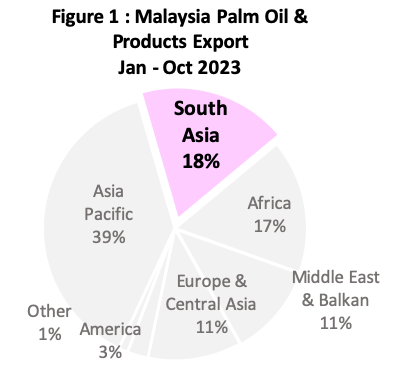

SOUTH ASIA REGION

Malaysian Palm Oil Export to South Asia Region

(January – October 2023)

Regional Summary

South Asia region accounted for 18% of the total Malaysian palm oil exported in Jan – Oct 2023. Palm oil assumed an important composition of Malaysian palm oil palm products exported to the region with market share 86% or 3,145,489 MT of the total Malaysian palm oil and products exported worldwide, followed by palm-based oleochemical (6%), palm kernel cake (4%), palm kernel oil (3%), and finished products (1%).

| Table 1: Malaysian Palm Oil and Palm Product Export to South Asia | ||||

|---|---|---|---|---|

| Products | Jan – Oct 2023 | Jan – Oct 32022 | Change (MT) | Change (%) |

| Palm Oil | 3,145,489 | 3,109,390 | 36,099 | 1.16 |

| Palm-Based Oleo | 231,125 | 217,922 | 13,202 | 6.06 |

| Palm Kernel Cake | 146,777 | 119,531 | 27,247 | 22.79 |

| Palm Kernel Oil | 116,709 | 95,715 | 20,994 | 21.93 |

| Finished Products | 28,797 | 31,060 | (2,263) | (7.29) |

| Other Palm Products | 2,640 | 3,536 | (896) | (25.33) |

| Palm Biodiesel | 0 | 224 | (224) | – |

| Grand Total | 3,671,539 | 3,577,379 | 94,160 | 2.63 |

Featured Analysis

- India, Pakistan and Bangladesh are the top 3 importers of Malaysian palm oil in South Asia.

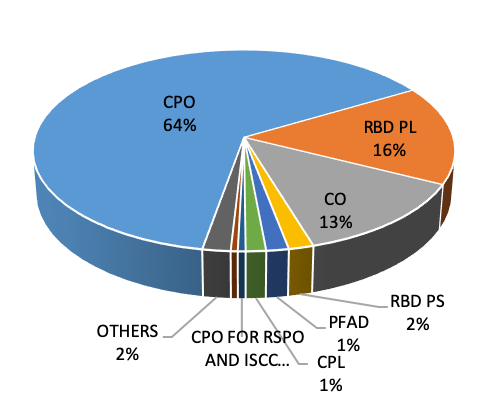

- Top 3 products imported into the region are crude palm oil (CPO), RBD palm olein (RBD PL) and cooking oil (CO). These three products accounted for 93% of the total palm oil going into South Asia region. Soap noodles and glycerine constitute most of palm based oleochemical products into the South Asia market. Lower import tax on CPO has encouraged more imports of CPO to India, which drives up the total palm oil import into this region.

- India’s NCDEX will launch sunflower oil futures contracts on 12 November 2023, offering importers a hedging tool amid volatile prices. India, the world’s largest sunflower oil importer, sources over 90% of its demand from countries like Russia, Ukraine, Romania, and Bulgaria, amounting to 2.5-3 MMT. The MD of NCDEX highlighted the rising imports and the industry’s need for sunflower oil futures to manage global price fluctuations. Initially, the exchange will introduce three monthly contracts with a delivery option in Chennai, Tamil Nadu, and attracting significant industry participation.

- India has extended the suspension of derivative contracts for soybean, soybean oil, and crude palm oil into late 2024 to curb food inflation as a major vegetable oil importer. The country imports nearly two-thirds of its edible oil requirements, with costs reaching USD 20.8 billion in the 2022-23 financial year. Geopolitical tensions and export curbs from leading producing countries have led to volatile vegetable oil prices, necessitating hedging for importers.

South Asia

During Jan-Oct 2023 period, MPO exports to the South Asian region registered a total of 3,145,490 MT against 3,109,391 MT which was registered during the same period of last year, an increase of 36,099 MT or by 1.16%. India holds the biggest market share of 72% as the largest importer of MPO in this region. Other markets with positive import growth include Afghanistan and Sri Lanka. Afghanistan recorded a significant import growth of cooking oil import from 165,828 MT to 213,952 MT.

| Table 2: Malaysian Palm Export to South Asian Countries | |||||

|---|---|---|---|---|---|

| COUNTRY | Jan – Oct 2023 | Jan – Oct 2022 | Diff (Vol) | Diff (%) | |

| 1 | India | 2,276,442 | 2,285,273 | (8,831) | (0.39) |

| 2 | Pakistan | 422,789 | 427,403 | (4,614) | (1.08) |

| 3 | Bangladesh | 200,243 | 197,513 | 2,730 | 1.38 |

| 4 | Afghanistan | 214,271 | 167,309 | 46,962 | 28.07 |

| 5 | Sri Lanka | 20,976 | 17,298 | 3,678 | 21.26 |

| 6 | Nepal | 5,987 | 8,179 | (2,192) | (26.80) |

| 7 | Maldives | 4,749 | 6,416 | (1,667) | (25.98) |

| 8 | Bhutan | 33 | 0 | 33 | – |

| 3,145,490 | 3,109,391 | 36,099 | 1.16 | ||

Source: MPOB

MPO exports to India during Jan-Oct 2023 marginally decreased by 0.39% from 2,285,273 MT to 2,276,442 MT mainly contributed by the easing of Indonesian export policy. Palm oil intake from Indonesia during this period increased by 8% YoY to 54.8% of the total palm oil imports. Imports from Indonesia increased on the back of competitive prices and favourable policies.

Total imports of soft oils (SFO and CDSBO) increased by 20% YoY to 5.84 million MT compared to 4.86 million MT imported in the previous year. Sunflower oil imports during Jan-Oct 2023 are higher by 70% YoY to 2.64 million MT compared to 1.56 million MT imported in the previous year and soybean oil imports declined by 3% YoY to 3.19 million MT. Increased supply of SFO from the black sea region has led to the surge in imports during this period.

Breakdown of Malaysian Palm Oil Export to South Asia

In terms of breakdown, the biggest product being exported to the region during Jan-Oct 2023 period is crude palm oil (CPO) accounting for 64% of overall palm oil imports followed by RBD palm olein (RBD PL) with 16% and cooking oil with 13%. These three palm oil products accounted for 93% of the total MPO exports to this region. Among the major importers of Malaysian CPO are India and Pakistan and major destinations for Malaysian RBD PL are India, Pakistan and Bangladesh. Cooking oil exports have also increased from 360,457 MT to 405,412 MT with major destinations include Pakistan and Afghanistan.

| Table 3: Break down of MPO into South Asia Market | ||||

|---|---|---|---|---|

| Jan – Oct 2023 | Jan – Oct 2022 | Diff (MT) |

Diff (%) |

|

| CPO | 2,004,441 | 1,865,964 | 138,477 | 7.42 |

| RBD PL | 500,983 | 654,699 | -153,716 | -23.48 |

| CO | 405,412 | 360,457 | 44,955 | 12.47 |

| RBD PS | 53,306 | 44,399 | 8,906 | 20.06 |

| PFAD | 47,644 | 53,755 | -6,111 | -11.37 |

| CPL | 42,881 | 23,987 | 18,894 | 78.77 |

| CPO FOR RSPO & ISCC | 16,454 | 25,699 | -9,246 | -35.98 |

| PAO | 14,764 | 17,631 | -2,867 | -16.26 |

| Others | 59,605 | 62,800 | -3,194 | -5.09 |

| 3,145,490 | 3,109,391 | 36,099 | 1.16 | |

For more info please contact Mrs Azriyah Email : azriyah@mpoc.org.my

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.