ASIA PACIFIC REGION

Malaysian Palm Oil Exports Performance

(January – December 2023)

Regional Summary

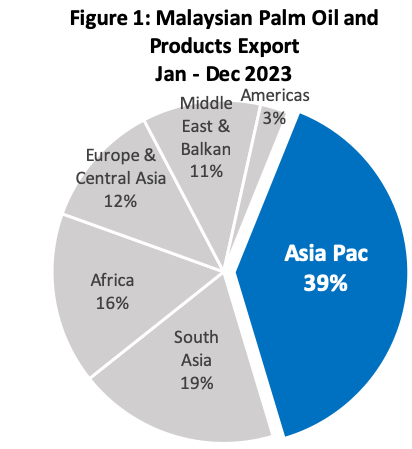

Asia Pacific was the largest importing region for Malaysian palm oil and palm products and accounted for 39% of the total Malaysian exports in 2023. In the Asia Pacific region, palm oil is the leading export product, comprising 43.21%, equivalent to 4.09 million MT. Following this, palm kernel cake accounts for 20%, palm-based oleo for 13%, palm kernel oil for 3%, finished products for 1.7%, and biodiesel for 0.75%.

Figure 2: MPO Export Breakdown to the US

| Table 1: Malaysian Palm Oil and Palm Product Export to Asia Pacific | ||||

|---|---|---|---|---|

| Products | Jan – Dec 2023 | Jan – Dec 2022 | Change (MT) | Change (%) |

| Palm Oil | 4,086,135 | 4,430,645 | (344,511) | (7.78) |

| Palm Kernel Cake | 1,890,170 | 1,785,736 | 104,433 | 5.85 |

| Palm-Based Oleo | 1,711,105 | 1,803,544 | (92,439) | (5.13) |

| Palm Kernel Oil | 1,260,935 | 1,242,812 | 18,124 | 1.46 |

| Finished Products | 284,138 | 323,619 | (39,481) | (12.20) |

| Biodiesel | 158,655 | 182,901 | (24,246) | (13.26) |

| Other Palm Products | 64,978 | 60,546 | 4,432 | 7.32 |

| Total | 9,456,116 | 9,829,803 | (373,687) | (3.80) |

Featured Analysis

- The overall Malaysian palm oil and palm products export to Asia Pacific region went down by 3.80%. which was primarily led by the decline in the imports by China and the Philippines.

- Malaysian palm oil exports to China during January to December period declined by 16.83% primarily due to competition with Indonesian palm oil suppliers.

- Malaysian palm oil exports to the Philippines also experienced a significant decline during the reviewed period. The total exports registered a volume of 196,775 MT which was 30.81% lower than last year. Overall palm oil consumption in the Philippines has seen a declined as price competitiveness of palm oil has reduced and consumption has partly shifted back to coconut oil.

- However, Malaysian palm oil exports to Vietnam and South Korea went up by 46.31% and 12.54% respectively. Increase in Vietnam’s import of Malaysian palm was largely driven by the recovery of the tourism and food services sector. Similarly, Malaysia’s palm oil exports to South Korea recorded an increase of 52,409 MT or 12.54%. Higher import by South Korea can be attributed to the cost competitiveness of palm oil compared to soybean oil, particularly in biofuel production.

- Malaysian palm oil exports to Singapore also dropped by 15.88%. The primary reason behind the decrease in exports to Singapore is the European Union’s investigation into China’s export of used cooking oil or biodiesel. The investigation has affected Singapore biodiesel production which reflected in the drop of palm oil import as biodiesel feedstock.

ASIA PACIFIC

From January to December 2023, Malaysian palm oil exports to Asia Pacific region decreased by 344,511 MT or by 7.78% to 4.086 million MT compared to the same period in 2022. The primary cause of this decline is lower imports by China and the Philippines, as both countries experienced a collective drop of 493,552 MT. This decline was partially mitigated by an improvement in exports to Vietnam and South Korea, which witnessed a combined increase of 197,757 MT.

| Table 2: Malaysian Palm Oil Exports Performance in Asia Pacific Region | |||||

|---|---|---|---|---|---|

| Country | Jan-Dec 2023 | Jan-Dec 2022 | Diff (MT) | Diff (%) | |

| 1 | China | 1,466,864 | 1,763,640 | (296,777) | (16.83) |

| 2 | Japan | 549,050 | 564,082 | (15,033) | (2.66) |

| 3 | South Korea | 470,274 | 417,865 | 52,409 | 12.54 |

| 4 | Vietnam | 459,229 | 313,881 | 145,348 | 46.31 |

| 5 | Philippines | 441,943 | 638,718 | (196,775) | (30.81) |

| 6 | Taiwan | 255,087 | 223,882 | 31,204 | 13.94 |

| 7 | Singapore | 205,907 | 244,765 | (38,858) | (15.88) |

| 8 | Australia | 123,946 | 136,114 | (12,167) | (8.94) |

| 9 | Myanmar | 56,318 | 43,420 | 12,899 | 29.71 |

| 10 | New Zealand | 18,713 | 30,275 | (11,562) | (38.19) |

| 11 | Indonesia | 9,960 | 1,785 | 8,175 | 457.92 |

| 12 | Brunei | 9,264 | 8,069 | 1,194 | 14.80 |

| 13 | Papua N Guinea | 8,236 | 30,178 | (21,942) | (72.71) |

| 14 | Fiji | 3,734 | 3,351 | 382 | 11.41 |

| 15 | Hong Kong | 2,840 | 2,914 | (74) | (2.55) |

| 16 | Mongolia | 2,068 | 2,127 | (60) | (2.80) |

| 17 | Cambodia | 1,429 | 1,911 | (482) | (25.20) |

| 18 | Others | 1,274 | 3,666 | (2,392) | (65.26) |

| Grand Total | 4,086,135 | 4,430,645 | (344,511) | (7.78) | |

Source: MPOB

China remains as the biggest importer of Malaysian palm oil in the region with 1,466,684 MT of imports during the January to December 2023 period. The total imports in 2023 declined by 296,777 MT in comparison to the corresponding period of last year. The major factor driving this decline was increased competition from Indonesia. Indonesia’s palm oil exports to China witnessed a significant increase of 36.48%, increasing from 3.22 million metric tons to 4.40 million metric tons from January to October 2023. The data for Indonesian exports to China is currently only available till October 2023.

Malaysia experienced a significant decline in palm oil exports to the Philippines from January to December 2023, amounting to a decrease of 196,775 MT or 30.81%. However, it’s noteworthy that in December, there was a year-on-year increase in exports, increase by 23.28% from 34,695 to 42,773 MT. Palm oil consumption in Philippines has suffered a setback as price competitiveness of palm oil with coconut oil has deteriorated. Therefore, consumption has partly shifted back to coconut oil. According to Oil World, there is an overall decline in total vegetable oil consumption for the 2022/23 period in the Philippines. With a notable decline in the Philippines’ import of palm oil from both Malaysia and Indonesia in 2023, there is an anticipation of a recovery in palm oil imports in 2024 to replenish their palm oil inventory.

From January to December 2023, Malaysia witnessed a substantial 46.31% increase in palm oil exports to Vietnam, rising from 313,881 to 459,229 tonnes, largely driven by the recovery of the tourism and food services sector. The primary palm products imported by Vietnam are RBD palm oil, RBD palm olein, and cooking oil, collectively contribute 94.69% of the total palm oil imports for the year. Vietnam primarily uses palm oil in food services and food processing sector because of its price competitiveness and functionality against other vegetable oils.

Between January and December 2023, Malaysia’s palm oil export to South Korea recorded an increase of 52,409 MT, representing a growth of 12.54%, totalling 470,274 MT. The improved palm oil imports by South Korea can be primarily attributed to the cost competitiveness of palm oil compared to soybean oil, particularly in industrial applications such as biofuel production. South Korea is projected to raise its biofuel mandate from 3.5% to 4.0% in 2024, which will require an additional 100,000 MT of feedstock. According to the United States Department of Agriculture (USDA), palm oil usage in biofuel is projected to witness a rise of around 50,000 MT if the 4% biofuel mandate is implemented.

Malaysia experienced a decline of 15.88% in palm oil exports to Singapore between January to December 2023 period, dropping from 244,765 metric tons to 205,907 MT. This contrasts with Malaysia’s palm oil exports to Singapore in the first half of 2023, with an increase of 23%. The primary reason behind the decrease in exports to Singapore during the second half of 2023 is due to European Union’s investigation into China’s export of used cooking oil or biodiesel. Around 35% to 40% of palm oil imported into Singapore is intended for the production of biodiesel before exporting to China. Indonesia also experienced a significant drop of 49.43% in its palm oil exports to Singapore between January to October 2023.

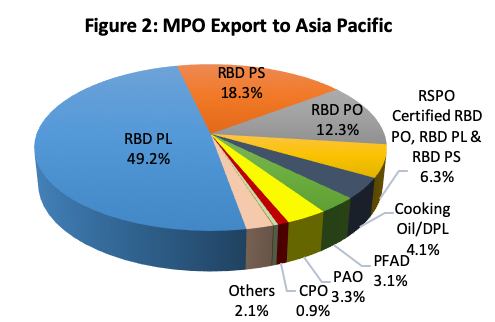

| Table 3: Breakdown of MPO Export to Asia Pacific Region | ||||

|---|---|---|---|---|

| PRODUCT | Jan-Dec 2023 | Jan-Dec 2022 | Diff (MT) | Diff (%) |

| RBD PL | 2,010,187 | 2,272,921 | (262,734) | (11.56) |

| RBD PS | 748,544 | 792,053 | (43,510) | (5.49) |

| RBD PO | 501,260 | 508,862 | (7,602) | (1.49) |

| RSPO Certified RBD PO, RBD PL & RBD PS | 257,347 | 203,105 | 54,242 | 26.71 |

| Cooking Oil/DPL | 165,881 | 189,333 | (23,452) | (12.39) |

| PFAD | 128,515 | 137,295 | (8,780) | (6.40) |

| PAO | 133,469 | 135,684 | (2,215) | (1.63) |

| CPO | 36,398 | 34,098 | 2,301 | 6.75 |

| CPS | 15,036 | 44,840 | (29,804) | (66.47) |

| CPL | 2,232 | 20,701 | (18,469) | (89.22) |

| Others | 87,267 | 91,752 | (4,486) | (4.89) |

| Total | 4,086,135 | 4,430,645 | (344,511) | (7.78) |

For more info please contact Mrs Rina Mariati

Email : rina@mpoc.org.my

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.