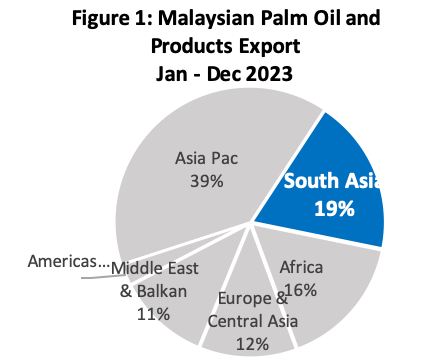

SOUTH ASIA REGION

Malaysian Palm Oil Export to South Asia Region

(January – December 2023)

Regional Summary

South Asia region accounted for 19% of the total Malaysian palm oil exported in Jan – Dec 2023. Palm oil was the main commodity exported to the region with market share 85% or 3,906,167 MT of the total Malaysian palm oil and products exported, followed by palm-based oleochemical (6%), palm kernel cake (5%), palm kernel oil (3%), and finished products (1%).

| Table 1: Malaysian Palm Oil and Palm Product Export to South Asia | ||||

|---|---|---|---|---|

| Products | Jan – Dec 2023 | Jan – Dec 2022 | Change (MT) | Change (%) |

| Palm Oil | 3,906,167 | 3,950,227 | (44,060) | (1.12) |

| Palm-Based Oleo | 277,549 | 261,328 | 16,221 | 6.21 |

| Palm Kernel Cake | 205,723 | 148,030 | 57,693 | 38.97 |

| Palm Kernel Oil | 142,698 | 130,689 | 12,009 | 9.19 |

| Finished Products | 34,487 | 38,222 | (3,735) | (9.77) |

| Other Palm Products | 2,940 | 3,736 | (796) | (21.30) |

| Palm Biodiesel | 0 | 224 | (224) | – |

| Grand Total | 4,569,563 | 4,532,456 | 37,108 | 0.82 |

Featured Analysis

- India, Pakistan, Bangladesh and Afghanistan are the top importers of Malaysian palm oil in this region, accounting for 96% of total Malaysian palm oil exports to the region.

- During 2023, vegetable oil imports in India increased by 6% to 16.06 million MT compared to 15.12 million MT during 2022. Palm oil imports had a marginal increase of 1% to 9.52 million MT during 2023 compared to 9.42 million MT imported in 2022. However, palm oil import share declined by 3% to 59.3% out of the total vegetable oil imports as a result of an increase in soft oils’ imports by 15% to 6.53 million MT compared to 5.7 million MT in 2022. The increase in soft oils’ imports in India was due to the high imports of sunflower oil attributed by lower prices and high supplies from Ukraine and Russia during 2023.

- As of December 2023, Malaysian palm oil share in India declined by around 7% to 31.7%, whilst Indonesian share increased by 5.7% to 56.3%.

- On 15 January 2024, the Ministry of Finance, India notified that the existing import duty on edible oils has been extended to 1 more year until March 2025 from March 2024. The current import duties: crude palm oil (5%), RBD Olein (12.5%), crude soybean oil (5%) and crude sunflower oil (5%). This decision is said to be made to bolster consumer support for edible oils in anticipation of the upcoming election.

- The continuation of the import duty would prompt higher edible oil imports in the near future and would support global edible oil prices due to the aggressive buying from the major edible oil importer India.

- In Pakistan, the imports of oils and fats in Pakistan are poised for a marginal recovery following a dip in Q4 of 2023. This resurgence is expected due to the combination of lower imports in the preceding quarter and an anticipated surge in consumption during Ramadan, commencing in early March. Although ongoing challenges persist, including difficulties with forex availability and the instability of the Pakistan rupee, the industry holds hope for positive developments post the elections scheduled for February 2024.

South Asia

During Jan-Dec 2023 period, Malaysian palm oil exports to the South Asian region registered a total of 3,906,167 MT against 3,950,227 MT which was recorded during the same period of last year, a decrease of 44,060 MT or by 1.12%. India holds the biggest market share of 72% as the largest importer of MPO in this region. The markets with positive import growth are Afghanistan, Sri Lanka and Bangladesh.

| Table 2: Malaysian Palm Export to South Asian Countries | |||||

|---|---|---|---|---|---|

| COUNTRY | Jan – Dec 2023 | Jan – Dec 2022 | Diff (Vol) | Diff (%) | |

| 1 | India | 2,809,956 | 2,891,422 | (81,466) | (2.82) |

| 2 | Pakistan | 503,502 | 569,961 | (66,459) | (11.66) |

| 3 | Bangladesh | 275,376 | 227,642 | 47,734 | 20.97 |

| 4 | Afghanistan | 279,835 | 218,798 | 61,037 | 27.90 |

| 5 | Sri Lanka | 24,313 | 20,064 | 4,249 | 21.18 |

| 6 | Nepal | 6,537 | 14,367 | (7,830) | (54.50) |

| 7 | Maldives | 6,600 | 7,974 | (1,373) | (17.22) |

| 8 | Bhutan | 49 | 0 | 49 | – |

| 3,906,167 | 3,950,227 | (44,060) | (1.12) | ||

Source: MPOB

In 2023, MPO exports to India marginally decreased by 2.82% from 2,891,422 MT to 2,809,956 MT. Higher imports of palm oil from Indonesia and Thailand have resulted in slight decrease of MPO import into this country. MPO exports to Pakistan went down to 503,502 MT from 569,961 MT which was mainly due to higher exports from Indonesian suppliers and difficulties with foreign exchange availability in Pakistan.

MPO exports to Afghanistan registered an increase of 27.9% or 61,037 MT. Afghanistan importers are relying more on direct imports of palm oil and its finished products rather than importing from Pakistan. Re-export of edible oil from Pakistan has reduced significantly over the years which has prompted more Malaysian exporters to operate in this market.

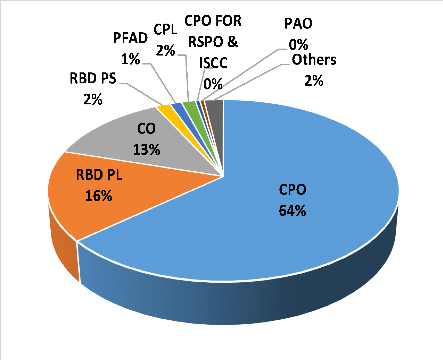

Breakdown of Malaysian Palm Oil Export to South Asia

In terms of breakdown, the biggest product being exported to the region during Jan-Dec 2023 period is crude palm oil (CPO) accounting for 64% of overall palm oil imports followed by RBD palm olein (RBD PL) with 16% and cooking oil with 13%. The high CPO exports to this region is due to the preference of CPO imports in India. These three palm oil products accounted for 93% of the total MPO exports to this region. All other markets in the region are importing processed palm oil. Cooking oil exports to this region have also increased from 462,290 MT to 506,214 MT with major destinations include Pakistan and Afghanistan.

| Table 3: Malaysian Palm Export to South Asian Countries | ||||

|---|---|---|---|---|

| Jan – Dec 2023 | Jan – Dec 2022 | Diff (MT) | Diff (%) | |

| CPO | 2,485,242 | 2,438,870 | 46,372 | 1.90 |

| RBD PL | 628,188 | 777,991 | (149,802) | (19.26) |

| Cooking Oil | 506,214 | 462,290 | 43,924 | 9.50 |

| RBD PS | 62,990 | 49,582 | 13,408 | 27.04 |

| PFAD | 48,603 | 56,287 | (7,684) | (13.65) |

| CPL | 58,383 | 32,807 | 25,576 | 77.96 |

| CPO FOR RSPO & ISCC | 18,454 | 26,699 | (8,246) | (30.88) |

| PAO | 18,115 | 21,401 | (3,286) | (15.35) |

| Others | 79,978 | 84,299 | (4,321) | (5.13) |

| 3,906,167 | 3,950,227 | (44,060) | (1.12) | |

Figure 2: South Asia MPO Import Breakdown

For more info please contact Mrs Azriyah Email : azriyah@mpoc.org.my

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.