MIDDLE EAST & BALKAN REGION

Malaysian Palm Oil Exports Performance

(January – November 2023)

Regional Summary

he Middle East and Balkan region accounted for 12% of the total Malaysian palm oil exported in Jan – Nov 2023. Palm oil is the main product composition of Malaysian palm oil palm products exported, with a market share of 78% or 2,568,220 MT of the total Malaysian palm oil and products exported into the region. The remaining 22% are made of palm-based oleochemical (10%), PKO (6%), finished products (4%) and other products (2%).

| Table 1: Malaysian Palm Oil and Palm Product Export to the Middle East & Balkan | ||||

|---|---|---|---|---|

| Product Group | Jan-Nov 2023 | Jan-Nov 2022 | Change (MT) | Change (%) |

| Palm Oil | 2,001,489 | 2,242,183 | (240,694) | (10.73) |

| Palm-Based Oleo | 257,282 | 219,395 | 37,886 | 17.27 |

| Palm Kernel Oil | 146,087 | 141,862 | 4,225 | 2.98 |

| Finished Products | 110,712 | 109,565 | 1,147 | 1.05 |

| Palm Kernel Cake | 51,943 | 74,798 | (22,855) | (30.56) |

| Other Palm Products | 708 | 8,971 | (8,263) | (92.11) |

| Grand Total | 2,568,220 | 2,796,774 | (228,553) | (8.17) |

Featured Analysis

- Turkiye is the leading importer of Malaysian palm oil in this region with a volume of 850,206 MT. The country has recorded an increase in imports with 11.29% of Malaysian palm oil. A significant drop in MPO imports in May, June and July, while August, September, October and November showed some improvement in imports.

- Freight cost has returned to a normal rate. The Importers from the GCC countries and Eastern Africa have reduced their dependency on Saudi Arabia and the UAE to import palm oil. They prefer to import directly from Malaysia due to lower cost and reduced time.

- Iran’s MPO import registered 219,438 MT or decrease by 44 % in Jan-Nov 2023 period compared to same period last year. Iranian letters of credit (LCs) are not accepted by foreign banks including banks in Malaysia. Almost all the payments for importing goods will be done through third countries Iran’s payment. Recently, channel through some of the third party countries has also affected and stop accepting the LC from Iran. This has affecting the Malaysian palm oil import from Iran plummeted by 44 % in 2023 this year.

- RBD palm olein stands out as the most demanded palm oil fraction in the Middle East region, constituting 53% of the total imported palm oil products. The majority of RBD palm olein in this area originates from established markets like Iran, Turkey, Saudi Arabia, and the UAE, contributing to 91% of the total RBD palm olein imports. Notably, a portion of this volume, specifically 21,686 MT destined for Turkey and Saudi Arabia were RSPO certified palm olein.

Middle East

| Table 2: Malaysian Palm Export to Middle East Countries | |||||

|---|---|---|---|---|---|

| Country | Jan-Nov 2023 | Jan-Nov 2022 | Change (MT) | Change (%) | |

| 1 | Turkiye | 850,206 | 763,963 | 86,243 | 11.29 |

| 2 | Saudi Arabia | 345,438 | 495,370 | (149,931) | (30.27) |

| 3 | U.A.E | 282,066 | 298,980 | (16,915) | (5.66) |

| 4 | Iran | 219,917 | 390,744 | (170,827) | (43.72) |

| 5 | Yemen Arab Rep. | 123,085 | 29,547 | 93,538 | 316.57 |

| 6 | Oman | 37,452 | 93,002 | (55,550) | (59.73) |

| 7 | Jordan | 36,562 | 31,456 | 5,107 | 16.23 |

| 8 | Kuwait | 26,041 | 23,488 | 2,553 | 10.87 |

| 9 | Syria | 25,968 | 36,431 | (10,463) | (28.72) |

| 10 | Qatar | 23,464 | 29,503 | (6,039) | (20.47) |

| 11 | Iraq | 14,865 | 37,388 | (22,522) | (60.24) |

| 12 | Lebanon | 8,256 | 5,451 | 2,806 | 51.47 |

| 13 | Bahrain | 6,735 | 5,842 | 893 | 15.28 |

| 14 | Palestine | 450 | 22 | 429 | 1,994.74 |

| Grand Total | 2,000,507 | 2,241,187 | (240,680) | (10.74) | |

Source : MPOB

Imports of Malaysian palm oil by the Middle East region registered a volume of 2,000,507 MT, which is 240,680 MT or 10.74% lower compared to the same period in 2022. Turkiye is the leading importer of Malaysian palm oil in this region with a volume of 850,206 MT. The country has recorded an increase in imports with 11.29% of Malaysian palm oil. A significant drop in MPO imports in May, June and July, while August, September, October and November showed some improvement in imports.

Imports of MPO to Saudi Arabia from January to November 2023 dropped by 30.27% compared to last year. Indonesian palm oil (IPO) supplies at a discounted price have attracted the palm oil demand in the region. Hence, some of MPO’s market shares were taken by IPO. Freight cost has returned to the regular rate. Saudi Arabia and UAE, which were used as the re-export hub to their neighbouring and Eastern African countries, which is now less attractive. The importers from those countries were importing directly from Malaysia. Countries like Yemen, which traditionally imports palm oil from their neighbours, opt to import directly from Malaysia, taking advantage of the lower freight cost. Jordan and Lebanon registered an increase in MPO imports because MPO exporters used their ports for their shipments to Syria

Imports of Malaysian palm oil by UAE and Iran showed a drop of 5.66% and 43.72% respectively, registering a volume of 282,066 MT and 219,917 MT until November this year. UAE and Iran is still important exporting country ranked as the region’s third and fourth largest MPO export destination.

Other countries that recorded an increase were Yemen (316.57%), Jordan (16.23%), Kuwait (10.87%), Bahrain (15.28%) and Lebanon (51.47%). While countries that registered a drop in imports of MPO were Oman (59.73%), Qatar (20.47), Syria (28.72) and Iraq (60.24%).

| Table 3: Breakdown of Malaysian Palm Oil Export to Middle East | ||||

|---|---|---|---|---|

| Product | Jan-Nov 2023 | Jan-Nov 2022 | Y-O-Y Change (MT) | Y-O-Y Change (%) |

| RBD PL | 1,051,809 | 1,274,693 | (222,884) | (17.49) |

| RBD PO | 207,823 | 351,448 | (143,626) | (40.87) |

| RBD PS | 188,706 | 212,206 | (23,499) | (11.07) |

| COOKING OIL | 285,562 | 179,712 | 105,850 | 58.90 |

| CPL | 230,576 | 195,565 | 35,011 | 17.90 |

| CPO | 22,401 | 9,001 | 13,401 | 148.88 |

| Others | 13,630 | 18,562 | (4,933) | (26.57) |

| Grand Total | 2,000,507 | 2,241,187 | (240,680) | (10.74) |

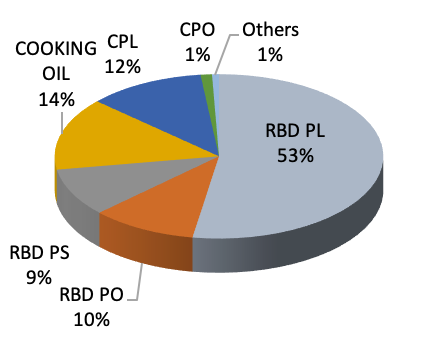

Figure 2: Middle East MPO Import Breakdown

RBD palm olein is the most imported palm oil fraction in this region which accounted for 53% of the total palm oil products imported into the region. Most of the RBD palm olein in this region was imported from traditional markets such as Iran, Turkiye, Saudi Arabia and UAE, accounting for 91% of the total RBD PL imported into the region. Out of this volume, 21,686 MT to Turkey and Saudi Arabia were RSPO-certified Palm Olein.

Balkan

| Table 4: Malaysian Palm Oil Export to Balkan Countries | |||||

|---|---|---|---|---|---|

| Country | Jan-Nov 2023 | Jan-Nov 2022 | Change (MT) | Change (%) | |

| 1 | Serbia | 728 | 579 | 150 | 25.87 |

| 2 | Montenegro | 97 | 265 | (168) | (63.24) |

| 3 | Bosnia Herzegovina | 96 | 24 | 72 | 299.25 |

| 4 | Macedonia | 60 | 129 | (69) | (53.12) |

| Grand Total | 982 | 996 | (15) | (1.48) | |

Source: MPOB

The Balkan region comprising Bosnia & Herzegovina, Serbia, Montenegro and Macedonia imported a small volume of Malaysian palm oil. During the period from Jan – Nov 2023, the region imported 982 MT of Malaysian palm oil, which recorded a slight drop of 15 MT or 1.5% compared to the corresponding period of last year. The region is mainly a sunflower-producing region, and the higher sunflower seed output has impacted palm oil imports.

| Table 5: Breakdown of MPO Export to Balkan | ||||

|---|---|---|---|---|

| Product | Jan-Nov 2023 | Jan-Nov 2022 | Change (MT) | Change (%) |

| RBD PO | 654 | 82 | 572 | 700.96 |

| COOKING OIL | 281 | 547 | (267) | (48.72) |

| RBD PL | 47 | 368 | (320) | (87.09) |

| Grand Total | 982 | 996 | (15) | (1.48) |

Source: MPOB

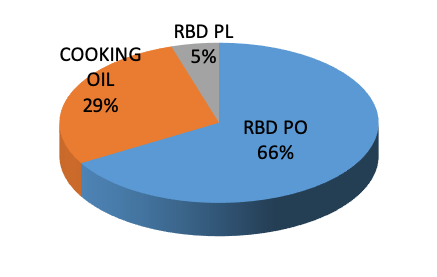

Figure 3: MPO Export to Balkan

For this period, RBD Palm Oil is the largest imported oil fraction by the region, which accounted for 66% of the total palm oil imported during the review period.

For more info please contact Mr. Suhaili

Email : msuhaili@mpoc.org.my

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.