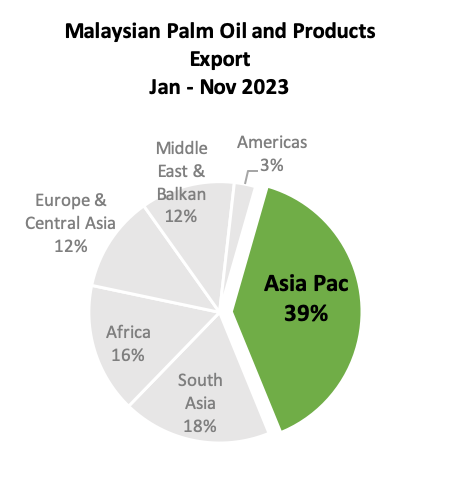

ASIA PACIFIC REGION

Malaysian Palm Oil Exports Performance

(January – November 2023)

Regional Summary

In the Asia Pacific region, palm oil is the leading exported product, comprising 42.58%, equivalent to 3.7 million MT. Following this, palm kernel cake accounts for 20%, palm-based oleo for 13%, palm kernel oil for 3%, finished products for 1.7%, and biodiesel for 0.75%. In November, the exports of palm oil and palm products to the Asia-Pacific region reached a total of 999,919 million tonnes.

Figure 2: MPO Export Breakdown to the US

| Table 1: Malaysian Palm Oil and Palm Product Export to Asia Pacific | ||||

|---|---|---|---|---|

| Products | Jan – Nov 2023 | Jan – Nov 2022 | Change (MT) | Change (%) |

| Palm Oil | 3,695,934 | 4,078,981 | (383,047) | (9.39) |

| Palm Kernel Cake | 1,788,327 | 1,661,864 | 126,463 | 7.61 |

| Palm-Based Oleo | 1,155,240 | 1,135,232 | 20,008 | 1.76 |

| Palm Kernel Oil | 260,573 | 273,023 | (12,449) | (4.56) |

| Finished Products | 145,882 | 168,916 | (23,033) | (13.64) |

| Biodiesel | 62,556 | 49,554 | 13,003 | 26.24 |

| Other Palm Products | 1,568,292 | 1,667,896 | (99,604) | (5.97) |

| Total | 8,676,805 | 9,035,465 | (358,660) | (3.97) |

Source: MPOB

Featured Analysis

- The decline in Malaysian palm oil exports to China by 20.92% is primarily caused by intense price competition from Indonesia. In terms of market share, Indonesia holds a dominant 77%, while Malaysia accounts for 22%.

- In November, Malaysian palm oil exports to the Philippines reached 53,426 MT, marking the highest monthly export for the year 2023. With a notable decline in the Philippines’ import of palm oil from both Malaysia and Indonesia in 2023, there is an anticipation of a recovery in palm oil imports in 2024 to replenish their palm oil inventory.

- Malaysia palm oil export to Vietnam continue to remain robust in November at 47,000 MT. This reflects a substantial increase of 64.45% compared to the corresponding period last year.

- Between January and November 2023, Malaysia’s palm oil export to South Korea recorded a notable increase of 51,639 MT, representing a growth of 13.50%, totalling 434,114 MT. The improved palm oil imports by South Korea can be primarily attributed to the cost competitiveness of palm oil compared to soybean oil, particularly in industrial applications such as biofuel production.

ASIA PACIFIC

| Table 2: Malaysian Palm Oil Exports Performance in Asia Pacific Region | |||||

|---|---|---|---|---|---|

| Country | Jan-Nov 2023 | Jan-Nov 2022 | Diff (MT) | Diff (%) | |

| 1 | China | 1,301,657 | 1,645,970 | (344,313) | (20.92) |

| 2 | Japan | 506,052 | 510,230 | (4,178) | (0.82) |

| 3 | South Korea | 434,114 | 382,475 | 51,639 | 13.50 |

| 4 | Vietnam | 424,491 | 291,339 | 133,153 | 45.70 |

| 5 | Philippines | 399,170 | 604,023 | (204,854) | (33.91) |

| 6 | Taiwan | 230,936 | 200,708 | 30,228 | 15.06 |

| 7 | Singapore | 192,593 | 208,887 | (16,294) | (7.80) |

| 8 | Australia | 111,993 | 114,594 | (2,600) | (2.27) |

| 9 | Myanmar | 49,625 | 42,909 | 6,716 | 15.65 |

| 10 | New Zealand | 18,013 | 25,400 | (7,387) | (29.08) |

| 11 | Brunei | 8,428 | 7,500 | 928 | 12.37 |

| 12 | Papua N Guinea | 6,915 | 29,868 | (22,953) | (76.85) |

| 13 | Fiji | 3,232 | 3,311 | (80) | (2.40) |

| 14 | Hong Kong | 2,611 | 2,707 | (96) | (3.55) |

| 15 | Mongolia | 1,866 | 2,047 | (181) | (8.85) |

| 16 | Indonesia | 1,675 | 1,728 | (53) | (3.06) |

| 17 | Cambodia | 1,429 | 1,758 | (328) | (18.68) |

| 18 | Others | 1,134 | 3,526 | (2,392) | (67.84) |

| Grand Total | 3,695,934 | 4,078,981 | (383,047) | (9.39) | |

Source: MPOB

From January to November 2023, Malaysian palm oil export to Asia Pacific region decreased by 383,047 MT or by 9.39% to 3.69 million MT compared to the same period in 2022. The primary cause of the notable decline is due to the decline in imports by China and the Philippines, as both countries experienced a collective drop of 549,167 MT. This decline was partially mitigated by an improvement in exports to Vietnam and South Korea, which witnessed a combined increase of 184,792 MT.

China remain as the biggest importer of Malaysian palm oil in the region with 1,301,657 MT of imports during the January to November 2023 period, decreased by 344,313 MT in comparison to the corresponding period last year. The major factor driving this decline is intense competition from Indonesia. According to the Chinese General Administration of Customs, China palm oil imports from January to October 2023 increased 34.7% to 4.64 million tonnes, representing a growth of 1.19 million tonnes. In terms of market share, Indonesia holds a dominant 77%, while Malaysia accounts for 22%.

In November, Malaysian palm oil exports to the Philippines reached 53,426 MT, marking the highest monthly export for the year 2023. However, from January to November 2023, Malaysia experienced a significant decline in palm oil exports to the Philippines, amounting to a decrease of 204,854 metric tons or 33.91%. Palm oil consumption in Philippines has suffered a setback as price competitiveness of palm oil has deteriorated. Therefore, consumption has partly shifted back to coconut oil. According to Oil World, there is an overall decline in total vegetable oil consumption for the 2022/23 period in the Philippines. With a notable decline in the Philippines’ import of palm oil from both Malaysia and Indonesia in 2023, there is an anticipation of a recovery in palm oil imports in 2024 to replenish their palm oil inventory.

Malaysia palm oil export to Vietnam continue to remain robust in November at 47,000 MT. This reflects a substantial increase of 64.45% compared to the corresponding period last year, which saw exports at 28,579 metric tons. From January to November 2023, Malaysia witnessed a substantial 45.70% increase in palm oil exports to Vietnam, rising from 291,339 to 424,491 tonnes, largely driven by the recovery of the tourism and food services sector. The primary palm products imported by Vietnam are RBD palm oil, RBD palm olein, and cooking oil, collectively contribute 93.89% of the total palm oil imports for the year. Vietnam primarily uses palm oil in food services and food processing sector because of its price competitiveness and functionality against other vegetable oil.

Between January and November 2023, Malaysia’s palm oil export to South Korea recorded a notable increase of 51,639 MT, representing a growth of 13.50%, totalling 434,114 MT. The improved palm oil imports by South Korea can be primarily attributed to the cost competitiveness of palm oil compared to soybean oil, particularly in industrial applications such as biofuel production. South Korea is projected to raise its biofuel mandate from 3.5% to 4.0% in 2024, which will require an additional 100,000 metric tons of feedstock. According to the United States Department of Agriculture (USDA), palm oil usage in biofuel is projected to witness a rise of around 50,000 metric tons if the 4% biofuel mandate is implemented.

The total palm oil exports from Malaysia to the Asia Pacific region in the month of November amounted to 427,335 MT, a marginal decline of 14,197 MT from the October export volume of 441,532 MT.

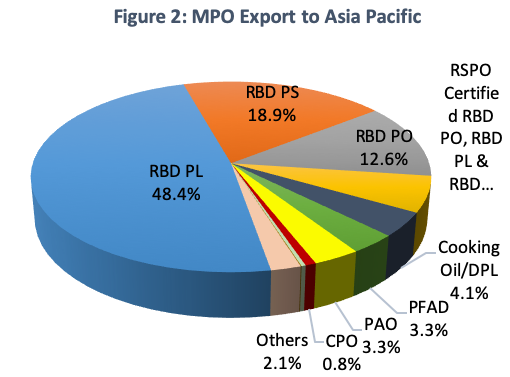

| Table 3: Breakdown of MPO Export to Asia Pacific Region | ||||

|---|---|---|---|---|

| PRODUCT | Jan-Nov 2023 | Jan-Nov 2022 | Diff (MT) | Diff (%) |

| RBD PL | 1,787,906 | 2,147,621 | (359,715) | (16.75) |

| RBD PS | 699,489 | 725,247 | (25,759) | (3.55) |

| RBD PO | 465,037 | 455,368 | 9,669 | 2.12 |

| RSPO Certified RBD PO, RBD PL & RBD PS | 224,897 | 184,074 | 40,823 | 22.18 |

| Cooking Oil/DPL | 152,092 | 178,482 | (26,390) | (14.79) |

| PFAD | 122,516 | 125,896 | (3,380) | (2.68) |

| PAO | 123,096 | 103,181 | 19,915 | 19.30 |

| CPO | 28,398 | 19,600 | 8,799 | 44.89 |

| CPS | 11,436 | 37,340 | (25,904) | (69.37) |

| CPL | 2,232 | 17,721 | (15,490) | (87.41) |

| Others | 78,835 | 84,451 | (5,616) | (6.65) |

| Total | 3,695,934 | 4,078,981 | (383,047) | (9.39) |

For more info please contact Mrs Rina Mariati

Email : rina@mpoc.org.my

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.