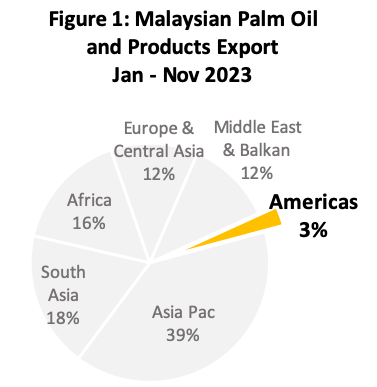

AMERICAS REGION

Malaysian Palm Oil Exports Performance

(January – November 2023)

Regional Summary

The Americas region accounted for 3% of the total Malaysian palm oil and palm products exported in Jan– Nov 2023. Palm-based oleo assumed an important composition exported to the Americas with market share of 44% or 224,351 MT from the total Malaysian palm oil and palm products exported to this region. The second most exported composition is palm oil at 34.1%, followed by palm kernel oil at 11.2%, finished products at 10.9% and biodiesel at 7.1%.

| Table 1: Malaysian Palm Oil and Palm Product Export to the Americas | ||||

|---|---|---|---|---|

| Products | Jan – Nov 2023 | Jan – Nov 2022 |

Change (MT) | Change (%) |

| Palm-Based Oleo | 224,351 | 274,587 | (50,236) | (18.3) |

| Palm Oil | 173,216 | 224,067 | (50,851) | (22.7) |

| Palm Kernel Oil | 57,085 | 82,874 | (25,789) | (31.1) |

| Finished Products | 55,848 | 49,527 | 6,321 | 12.8 |

| Other Palm Products | 36,188 | 378 | 35,810 | 9,478.6 |

| Biodiesel | 3 | 10,075 | (10,072) | (100.0) |

| Grand Total | 508,112 | 578,697 | (70,585) | (12.2) |

Source: MPOB

Featured Analysis

- USA, Canada, Trinidad, Mexico, Chile, Brazil, Dominica, Guyana, Panama and Argentina are the top 10 export destination for Malaysian palm oil and palm products in the Americas region.

- Purified glycerine, palmitic acid, distilled palm oil fatty acid, stearyl alcohol and lauryl-stearyl alcohol are the top five palm-based oleo products exported from Malaysia to the region. These five products accounted for 53.2% of the total palm-based oleo products. RBD palm oil, RBD palm stearin, RBD palm olein, NBD palm olein and cooking oil are the top five palm oil products exported to the Americas, accounting for 87.9% from the overall palm oil export to this region.

- USDA sees total 2023-24 U.S. soybean exports at a four-year low and down 12% on the year, and as such, soybean inspections have lagged normal levels for nearly two months. Delays at the Panama Canal could directly impact U.S. Gulf exports as the passageway is a key route to Asia. Additionally, unusually low water levels on the Mississippi River have hampered barge movement toward the U.S. Gulf both this year and last year (Source: Reuters)

- Brazil’s National Supply Company (Conab), has adjusted its projections for the upcoming soybean harvest due to unfavourable weather conditions in vital cultivation regions. Despite this revision, Conab foresees a record-breaking soybean crop, yet concerns arise as soybean planting falls behind schedule, potentially impacting global soybean and corn production in the coming months. The agency has also modified its projections for corn production, anticipating reduced planting for the second corn crop, known as safrinha, due to dry weather and low prices (Source : Reuters)

- Cargill has confirmed that it is ceasing offering conventional palm oil in its US portfolio of products, as it moves to offer the key ingredient through certified Roundtable for Sustainable Palm Oil (RSPO) sourcing. Reflecting growing consumer demand for more sustainably sourced ingredients, Cargill will be one of the first, large-scale US suppliers to exclusively offer palm oil certified by the Roundtable for Sustainable Palm Oil (RSPO) effective October 2023 (Source : www.cargill.com).

U.S.A.

Malaysian palm oil export to the Americas region during January-November 2023 period recorded a total volume of 224,067 MT against 173,216 MT which was registered during the same period of 2022 (refer to Table 2). This represents a decline of 50,851 MT or by 29.4%.

There was a decline in the purchase of Malaysian palm oil from the biggest buyer in the region, the United States (US). However, the US still leads the palm oil market in terms of market share in the Americas region. The leading palm oil suppliers to the US consisted of Indonesia at around 86% of total import followed by Malaysia at approximately 9.3%. During Jan-Nov 2023 period, total MPO exports to US went down to 108,537 MT from 167,608 MT recorded during the same period of last year. Canada, another important market for MPO in this region, has been consistently importing palm oil from Malaysia. Total MPO export to Canada increased by 13.0% to 12,813 MT during Jan-Nov 2023 period from 11,340 MT registered during the same period last year (refer to Table 2).

| Table 2: Malaysian Palm Oil Export to the Americas Region | |||||

|---|---|---|---|---|---|

| COUNTRY | Jan – Nov 2023 | Jan – Nov 2022 | Diff (Vol) | Diff (%) | |

| 1 | U.S.A | 108,537 | 167,608 | (59,071) | (35.2) |

| 2 | Canada | 12,813 | 11,340 | 1,473 | 13.0 |

| 3 | Trinidad | 10,520 | 9,248 | 1,272 | 13.8 |

| 4 | Mexico | 8,949 | 8,598 | 351 | 4.1 |

| 5 | Chile | 6,222 | 2,744 | 3,478 | 126.8 |

| 6 | Brazil | 5,967 | 7,320 | (1,353) | (18.5) |

| 7 | Dominica | 4,033 | 972.6 | 3,060 | 314.6 |

| 8 | Guyana | 3,355 | 1,316 | 2,039 | 154.9 |

| 9 | Panama | 2,672 | 972.94 | 1,699 | 174.6 |

| 10 | Argentina | 1,858 | 2,636 | (778) | (29.5) |

| 11 | Haiti | 1,593 | 2,084 | (491) | (23.5) |

| 12 | Uruguay | 1,184 | 195 | 989 | 505.8 |

| 13 | Barbados | 1,111 | 695 | 416 | 59.8 |

| 14 | Guatemala | 960 | 1,242 | (282) | (22.7) |

| 15 | Jamaica | 953 | 1,013 | (59) | (5.9) |

| 16 | Suriname | 878 | 211 | 667 | 315.4 |

| 17 | Grenada | 254 | 38 | 215 | 564.1 |

| 18 | St Vincent and The Grenadines | 247 | 54 | 193 | 359.2 |

| 19 | Antigua | 236 | 201 | 34 | 17.0 |

| 20 | Cuba | 200 | 190 | 10 | 5.5 |

| 21 | Peru | 133 | 179 | (46) | (25.6) |

| 22 | Venezuela | 100 | 23 | 76 | 326.3 |

| 23 | Dominican Republic | 97 | – | 97 | N/A |

| 24 | Ecuador | 72 | 4,960 | (4,888) | (98.5) |

| 25 | St. Lucia | 71 | 25 | 47 | 188.7 |

| 26 | Costa Rica | 68 | 46 | 22 | 48.0 |

| 27 | Paraguay | 64 | 45 | 20 | 44.3 |

| 28 | Saint Kitts And Nevis | 39 | 17 | 21 | 122.3 |

| 29 | Belize | 21 | – | 21 | N/A |

| 30 | Puerto Rico | 8 | 25 | (16) | (66.4) |

| 31 | Colombia | – | 68 | (68) | (100.0) |

| TOTAL | 224,067 | 173,216 | 50,851 | 29.4 | |

Source: Source: MPOB

Other markets with positive import growth include Trinidad, Mexico, Chile and Dominica. Chile recorded the highest increment in terms of volume, increasing by 3,478 MT while Dominica recorded the highest increment in terms of percentage, increasing by 314.6%.

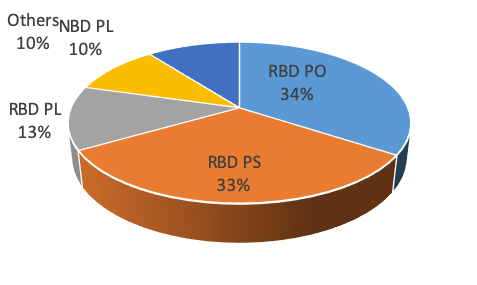

Breakdown of Malaysian Palm Oil Export to USA

In terms of product breakdown to the US, RBD palm oil, RBD palm stearin and RBD palm olein are the top three products exported to US comprising almost 78.7% of the overall MPO export to US (refer to table 3). Despite being the most imported palm oil fraction, RBD palm oil has recorded a drop by 34.7%. Similar trend was observed in the exports of RBD palm stearin, where export went down by 29.9% as well as for RBD palm olein, where export went down by 55.9%. Higher imports of soybean and sunflower oil by the US offset the reduction of RBD palm oil imports besides competitive price of Indonesian palm oil going into the US market.

| Table 3: Breakdown of MPO Export to the US | ||||

|---|---|---|---|---|

| Jan – Nov 2023 | Jan – Nov 2022 | Diff (MT) |

Diff (%) |

|

| RBD PO | 37,134 | 56,903 | (19,769) | (34.7) |

| RBD PS | 35,250 | 50,272 | (15,023) | (29.9) |

| RBD PL | 13,836 | 31,386 | (17,550) | (55.9) |

| NBD PL | 10,950 | 15,932 | (4,982) | (31.3) |

| Others | 11,368 | 13,115 | (1,747) | (13.3) |

| Total | 108,537 | 167,608 | (59,071) | (35.2) |

Source: MPOB

Figure 2: MPO Export Breakdown to the US

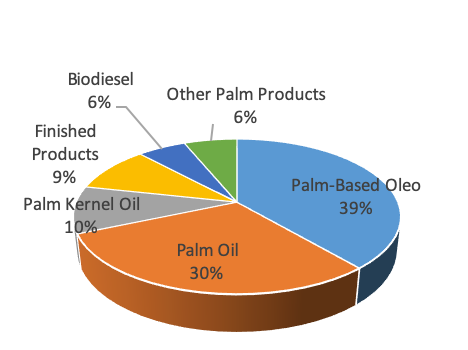

Other than palm oil, Malaysia also exported palm-based oleo, palm kernel oil, finished products and biodiesel to the US (refer to table 4). The top 5 exported items under the category of palm-based oleo are purified glycerine, palmitic acid, distilled palm oil fatty acid, stearyl alcohol, and lauryl-stearyl alcohol (refer to table 5).

| Table 4: Malaysian Palm Oil and Palm Products Export to the US | ||||

|---|---|---|---|---|

| Jan – Nov 2023 | Jan – Nov 2022 | Diff (MT) |

Diff (%) |

|

| Palm-Based Oleo | 224,351 | 274,587 | (50,236) | (18.3) |

| Palm Oil | 173,216 | 224,067 | (50,851) | (22.7) |

| Palm Kernel Oil | 57,085 | 82,874 | (25,789) | (31.1) |

| Finished Products | 55,848 | 49,527 | 6,321 | 12.8 |

| Biodiesel | 33,209 | 10,075 | 23,133 | 229.6 |

| Other Palm Products | 36,188 | 378 | 35,810 | 9,478.6 |

| Grand Total | 579,896 | 641,508 | (61,612) | (9.6) |

Source: MPOB

Figure 3: Palm Oil and Palm Products Export to the US

| Table 5: Breakdown of Palm-Based Oleo Products Export to the US | ||||

|---|---|---|---|---|

| Jan – Nov 2023 | Jan – Nov 2022 | Diff (MT) | Diff (%) | |

| Purified Glycerine | 19,613 | 32,645 | (13,031) | (39.9) |

| Palmitic Acid | 17,065 | 23,229 | (6,164) | (26.5) |

| Distilled Palm Oil Fatty Acid | 10,484 | 15,623 | (5,139) | (32.9) |

| Stearyl Alcohol | 10,326 | 11,646 | (1,320) | (11.3) |

| Lauryl-stearyl Alcohol | 9,511 | 2,498 | 7,013 | 280.8 |

| Others | 59,258 | 100,005 | (40,747) | (40.7) |

| Total | 126,257 | 185,646 | (59,389) | (32.0) |

Source: MPOB

For more info please contact Mrs Nur Adibah

Email : nuradibah@mpoc.org.my

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.