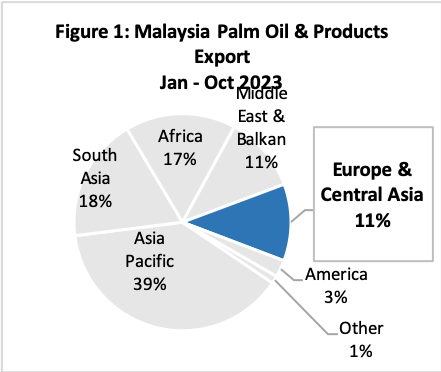

EUROPE & CENTRAL ASIAN REGIONS

Malaysian Palm Oil Exports Performance

(January – October 2023)

Regional Summary

Europe and Central Asian regions accounted for 8% of the total Malaysian palm oil exported in Jan – Oct 2023. Palm oil assumed an important composition of Malaysian palm oil palm products exported to the region with market share 41% or 924,121 MT of the total Malaysian palm oil and products exported worldwide. The remaining 60% are made of palm-based oleochemicals (21%), other palm products (20%) palm kernel oil (8%), biodiesel (5%), palm kernel cake (3%), and finished products (2%).

| Table 1: Malaysian Palm Oil and Palm Product Export to Europe & Central Asia | ||||

|---|---|---|---|---|

| Products | Jan – Oct 2023 | Jan – Oct 2022 | Change (MT) | Change (%) |

| Palm Oil | 924,121 | 1,271,604 | (347,484) | (27.33) |

| Palm-Based Oleo | 489,698 | 376,108 | 113,591 | 30.20 |

| Other Palm Products | 445,215 | 218,034 | 227,181 | 104.20 |

| Palm Kernel Oil | 176,010 | 216,854 | (40,845) | (18.84) |

| Biodiesel | 121,868 | 218,176 | (96,308) | (44.14) |

| Palm Kernel Cake | 69,010 | 63,528 | 5,482 | 8.63 |

| Finished Products | 54,356 | 41,540 | 12,816 | 30.85 |

| Grand Total | 2,280,277 | 2,405,844 | (125,567) | (5.22) |

Featured Analysis

- Netherlands, Italy, Spain, Sweden, Germany, Belgium, Uzbekistan, Denmark, United Kingdom and Russia are the top 10 importers of Malaysian palm oil in Europe and Central Asian regions.

- Exports of Malaysian oil palm products to Europe during Jan – Oct 2023 decreased by 6% as compared the volume imported in 2022. Favourable crops of rapeseed and sunflower continues to contribute to a steady supply, leading to a reduced demand for palm oil in the region. However, demand for palm-based wastes such as palm oil mill effluent and sludge oil continues to increase, with major demand coming from Italy, Netherlands and Spain.

- Palm oil mill effluent, crude palm oil, and RBD palm stearin were three major components of Malaysian palm oil imported by the Europe region and these three products accounted for 33% of the total Malaysian oil palm products exported into the region.

- The export performance of Malaysian oil palm products into Central Asian region for January – October 2023 was promising with 64,902 MT, an increase of 35% Y-o-Y. Uzbekistan has surpassed its import of Malaysian palm oil in 2022, aided by the ease in logistics situation from China after a restrictive Covid-19 curbing measures in the previous year, indicating a very strong demand from its industries.

- RBD palm oil, RBD palm stearin and hydrogenated palm kernel stearin are the main Malaysian oil palm product components going into the region. These three, accounted for 69% of the total Malaysian oil palm products imported by the region.

Europe

Exports of Malaysian oil palm products to Europe during Jan – Oct 2023 decreased by 6% as compared the volume imported in 2022. The Netherlands remained the biggest exporting destination of Malaysian palm oil from January until October 2023 for the European region. The Netherlands imported as much as 1.08 million MT of Malaysian oil palm products. The Netherlands retains a consistent decline in importing palm oil from Malaysia, with a significant decline of 18.3% Y-o-Y. Spain also recorded a similar decline of 3.8% Y-o-Y, with an import volume of 255,388 MT. Sweden recorded an import of 115,694 MT from Malaysia, a decline of 5.8% Y-o-Y. Favourable crops of rapeseed and sunflower continues to contribute to a steady supply, leading to a reduced demand for palm oil in the region. However, demand for palm-based wastes such as palm oil mill effluent and sludge oil continues to increase, with major demand coming from Italy, Netherlands and Spain.

| Table 2: Malaysian Oil Palm Product Exports to Europe by Country | |||||

|---|---|---|---|---|---|

| COUNTRY | Jan – Oct 2023 | Jan – Oct 2022 | Diff (Vol) | Diff (%) | |

| 1 | Netherlands | 1,086,144 | 1,330,294 | (244,150) | (18.35) |

| 2 | Italy | 410,992 | 308,793 | 102,199 | 33.10 |

| 3 | Spain | 255,388 | 265,436 | (10,048) | (3.79) |

| 4 | Sweden | 115,694 | 122,772 | (7,078) | (5.77) |

| 5 | Germany | 61,063 | 51,212 | 9,851 | 19.24 |

| 6 | Belgium | 60,696 | 59,156 | 1,541 | 2.60 |

| 7 | Denmark | 37,962 | 31,272 | 6,690 | 21.39 |

| 8 | United Kingdom | 34,212 | 40,703 | (6,491) | (15.95) |

| 9 | Russia | 32,054 | 37,031 | (4,977) | (13.44) |

| 10 | Switzerland | 17,807 | 18,468 | (661) | (3.58) |

| 11 | Others | 103,364 | 92,577 | 10,787 | 11.65 |

| Total | 2,215,375 | 2,357,713 | (142,338) | (6.04) | |

Source: MPOB

Other markets with positive import growth include Italy, Germany, Belgium, and Denmark. Italy recorded a significant import growth of oil palm products, contributed by a surge in demand for palm oil mill effluent.

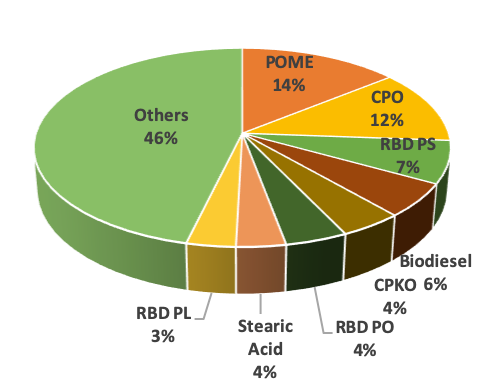

Breakdown of Malaysian Palm Oil Export to Europe

Palm oil mill effluent (POME), crude palm oil, and RBD palm stearin were three major components of Malaysian palm oil imported by the region and these three products accounted for 33% of the total Malaysian oil palm products exported into the Europe region. Demand for waste-based palm oil products especially POME and sludge oil rose by a staggering 181% and 92% respectively, in account for its use as an advanced biofuel feedstocks in the region, with strong demand for both products originating from Italy, Netherlands, Spain and Belgium.

| Table 3: Breakdown of Malaysian PO & Products Export to Europe Jan – Oct 2023 | ||||

|---|---|---|---|---|

| Jan-Oct 2023 | Jan-Oct 2022 | Diff (MT) | Diff (%) | |

| POME | 314,604 | 111,999 | 202,604 | 180.90 |

| CPO | 264,895 | 482,464 | (217,569) | (45.10) |

| RBD PS | 152,795 | 168,363 | (15,568) | (9.25) |

| Biodiesel | 121,868 | 218,176 | (96,308) | (44.14) |

| CPKO | 94,798 | 105,477 | (10,679) | (10.12) |

| RBD PO | 93,765 | 116,037 | (22,272) | (19.19) |

| Stearic Acid | 74,258 | 36,866 | 37,392 | 101.43 |

| RBD PL | 73,877 | 98,394 | (24,516) | (24.92) |

| Others | 1,024,515 | 1,019,936 | 4,579 | 0.45 |

| Total | 2,215,375 | 2,357,713 | (142,338) | (6.04) |

Figure 2: Breakdown of Malaysian Oil Palm and Product Exports to Europe Jan – Oct 2023

Central Asia

The export performance of Malaysian oil palm products into Central Asian region for January – October 2023 was promising with 64,902 MT, an increase of 35% Y-o-Y. As with the previous months, Uzbekistan and Kazakhstan are observed to lead the highest palm oil import from Malaysia with 43,741 MT and 19,092 MT, respectively. Uzbekistan has surpassed its import of Malaysian palm oil in 2022, aided by the ease in logistics situation from China after a restrictive Covid-19 curbing measures in the previous year, indicating a very strong demand from its industries.

| Table 4: Malaysian Oil Palm Product Exports to Central Asia | |||||

|---|---|---|---|---|---|

| COUNTRY | Jan – Oct 2023 | Jan – Oct 2022 | Diff (Vol) | Diff (%) | |

| 1 | Uzbekistan | 43,741 | 19,393 | 24,348 | 125.55 |

| 2 | Kazakhstan | 19,092 | 26,360 | (7,268) | (27.57) |

| 3 | Turkmenistan | 718 | 901 | (183) | (20.30) |

| 4 | Tajikistan | 682 | 509 | 173 | 33.90 |

| 5 | Kyrgyzstan | 670 | 968 | (299) | (30.84) |

| Total | 64,902 | 48,131 | 16,771 | 34.84 | |

| Source: MPOB | |||||

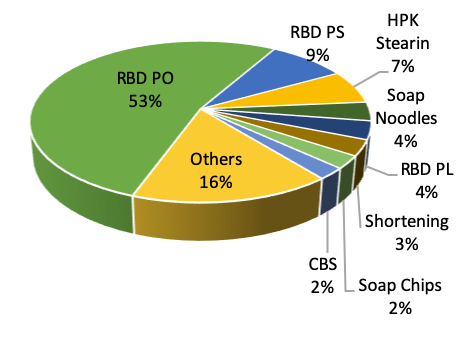

Breakdown of Malaysian Oil Palm Product Exports to Central Asia

RBD palm oil, RBD palm stearin and hydrogenated palm kernel stearin are the main Malaysian oil palm product components going into the region. These three, accounted for 69% of the total Malaysian oil palm products imported by the region. Recovering logistics situation in China would further aid in market penetration of Malaysian oil palm products into the region.

| Table 5: Breakdown of Malaysian Oil Palm & Product Exports to Central Asian Market (MT) | ||||

|---|---|---|---|---|

| Jan-Oct 2023 | Jan-Oct 2022 | Diff (MT) | Diff (%) | |

| RBD PO | 34,235 | 11,653 | 22,582 | 193.79 |

| RBD PS | 5,576 | 10,772 | (5,196) | (48.24) |

| HPK Stearin | 4,353 | 3,050 | 1,302 | 42.70 |

| Soap Noodles | 2,458 | 1,786 | 672 | 37.63 |

| RBD PL | 2,374 | 3,657 | (1,283) | (35.08) |

| Shortening | 2,055 | 2,594 | (539) | (20.79) |

| Soap Chips | 1,681 | 1,524 | 157 | 10.31 |

| CBS | 1,525 | 975 | 550 | 56.38 |

| Others | 10,644 | 12,119 | (1,475) | (12.17) |

| Total | 64,902 | 48,131 | 16,771 | 34.84 |

Figure 3: Breakdown of Malaysian Oil Palm Product Exports to Central Asia

For more info please contact Mr Fazari: fazari@mpoc.org.my

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.