There is no direct trade agreement that exists between Malaysia and the major consuming countries in North and East Africa region, however, there are several agreements among the consuming countries in the region that can significantly benefit the Malaysian palm oil industry

List of Trade agreements that exist as follows:

- Pan Arab Free Trade Agreement (PAFTA) / Greater Arab Free Trade Agreement (GAFTA)

PAFTA includes Egypt, Bahrain, Algeria, Saudi Arabia, UAE, Jordan, Iraq, Kuwait, Lebanon, Libya, Morocco, Oman, Palestine, Qatar, Syria, Sudan, Tunisia, and Yemen. Member States of the Arab League that have not yet completed the entry procedures are Djibouti, Comoros, Mauritania and Somalia.

PAFTA was established to create an Arab free trade area, by the Economic Council (ESC) of the Arab League. This is to enhance economic and trade relations between the Arab states and with the other part of the world. This is the first comprehensive initiative to create an Arab economic bloc that has given positive impact in the world economy. A first free trade agreement was signed between the members of the Arab League in 1981 and in February 1997 it was decided that, in a period of ten years, the establishment of PAFTA would be completed. However, in March 2001 a decision of the ESC, based on a recommendation of the 2001 Arab Summit in Amman, has decided to speed up the implementation and most of the tariffs eliminated on 1 January 2005 among its members.

- Common Market for Eastern and Southern Africa (COMESA)

Common Market for Eastern and Southern Africa (COMESA) includes Angola, Burundi, Comoros Islands, DR Congo, Djibouti, Eritrea, Ethiopia, Kenya, Madagascar, Malawi, Mauritius, Namibia, Rwanda, Seychelles, Sudan, Swaziland, Uganda, Zambia and Zimbabwe. The establishment of the COMESA as a trading area of Eastern and Southern Africa can be interpreted as the first step toward the creation of an African economic community.

The COMESA Agreement’s objective was to create a preferential trade zone and establish a free trade zone among its members with the eventual aim to develop into a customs union and later a common market. Populations in the COMESA member countries are estimated at 380 million which normally account for a wide and competitive market.

Egypt signed the Common Market for East and South Africa (COMESA) Agreement on 29 June 1998. The application of customs exemptions on imports from other member countries was in effect as of 17 February 1999 based on equal treatment as regards goods with valid certificates of origin given by relevant authorities in every country. Nine members signed for the Agreement on a Free Trade Area are Egypt, Kenya, Sudan, Mauritius, Zambia, Zimbabwe, Djibouti, Malawi, and Madagascar granting full customs exemptions regarding exchanged imports, provided that products are accompanied by certificates of origin. Rwanda and Burundi opted out from the Agreement on 1 January 2004.

- Agadir Free Trade Agreement

The Agadir Agreement was established in 2004, which came into force in 2006, to establish a free trade area between Egypt, Jordan, Morocco, and Tunisia. The Agadir Agreement was signed in Rabat with the aim of establishing a free trade area between the Arab countries of the Mediterranean Area, as a part of the free trade Euro-Mediterranean area as stated in Barcelona Declaration. Since the agreement date of entry into force in July 2006, the industrial and agricultural products traded between the four signatory countries have been fully liberalized. The actual implementation of the agreement was made by the 27 March 2007, after the publication of customs circulars. The agreement is open to other Arab Mediterranean countries to join.

Several important issues such as customs systems, rules of origin, government procurements, financial transactions, safeguard measures, new industries, subsidy and dumping, intellectual property, standards and specifications, and establishing a dispute settlement mechanism. The rules of origin is one of the most important articles stipulated in the Agadir Agreement as this will increase the prospective European Market Access for products of its members. The rules of origin will encourage investments in the participating countries and increase inter-country regional cooperation. All the industrial and agriculture products are entitled for exemption of tariff and the non-tariff measures.

One of the major opportunities created by Agadir Agreement is the accumulation of origin between the United States and Europe. This system allows obtaining preferential tariff treatment for products made with materials from one of the other countries of the Pan-Euro-Mediterranean area as if they had been produced on its territory. The customs authorities of the exporting country issuing certificates of circulation to prove the origin declared. This allows importers to other contracting parties to enjoy the preferential tariff arrangements.

Benefits of trade agreements to Malaysia palm oil industry

The three trade agreements stipulated above has a positive and significant impact in stimulating trade from Malaysia to key markets like Egypt to become the main re-export center to other African countries. Huge population with 100 million in Egypt, around 109 million in Ethiopia and more than 40 million in each country in the region will give a good prospect for palm oil demand. Landlocked countries coupled with limited local production such as Ethiopia, Sudan and other central African countries would require efficient and effective supplies to satisfy their local requirements. Most oils and fats consumption in this region especially palm oil met through imports whether by import directly from producing countries or other importing countries. The current existing trade agreements create countless opportunities and facilitate the export growth of Malaysian palm oil into the region.

Egypt enjoyed preferential access to several countries through the multiple free trade agreements which provide access to 1.5 billion consumers, of which 100 million consumers are in Egypt. Egypt is also an important connecting point for the east and west region, linking the established and emerging markets with 8% of world trade passing through the Suez Canal.

Egypt has a favorable import duty-free structure for palm oil products. Imported semi-refined and fully refined oils entitled for zero import duty, the same as crude oils. This makes Egypt a suitable market for palm oil products not only for local consumption but also to be processed locally and re-exports to neighboring countries such as the COMESA countries and other regional economic groupings. As a member of regional trade agreements and having certificates of origin, Egypt is exempted from customs duties and any other equivalent charges. It is important to note also that regional trade agreements exert a positive impact on Egypt’s trade with palm oil emerging markets such as Morocco and Algeria. Potential products to be exported to those countries are such as blended cooking oil, palm based cheese and other specialty fat products. For countries such as Ethiopia, Djibouti, Eritrea, Somalia and Sudan, packed palm oil products are highly demanded.

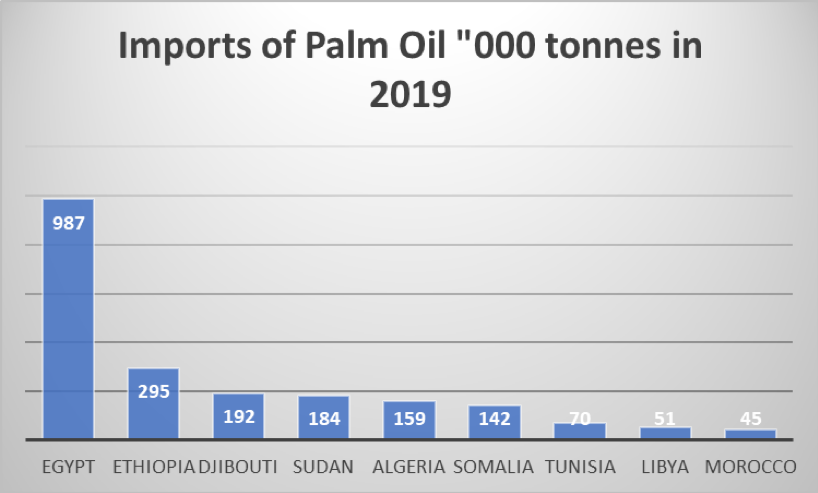

Egypt is the biggest importer of palm oil in the West of Suez Region. In 2019, Egypt’s imports of palm oil recorded at 987,000 MT which represents 46% of the total imports of palm oil in the region as represented in the following chart.

Egypt as a well-established palm oil market will continue to be the largest palm oil market in Africa. Giving its huge population and established logistic infrastructures, Egypt holds a huge potential as a hub for palm oil and its products. Another new establishing port in Egypt, Sokhna port, managed by DP World is planning to allocate an area in its second phase of the port for liquid bulk tanks. Currently, it only handles containerized and dry bulk. This is a feasible opportunity for palm oil investments in Egypt with regards to logistics and availability of oil for both local market and re-export.

Prepared by Mohd. Suhaili Hambali

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.