Country Background

Tunisia is a small country in North Africa with a population of about 12 million. It is not only a producer and exporter of edible oil (olive oil) but also an importer of oils and fats. Tunisia is one of the largest producers of olive oil outside the European Union and comes fourth in the world, following Spain, Italy, and Greece. Olive cultivation plays a vital role in Tunisia’s socio and economic life, making up nearly 15% of the total value of agricultural production. However, Tunisia’s oilseed production remains insignificant despite the government’s encouraging farmers to grow rapeseed and sunflower crops to diversify oilseed production. Tunisia is a middle-income country with a stable economy. It has a young population and a growing middle class, both of which are factors that are driving demand for processed foods. Tunisia is also a member of the European Union, which gives it access to a large and growing market.

Tunisia has been experiencing growth in its food industry in recent years. Tunisia’s food processing sector has also seen advancements with the development of food manufacturing and packaging facilities. It has allowed for value addition and the production of a wide range of processed food products, such as canned goods, sauces, pastries, and dairy products. These products are not only consumed domestically but are also exported to neighboring countries and beyond. Food manufacturing development helped palm oil gain momentum in this area and offers an excellent opportunity for more palm oil intake. Revenue in the food market amounts to US$8,089.00 million in 2023. The market is expected to grow annually by 6.8% (CAGR 2023-2027). The market’s largest segment is confectionery & snacks, with a market volume of US$2,150.00 million in 2023.

To support the growth of the food industry, the Tunisian government has implemented policies and initiatives to enhance the sector’s competitiveness and encourage investment. It includes providing incentives for agribusinesses, improving infrastructure, and facilitating market access. Overall, Tunisia’s food industry is expanding due to its diverse agricultural resources, unique cuisine, and efforts to promote quality and sustainability. The sector’s growth presents opportunities for economic development, employment, and increased exports for the country.

Oils and Fats Scenario

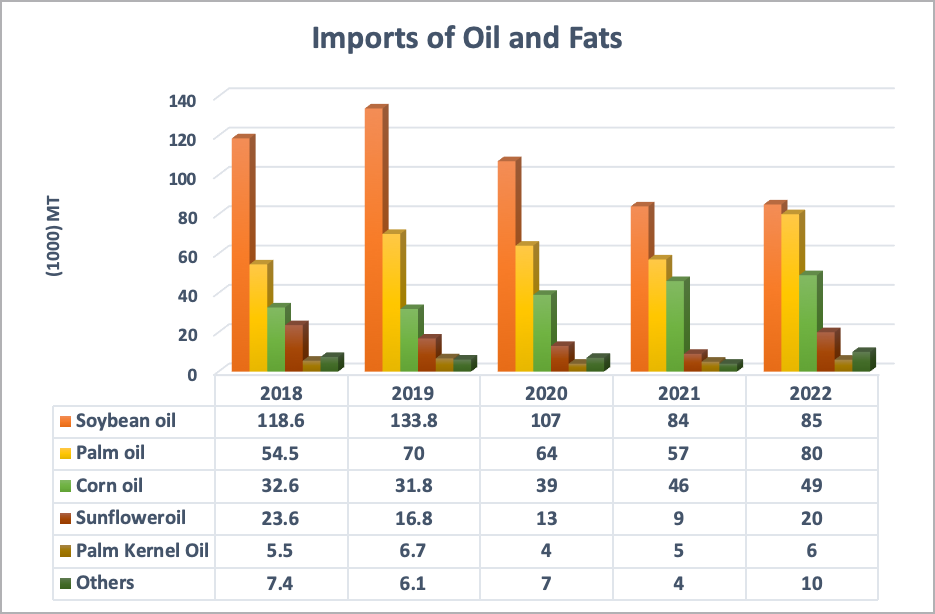

Tunisia is a net importer of vegetable oils. Tunisia’s edible oils and fats consumption consists of soybean oil (57%), palm oil (21%), and olive oil from domestic production (9%). Total consumption was estimated at 307,000 MT in 2022. Despite its status as a major olive oil producer, only a small percentage, between 15% – 20%, is consumed domestically, with olive oil increasingly replaced with other vegetable oils in the traditional Tunisian diet. Olive oil is relatively expensive and thus unaffordable for many Tunisian households. As a result, olive oil tends to be used as an occasional salad dressing, while imported vegetable oils are used in everyday cooking. Soybean oil, the most consumed oil in the country, dominates total oil imports. Over 97% of Tunisia’s soybean oil imports are crude grade, to be refined and packaged for the domestic market and with a small amount for export.

Palm oil and soybean oil are the two largest imported and consumed oils in Tunisia and collecitvley they account for nearly two thirds of the total import.

Import Duties on Edible Oils

The official import tariff on palm oil is 36%, whether refined or crude. At the same time, soybean oil is subjected to much lower duties at 0%t for crude and 10% for refined. However, the government issued a declaration on Refined palm oil to be subjected to 10%, and this declaration is reviewed annually.

| Oil Type/ import duties | Crude % | others % | ||

|---|---|---|---|---|

| Import Duty | VAT. | Import Duty | VAT. | |

| Soybean oil | 0 | 0 | 10 | 0 |

| Palm oil | 36 | 19 | 36 | 19 |

| Sunflower oil | 36 | 19 | 36 | 19 |

Source: Tunisia Custom Authority

Malaysian Palm Oil Performance

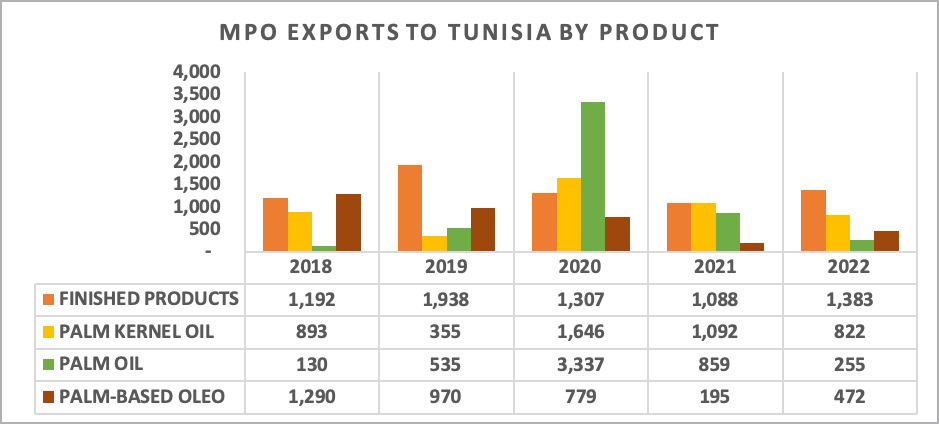

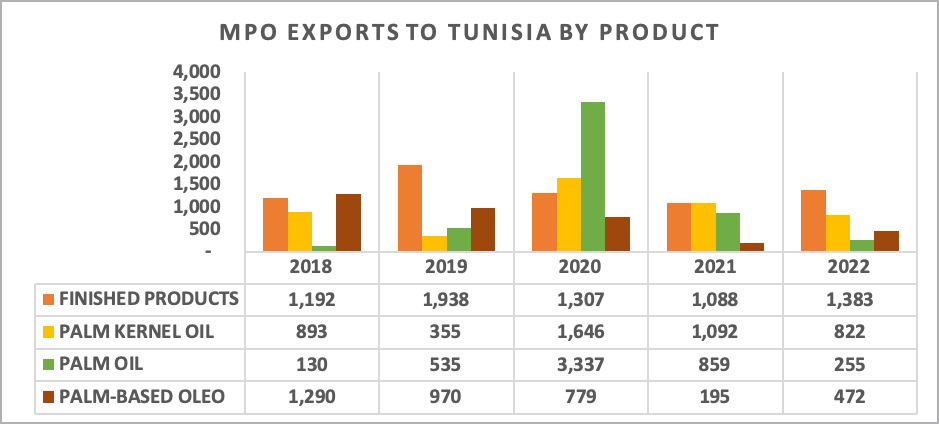

Malaysia’s exports of palm oil fluctuate over the period from 2018 to 2022. Exports dropped significantly by 70% to 255 MT in 2022 compared to 859 MT in 2021. However, Palm oil finished products imports are in an improved situation than palm oil, with imports totaling 1,382 MT in 2022, an increase of 27% compared to 1,088 MT in 2021.

In Jan-Apr 2023, MPO exports to Tunisia were recorded at 564 MT compared to 106 MT last year, representing a considerable increase. The export of finished palm oil products from Malaysia to Tunisia increased by 1.3%. The palm kernel oil export from Malaysia to Tunisia increased by 89.1%. In addition, the export of palm-based oleo from Malaysia to Tunisia increased by 72.2%. As a result, the total export of palm oil products to Tunisia increased by 71.2%. It reveals the growing demand for Malaysian palm oil products in Tunisia and offers excellent potential for additional Malaysian exports to this market.

| Product | Jan -Apr 2022 | Jan-Apr 2023 |

|---|---|---|

| FINISHED PRODUCTS | 594.64 | 579.87 |

| PALM KERNEL OIL | 219.52 | 421.53 |

| PALM OIL | 106.4 | 564.15 |

| PALM-BASED OLEO | 90 | 158 |

| Total | 1010.56 | 1723.55 |

Source: MPOB Statistics

Areas of Expansion for Malaysian Palm Oil

The development of food manufacturing offers an excellent potential for more palm oil consumption in various food products. The cheese manufacturing sector is growing both locally and regionally, which also presents opportunity for additional palm oil consumption. Biscuits and chips are also increasing on average by 5-10% annually. The growth in food industries is not only for the local market needs but also caters to the neighboring counties like Libya, Algeria, and Morocco. Libya is a massive Tunisian product market due to the zero import duties between the two countries. The anticipated elimination of the food subsidy program in a short time will create more demand for palm oil products.

The three key oils and fats players in the country are planning to increase their requirements of palm oil which may collectively double the total imports of palm oil due to their expansion in the exports of food products that highly relies on palm oil as a key ingredient. Therefore, this is an excellent opportunity for Malaysian palm oil exporters to enhance their market share.

Conclusion

The Tunisian government’s efforts to promote local food production have positioned Tunisia as a promising market for the expansion of palm oil. The development of the food manufacturing sector in the country has contributed to the growing momentum of palm oil and created an excellent opportunity for increased consumption. The recorded uptrend in 2022 further underscores the high potential for additional demand in the near future. Additionally, Tunisia’s strategic location on the Mediterranean Sea enhances its suitability for entering the European market. This advantage is bolstered by the trade agreement between Europe and Tunisia, which provides further support for trade and expansion. As a result, there is a rising need for more palm oil to meet the demands of local production and facilitate the export of palm oil-based products.

Prepared by Lamyaa El Enany

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.