This article provides a brief overview of Russia’s attack on Europe’s breadbasket for agricultural markets in general and oils & fats in particular.

From breadbasket to a disaster zone

The main facts about the Ukrainian agricultural sector, according to the U.S. Department of Agriculture (USDA), are:

- Ukraine is one of the world’s leading agricultural producers and exporters and plays a crucial role in supplying the world’s markets with oilseeds and grains.

- More than 55 percent of Ukraine’s land area is arable.

- Fourteen percent of Ukraine’s population works in agriculture.

- Agricultural products are Ukraine’s main exports. In 2021, they amounted to USD 27.8 billion, which accounts for 41 percent of the country’s total exports of USD 68 billion.

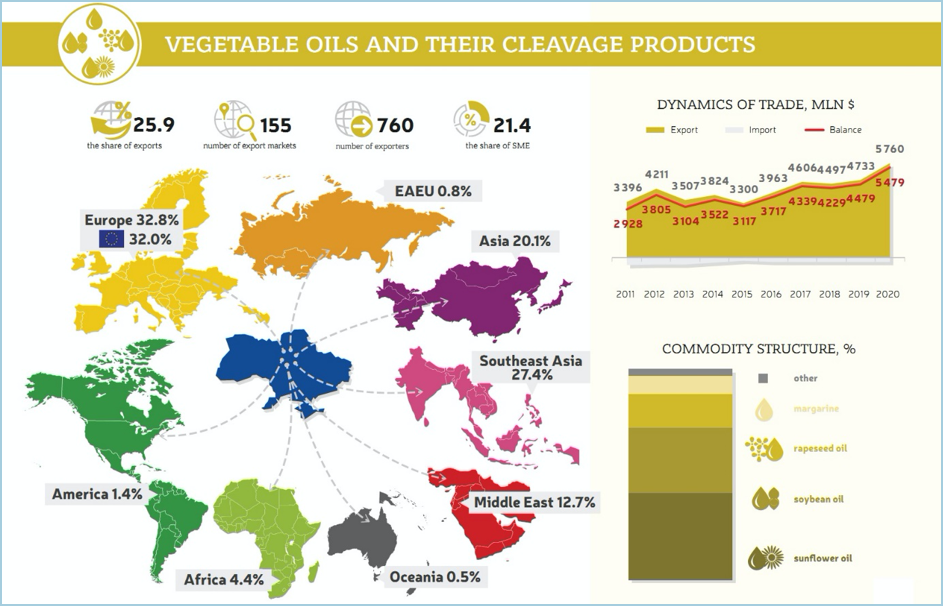

In particular, the vegetable oils sunflower, soybean, and rapeseed are essential commodities.

Source: Ukrainian Vegetable Oil Market Review 2021: Exports, Production, Prices — Latifundist.com

A comparison of concrete numbers clearly shows the importance of Ukraine to global markets:

Ukraine Sunflower and Rapeseed Production and Exports – 2021/22 Marketing Year

| Production | Exports | |||

|---|---|---|---|---|

| Volume (1,000 MT) |

% of Global Production |

Volume (1,000 MT) |

% of Global Production |

|

| Sunflower Seeds | 17.500 | 30,6 | 150 | 5 |

| Sunflower Oil | 6.450 | 30,6 | 5.750 | 47 |

| Sunflower Meal | 6.195 | 27,5 | 4.850 | 58 |

| Rapeseed | 3.015 | 4,2 | 2.700 | 20 |

Source: USDA Ukraine-Ag-Production-Trade

Apart from rapeseed and sunflower, Ukraine also is the world’s ninth-largest producer of soybeans. Of the crop, it exported 600 million U.S. dollars worth of the produce in 2021. Soybeans are planted from April through May, i.e. when the war is still in full swing. Some products may be possible in the central and especially the western regions of Ukraine, where the fighting is less severe or at least has been to date

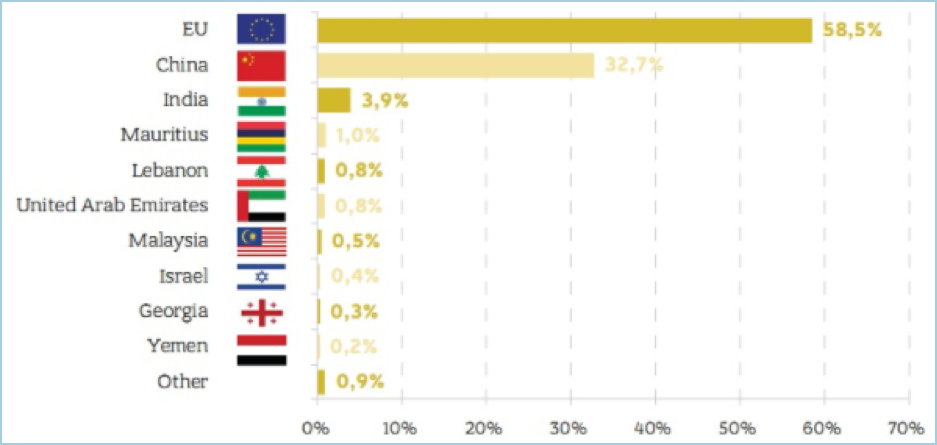

The EU is by far the biggest buyer of Ukrainian food products. Together with China, the share reaches over 90%. Ukraine is an essential supplier of corn, wheat, and oilseeds to the EU, not least for animal feed. Thus, the current situation also harms livestock farming in Europe, especially pig farming.

Top-10 Importers of Ukrainian Food Products, 2020

Source: Ukrainian Vegetable Oil Market Review 2021: Exports, Production, Prices — Latifundist.com

Against this background, Russia’s invasion shortly before the period of spring sowing could not have come at a worse time for Ukrainian agriculture. In large parts of the country, airstrikes, mines, and artillery fire have made work in the fields extremely dangerous. Also, farmers are suffering from a shortage of essential supplies, especially fuel for agricultural machines.

Because the war threatens food production in Ukraine, it leads to rising food prices in Europe and poses an acute risk of global food shortages that would hit some of the world’s poorest countries hardest.

In early March, Ukraine had decided to halt exports of essential food commodities such as wheat and sunflower oil to ensure domestic supplies. As the war drags on, haunting memories resurface of the Holodomor in Ukraine, the devastating famine in the years 1932-33, deliberately caused under Stalin for the political goal of suppressing the Ukrainian quest for freedom and consolidating Soviet rule there. According to estimates, between three and seven million Ukrainians succumbed to hunger back then. Today, the world is increasingly wondering if the Holodomor can repeat itself, albeit globally.

So, the repercussions on the global agricultural markets are already severe and potentially catastrophic. And the oils & fats sector does not remain untouched, of course.

Which Way for Oils & Fats?

At the time of this writing, the war in Ukraine continues to wreak havoc in the global oils and fats markets. While in Europe, the missing sunflower oil from Ukraine and Russia has led to fierce competition for rapeseed oil, coveted for food as well as biodiesel. Prices have reached unprecedented heights.

At the same time, supply-side constraints in various forms make it unlikely that replacement effects will take hold soon. As far as palm oil is concerned, Indonesia has only recently lifted export restrictions, and it is yet unclear if or how that will boost export supplies. Malaysia, in turn, is still reeling from severe labor shortages on plantations because of COVID-19.

This situation is commented on by industry analyst Oil World in its March 25th issue of Oil World Monthly as follows:

“Given the limited scope for raising production and exports of other oils and fats to offset the shortage of supplies from the Black Sea, demand destruction via high prices is currently the markets’ main resort.”

This also appears to apply to palm oil. Oil World reckons that production levels below expectations, the Indonesian export controls, and continued demand for biodiesel were factors in rising palm oil prices over the past few months. With that, palm oils competitiveness has deteriorated, leading to lower demand.

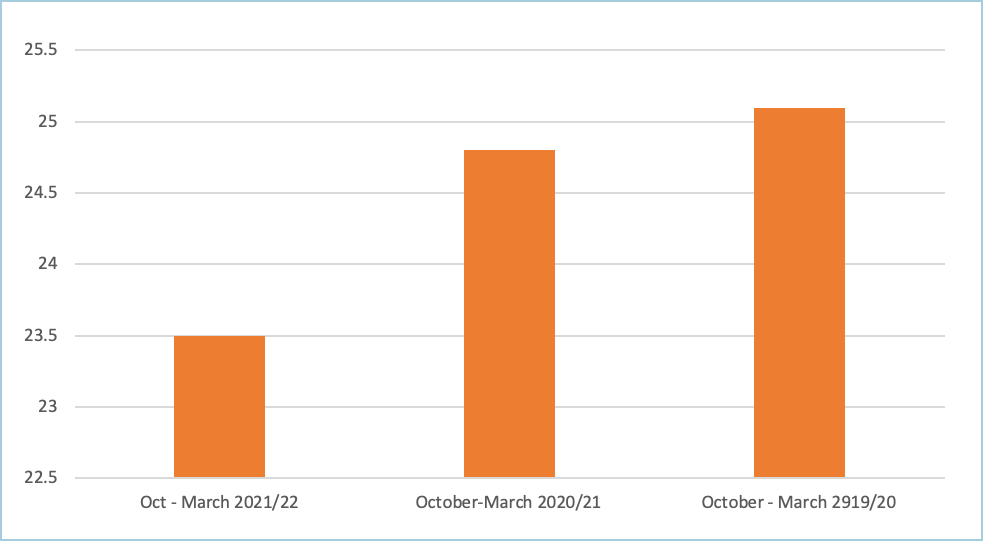

For the period October 2021 thru March 2022, Oil World sees global palm oil exports at a seven-year low.

World Palm Oil Exports (in Million MT)

Source: Oil World

In contribution to the global total, China’s palm oil imports decline by one million tons (Oct. – March 2021/22) and India’s by 350 thousand tons. Lower imports into the European Union have been recorded as well.

The EU’s Reaction

Given the enormous importance Ukraine has for European food security, it is no surprise that the war has led to at least a partial rethinking of EU agricultural policy. Food sovereignty is once again playing a more significant role in the face of Russian aggression.

Thus, most EU agriculture ministers favor expanding the cultivation of protein crops such as soybeans in the Union. This is intended to make the EU less dependent on feed imports. Austria had submitted the corresponding proposal for an EU protein strategy.

With unfamiliar speed, the EU has already put in place two primary measures:

- Ecological Focus Areas (EFA), arable land intentionally left fallow to safeguard biodiversity, now may be cultivated throughout 2022 with any crop.

- The EU Commission postponed its proposal for a new EU regulation on herbicides and fungicides.

Beyond such short-term market interventions, Janusz Wojciechowski, the EU Commissioner for Agriculture, also wants to review the Farm-to-Fork strategy and the Green Deal. It is not a question of abandoning these strategies, the Pole stressed. However, they should be carefully re-examined to ensure that the Green Deal measures do not jeopardize Europe’s food security.

This sounds like environmental concerns are not the top priority of European policymakers. Several ecological NGOs are already up in arms. FOODnavigator.com observes that they already warn about the “misuse” of the war to advance the political agenda of private sector groups regarding the EU’s environmental and health commitments.

Conclusion: What now?

It is impossible to know what the war in Ukraine and the new emerging world disorder will mean for the global economy in general and oils and fats markets in particular.

But the writing is on the wall: rising inflation, further deglobalization, more inward-looking theories of autarky and food security.

The average Western European consumer, accustomed to the spoils awarded by affluent societies, will have realized the hard way that their cozy lives are quickly becoming a thing of the past. A continent that outsourced military strength to the United States, energy to Russia, and economic growth to China, will have to adapt one way or the other.

Europeans may see themselves forced to cut back on consumption across the board. And the reason will not be to protect the climate but simply because they cannot afford the prices any longer.

As far as oils & fats are concerned, palm oil may see a new dawn. Companies and countries have already begun to slowly erode the environmental and sustainability criteria used to keep palm oil out.

But the palm oil-producing countries cannot scale up production at will. Much will depend on how long the war in Ukraine continues and if another – perhaps more devastating – strand of the coronavirus will appear, hurting supply and demand once more.

The future has always been uncertain. But these days, “uncertain” seems to be an understatement.

Prepared by Uthaya Kumar

MPOC Brussels

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.