecast for the change in the economic growth in 2020 for the Asia Pacific countries due to the coronavirus pandemic.

Change in Economic Growth (2020 Estimates)

The Asia Pacific is an important market for Malaysian palm oil. In 2019, the region imported 10.9 million MT of oils and fats and palm oil was the main imported oil with a share of 61.8% which equals 6.7 million MT. With the population of 933 million people, the consumption of oils and fats was about 39 million MT and the range caput use was around 14.2 kg to 33.9 kg compared to the world average caput use was 30.8 kg in 2019.

Malaysia as the pioneer in introducing the versatility and the importance of palm oil usage to the world has forged numbers of a long-term relationship with major importing countries globally. With the initiative taken by the Malaysian government through the Ministry of Plantation Industries and Commodities, MPOB and MPOC have opened the door for Malaysian palm oil to find its new home around the world. Even though currently, Malaysian position as the number one palm oil supplier has been taken by our neighbouring country, there are countries that still favour importing palm from Malaysia more than other countries such as the Philippines, Japan and South Korea.

| Malaysian Palm Products Export to Asia Pacific Region (By Products) | ||||

|---|---|---|---|---|

| PRODUCT | Jan-Sept 2020 | Jan-Sept 2019 | Change (MT) | Change (%) |

| RBD Palm Olein | 1,114,683 | 1,189,656 | (74,973) | (6.30) |

| RBD Palm Oil | 370,805 | 347,547 | 23,258 | 6.69 |

| RBD Palm Stearin | 125,643 | 307,803 | (182,160) | (59.18) |

| Palm Fatty Acid Distillate | 126,563 | 175,923 | (49,360) | (28.06) |

| Cooking Oil | 66,701 | 79,919 | (13,218) | (16.54) |

| Palm Acid Oil | 70,669 | 63,121 | 7,548 | 11.96 |

| Others | 270,345 | 219,500 | 50,846 | 23.16 |

| Total | 2,145,409 | 2,383,468 | (238,059) | (9.99) |

Source: Oil MPOB

RBD palm olein is the most imported palm oil product in the Asia Pacific region with an average import of 1.6 million MT per year. From January to September 2020, the import of RBD palm olein dropped by 74,973 MT or 6.3% to 1.1 million MT compared to the same period in 2019. However, RBD palm stearin shows the biggest drop in palm oil import in the Asia Pacific region which by 182,160 MT or 59.2%. Palm stearin is the solid fraction of palm oil that can be used for obtaining palm mid fractions (PMF) and also for blends with other vegetable oils to produce margarine fats, shortenings and others.

| Malaysian RBD Palm Stearin Export to Asia Pacific Region (by countries) | |||||

|---|---|---|---|---|---|

| Countries | Jan – Sept 20 | Jan – Sep 19 | Change (MT) | Change (%) | Jan – Dec 19 |

| Japan | 34,339 | 95,209 | (60,869) | (63.93) | 127,217 |

| South Korea | 52,835 | 86,949 | (34,114) | (39.23) | 98,650 |

| Indonesia | 14 | 77,802 | (77,788) | (99.98) | 85,802 |

| Vietnam | 18,341 | 19,837 | (1,497) | (7.55) | 24,821 |

| Philippines | 7,128 | 7,510 | (382) | (5.09) | 9,240 |

| Taiwan | 5,835 | 7,346 | (1,511) | (20.57) | 10,026 |

| Australia | 2,198 | 7,313 | (5,115) | (69.94) | 10,204 |

| New Zealand | 1,507 | 2,983 | (1,476) | (49.48) | 4,597 |

| Singapore | 3,406 | 2,756 | 650 | 23.59 | 3,356 |

| Brunei | 40 | 80 | (40) | (50.00) | 80 |

| Papua N Guinea | – | 18 | (18) | (100.00) | 18 |

| Total | 125,643 | 307,803 | (182,160) | (59.18) | 374,010 |

Source: Oil MPOB

Japan, South Korea and Indonesia are the main importers of Malaysian RBD palm stearin in 2019. The import of Malaysian RBD palm stearin in these three countries accounted for 83% share of the total Malaysian RBD palm stearin import in the Asia Pacific region. The drop in the Malaysian RBD palm stearin import for the period January to September 2020 was mainly due to the higher drop in imports by these countries.

From the table above, Japan and Korea recorded drops in the Malaysian palm stearin import at 60,869 MT or 63.9% and 34,114 MT or 39.2% respectively. The drop was mainly due to the disruption in the food and non-food industry activities in Japan and Korea because of the COVID-19 pandemic. In Japan and Korea, palm stearin is used for margarine and shortening production which is as a deep frying fat for the food manufacturing industry especially, instant noodle. Besides, the countries also used palm stearin for soaps and detergents, oleochemical and bioenergy sectors.

Japanese Government is very aggressive in expediting the adaptation of their renewable energy usage. In their Fourth Strategic Plan, they set the renewable energy share target at 24% by 2030 and their current renewable energy share is at 18%. The scenario has led to the increase in demand for palm products such as stearin and palm kernel shells in their energy sector specifically in their biomass plant. Japan’s first palm oil power plant opened in 2014.

Due to the Korean Government has maintained the biodiesel mandate of 3% in the country, it is expected the demand of palm stearin this year will slightly drop due to reduction in the biodiesel production caused by the low crude oil price. The demand setback for the transportation and aviation sectors due to the COVID-19 pandemic has significantly dropped the crude oil prices.

While for Indonesia, the drop in the palm stearin import in 2020 mainly due to the price factor. In 2019, Indonesia took advantage during the low palm oil price period to import Malaysian palm oil for its biodiesel sector.

Despite the drop in the import of the Malaysian palm stearin, South Korea recorded positive changes in the total Malaysian palm oil import at 17,970 MT or 5.5% to 342,122 while Japan recorded a slight decrease at 35,548 MT or 9.7% to 330,612 MT in January to September 2020 period. Malaysia as the main supplier of palm oil for Japan and South Korea should continue to pursue and dominate the market. Besides the growth in food sectors in both countries, the growth in the bioenergy sector in Japan will also give a bright opportunity for Malaysian palm oil exporters.

Source:

- USDA GAIN Reports

- Statista

- Oil World

- MPOB

Prepared by : Rina Mariati & Muhammad Kharibi

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.